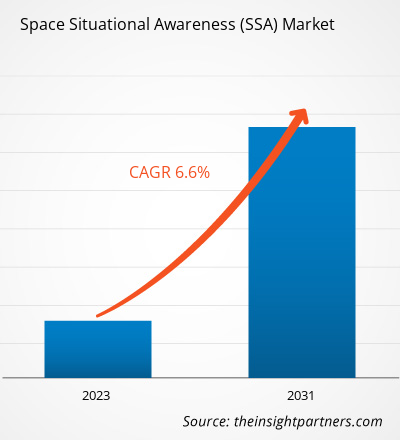

The space situational awareness (SSA) market size is projected to reach US$ 12680.17 million by 2031 from US$ 1,607.33 million in 2023. The market is foreseen to grow at a CAGR of 6.60% by 2031. The space situational awareness market growth is driven by countries with prominent space exploration organizations, rising investments in space research, and new types of space operations generating new threats for maintaining precise information on space object orbits. The US, Russia, China, the UK, Japan, and France are a few major countries operating largest number of satellites in the space.

Space Situational Awareness (SSA) Market Analysis

A number of objects such as probes, satellites, crewed spacecraft, landers, and space station flight elements are launched into Earth's orbit and beyond for interplanetary exploration missions to gain further understanding of the cosmos. As per United Nations Office for Outer Space Affairs (UNOOSA), 2,163 objects were launched into space in 2022, while in 2021 and 2020, a total of 1,810 and 1,274 objects, respectively, were launched. The number of space rocket launches, primarily for deploying satellites in space, is also rising rapidly. In 2021, there were 136 successful rocket launches, whereas in 2022, the number rose to 180. In the first half of 2022, US-based companies launched 37 rockets, of which 27 were by SpaceX, 4 by RocketLab, 3 by United Launch Alliance, and 1 by Astra, Northrop Grumman, and Virgin Orbit. China, Russia, and India launched 21, 9, and 2 rockets, respectively, in the first half of 2022. Of the 21 rocket launches by China, Kuaizhou 1A rocket deployed a small research satellite named Tianxing 1 into a low-altitude polar orbit less than 180 miles (290 km) above Earth. Again, in January 2023, China launched 14 satellites atop a Long March-2D carrier rocket from the Taiyuan Satellite Launch Center in northern China's Shanxi Province. The 14 satellites included Qilu-2 and Qilu-3, Luojia-3 01, and Jilin-1 Gaofen 03D34. In February 2023, the Indian Space Research Organisation (ISRO) announced the successful deployment of three satellites into their intended orbits via SSLV-D2 vehicle.

Space Situational Awareness (SSA) Market Overview

Space situational awareness (SSA) is a vital component of space domain awareness (SDA) that assists decision-makers in understanding current and predicted operational environments. SSA tracks and identifies objects that help determine their orbits, understand their functional environment, and forecast future positions and challenges to their operations. Also, SSA assists in estimating debris from meteor storms, fragmentation events, or other potential natural events that may affect space operations. SSA is a foundation for all space traffic management (STM) and space safety activities. Therefore, all these benefits of SSA propel its penetration.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Space Situational Awareness (SSA) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Space Situational Awareness (SSA) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Space Situational Awareness (SSA) Market Drivers and Opportunities

Rising Amount of Space Debris

In 2021, Space Track reported four on-orbit breakup events generating 150 fragment debris and two collision events producing 942 objects, including that from the Russian ASAT test. These orbiting space debris threaten about 3,000 functioning satellites presently in orbit, used for modern critical communication and other purposes. Any damage, even minor, to such space assets can have cascading impacts on many vital systems, including communication, transportation, time scheduling, and critical defense-related aspects. Many state-of-the-art defense technologies such as guided missiles, drones, intelligence data collections, encrypted communications, and navigation would be limited or can become inoperable with defunct satellite systems. It is thus crucial to analyze the comparative approach of all space objects to detect collision threats well in advance. SSA deals with the thorough knowledge of the space environment, assessment of any threats to space activities, and implementing necessary mitigation measures to safeguard functional space assets. It consequently plays a crucial role in ensuring safe and sustainable space activities complying with domestic and international guidelines, standards, and other norms. Owing to the critical functionality of SSA and the rising importance of satellites, the space situational awareness market is positively impacted by the increasing amount of space debris.

Rising Partnership Among Countries

Assets in space are gaining importance for several countries, mainly concerning national security. The growing interest in deploying space assets and ensuring their long functional life is leading to several partnerships among countries. Such partnerships cover several aspects of space-related joint missions and information sharing, which, in turn, is expected to offer promising growth opportunities for the space situational awareness market. In April 2022, India and the US signed a new SSA arrangement. The partnership is expected to launch new defense space exchanges between the US Space Command and India's Defence Space Agency. In December 2021, Australia and South Korea signed a memorandum of understanding (MoU) to collaborate on space exploration, launch services, and satellite navigation, as well as improve each other's capacities in SSA, Earth observation, space traffic, and debris management. In November 2021, Japan and India held a virtual space dialogue to exchange information on the space policy of each country and have discussions on space security, bilateral cooperation between Japan Aerospace Exploration Agency (JAXA) and ISRO, their space industries, space-related rules and norms, global navigation satellite systems, SSA, and other areas of mutual interest. In March 2019, Japan and the US governments signed agreements to link up the SSA systems of Japan's Self-Defense Forces (SDF) and the US military from fiscal 2023 to share real-time information on third-country satellites and space debris, among others. Such partnerships and agreements between various countries showcase the growing importance of space, available space assets, and SSA among the various governments, which is expected to offer ample growth opportunities for the space situational awareness market in the near future.

Space Situational Awareness (SSA) Market Report Segmentation Analysis

Key segments that contributed to the derivation of the space situational awareness (SSA) market market analysis are offering, object, end user, and orbit range.

- By offering, the space situational awareness market is bifurcated into software and service. The service segment accounted for a larger market share in 2023.

- By object, the space situational awareness market is segmented into mission-related debris, rocket bodies, fragmentation debris, functional spacecraft, and nonfunctional spacecraft. The fragmentation debris segment held a larger market share in 2023.

- By end user, the space situational awareness market is bifurcated into commercial and government & military. The government and military segment held a larger market share in 2023.

- Based on orbit range, the space situational awareness market is bifurcated into deep space and near-Earth. The near-earth segment held a larger market share in 2023.

Space Situational Awareness (SSA) Market Share Analysis by Geography

The global space situational awareness (SSA) market is broadly segmented into North America, Europe, Asia Pacific (APAC), Rest of the World (RoW). Increasing collision threats of orbital debris with the operational space assets have become a perennial problem for the sustainable and safe use of outer space. These threats restrict unhindered access to the space and also compel space authorities to take appropriate measures to mitigate them. The development of Space Situational Awareness (SSA) programs in the US help monitor various threats from human-made objects, which include other satellites, space vessels, antisatellite weapons, and space debris. SSA also helps serve military objectives, which include preparing for defensive and offensive operations, in the US.

The US government, through the Center for Space Situational Awareness Research (CSSAR), provides cadets and faculty at the US Air Force Academy with an education and research program in the space situational awareness using world-class capabilities and facilities. CSSAR also helps provide information regarding spectral, non-imaging photometric, and polarimetric techniques, which leads to the characterization and identification of unresolved space objects. It also helps in the fusion of disparate data sources, thereby maximizing situational awareness and further developing optical sensing capability. CSSAR has also developed a network of small aperture telescopes that can help in providing global coverage of the space catalog and enhancing the capability to observe satellites simultaneously from multiple telescope locations for data fusion research.

Space Situational Awareness (SSA) Market Regional Insights

Space Situational Awareness (SSA) Market Regional Insights

The regional trends and factors influencing the Space Situational Awareness (SSA) Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Space Situational Awareness (SSA) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Space Situational Awareness (SSA) Market

Space Situational Awareness (SSA) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,607.33 Million |

| Market Size by 2031 | US$ 12680.17 Million |

| Global CAGR (2023 - 2031) | 6.60% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

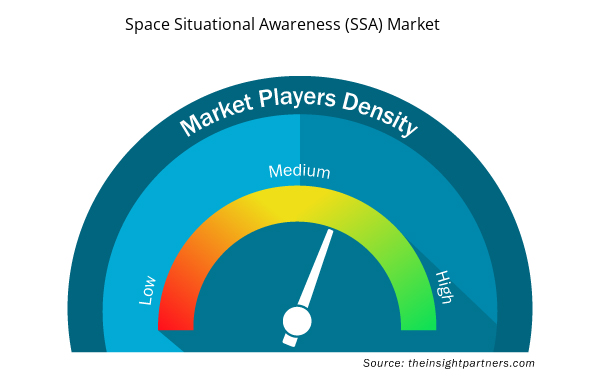

Space Situational Awareness (SSA) Market Players Density: Understanding Its Impact on Business Dynamics

The Space Situational Awareness (SSA) Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Space Situational Awareness (SSA) Market are:

- Analytical Graphics, Inc.

- Exoanalytic Solutions, Inc

- Globvision Inc.

- GMV Innovating Solutions SL

- L3Harris Technologies, Inc.

- Kratos Defense and Security Solutions, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Space Situational Awareness (SSA) Market top key players overview

Space Situational Awareness (SSA) Market News and Recent Developments

The space situational awareness (SSA) market market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In April 2022, Ansys (NASDAQ:ANSS) Government Initiatives (AGI) is supporting Northrop Grumman in developing, testing, and delivering a Deep-Space Advanced Radar Capability (DARC) in support of the U.S. Space Force (USSF) Space Systems Command (SSC) Space Domain Awareness mission. (Source: Ansys, Press Release)

- In September 2022, ExoAnalytic Solutions is anticipating America's return to the Moon via Artemis. As part of their support to the Air Force Blue Horizons Fellowship program and their Project Rocket cislunar tracking efforts, the company is demonstrating the application of its world-leading space domain awareness services to the Artemis I flight test. (Source: ExoAnalytic Solutions, Press Release)

Space Situational Awareness (SSA) Market Report Coverage and Deliverables

The “Space Situational Awareness (SSA) Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Space situational awareness (SSA) market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Space situational awareness (SSA) market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Space situational awareness (SSA) market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Space situational awareness (SSA) market landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Offering, Object, End User, and Orbit Range

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Canada, China, France, Germany, India, Italy, Japan, Mexico, MIddle East & Africa, Russia, South America, South Korea, United Kingdom, United States

Get Free Sample For

Get Free Sample For