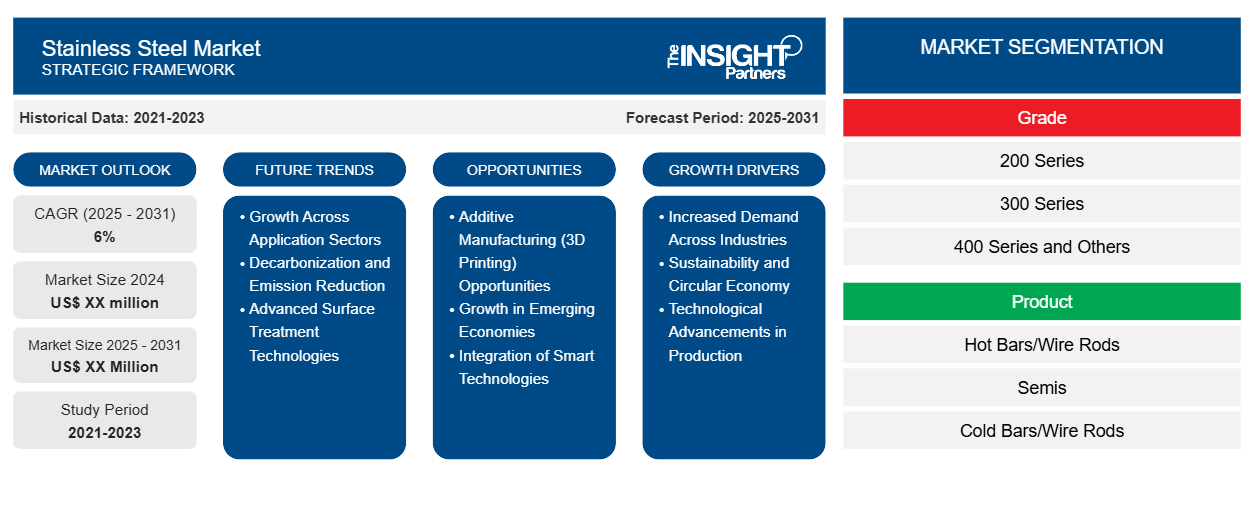

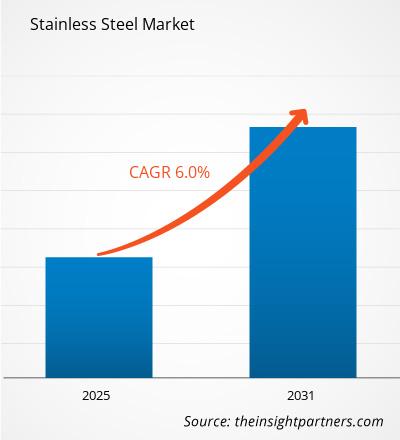

The Stainless Steel Market is expected to register a CAGR of 6% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by grade (200 series, 300 series, 400 series and others) and product (hot bars/wire rods, semis, cold bars/wire rods, hot coils, hot plate and sheet and cold-rolled flat). The report further presents analysis based on application (automotive and transportation, building and construction, consumer goods, heavy industries, electrical machinery and others). The global analysis is further broken-down at regional level and major countries. The market size and forecast at global, regional, and country levels for all the key market segments are covered under the scope. The report offers the value in USD for the above analysis and segments. The report provides key statistics on the market status of the key market players and offers market trends and opportunities.

Purpose of the Report

The report Stainless Steel Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Stainless Steel Market Segmentation

Grade

- 200 Series

- 300 Series

- 400 Series and Others

Product

- Hot Bars/Wire Rods

- Semis

- Cold Bars/Wire Rods

- Hot Coils

- Hot Plate and Sheet and Cold-Rolled Flat

Application

- Automotive and Transportation

- Building and Construction

- Consumer Goods

- Heavy Industries

- Electrical Machinery and Others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Stainless Steel Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Stainless Steel Market Growth Drivers

- Increased Demand Across Industries: The increased consumption of stainless steel across various end-use industries like construction, automotive, and consumer goods has emerged as a significant driver for the stainless steel market. Among these, the construction vertical is experiencing a promising growth trajectory on account of urbanization and infrastructure development, which, in turn, need more and more stainless steel for structure, roofing, and facades. On similar lines, the automobile sector is taking advantage of stainless steel owing to the durability and resistance that the material offers in corrosion, which finally adds to the durability and performance of the vehicles.

- Sustainability and Circular Economy: All industries are increasingly saddening towards keeping sustainable development norms, whereby manufacturers are pushing more towards environmentally friendly practices. Stainless steel results in repurposing; hence, it also forms part of the global waste reduction agenda and connects circular economy value chains. With increasing regulation with stricter standards defined concerning emissions and materials use, the industries will continue shifting to sustainable alternatives such as stainless steel, increasing consumption.

- Technological Advancements in Production: Improvement of melting and refining processes and newer manufacturing technologies increase efficiency and quality in manufacturing stainless steel. For instance, electric arc furnace (EAF) technology has made production methods more sustainable because of lower energy requirements and lower emissions while producing steel. This has reduced production costs and improved product quality, making them more valuable to end-users.

Stainless Steel Market Future Trends

- Growth Across Application Sectors: The use of stainless steel in the industry has boomed. This is because of the hitherto mentioned property features such as corrosion resistance, strength, and beauty. These combine to broaden usage in industries concerning construction, automotive, food processing, and consumer goods, where durability, safety, and aesthetics can be important.

- Decarbonization and Emission Reduction: The steel industry's carbon reduction pressure increases with decarbonization and emission reduction in production. The new ways companies are exploring to reduce their emissions while producing stainless steel include using renewable energy sources and installing carbon capture technologies. As such, it is not just a mere regulatory demand but also conforming to what consumers expect in environmentally friendly products.

- Advanced Surface Treatment Technologies: Electropolishing and other advanced surface treatment technologies continue to gain traction to enhance the performance and aesthetics of stainless steel products. Improved corrosion resistance, surface finish, and aesthetics make stainless steel an attractive option for food processing, pharmaceuticals, and high-end consumer goods applications. This trend was reflective of an industry's dedication to quality and performance.

Stainless Steel Market Opportunities

- Additive Manufacturing (3D Printing) Opportunities: Opportunities for the stainless steel industry are vastly tremendous from the introduction of additive manufacturing (3D printing). The technology differentiates itself in creating unique geometries and complex custom-made components after long-term operations with traditional manufacturing techniques. As industries seek more productive and flexible production modes, they can bring fresh uses and mining niches into play with stainless steel.

- Growth in Emerging Economies: The emerging economies are rapidly moving towards industrialization and urbanization, creating hot opportunities for stainless steel makers. As these markets grow and evolve, consumption patterns will shift proportionately, and there will be a sharp increase in demand for stainless steel in construction, automotive, and consumer goods. Companies that now base themselves in these areas could benefit from this boom and grab a considerable market share.

- Integration of Smart Technologies: Smart technologies such as IoT and AI can be integrated into the production processes of stainless steel. Their application will improve operations and enhance the quality of products. Manufacturers will optimize their production lines using data analytics, waste minimization, and improved supply chain management. This process technology improvement will yield higher productivity and increased responsiveness to market demand and consumer preferences by reducing lead times.

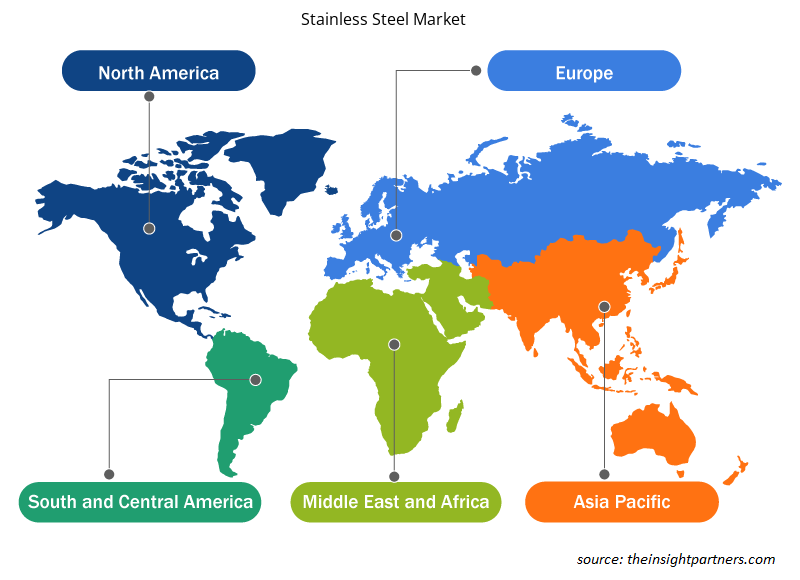

Stainless Steel Market Regional Insights

The regional trends and factors influencing the Stainless Steel Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Stainless Steel Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Stainless Steel Market

Stainless Steel Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Grade

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

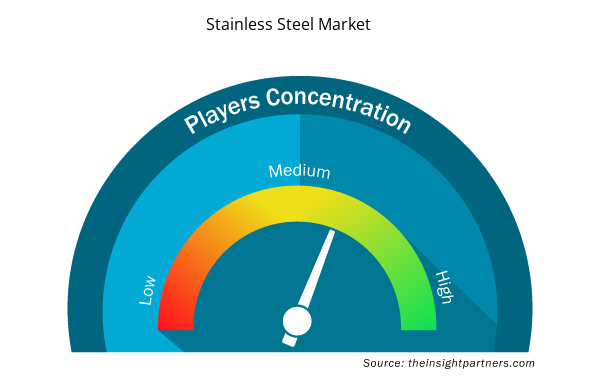

Stainless Steel Market Players Density: Understanding Its Impact on Business Dynamics

The Stainless Steel Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Stainless Steel Market are:

- Acerinox S.A

- Aperam S.A.

- ArcelorMittal S.A

- Jindal Stainless Limited.

- Outokumpu OYJ

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Stainless Steel Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Stainless Steel Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Stainless Steel Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Grade, Product, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Increased focus on eletropolishing and surface treatments is expected to be the key market trends

The report can be delivered in PDF/Word format, we can also share excel data sheet based on request.

On the basis of geography, the stainless steel market is classified into North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America

Acerinox S.A.; Aperam; ArcelorMittal; Jindal Stainless Ltd; Sandmeyer Steel Company; Sandvik AB are some of the key players operating in the stainless steel market

Sustainability and environmental regulations is driving the market growth

The Stainless Steel Market is estimated to witness a CAGR of 6% from 2023 to 2031

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies

- Acerinox S.A

- Aperam S.A.

- ArcelorMittal S.A

- Jindal Stainless Limited.

- Outokumpu OYJ

- Sandmeyer Steel Company

- Sandvik AB.

- Schmolz + Bickenbach Group

- Thyssenkrupp AG

- Guangxi Chengdu Group

Get Free Sample For

Get Free Sample For