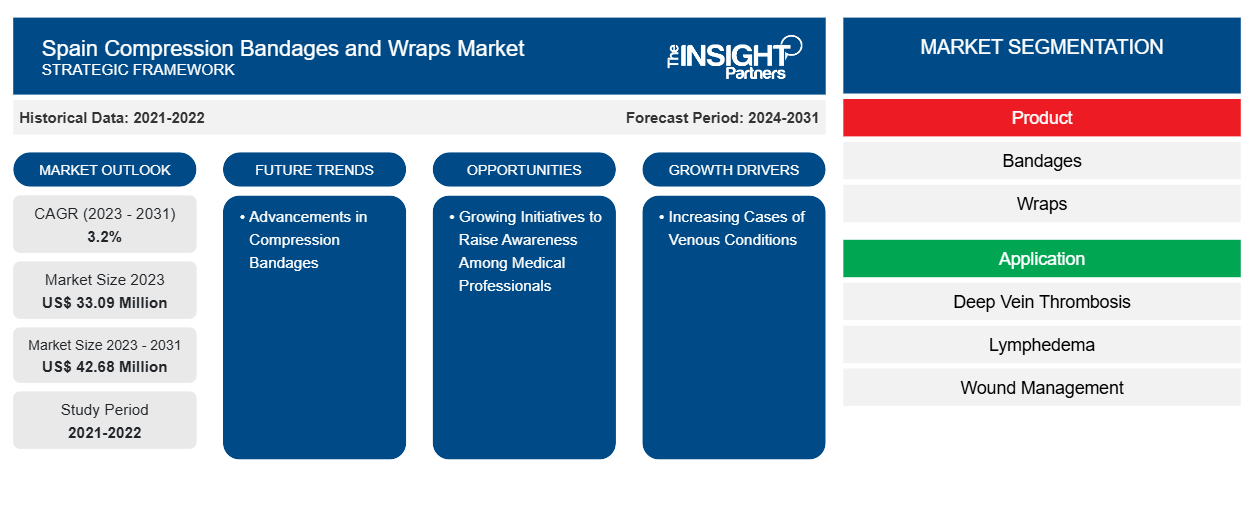

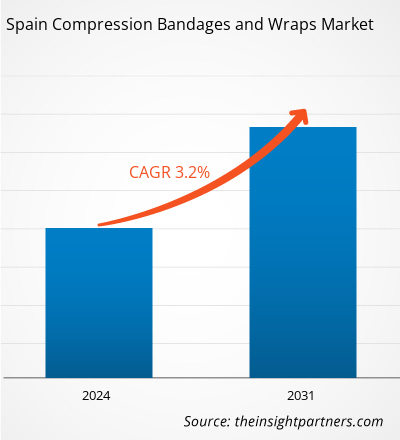

The Spain compression bandages and wraps market size is projected to reach US$ 42.68 million by 2031 from US$ 33.09 million in 2023. The market is expected to register a CAGR of 3.2% during 2023–2031. Advancements in compression bandages are likely to remain as one of the key trends in coming years.

Spain Compression Bandages and Wraps Market Analysis

The factors supporting the growth of the market include increasing sports participation and active lifestyle as well as the ease of use and the high efficacy of the treatment, expanding the popularity of these products in the medical field. The availability of patient-friendly compression therapy products, such as compression bandages, contributes to market growth. The rise in R&D activities by manufacturers to create compression products that are easy to use and available in different designs for treating trauma or pain management plays a major role in growing the market.

Spain Compression Bandages and Wraps Market Overview

Many athletes and individuals with active lifestyles use compression bandages to prevent injuries caused by sports. The surge in sports and fitness engagement is one of the factors that fuel the growth of the Spain compression bandages and wraps market. As participation in sports increases, the incidence of sports-related injuries and muscle fatigue decreases. As per the Statistics 2022, Survey of Sporting Habits In Spain 2022, the results in the 2022 edition of the Survey of Sporting Habits indicate that approximately 6 out of 10 people aged 15 years old and over practiced sports in the last year, accounting for 57.3% either regularly or occasionally. The participation rates in sports clearly show that those who usually play sports do it frequently; 23.8% of the population do it daily, and 52.5% at least once a week. Furthermore, 56.2% of the population play sports at least once a month and 56.7% at least once a quarter. Athletes and fitness enthusiasts in Spain increasingly turn to compression garments to expedite recovery and enhance performance, supporting the demand for compression therapy products.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Spain Compression Bandages and Wraps Market Drivers and Opportunities

Increasing Cases of Venous Conditions

Obesity, physical inactivity, prolonged sitting, and other lifestyle factors are identified as contributing factors in the development of venous disorders such as leg ulcers, varicose veins, and deep vein thrombosis. A study titled “Validity of Chronic Venous Disease Diagnoses and Epidemiology Using Validated Electronic Health Records from Primary Care,” published in 2021 in the National Center for Biotechnology Information (NCBI), conducted in Spain, Catalonia, surveyed a population of 5.8 million and reported more than 5.6% of the total prevalence and incidence of varicose veins. The prevalence rates for chronic venous disease, chronic venous insufficiency, and venous leg ulcer were 9.54%, 3.87%, and 0.33%, respectively. The incidence rates for chronic venous disease, chronic venous insufficiency, and venous leg ulcer were 7.91/1,000 person-years; 3.37/1,000 person-years; and 0.23/1,000 person-years; respectively. As per Statista, in 2020, more than 500,000 women aged 65–74 were diagnosed with varicose veins in Spain. The prevalence of venous disease is increasing with age, with the highest rates observed in individuals aged 65 and above. With growing chronic venous disease, there is a substantial patient base seeking compression therapy products for effective treatment and management. Further, as per a study titled “An estimate of the economic burden of venous leg ulcers associated with deep venous disease,” published in 2021 in NCBI, the total annual incidence of new or recurrent deep venous disease-related venous leg ulcers (DRV) in Spain was found to be at 85,000 in 2019. The majority of leg ulcers are caused by problems in the veins, leading to an accumulation of blood in the legs. People suffering from venous disorders apply these bandages and wraps with the goal of increasing blood flow in the veins and facilitating the return of blood to the heart. This aids in preventing the buildup of fluid in the tissues, especially in cases of fluid retention-induced swelling. Compression wraps involve applying several layers of bandages to provide gradual compression. Also, compression bandages are wrapped with gradient pressure to treat and prevent varicose veins, venous leg ulcers, and deep vein thrombosis. Thus, the rising cases of various venous diseases drive the Spain compression bandages and wraps market.

Growing Initiatives to Raise Awareness Among Medical Professionals

Initiatives by various organizations across Spain help promote awareness regarding the use of compression therapy and compression products, including bandage pressure optimization. The strong pressure bandages can be utilized for the treatment of venous leg ulcers, lymphedema, and deep vein thrombosis. Patients who develop venous leg ulcers experience substantial suffering and a reduced quality of life. Many patients suffering from leg ulcers are not receiving the appropriate treatment, resulting in delayed healing times, a higher risk of complications, and treatment costs. Awareness campaigns and events are essential to raise knowledge and advance the understanding and management of venous leg ulcers among healthcare professionals. Through collaboration, education, and practical training, these events have significantly contributed to improving patient outcomes and the quality of wound care across Spain.

In 2023, Five Leg Ulcer & Compression Days Events were conducted across Spain from April to November. These events were held in Madrid, Santiago de Compostela, Vigo, Valencia, and Alicante. The training targeted nurses were the key decision-makers regarding the compression systems used for patients in Spain. In total, 490 nurses participated in these remarkable training sessions, with 180 attendees in Madrid and 310 in the sessions held in November. The Leg Ulcer & Compression Days include workshops, symposia, and webinars that are dedicated to medical professionals, such as specialists, general practitioners, and nurses, dealing with patients having leg ulcers

. The key objectives of these training sessions are listed below:

- Increasing Awareness: The events highlight the country's high incidence of venous leg ulcers and the lack of suitable treatment for affected individuals.

- Guideline Adherence: Participants were educated on the most recent clinical guidelines and evidence-based practices recommended for managing venous leg ulcers.

- Hands-on Workshops: Practical workshops were held to demonstrate appropriate diagnosis techniques and the application of compression products, encouraging healthcare professionals to deliver effective care to patients.

These events served as a pivotal training session to increase awareness about the critical importance of early diagnosis and prompt treatment of venous leg ulcers, as well as the importance of compression products. Therefore, growing initiatives to raise awareness among medical professionals are likely to create opportunities for the Spain compression bandages and wraps market growth in the coming years.

Spain Compression Bandages and Wraps Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Spain compression bandages and wraps market analysis are product, application, and end user.

- Based on product, the Spain compression bandages and wraps market is bifurcated into bandages and wraps. The bandages segment held a larger market share in 2023 and is expected to register a higher CAGR in the market during 2023–2031.

- By application, the market is segmented into wound management, deep vein thrombosis, lymphedema, and others. The deep vein thrombosis segment held the largest share of the market in 2023. The lymphedema segment is expected to register the highest CAGR in the market during 2023–2031.

- Based on end user, the Spain compression bandages and wraps market is divided into hospitals and clinics, ambulatory surgical centers, home care, and others. The hospitals and clinics segment dominated the market in 2023 and is expected to register the highest CAGR during 2023–2031.

Spain Compression Bandages and Wraps Market Regional Insights

The regional trends and factors influencing the Spain Compression Bandages and Wraps Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Spain Compression Bandages and Wraps Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Spain Compression Bandages and Wraps Market

Spain Compression Bandages and Wraps Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 33.09 Million |

| Market Size by 2031 | US$ 42.68 Million |

| Global CAGR (2023 - 2031) | 3.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Spain

|

| Market leaders and key company profiles |

Spain Compression Bandages and Wraps Market Players Density: Understanding Its Impact on Business Dynamics

The Spain Compression Bandages and Wraps Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Spain Compression Bandages and Wraps Market are:

- Essity AB,

- Paul Hartmann AG,

- Smith & Nephew Plc,

- Bimedica,

- Molnlycke Health Care AB,

- B Braun SE,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Spain Compression Bandages and Wraps Market top key players overview

Spain Compression Bandages and Wraps Market Report Coverage and Deliverables

The “Spain Compression Bandages and Wraps Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Spain compression bandages and wraps market size and forecast at the country level for all the key market segments covered under the scope

- Spain compression bandages and wraps market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Spain compression bandages and wraps market analysis covering key market trends and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Spain compression bandages and wraps market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The estimated value of the Spain compression bandages and wraps market can reach US$ 42.68 million by 2031.

Increasing occurrence of venous conditions and growing incidence of cancer leading to lymphedema are the most influential factors responsible for the market growth.

Essity AB, Paul Hartmann AG, Smith & Nephew Plc, Bimedica, Molnlycke Health Care AB, B Braun SE, 3M Co, Calvo Izquierdo SL, Cardinal Health Inc., and Convatec Group Plc are among the key market players in the Spain compression bandages and wraps market.

The Spain compression bandages and wraps market is estimated to register a CAGR of 3.2% from 2023 to 2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Spain Compression Bandages and Wraps Market

- Essity AB

- Paul Hartmann AG

- Smith & Nephew Plc

- Bimedica

- Molnlycke Health Care AB

- B Braun SE

- 3M Co

- Calvo Izquierdo SL

- Cardinal Health Inc

- Convatec Group Plc.

Get Free Sample For

Get Free Sample For