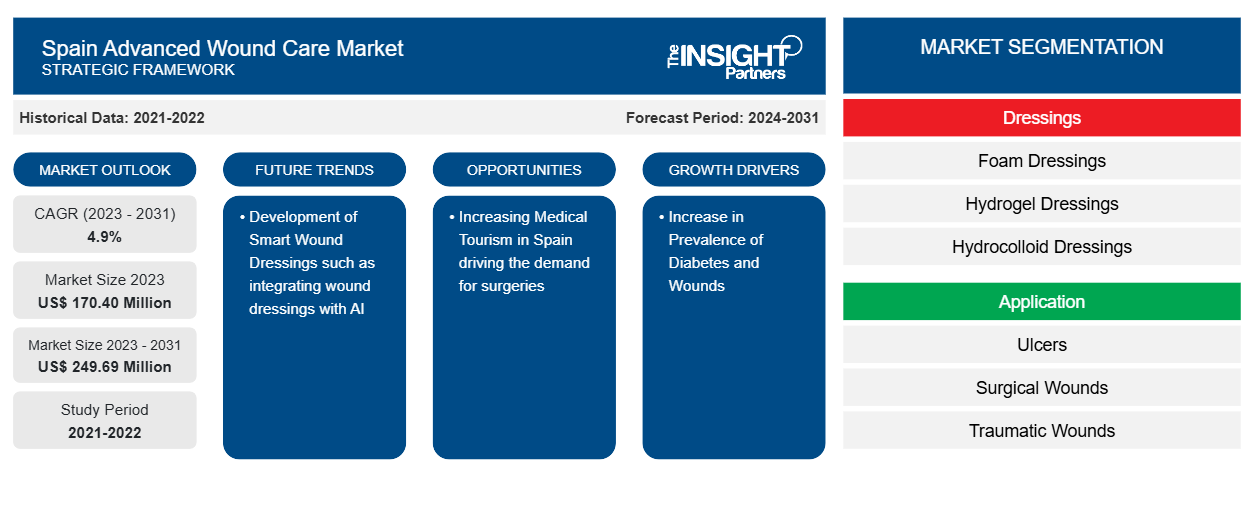

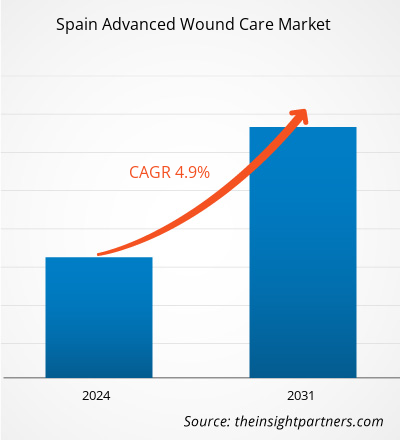

The Spain advanced wound care market size is projected to reach US$ 249.69 million by 2031 from US$ 170.40 million in 2023. The market is expected to register a CAGR of 4.9% during 2023–2031. The developments of smart wound dressings are likely to remain a key trend in the market.

Spain Advanced Wound Care Market Analysis

The increasing prevalence of chronic diseases such as diabetes and cancer that can cause wounds and the rising incidence of traumatic injuries drive the Spain advanced wound care market growth. However, the high cost of advanced wound care treatments and lack of reimbursement hinder market growth. Furthermore, rising awareness of advanced wound care would propel the growth of the Spain advanced wound care market during the forecast period.

Spain Advanced Wound Care Market Overview

Wound care and wound dressing have broad applications in traumatic injuries. Accidents often cause severe injuries and blood loss. Individuals affected in accidents require immediate medical attention and sometimes surgical intervention for immediate relief. Therefore, an increase in road accidents across the country boosts the demand for advanced wound dressing products.

According to the Spanish National Statistics Institute, ~20% of the total population of Spain was aged about 65 years in 2022. Older adults are more prone to traumatic wounds than younger people due to the increase in incidents of falls with age. Also, the effect of wounds on quality of life is particularly deep in the geriatric population. The process of traumatic wound healing is slow in the aging population due to the basic biology underlying traumatic wounds and the influence of age-associated changes on wound healing. Therefore, the rise in demand for advanced wound care products due to the increase in a number of traumatic injury cases in the geriatric population drives the Spain advanced wound care market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Spain Advanced Wound Care Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Spain Advanced Wound Care Market Drivers and Opportunities

Increase in Prevalence of Diabetes and Wounds Favors Market Growth

Chronic wound is the type of wound that proceeds through an orderly and timely process that produces anatomic and functional integrity within 3 months, or that has proceeded through the repair process without establishing a sustained, anatomic and functional results. Upsurge in the prevalence of numerous chronic diseases such as diabetes, cancer, and other autoimmune disorders is burdening the healthcare system in Spain. Chronic diseases directly affect the body's ability to heal. Diabetes and immunodeficiency conditions are among the most detrimental conditions that can lead to diabetic wounds. Diabetes is the chronic disease that is commonly identified and associated as a risk factor for hospital-acquired and facility pressure injuries. The disease adversely affects the immune system, causing infections to be more common and causing wounds. It is one of the most significant global health emergencies of the 21st century.

As per the article ‘Diabetes Incidence Rising in Spanish Youth,’ Spain has the second highest number of diabetes patients in Europe. According to the International Diabetes Federation (IDF), about 5.14 million people in Spain were affected by diabetes in 2021, and the count is expected to increase to 5.6 million by 2045. As per the article ‘Diabetes Incidence Rising in Spanish Youth,’ ~23.3% of people aged 16 years and below are overweight, and 17.3% are obese. Diabetes negatively affects many parts of the body, especially the feet. Diabetic foot ulcers (DFUs) are sores that develop on the feet, and they can develop even from seemingly trivial injuries to the feet. DFU is a common cause of amputation due to diabetes. Thus, the rising prevalence of chronic diseases that increase the number of wound cases fuels the growth of the Spain advanced wound care market.

Increasing Medical Tourism to Create Significant Opportunities

Medical tourism in Spain is on the rise as patients in other countries in Europe and the Middle East & North Africa are opting for medical treatment in Spain. As per Vaidam Health, Spain has the potential to be one of the leading countries in medical tourism globally, and health tourism in Spain is growing at a rate of 20% per year. As per the same source, Spain was ranked seventh on the World Health Organization's (WHO) international comparative list of the world's best health systems. Cost-effective surgical procedure is one of the major factors that bring visitors to Spain. Compared to other countries in Europe and the US, patients traveling to Spain can save 30% - 70% in medical expenses. Some of the hospitals in Spain, which are well-equipped with modern equipment and technologies, are dedicated to medical tourists. Moreover, various healthcare organizations in Spain, both private and government-owned, have specialized departments catering exclusively to medical tourists. Spain’s resilient economy also helps boost its healthcare system by creating leading medical facilities with qualified physicians providing healthcare to their citizens and foreign patients. In addition, there is an increase in the number of specialized wound care clinics in the country, which provide services for people who have hard-to-heal wounds. Owing to all these factors, rising medical tourism in Spain is anticipated to provide significant opportunities to the players operating in the Spain advanced wound care market during the forecast period.

Spain Advanced Wound Care Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Spain advanced wound care market analysis are dressings, application, and end user.

- Based on dressings, the Spain advanced wound care market is segmented into film dressings, hydrogel dressings, alginate dressings, silver dressings, hydrocolloid dressings, post operative dressings, foam dressings, superabsorbent dressings, wound contact layers, and others. The foam dressings segment held the largest market share in 2023.

- By application, the market is categorized into surgical wounds, burns, traumatic wounds, ulcers, and others. The ulcers segment held the largest share of the Spain advanced wound care market in 2023.

- Based on end user, the Spain advanced wound care market is segmented into hospitals and clinics, ambulatory care centers, wound care centers, and others. The hospitals and clinics segment held the largest market share in 2023.

Spain Advanced Wound Care Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 170.40 Million |

| Market Size by 2031 | US$ 249.69 Million |

| CAGR (2023 - 2031) | 4.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Dressings

|

| Regions and Countries Covered |

Spain

|

| Market leaders and key company profiles |

|

Spain Advanced Wound Care Market Players Density: Understanding Its Impact on Business Dynamics

The Spain Advanced Wound Care Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Spain Advanced Wound Care Market top key players overview

Spain Advanced Wound Care Market News and Recent Developments

The Spain advanced wound care market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Hygiene and health company Essity signed an agreement to acquire the remaining 25% of the shares in the Swedish medical solutions company ABIGO Medical AB. Essity acquired 75% of ABIGO Medical in February 2020. Following the acquisition, ABIGO Medical will be a wholly owned subsidiary of Essity in the product category Medical Solutions. (Source: Essity AB., Company Website, July 2021)

Spain Advanced Wound Care Market Report Coverage and Deliverables

The “Spain Advanced Wound Care Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Spain advanced wound care market size and forecast at country levels for all the key market segments covered under the scope

- Spain advanced wound care market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Spain advanced wound care market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Spain advanced wound care market.

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the Spain advanced wound care market?

What are the future trends in the Spain advanced wound care market?

Which are the leading players operating in the Spain advanced wound care market?

What are the factors driving the Spain advanced wound care market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For