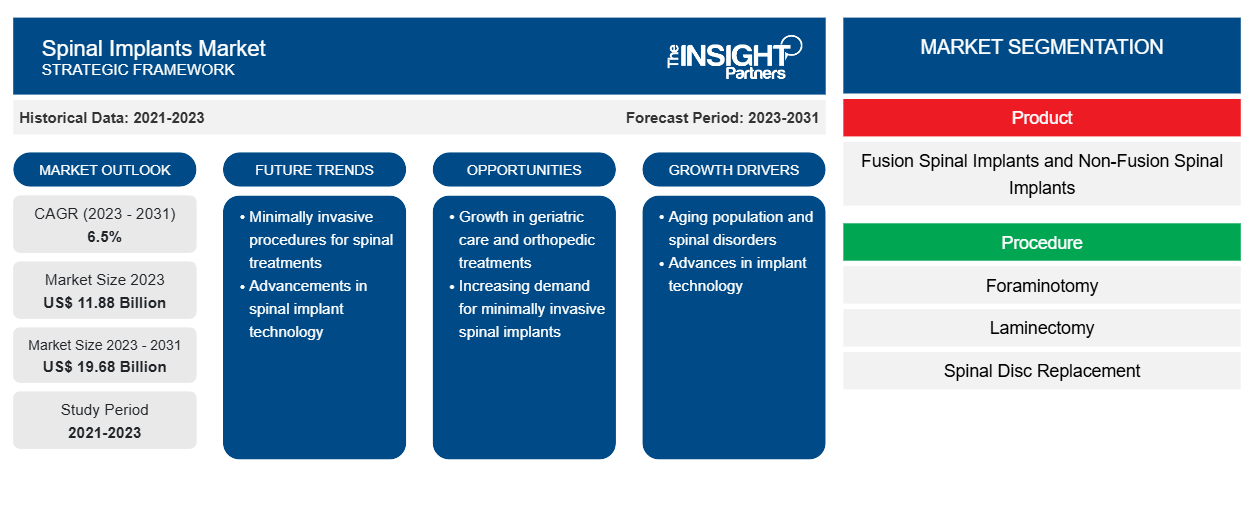

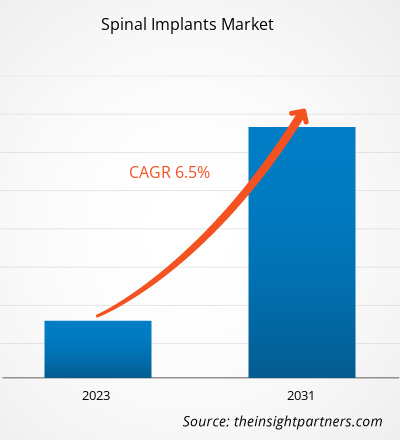

[Research Report] The spinal implants market forecast can help stakeholders in this marketplace outline their growth strategies. The market is projected to grow from US$ 11.88 billion in 2023 to US$ 19.68 billion by 2031; it is estimated to record a CAGR of 6.5% during 2023–2031.

Market Insights and Analyst View:

Spinal implants are medical devices used in spine stabilization procedures to strengthen the spine, treat deformity, and facilitate fusion. Spine injuries are generally caused by trauma or by slipped vertebrae due to degenerative intervertebral disks. Factors such as the surging number of spinal implant procedures, and the rising incidence of trauma and sport-related injuries propel the spinal implants market growth. However, stringent regulations impede the growth of the market. 3D printing of implants for surgical procedures is expected to bring new spinal implants market trends in the coming years.

Growth Drivers:

Rising Incidence of Trauma and Sport-Related Injuries

Traumatic injuries, including those from accidents and sports activities, often require spinal interventions, including the use of implants for stabilization and reconstruction. The increasing incidence of traumatic spinal injuries contributes to the demand for spinal implants. According to the World Health Organization (WHO), globally, ~1.19 million people die every year in road crashes, and 20–50 million people suffer non-fatal injuries, with many incurring a disability. Similarly, according to the Mayo Clinic estimates, sports and athletic activities such as diving in shallow water, basketball, and football cause ~10% of spinal cord injuries. The WHO data also suggests that 250,000–500,000 spinal cord injuries (SCIs) are recorded annually across the world. However, the majority of spinal cord injuries, including those caused by car accidents, falls, or assaults, are preventable. People suffering from SCIs are 2–5 times more likely to die prematurely than those without them, with low- and middle-income nations reporting notably lower survival rates. Thus, the increasing incidence of trauma and sport-related injuries results in a high demand for surgical interventions, in turn, boosting the spinal implants market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Spinal Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Spinal Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The spinal implants market analysis has been carried out by considering the following segments: product, procedure, material, and end user.

By product, the market is bifurcated into fusion spinal implants and non-fusion spinal implants. The fusion spinal implants segment held a larger spinal implants market share in 2023. It is anticipated to register a higher CAGR during the forecast period. The market for the fusion spinal implants segment is subsegmented into thoracolumbar devices, cervical fixation devices, and interbody fusion devices.

The market, by procedure, is categorized into foraminotomy, laminectomy, spinal disc replacement, spine fusion, and discectomy. The laminectomy segment held the largest spinal implants market share in 2023, and spine fusion is further estimated to register the highest CAGR during the forecast period.

The spinal implants market, by material, is segmented into titanium, carbon fiber, and stainless steel. The stainless steel segment held the largest market share in 2023; it is anticipated to register the highest CAGR during the forecast period.

The spinal implants market, by end user, is categorized into hospitals, diagnostic and imaging centers, and others. The hospitals segment held the largest market share in 2023. It is further expected to register the highest CAGR during the forecast period.

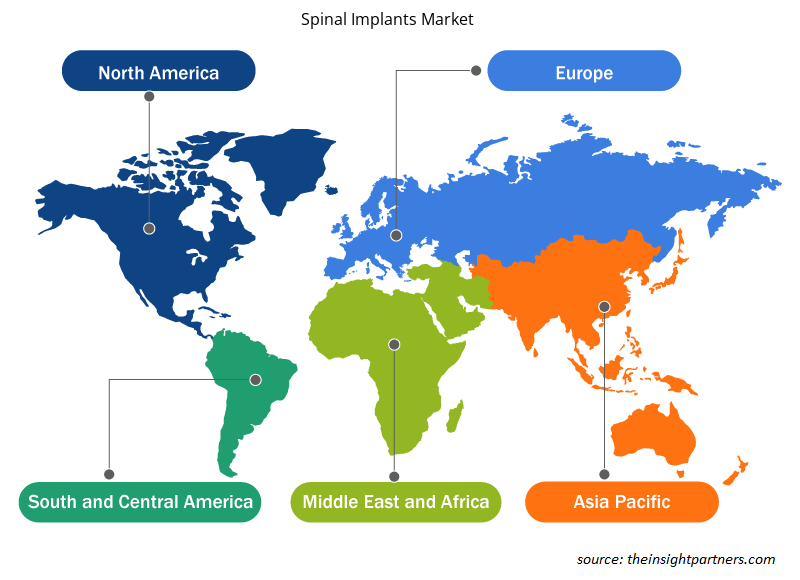

Regional Analysis:

The geographic scope of the spinal implants market report includes North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2023, North America held the largest market share. The growing adoption of the latest medical devices, the high prevalence of spinal injuries, and product innovations by key players contribute to the expansion of the spinal implants market size in North America. According to the Cleaveland Clinic, the US reports ~18,000 new traumatic spinal cord injury cases each year, which is equivalent to ~54 cases per 1 million population. Additionally, age-related wear-and-tear triggers the prevalence of lower back pain (LBP) among the geriatric population in the US, in turn, fuels the demand for spinal surgeries and implantable devices. According to National Health Services, in 2022, the lifetime incidence of LBP in the US is reported to be 60–90%, with an annual incidence of 5%. The source also states that 14.3% of new patients visit physicians each year because of LBP, and ~13 million people visit physicians due to chronic LBP. Thus, the high prevalence of spinal cord injury and LBP favors the spinal implants market progress.

Spinal Implants Market Regional Insights

Spinal Implants Market Regional Insights

The regional trends and factors influencing the Spinal Implants Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Spinal Implants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Spinal Implants Market

Spinal Implants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 11.88 Billion |

| Market Size by 2031 | US$ 19.68 Billion |

| Global CAGR (2023 - 2031) | 6.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

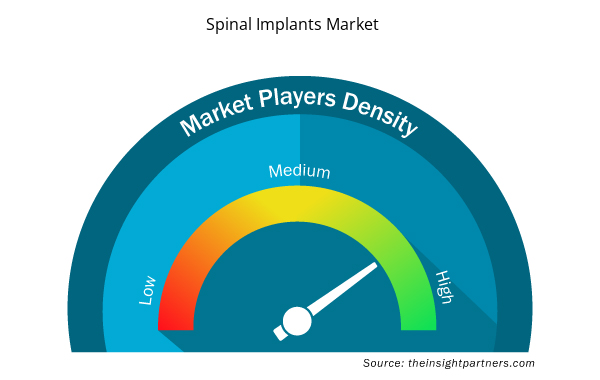

Spinal Implants Market Players Density: Understanding Its Impact on Business Dynamics

The Spinal Implants Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Spinal Implants Market are:

- Stryker Corporation

- Johnson & Johnson

- Globus Medical Inc

- ZimVie Inc

- Camber Spine Technologies LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Spinal Implants Market top key players overview

Industry Developments and Future Opportunities:

A few strategic developments by leading players operating in the spinal implants market, as per company press releases, are listed below:

- In October 2023, Silony Medical International AG completed the acquisition of Centinel Spine's Global Fusion Business. Through this acquisition, Silony makes major entry into the US market & significantly strengthens its anterior standalone cage offering.

- In September 2023, Globus Medical Inc completed its merger with NuVasive Inc. The combined company provides surgeons and patients with one of the most complete musculoskeletal procedural solutions, enabling technological advances across the care continuum.

- In November 2022, NuVasive Inc. announced the commercial launch of the NuVasive Tube System (NTS) and Excavation Micro, a revolutionary minimally invasive surgery (MIS) technology offering complete solutions for transforaminal lumbar interbody fusion (TLIF) and decompression. With additions to the NuVasive P360 portfolio, the company enhanced its access and instrumentation technology capabilities.

- In August 2022, Nexus Spine announced the full commercial launch of its PressON posterior lumbar fixation system. PressON rods are designed to press onto pedicle screws rather than set screws. This unique biomechanically stronger design measures approximately one-quarter the size of standard systems. The rods are implanted faster, and they avoid the chance of set screw loosening and allow for intraoperative rod assembly for patients. The complete market release allowed the company to expand its compliant mechanism-based portfolio, which includes a range of flexible Tranquil titanium interbody fusion devices that are offered after an exhaustive validation period of refinements and system improvements.

- In October 2021, NuVasive Inc launched the Cohere TLIF-O implant. With the addition of the Cohere TLIF-O implant to its Advanced Materials Science (AMS) portfolio, NuVasive has become the only company to provide both porous PEEK and porous titanium implants for posterior spinal surgery.

Competitive Landscape and Key Companies:

Stryker Corporation, Johnson & Johnson, Globus Medical Inc, ZimVie Inc, Camber Spine Technologies LLC, Spineart SA, Medtronic plc, Orthofix US LLC, ATEC Spine Inc, and B. Braun SE are among the prominent companies profiled in the spinal implants market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Procedure, Material, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The spinal implants market, by end user, is categorized into hospitals, diagnostic and imaging centers, and others. The hospitals segment held the largest market share in 2023. It is further expected to register the highest CAGR during the forecast period.

The spinal implants market, by material, is segmented into titanium, carbon fiber, and stainless steel. The stainless steel segment held the largest market share in 2023; it is anticipated to register the highest CAGR during the forecast period.

The market, by procedure, is categorized into foraminotomy, laminectomy, spinal disc replacement, spine fusion, and discectomy. The laminectomy segment held the largest spinal implants market share in 2023, and spine fusion is further estimated to register the highest CAGR during the forecast period.

The spinal implants market is expected to be valued at US$ 19.68 billion in 2031.

By product, the market is bifurcated into fusion spinal implants and non-fusion spinal implants. The fusion spinal implants segment held a larger spinal implants market share in 2023. It is anticipated to register a higher CAGR during the forecast period.

The spinal implants market was valued at US$ 11.88 billion in 2023.

Factors such as surging number of spinal implant procedures and rising incidence of trauma and sport-related injuries propel the spinal implants market growth.

The spinal implants market majorly consists of the players, including Stryker Corporation, Johnson & Johnson, Globus Medical Inc, ZimVie Inc, Camber Spine Technologies LLC, Spineart SA, Medtronic plc, Orthofix US LLC, ATEC Spine Inc, and B. Braun SE.

Spinal implants are medical devices used in spine stabilization procedures to stabilize and strengthen the spine, treat deformity, and facilitate fusion. The spine injuries are generally caused by trauma or by slipped vertebrae due to degenerative intervertebral disks.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Spinal Implants Market

- Stryker Corporation

- Johnson & Johnson

- Globus Medical Inc

- ZimVie Inc

- Camber Spine Technologies LLC

- Spineart SA

- Medtronic plc

- Orthofix US LLC

- ATEC Spine Inc

- B. Braun SE

Get Free Sample For

Get Free Sample For