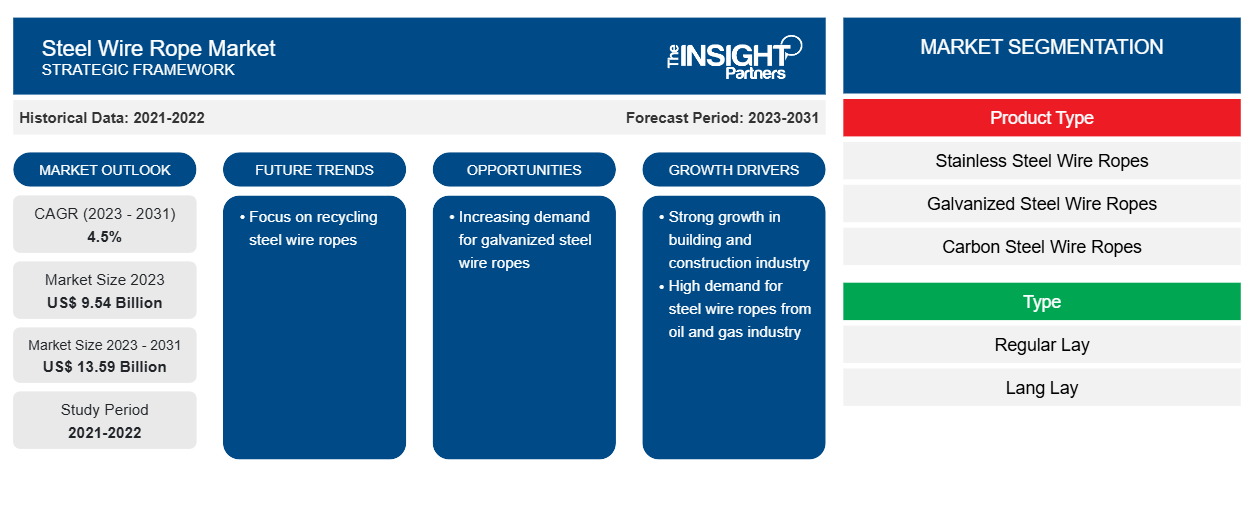

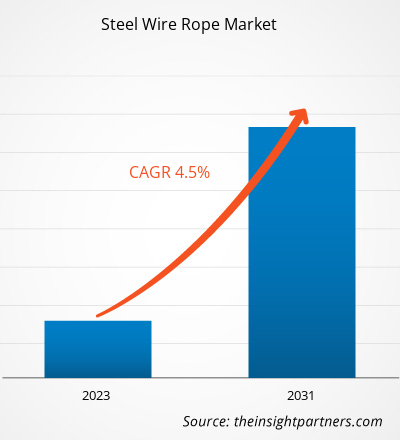

The steel wire rope market size is projected to reach US$ 13.59 billion by 2031 from US$ 9.54 billion in 2023. The market is expected to register a CAGR of 4.5% during 2023–2031. The growing focus on recycling steel wire ropes is likely to remain a key steel wire rope market trend.

Steel Wire Rope Market Analysis

In the building and construction industry, steel wire ropes are used in various applications, such as anchoring buildings, suspending scaffolding systems, and hoisting and lifting heavy loads. Stainless steel wire rope also finds application in bridge construction, where the highest tensile strength and durability are highly required. The ability of steel wire ropes to resist corrosion in harsh environments makes them ideal for coastal bridge construction. The building and construction industry is growing in various countries across the globe due to factors such as increasing investments in construction activities; growing residential, commercial, infrastructural, and industrial construction; increasing population; and rising urbanization. This, in turn, is increasing the demand for various construction materials and products, including steel wire ropes.

Steel Wire Rope Market Overview

Steel wire rope is a versatile and durable type of rope made from multiple strands of steel wire twisted or braided together to form a helix. It is commonly used in various industries and applications due to its strength, flexibility, and resistance to abrasion, corrosion, and fatigue. Steel wire ropes differ in lay, diameter, and tensile strength, tailored to suit specific needs. As a fundamental component of various sectors such as building and construction, mining, oil & gas, and marine, the demand for steel wire rope remains robust. The construction industry, in particular, drives significant demand for steel wire ropes due to their use in applications such as cranes, elevators, and suspension systems. Technological advancements, including the development of high-strength steel alloys and innovative manufacturing processes, have improved the performance and durability of steel wire ropes, expanding their applications and driving market growth. Additionally, increasing investment in infrastructure development and growing industrialization in emerging economies contribute to the expansion of the steel wire rope market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Steel Wire Rope Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Steel Wire Rope Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Steel Wire Rope Market Drivers and Opportunities

High Demand for Steel Wire Ropes from Oil & Gas Industry

In the oil & gas industry, steel wire ropes are used in drilling applications owing to their high tensile strength and resistance to rust and corrosion. They are also used in production as an important component in downhole tools. Steel wire ropes are also used for mooring, towlines, and working lines in offshore operations. The Middle East has various oil-producing countries, with the presence of many major oil producers in Saudi Arabia, the UAE, and Iraq. According to the Organization of the Petroleum Exporting Countries, Saudi Arabia possesses ~17% of the world's proven petroleum reserves. The oil & gas sector of the country accounts for ~50% of gross domestic product (GDP) and ~70% of export earnings. In the UAE, ~30% of the country's GDP is directly based on oil and gas output. The strong presence of the oil & gas industry in these countries creates a huge demand for steel wire ropes. Furthermore, oil-producing companies are spending more on increasing oil production to meet the rising energy demand due to the booming population, further creating a demand for steel wire ropes.

Increasing Demand for Galvanized Steel Wire Ropes

A galvanized wire rope is a steel wire rope coated in a layer of zinc. The coating helps protect the steel from moisture in the air, preventing the wire rope from being susceptible to rust. Galvanized wire rope is ideal for use in marine locations where the wire rope is exposed to wet, damp, and humid conditions. This type of rope also helps prevent the inner steel from degrading from rust deposits. There are several benefits of galvanized wire rope. It is cheaper than stainless steel wire rope, lighter than stainless steel, and available in steel core or fiber core. Thus, the increasing demand for galvanized steel wire ropes is expected to provide growth opportunities for the steel wire rope market in the coming years.

Steel Wire Rope Market Report Segmentation Analysis

Key segments that contributed to the derivation of the steel wire rope market analysis are base oil, product type, and end use industry.

- Based on product type, the steel wire rope market is divided into stainless steel wire rope, galvanized steel wire rope, carbon steel wire ropes, and coated steel wire ropes. The galvanized steel wire rope segment held the largest market share in 2023.

- By type, the market is segmented into regular lay and lang lay. The regular lay segment held a larger share of the market in 2023.

- In terms of end use, the market is segregated into mining, oil and gas, building and construction, marine and fishing, and others. The building and construction segment led the market in 2023.

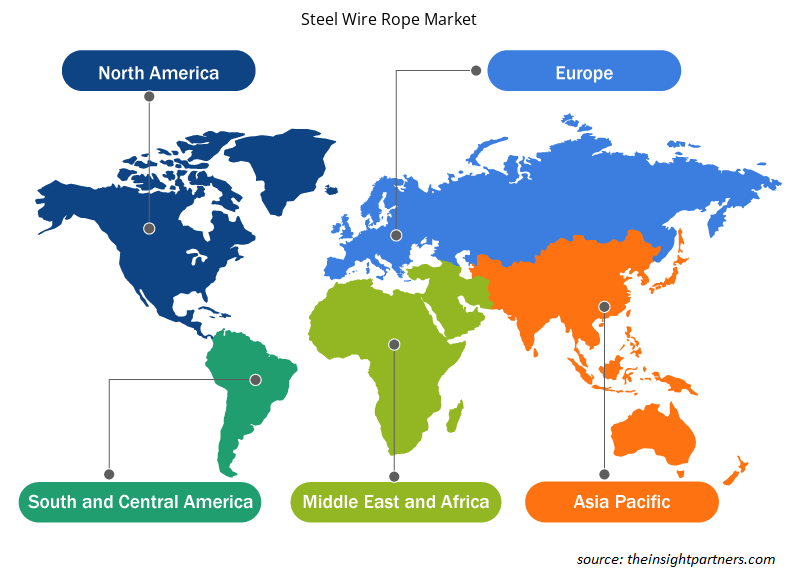

Steel Wire Rope Market Share Analysis by Geography

The geographic scope of the steel wire rope market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific has dominated the steel wire rope market. In 2022, the National Development and Reform Commission (NDRC) and the Ministry of Transport (China) unveiled the National Highway Network Planning document aimed at the construction of a functional, efficient, green, intelligent, and safe modern highway network by 2035. The plan also encompassed the construction of a 461,000 km highway, which includes 162,000 km of expressways. In the building and construction industry, stainless steel wire rope is used in anchoring buildings, lifting heavy loads, constructing bridges, and suspending scaffolding systems. Thus, the development of the building and construction industry in Asia Pacific is expected to boost the steel wire rope market over the coming years. Also, Asia Pacific is anticipated to register the highest CAGR in the coming years.

Steel Wire Rope Market Regional Insights

The regional trends and factors influencing the Steel Wire Rope Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Steel Wire Rope Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Steel Wire Rope Market

Steel Wire Rope Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 9.54 Billion |

| Market Size by 2031 | US$ 13.59 Billion |

| Global CAGR (2023 - 2031) | 4.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Steel Wire Rope Market Players Density: Understanding Its Impact on Business Dynamics

The Steel Wire Rope Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Steel Wire Rope Market are:

- Drahtseile Gebr Henschel GmbH

- Usha Martin Ltd

- Asahi Intecc Co Ltd

- Tyler Madison Inc

- Central Wire Inc

- TEUFELBERGER

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Steel Wire Rope Market top key players overview

Steel Wire Rope Market News and Recent Developments

The steel wire rope market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- Asahi Intecc Co., Ltd. merged with Toyoflex Corp to promote integration, rationalization, and efficiency of operations. The merger aims to enhance corporate value, develop R&D and production systems for global expansion, and establish a management foundation for sustainable growth. (Source: Asahi Intecc Co Ltd, Newsletter, 2023)

- Usha Martin Ltd, launched TITAN, a European wire rope center, to revolutionize the oil, energy, offshore, and marine sectors. It provides reliable anchoring, mooring, and towing wire ropes, connecting to Usha Martin's global hubs in Singapore, Houston, Australia, and Dubai. The center offers installation and inspection services worldwide, with over 5000 tons of mooring, towing, and anchor-handling wire ropes available with third-party certification. (Source: Usha Martin Limited, Newsletter, 2024)

- WireCo—a leading manufacturer of wire rope, synthetic rope, and electromechanical cable—launched Made in the USA High-Performance crane ropes at CONEXPO 2023. The US$ 30 million investment aims to provide the same quality ropes as those from Germany and Portugal but with local production. (Source: WireCo, Press Release, 2023)

Steel Wire Rope Market Report Coverage and Deliverables

The “Steel Wire Rope Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Explosion-Proof Equipment Market

- Dealer Management System Market

- Parking Management Market

- Hydrocephalus Shunts Market

- Enzymatic DNA Synthesis Market

- Small Molecule Drug Discovery Market

- GMP Cytokines Market

- Medical and Research Grade Collagen Market

- Terahertz Technology Market

- Public Key Infrastructure Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The building and construction segment held the largest share of the global steel wire rope market in 2023. In the construction industry, various equipment is used to carry heavy materials such as cement blocks, as well as other machinery. Equipment is also used to secure rebars, lift elevators, carry materials, and perform other heavy-load applications. Depending on applications, multiple types of steel wires are used in the construction industry. All these factors led to the dominance of building and construction segment in 2023.

The regular lay segment held the largest share of the global steel wire rope market in 2023. Regular lay steel wire rope consists of oppositely laid wires and strands. Wires are twisted in one direction, whereas the strands are twisted in the opposite direction to form a rope. This twist pattern between wire and strands of rope offers several advantages. All these factors led to the dominance of regular lay segment in 2023.

The galvanized steel wire ropes segment held the largest share in the global steel wire rope market in 2023. Galvanized steel wire ropes are coated with molten zinc and feature properties such as high strength and corrosion resistance. The iron element in the steel is prone to rusting and corrosion, but the addition of zinc acts as a protective layer between steel and moisture. These factors led to the dominance of the galvanized steel wire ropes segment in 2023.

A few players operating in the global steel wire rope market include Drahtseile Gebr Henschel GmbH, Usha Martin Ltd, Asahi Intecc Co Ltd, Tyler Madison Inc, Central Wire Inc, TEUFELBERGER, ArcelorMittal SA, PFEIFER Holding GmbH & Co. KG, WireCo, and Bekaert.

In 2023, Asia Pacific held the largest share of the global steel wire rope market. Asia Pacific is a major hub for oil and gas exploration and production, as well as trade activities. Governments of various countries in Asia Pacific have initiated projects to address the rising demand for oil and gas in their countries. As a result, the steel wire rope market has huge potential in Asia Pacific.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Steel Wire Rope Market

- Drahtseile Gebr Henschel GmbH

- Usha Martin Ltd

- Asahi Intecc Co Ltd

- Tyler Madison Inc

- Central Wire Inc

- TEUFELBERGER

- ArcelorMittal SA

- PFEIFER Holding GmbH & Co. KG

- WireCo

- Bekaert

Get Free Sample For

Get Free Sample For