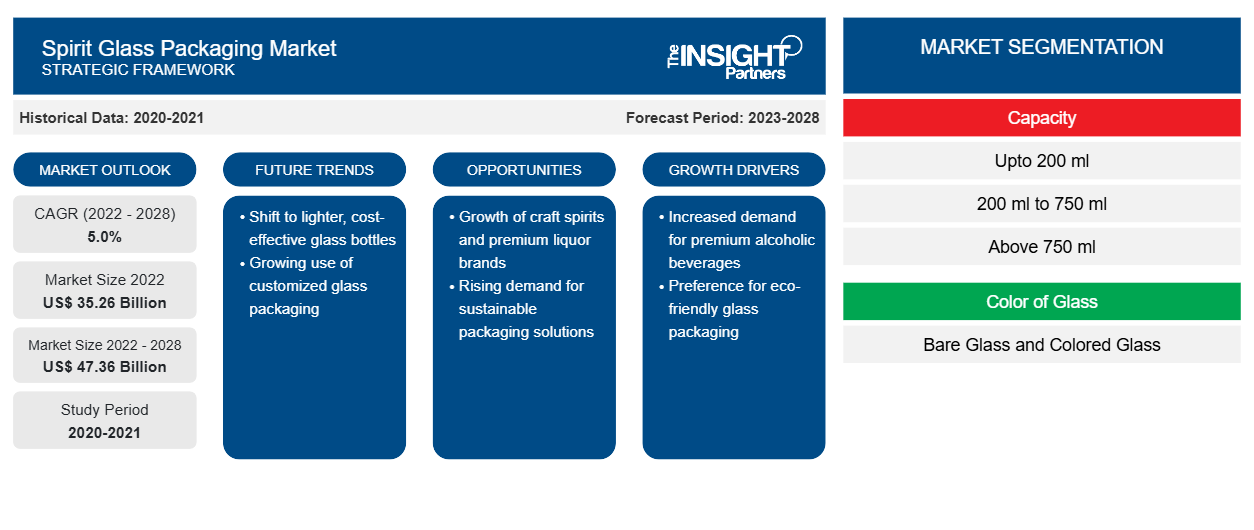

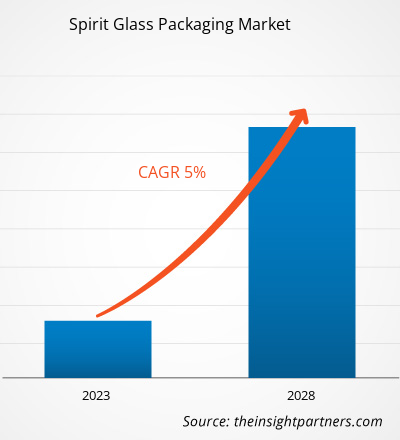

[Research Report] The spirit glass packaging market size was valued at US$ 35,258.06 million in 2022 and is expected to reach US$ 47,357.29 million by 2028; it is estimated to register a CAGR of 5.0% from 2022 to 2028.

Spirit glass packaging is extensively utilized in the spirits industry for containment of spirit products such as wine, beer, rum, whiskey, and vodka, among others. The product innovation of different spirits, such as flavored liquors and the development of bottled blended spirits, create a demand for spirit glass packaging. The distinctly designed and varied colored glass packaging enhances the overall sensory experience and influences the consumers’ buying decision. Glass packaging design and type positively influences brand image, product differentiation, and product acceptability & preference. The rising consumer preference for glass packaging has influenced spirit manufacturers to offer product differentiation through packaging design and innovative products for spirits. This is due to the availability of glass bottles with thick bases, embossing, and decoration, coupled with label design; all these features provide harmonized high-quality brand image and convey the brand or product story.

In 2022, Asia Pacific held the largest global spirit glass packaging market share. The market growth in Japan, India, China, Australia, South Korea, Singapore, Taiwan, and Indonesia is attributed to growing alcohol consumption among the population; the shift in changing preferences from standard to premium beers, whisky, vodka, wines, and other spirits; an increasing number of celebrations with alcoholic beverages; and unusual product innovation by the spirits manufacturers across the region. For instance, in September 2020, Scrapegrace Distillery, a New Zealand-based distillery, manufactured the world's first naturally black gin (naturally black brew), made from a blend of unusual botanicals. Also, this premium gin changes to red and purple hues when mixed with tonic. The distillery sold a three-month supply of the product in 24 hours. As product sales have increased, the glass packaging demand has also grown significantly. All these factors contribute to the region's spirit glass packaging market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Spirit Glass Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Spirit Glass Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Spirit Glass Packaging Market

The COVID-19 pandemic had a significant impact on the spirit glass packaging market. The global lockdowns and restrictions on travel and social gatherings have led to a decline in the consumption of alcoholic beverages, resulting in a decrease in demand for spirit glass packaging. Many bars, restaurants, and hotels, major customers of the HORECA sector, were forced to close temporarily or operate at reduced capacity, leading to reduced demand for smaller-sized glass bottles. Furthermore, disruption in the supply chain due to restrictions on transportation and manufacturing operations has increased the cost of production and distribution of spirit glass packaging.

In 2021, the global marketplace began recovering from the losses incurred in 2020 as governments of different countries announced relaxation in social restrictions. Manufacturers were permitted to operate at full capacities, which helped them overcome the demand-supply gap. Moreover, rising vaccination rates contributed to improvements in the overall conditions in different countries, which led to favorable environments for industrial and commercial progress. The increasing spirit production capacities in Asia Pacific and Europe further increased demand for spirit glass packaging in 2021.

Market Insights

Growth of HORECA Sector

The HORECA sector is one of the significant end-users of spirit glass packaging. HORECA is called Hotel/Restaurant/Catering, a part of the food service segment that includes bars, pubs, beer cafes, clubs, and hotels, among others. The impact of HORECA on spirit glass packaging is significant because of the large volume of products consumed by the sector. The inclination of the global population toward on-the-go food & beverages and a rise in disposable incomes are boosting the HORECA industry across the globe. According to National Restaurant Association (US), the food & beverage sales from the full-service segment (that includes family-dining, casual-dining, and fine-dining full-service restaurants) grew from US$ 199 billion in 2020 to US$ 289 billion in 2022. In contrast, the US sales from the limited-service segment (including quick-service restaurants, fast-casual restaurants, and cafeteria) increased from US$ 297 billion in 2020 to US$ 355 billion in 2022. The report revealed that the sales of food & beverages in the US from bars, taverns, nightclubs, or places involved in preparing and serving alcoholic beverages grew from US$ 13 billion in 2020 to US$ 21 billion in 2022.

Capacity Insights

Based on capacity, the global spirit glass packaging market is segmented into upto 200 ml, 200 ml to 750 ml, and above 750 ml. The 200 ml to 750 ml segment held the most significant global spirit glass packaging market share in 2022. This category includes glass bottles of capacities such as 375 ml, 500 ml, 650 ml, 700 ml, and 750 ml. These types of glass bottles are available in various shapes and designs. Also, these types of glass bottles come in different colors, such as amber brown, flint white, emerald, green, sapphire blue, sunshine yellow, ingot black, and gun metallic. These glass bottles are mainly used for the packaging of brandy, gin, rum, tequila, vodka, whiskey, wine, beer, etc. The 375ml and 650 ml bottles are primarily used for beer packaging, while 750 ml bottles are mainly used for spirits such as whisky, gin, rum, tequila, and liqueurs. Further, spirit glass manufacturers focus on making attractive glass bottles of various capacities that will affect product prices and consumer buying behavior.

The key players operating in the global spirit glass packaging market include O-I Glass Inc, Toyo Glass Co Ltd, Ardagh Group SA, Verallia SA, Vidrala SA, Gerresheimer AG, Nihon Yamamura Glass Co Ltd, Vitro SAB de CV, BA Glass BV, and HEINZ-GLAS GmbH & Co KGaA. Players operating in the global spirit glass packaging market focus on providing high-quality products to fulfill customer demand. They also focus on strategies such as investments in research and development activities and new product launches.

Report Spotlights

- Progressive industry trends in the spirit glass packaging market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the spirit glass packaging market from 2020 to 2028

- Estimation of global demand for spirit glass packaging

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the spirit glass packaging market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The spirit glass packaging market size at various nodes

- Detailed overview and segmentation of the market, as well as the spirit glass packaging industry dynamics

- The spirit glass packaging market size in various regions with promising growth opportunities

Spirit Glass Packaging Market Regional Insights

Spirit Glass Packaging Market Regional Insights

The regional trends and factors influencing the Spirit Glass Packaging Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Spirit Glass Packaging Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Spirit Glass Packaging Market

Spirit Glass Packaging Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 35.26 Billion |

| Market Size by 2028 | US$ 47.36 Billion |

| Global CAGR (2022 - 2028) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Capacity

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Spirit Glass Packaging Market Players Density: Understanding Its Impact on Business Dynamics

The Spirit Glass Packaging Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Spirit Glass Packaging Market are:

- O-I Glass Inc

- Toyo Glass Co Ltd

- Ardagh Group SA

- Verallia SA

- Vidrala SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Spirit Glass Packaging Market top key players overview

Global Spirit Glass Packaging Market

Based on capacity, the global spirit glass packaging market is segmented into upto 200 ml, 200 ml to 750 ml, and above 750 ml. Based on color of glass, the spirit glass packaging market is bifurcated into bare glass and colored glass. Based on application, the spirit glass packaging market is segmented into whiskey, vodka, rum, wine, beer, and others.

Company Profiles

- O-I Glass Inc

- Toyo Glass Co Ltd

- Ardagh Group SA

- Verallia SA

- Vidrala SA

- Gerresheimer AG

- Nihon Yamamura Glass Co Ltd

- Vitro SAB de CV

- BA Glass BV

- HEINZ-GLAS GmbH & Co KGaA.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Capacity, Color of Glass, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, South Africa, South Korea, United Kingdom, United States

Frequently Asked Questions

Asia Pacific accounted for the largest share of the global spirit glass packaging market. The market growth in Japan, India, China, Australia, South Korea, Singapore, Taiwan, and Indonesia is attributed to growing alcohol consumption among the population; the shift in changing preferences from standard to premium beers, whisky, vodka, wines, and other spirits; increasing number of celebrations with alcoholic beverages; and unusual product innovation by the spirits manufacturers across the region.

Based on capacity, 200 ml to 750 ml segment accounted for the largest revenue share. The growth of the segment is attributed to its usage for the packaging of brandy, gin, rum, tequila, vodka, whiskey, wine, beer, etc. The 375ml and 650 ml bottles are primarily used for beer packaging while, 750 ml bottles are majorly used for spirits such as whisky, gin, rum, tequila, and liqueurs among others.

The major players operating in the global spirit glass packaging market are O-I Glass Inc, Toyo Glass Co Ltd, Ardagh Group SA, Verallia SA, Vidrala SA, Gerresheimer AG, Nihon Yamamura Glass Co Ltd, Vitro SAB de CV, BA Glass BV, and HEINZ-GLAS GmbH & Co KGaA.

Spirit manufacturers globally are focused on investing significantly in innovative packaging solutions to expand their customer base. The innovation in packaging includes distinct design, vibrant colors, detailed labeling, and sustainable packaging. Luxury consumers and whiskey collectors demand distillery upgrades, refurbishments, and novel designs while considering whiskey collection as a form of investment. According to a report published by Scotch Whisky Association in 2023, consumers are attracted to premiumization and high-quality spirits such as scotch whiskey, which is boosting exports of spirits from Scotland. Moreover, changing consumer behavior has prompted spirit manufacturers to increase the customization of bottles, provide innovative glass packaging, and focus on the brand story.

Based on the application, beer segment is projected to register the highest CAGR over the forecast period. Increasing consumer preference for glass packaging has surged the growth of beer segment.

The consumption of spirits is continuously growing across the globe due to rising disposable income, growing favorable demographics, and changing consumer behavior. The high demand for different cocktails has created a trend for premium liquor contained in special glass packaging. The product innovation of different types of spirits, such as flavored liquors and the development of bottled blended spirits, create a demand for spirit glass packaging. Glass packaging design and type positively influences brand image, product differentiation, and product acceptability & preference.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Spirit Glass Packaging Market

- O-I Glass Inc

- Toyo Glass Co Ltd

- Ardagh Group SA

- Verallia SA

- Vidrala SA

- Gerresheimer AG

- Nihon Yamamura Glass Co Ltd

- Vitro SAB de CV

- BA Glass BV

- HEINZ-GLAS GmbH & Co KGaA.

Get Free Sample For

Get Free Sample For