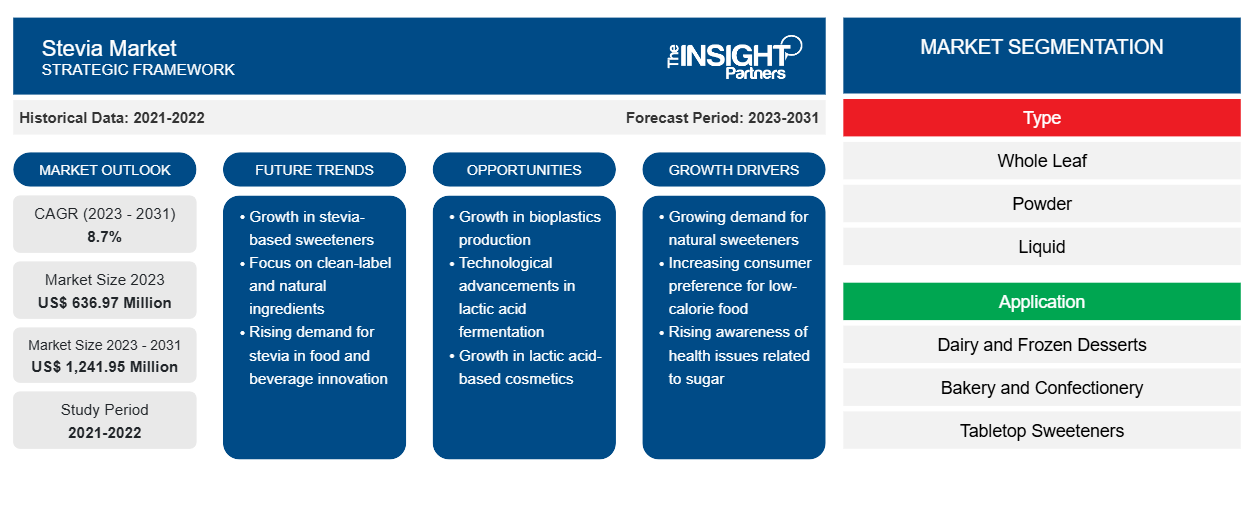

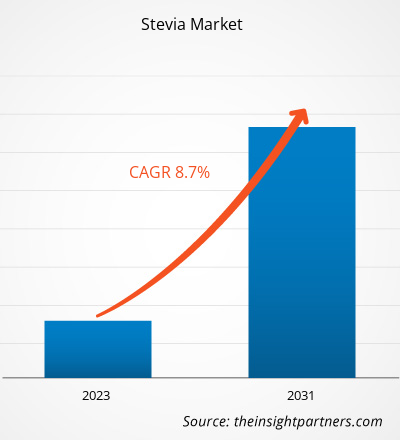

The stevia market size is projected to reach US$ 1,241.95 million by 2031 from US$ 636.97 million in 2023. The market is expected to register a CAGR of 8.7% during 2023–2031. Rising trend for low-calorie sugar alternatives with increasing calorie consciousness is likely to remain key trend in the market.

Stevia Market Analysis

The growing awareness about healthy diet and increasing health consciousness among people are the major drivers for the stevia market in the globe. Countries such as US, Germany, UK, Canada, China, Japan and South Korea are major contributors for the market growth in the globe. Consumers are seeking similar labels and natural ingredients as they become more aware of their own nutrition. Also, the increased awareness of obesity, weight control, and the significance of eating a healthy diet is driving up demand for stevia-based products worldwide. The global market for stevia has been rising on account of advancements in the food and beverages industry. The food and beverage industry are the largest manufacturing field in the global countries. The increased consumption of processed foods among consumers owing to busy lifestyle and convenience is driving the stevia market growth.

Stevia Market Overview

Increasing consumer inclination toward natural sweeteners has been driving the global stevia market growth. With the increasing incidence of diabetes and obesity worldwide, consumers are progressively shifting toward natural sweetening products. According to the International Diabetes Foundation, 641 million people will have diabetes by 2040, rising from 415 million in 2015. Obesity is a prevalent disease that leads to diabetes along with other chronic diseases such as hypertension, metabolic syndrome, cardiovascular risk, and retinopathy. The authorities across the world are focusing on a healthier lifestyle, which includes a reduction in the number of calories consumed, especially added sugar. The World Health Organization (WHO) has recommended a decrease in added sugars in the daily lifestyle. To lower the amount of sugar intake, consumers prefer natural sweeteners such as stevia, which helps in weight management by reducing added sugar and calories. Along with this, in Europe, consumers are increasingly consuming products having no added sugar. According to the 2020 New Nutrition Business survey, two-thirds of European consumers are trying to lower their sugar intake due to the increasing rate of obesity and diabetes, which has led to an increased demand for stevia in Europe. Thus, an increase in consumer inclination toward natural sweeteners is driving the growth of the stevia market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Stevia Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Stevia Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Stevia Market Drivers and Opportunities

Rising Concerns About Diabetes and Obesity to Favor Market

With the increasing incidence of diabetes and obesity worldwide, consumers are progressively shifting toward natural sweetening products. According to the International Diabetes Foundation, 641 million people will have diabetes by 2040, rising from 415 million in 2015. Obesity is a prevalent disease that leads to diabetes along with other chronic diseases such as hypertension, metabolic syndrome, cardiovascular risk, and retinopathy. The authorities across the world are focusing on a healthier lifestyle, which includes a reduction in the number of calories consumed, especially added sugar. The World Health Organization (WHO) has recommended a decrease in added sugars in the daily lifestyle. To lower the amount of sugar intake, consumers prefer natural sweeteners such as stevia, which helps in weight management by reducing added sugar and calories. Along with this, in Europe, consumers are increasingly consuming products having no added sugar. According to the 2020 New Nutrition Business survey, two-thirds of European consumers are trying to lower their sugar intake due to the increasing rate of obesity and diabetes, which has led to an increased demand for stevia in Europe. Thus, an increase in consumer inclination toward natural sweeteners is driving the growth of the stevia market

Increasing Demand for Low-Calorie Sweeteners in Food and Beverages

Businesses are becoming more aware of stevia; Pepsi and Coca-Cola, for instance, have begun using stevia into their soft drinks as a sweetener. Stevia is also used by other producers of food and beverages products such as yogurts, candies, and processed foods like ketchup. Opportunities in the market are also increased by developments in stevia labeling. The new EU labeling update, which changes the product's name from "Steviol glycosides (E 960)" to "Steviol glycosides from stevia (E 960)," gives consumers additional transparency and information about the product's botanical origin. Consumer demand is predicted to be impacted by the change. According to Cargill's Ingredient Tracker, just about 25% of European consumers are aware with the phrase "steviol glycosides," whereas 64% are familiar with "stevia." However, as consumers are paying more attention to ingredients used in processed food and beverages, the awareness for “steviol glycosides” term is projected to increase over the period of time, which is expected to open new opportunities in the coming years.

Stevia Market Report Segmentation Analysis

Key segments that contributed to the derivation of the stevia market analysis are type and application

- Based on type, the stevia market is divided into whole leaf, powder, and liquid. The powder segment held the largest market share in 2023. A stevia white powder is a natural and healthy substitute for sugar. Stevia leaves are dried to form the powder and the powdered form of stevia is loaded with the extracts of stevia leaves and erythritol

- In terms of application, the market is segmented into dairy and frozen desserts, bakery and confectionery, tabletop sweeteners, beverages, and others. The dairy and frozen desserts segment held a significant share of the market in 2023. The rising demand for low-calorie sweeteners in ice creams, yogurts, milkshakes, and other dairy products due to increasing calorie consciousness and increasing preference for products with “no-added sugar” claims is expected to drive the demand for stevia in dairy and frozen desserts, propelling the segment’s growth.

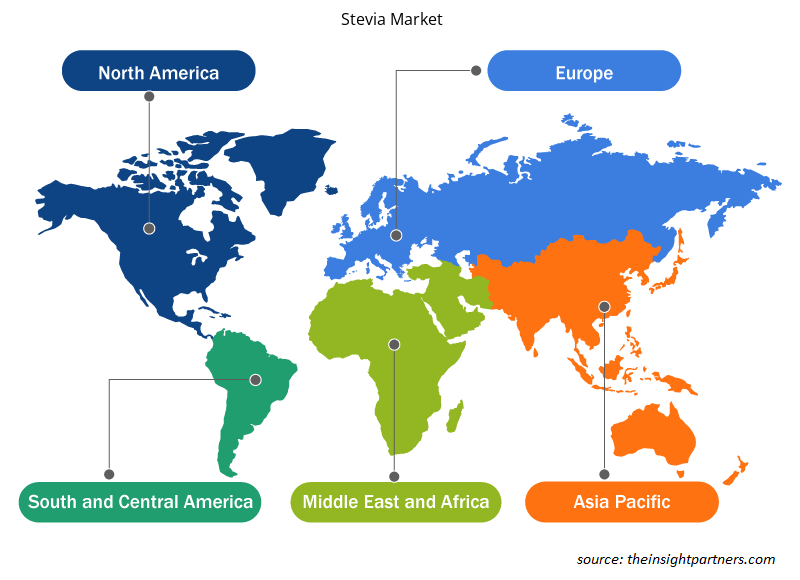

Stevia Market Share Analysis by Geography

The geographic scope of the stevia market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific has dominated the market. In Asia Pacific region, consumers, health experts and governments have become more concerned about health and diet. This has leads to the adoption of natural sweeteners, including stevia by the various food and beverage manufacturers. Stevia is a plant based sweetener which works well in various food and beverage applications. With the raising importance of stevia sweetener, its use has also increased in carbonated soft drink, ice creams, baked goods, flavored and sparking waters, ready to drink teas and coffees, flavored milks, tabletop sweeteners and other food and beverage products in the region. The various government policies also contribute for the growth of the stevia market in the region. For instances, Singapore's Ministry of Health (MOH) recommended several policies that could have an impact on the food and beverage industries, including prohibiting the sale of high-sugar pre-packaged drinks and levying a tax on sugar-based beverages.

Stevia Market Regional Insights

The regional trends and factors influencing the Stevia Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Stevia Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Stevia Market

Stevia Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 636.97 Million |

| Market Size by 2031 | US$ 1,241.95 Million |

| Global CAGR (2023 - 2031) | 8.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

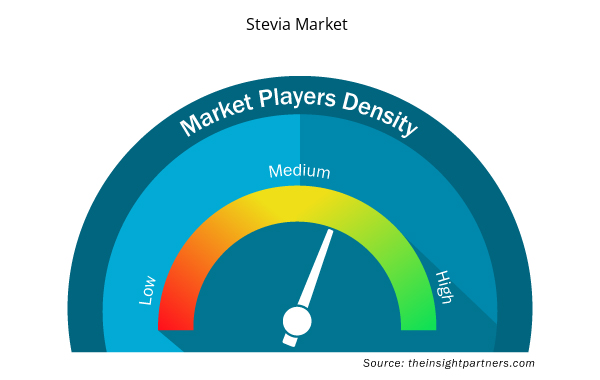

Stevia Market Players Density: Understanding Its Impact on Business Dynamics

The Stevia Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Stevia Market are:

- Cargill, Incorporated

- Ingredion Incorporated

- Tate & Lyle PLC

- GLG LIFE TECH CORP

- ADM

- Sunwin Stevia International, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Stevia Market top key players overview

Stevia Market News and Recent Developments

The stevia market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the stevia market are listed below:

- Tate & Lyle PLC (Tate & Lyle), a world leader in ingredient solutions for healthier food and beverages, is pleased to announce a new addition to its sweetener portfolio – TASTEVA® SOL Stevia Sweetener. An internationally patent protected breakthrough in stevia technology, this addition expands Tate & Lyle’s ability to help customers solve stevia solubility issues in food and beverages and helps deliver on consumer demand for healthier and tastier, sugar and calorie reduced products. (Source: Tate and Lyle, Company Website, July 2023)

- Ingredion Incorporated (NYSE: INGR), a leading global provider of specialty ingredients to the food and beverage industry, announces the expansion of PureCircle™ by Ingredion’s stevia production facility in Malaysia, further extending its position as the largest scale operator for stevia ingredients from bioconversion. This expansion grows PureCircle’s bioconversion technology capacity, supporting four times the current capacity for these ingredients. The investment significantly increases the scale and supply of the best-tasting stevia leaf ingredients for replacing sugar and artificial sweeteners across food and beverage categories.. (Ingredion, Press Release, November 2023)

Stevia Market Report Coverage and Deliverables

The “Stevia Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Stevia market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Stevia market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- stevia market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the stevia market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Asia Pacific dominates the stevia market in 2023 with rising demand for low-calorie and low-intensity sweeteners

Rising concerns about obesity and diabetes and shifting consumer demand for refined sugar alternatives are the key market drivers.

Increasing adoption of clean-label products with low-calorie sweeteners is likey to remain the key trend in the stevia market.

A few of the players operating in the global hair extension market includes Cargill, Incorporated; Ingredion Incorporated; Tate & Lyle PLC; GLG LIFE TECH CORP; ADM; Sunwin Stevia International, Inc.; S&W Seed Company; Morita Kagaku Kogyo Co., Ltd.; Zhucheng Haotian Pharm Co., Ltd.; and PureCircle

By 2031, the stevia market is projected to reach US$ 1,241.95 million.

The expected CAGR of the stevia market is 8.7%

Get Free Sample For

Get Free Sample For