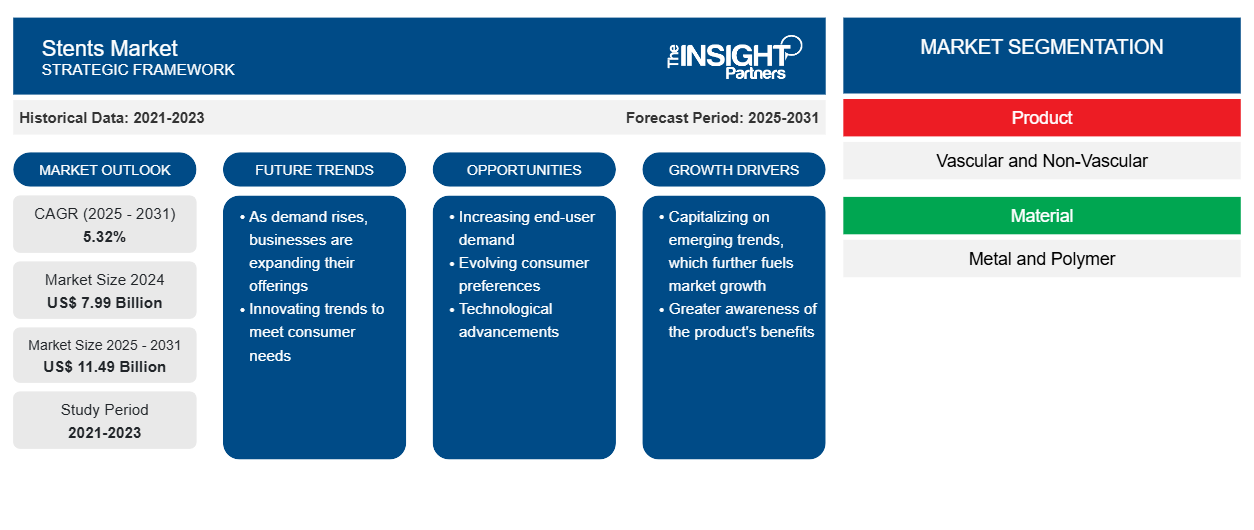

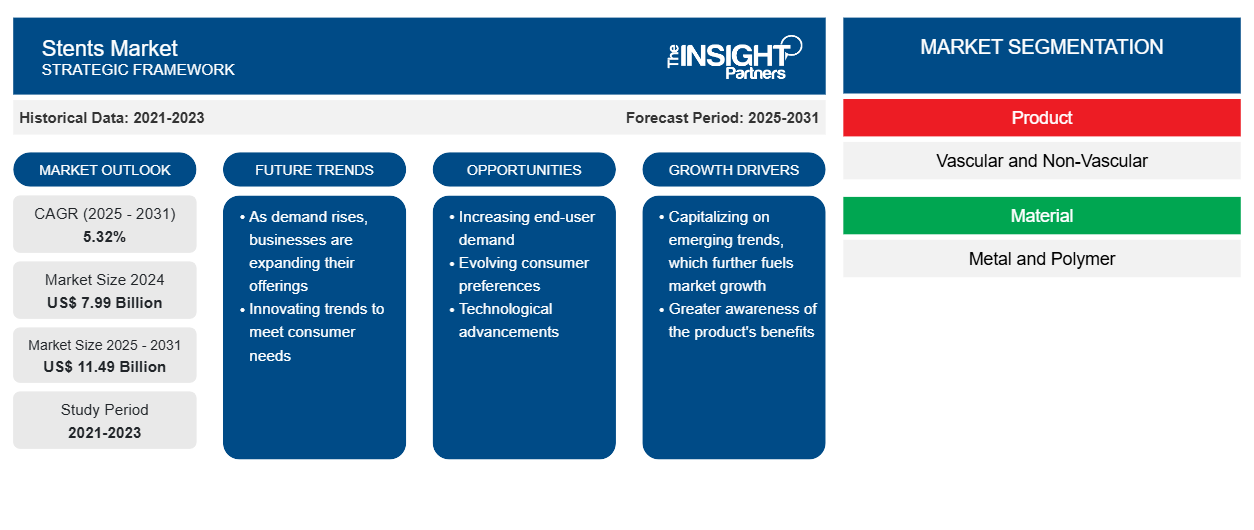

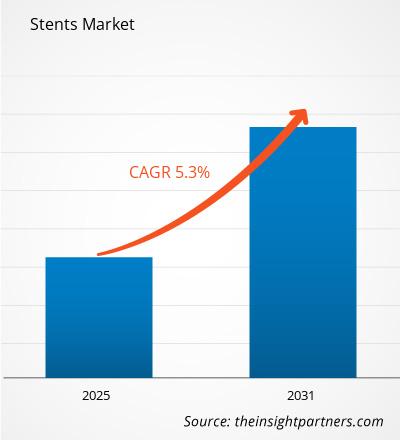

[Research Report] The global stents market was valued at US$ 7,203.47 million in 2022, and the market size is projected to reach US$ 11,114.13 million by 2031. It is expected to register a CAGR of 5.32% in the forecast period.

Market Insights and Analyst View:

A stent is a tiny mesh tube usually used to open bodily passageways, such as weak or constricted blood arteries. The coronary arteries provide the heart with blood that is rich in oxygen, and constriction in these arteries is frequently treated with stents. Stents can also treat a constricted lung airway and an aneurysm, a protrusion in the arterial wall.

Stenting is a minimally invasive treatment, which means that it is not regarded as major surgery and does not necessitate a large, open incision in the body. Patients might need specific tests or medications before receiving a stent to get ready for the surgery. Stents can be composed of silicone, cloth, metal mesh, or a mix of these elements. Coronary artery stents are typically composed of metal mesh and occasionally have an additional covering. Larger arteries like the aorta are treated with fabric stents, sometimes known as stent grafts. Silicone is frequently used to make stents in the lungs' airways.

Growth Drivers and Opportunities:

Cardiovascular diseases (CVDs) and other significant health issues that require constant monitoring and intensive care are increasingly common in the senior population. A few main risk factors for CVD are age, ethnicity, and family history. Using smoke, having high blood pressure (hypertension), having high cholesterol, being obese, being inactive, having diabetes, having a poor diet, and drinking alcohol are additional risk factors.

As a result, the world's aging population is expected to drive the cardiac output monitoring device market over the estimated period. According to World Health Organization (WHO) projections, by 2031, there will be 1.4 billion persons over 60 worldwide. With age, people become more susceptible to mobility limitations, as a result of which they require medical assistance or aid to avoid dependence on other individuals. The global population is aging rapidly, and the number of older adults is expected to increase significantly in the coming years. According to the 2021 Census, in the US, the population aged 65 and above surged nearly five times faster than the population growth during 1920–2021. In 2021, 55.8 million Americans, i.e., 16.8% of the total population, were aged 65 and above. Further, 13% of Brazil's population—more than 30 million seniors—is aged 60 or more; this population is expected to reach ~50 million by 2031, i.e., 24% of the country's population. Thus, the increasing geriatric population prone to CVD is a significant driver for the growth of the stents market.

On the other hand, the stringent regulation for approval presents a significant challenge hindering the growth of the stents market. Coronary stents are implantable devices placed percutaneously in one or more coronary arteries to maintain the patency. The various stages of the regulation of the stents require examination at each stage. The clinical evaluation of the drug-eluting stents aims to validate their safety and usefulness; the study design should fulfill both. The endpoints study for the other settings of coronary drug-eluting stents clinically important to the meaningful endpoints is strongly recommended. The information gathered in the post-marketing period is very important. The long-term (5-year) post-approval clinical follow-up is very important and recommended. Stringent regulations are required for the coronary stents for the proper functioning and accuracy of the coronary stents for treatment. These are likely to hamper the market growth soon.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Stents Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Stents Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global stents market” is segmented based on the product, material, type, end-use, and region. By product, the market is broadly segmented into vascular and non-vascular. The market is classified based on material, such as metal and polymer. The type segment of the market is broadly segmented into self-expandable and balloon-expandable stents. The market is classified into hospitals, ambulatory surgical centers, and others based on end-use. The stents market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on the product, the stents market is segmented into vascular and non-vascular. In 2022, the stents market revenue was mostly attributed to vascular stents, which had the largest share. The aging demographic base will contribute to the market's growth. For Instance, a report by the United Nations Department of Economic and Social Affairs estimates that 727 million people worldwide will be 65 or older in 2021. Additionally, as people age, their hearts and blood arteries alter, raising their risk of heart attacks, heart failure, and coronary heart disease. This adds to the market share. Additionally, the segmental outlook will improve with the growing use of vascular stents in such treatments and illness treatment solutions.

The stents market is segmented into metal and polymer based on the product segment. The demand for metal stents rises due to their benefits, which include reduced rates of stent fracture, biocompatibility, and flexibility. This adds to the market's growth. In addition, incorporating biodegradable polymers into metal stents to address the drawbacks of traditional goods will contribute to the segment's growth and support market projections.

Based on type, the stents market is classified into self-expandable stents and balloon-expandable stents. Expandable stents are projected to receive more regulatory approval, accelerating segmental expansion. Unlike stainless steel with a closed cell design for tight scaffolding, the balloon-expandable is made of cobalt-chromium struts. Following coronary angioplasty, these stents are frequently utilized to prevent coronary restenosis. Additionally, the advantages of balloon-expandable stents—such as increased radial stiffness and comparatively more precise placement, which is crucial in bifurcation lesions—will increase the market's sales of stents.

Based on the end-use segment, the stents market is segmented into hospitals, ambulatory surgical centers, and others. It is well known that hospitals have created infrastructure with the modern medical equipment needed for successful stent treatments. Stents are regarded as vital medicinal supplies and are frequently utilized in minimally invasive surgical treatments. Because hospitals have highly qualified doctors and nurses who can provide efficient post-surgery care, patients receive superior care there. Additionally, it is anticipated that the frequency of stenting procedures will rise in response to an increasingly sedentary lifestyle, poor diet, and unhealthy habits, including drinking alcohol, smoking, and using tobacco products. Additionally, it is anticipated that the Stents market would generate revenue due to the growing emphasis on modernizing the healthcare infrastructure, which includes hospitals.

Regional Analysis:

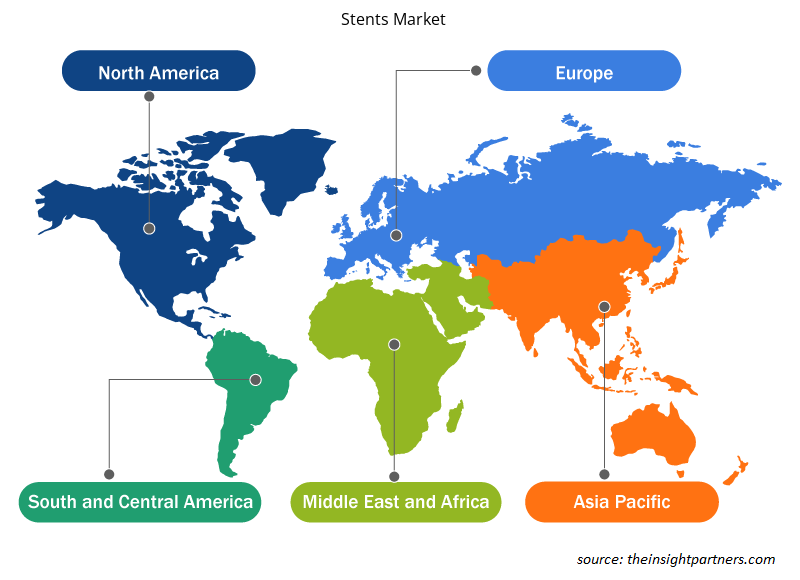

Based on geography, the global stents market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa.

The stents are developed for the treatment of narrow and weak arteries. The process of the treatment of these arteries is known as angioplasty. The angioplasty is done to restore North America, including countries such as the US.

The rising prevalence of various types of cardiac disease is one of the major factors for using coronary stents, which eventually drives the market for the stents. According to the American Heart Association (AHA) data, in 2022, 244.1 million persons in the US have CHD. The rising number of coronary heart diseases needs more coronary stents; hence, the market will grow.

The market's major players are developing various types of stents for portfolio enhancement. For instance, in February 2021, Medtronic received FDA approval and U.S. launch of the Resolute Onyx 2.0 mm Drug-Eluting Stent, which is majorly developed for smaller area treatments. The new stent is designed for cardiologists treating patients with coronary artery disease (CAD) with small vessels that are not treated properly using the larger stent technologies while using percutaneous coronary intervention (PCI). The CE mark for iVascular's balloon-expanding (BX) covered stent, iCover, was approved in May 2021. It treats ruptures, aneurysms, and arteriosclerotic lesions in the renal and iliac arteries. The company was able to grow because of this tactic.

Asia Pacific includes India, China, Japan, and the Rest of Asia Pacific. This region accounted for over 20.9% of the global stents market owing to the large population of countries such as China and India, the increasing focus of market players, and the rising number of conferences & meetings. Thus, there is a huge potential for the stents market during the forecast period for the above reasons. The developments of the companies and the mergers and collaborations form better opportunities for the users and the manufacturers to market and purchase. Japan has started to grow primary care and governance across the full pathway of CVD and diabetes care. Benchmarking and monitoring are the most common in primary care. The country has numerous policy instruments for improving the quality of services along the entire pathway, including integrated care models, financial incentives for improved quality and performance, benchmarking, and target setting.

BIOTRONIK received market approval for the Orsiro coronary drug-eluting stent (Orsiro DES) from the Japanese Ministry of Health. The stents have ultrathin 60-micron struts and a unique proBIO coating that reduces the nickel ion release. This makes the stent more compatible to be used in CVD treatments.

Some national-level conferences are also being held in the country to provide knowledge and lectures on cardiovascular diseases. For instance, the International Conference on Structural and Molecular Biology will be held in Japan on May 14-15, 2023. The conference aims to spread knowledge and awareness about the various diseases and related treatment procedures.

Owing to these developments by Japan's industry players, the stents market will likely grow in the forecast period.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global stents market are listed below:

- In August 2022, The drug-eluting stent (DES) Onyx Frontier was introduced by Medtronic. The new product enhances performance and provides sophisticated delivery management in difficult situations.

- In December 2022, The National Medical Products Administration (NMPA) of China granted MicroPort Scientific a registration certificate for its Bridge vertebral drug-eluting stent. The device has a novel medication delivery architecture minimizes restenosis and thromboembolic complications while promoting quicker endothelialization. The approval strengthens the company's market presence.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global stents market are Abbott, Medtronic, Boston Scientific Corporation, Terumo Corporation, B Braun Melsungen AG; Biotronik; Stentys SA; MicroPort Scientific Corporation; C. R. Bard, Inc.; Cook Medical and others. These stents markets focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. Their widespread global presence allows them to serve many customers and increase their market share. The report offers stents market trends analysis emphasizing various parameters such as technological advancements, market dynamics, and competitive landscape analysis of leading global market players.

Report ScopeStents Market Regional Insights

The regional trends and factors influencing the Stents Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Stents Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Stents Market

Stents Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 7.99 Billion |

| Market Size by 2031 | US$ 11.49 Billion |

| Global CAGR (2025 - 2031) | 5.32% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Stents Market Players Density: Understanding Its Impact on Business Dynamics

The Stents Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Stents Market are:

- Boston Scientific Corporation

- Johnson and Johnson

- Bitronik, Inc

- B. Braun Melsungen AG

- Abbott

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Stents Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Single-Use Negative Pressure Wound Therapy Devices Market

- Sterilization Services Market

- Skin Graft Market

- Hot Melt Adhesives Market

- Visualization and 3D Rendering Software Market

- Mail Order Pharmacy Market

- Trade Promotion Management Software Market

- Ceiling Fans Market

- Enzymatic DNA Synthesis Market

- Transdermal Drug Delivery System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Material, Type, End Use, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. Boston Scientific Corporation

2. Johnson and Johnson

3. Bitronik, Inc

4. B. Braun Melsungen AG

5. Abbott

6. Medtronic

7. Opto Circuits (India) Ltd

8. STI Laser Industries, Ltd

9. Vascular Concept

10. Cook

Get Free Sample For

Get Free Sample For