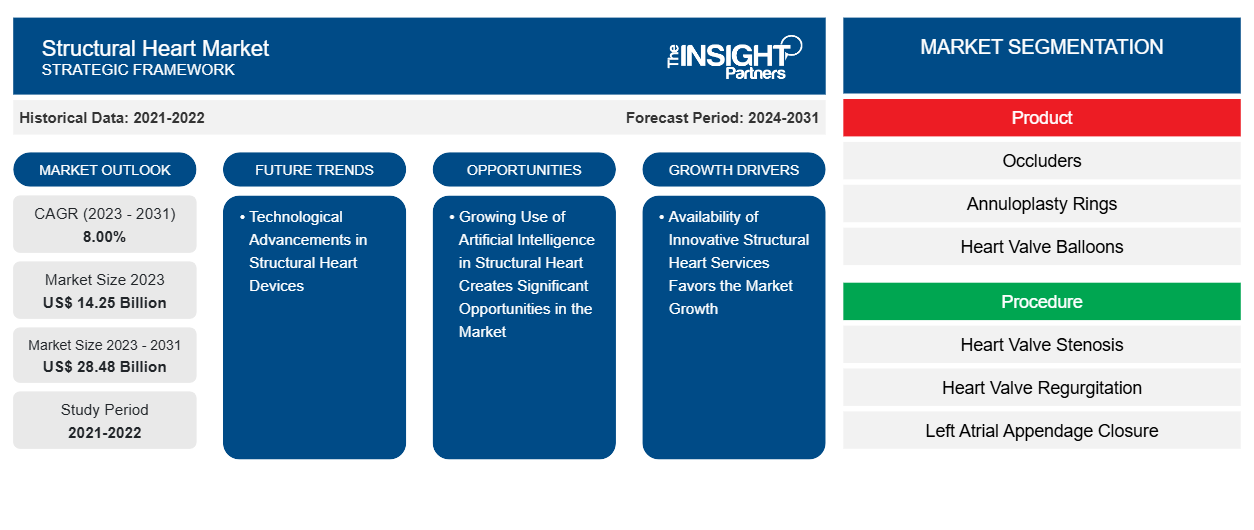

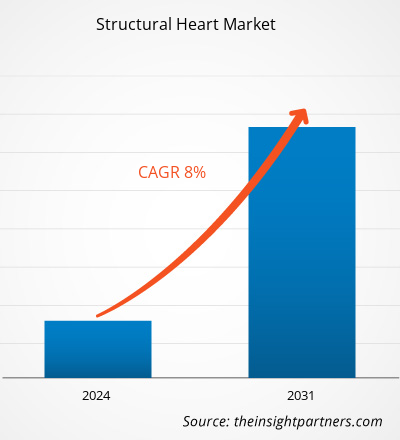

The structural heart market size is projected to reach US$ 28.48 billion by 2031 from US$ 14.25 billion in 2023. The market is expected to register a CAGR of 8.00% during 2023–2031. Technological advancements in structural heart devices will likely remain a key trend in the market.

Structural Heart Market Analysis

Devices and procedures used to treat structural heart diseases, such as congenital heart abnormalities, valvular heart disease, and cardiomyopathy, are included in the structural heart market. Growing aging populations, rising rates of cardiovascular conditions, and technological breakthroughs drive this market. The prominent companies in the market are Abbott Laboratories, LivaNova PLC, Edwards Lifesciences Corporation, Boston Scientific Corporation, etc. These companies concentrate on research and development, strategic acquisitions, mergers, and introducing new products to sustain and expand their market positions.

Structural Heart Market Overview

According to the World Health Organization (WHO), cardiovascular diseases are the second leading cause of death worldwide. Therefore, various initiatives are being taken to control cardiovascular diseases. Heart valve disease is expected to be one of the most common causes of heart failure. Degenerative diseases of aortic and mitral valves and diseases of dysfunctional tricuspid valves lead to a worse clinical course in severe cases. Minimally invasive, surgical, and catheter-based interventions for structural heart disease have increased dramatically recently. The UK Factsheet January 2022, published by the British Heart Foundation (BHF), shows that ~7.6 million people with cardiovascular diseases live in the UK. According to the same source, ~4 million men and ~3.6 million women were diagnosed with heart and circulatory diseases in the country in 2021. The high prevalence of cardiovascular disease leads to the high demand for treatment procedures such as angioplasty and cardiac surgery for survival. This creates opportunities for companies providing structural heart valves and annuloplasty rings, among other devices.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Structural Heart Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Structural Heart Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Structural Heart Market Drivers and Opportunities

Availability of Innovative Structural Heart Services Favors the Market Growth

The availability of technologically advanced products and treatment services allows surgeons, physicians, and other healthcare providers to offer superior services to their patients, which helps them maintain the optimum quality of life. The innovations are not limited to healthcare facilities and are extended to programs designed for patients to benefit from treatment facilities. Heart diseases are complex, and the success of their intervention depends on innovations bringing treatment options that were deemed impossible earlier into reality. The heart disease treatment landscape—from structural inventions to surgical valve therapies—has experienced breakthrough innovations over the past few decades. Companies in the structural heart market offer a broad portfolio of solutions for different heart conditions, including vascular disease, irregular heartbeats, and heart valve diseases. Physicians can now manage arrhythmias by using remote monitoring devices to keep a tab on their patients, thereby treating an array of structural heart conditions.

The Food and Drug Administration (FDA) has approved various therapies limited to the selected groups of patients. For instance, Premier Health, one of the innovative structural heart services providers, offers alcohol septal ablation treatment for hypertrophic cardiomyopathy. The therapy mainly uses a catheter-based technology. Balloon valvuloplasty uses a transcatheter approach for widening up stiff and narrow heart valves, atrial septal defect transcatheter repair, which closes an opening between the heart’s left, and the service providers providing the right atrium without surgery and more services. CentraCare's Heart & Vascular Center used EchoPixel's True3D and HTG pre-planning software, which provides mixed reality capabilities that allow structural heart care teams to interact with a real-time holographic version of the patient's anatomy without physically touching it or exposing it to contrast agents and radiations. In August 2021, the first 3D-printed heart valve of an Indian make was developed in Chennai.

The innovative technologies and techniques of structural heart programs are specifically designed to provide quality care for the best patient results, fewer complications, and shorter recovery times with long-lasting advantages. Such technologies are likely to attract more patients suffering from structural heart diseases. Eventually, the benefits of the services are likely to enhance the market's growth in the forecasted period.

Growing Use of Artificial Intelligence in Structural Heart Creates Significant Opportunities in the Market

The number of interventional structural heart disease (SHD) procedures, such as transcatheter valve procedures, has increased significantly in recent years, triggering the need for well-founded knowledge about optimal anatomical spatial orientation during these procedures. This has led to the development new procedural capabilities and technologies in periprocedural planning. Hybrid fusion imaging (FI) combines multiple modalities with fluoroscopy, mainly based on multislice spiral computed tomography (MSCT) and echocardiography. Ongoing developments in machine learning and artificial intelligence (AI) facilitate the routine use of individualized segmented 3D heart models that allow for multiple combinations of different imaging modalities. As AI enables computers to perform tasks at a more incredible speed and with potentially better precision than humans, risk stratification and outcome aspects can be optimized in the future. The application of computer modeling, 3D printing, and AI has already led to transformations in procedure planning and physician education on SHD. These technologies also promise unlimited possibilities. With further research and development, AI can advance precision medicine at every step, including diagnosis, treatment stratification and device selection, procedure delivery and guidance, and post-procedure/discharge monitoring and rehabilitation.

The structural heart is a rapidly evolving branch of cardiology, and North American, European, and other developing countries are experiencing advancements in related technologies. The occurrence of cardiovascular diseases is increasing in the country and also worldwide. The structural heart is at the initial stage of development in regions such as Asia Pacific, the Middle East, and Africa. For instance, in India, KIMS hospital provides services for the structural heart in the south Indian region. Most of the people in this region chew or smoke tobacco, and the incidence of structural heart disease is increasing in this region. According to the American Heart, cardiovascular diseases caused ~19.1 million deaths worldwide in 2020. In 2020, Eastern Europe and Central Asia had the highest cardiovascular mortality rates. Oceania, Central Europe, North Africa, the Middle East, Sub-Saharan Africa, and South and Southeast Asia also reported higher mortality rates. Thus, with the rising incidence of structural heart diseases in the abovementioned regions, the market players are likely to grab significant opportunities to offer effective products.

Structural Heart Market Report Segmentation Analysis

Key segments that contributed to the derivation of the structural heart market analysis are product, procedure, and end user.

- Based on product, the structural heart market is divided into occluders, annuloplasty rings, heart valve balloons, and others. The occluders segment held the most significant market share in 2023.

- By procedure, the market is categorized into heart valve stenosis, heart valve regurgitation, and left atrial appendage closure. The heart valve stenosis segment held the largest share of the market in 2023.

- By end user, the market is segmented into hospitals, ambulatory surgical centers, and cardiac centers. The hospitals segment held the largest share of the market in 2023.

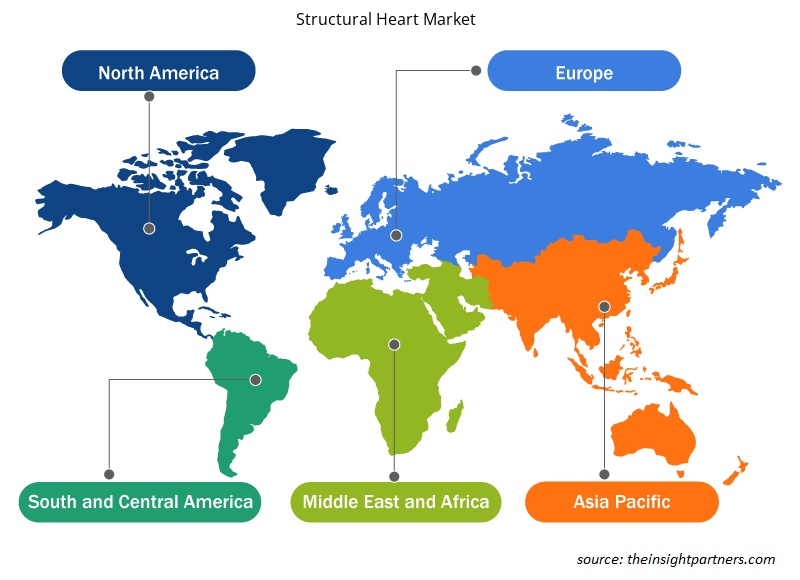

Structural Heart Market Share Analysis by Geography

The geographic scope of the structural heart market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North America structural heart market is segmented into the US, Canada, and Mexico. The market growth in this region is attributed to the rise in the prevalence of heart diseases, increased regulatory approvals, research & development, and new product launches. Additionally, many cardiac centers, specialty care centers, ambulatory surgical centers, and favorable reimbursement scenarios in the region are expected to boost the structural heart market growth during the forecast period. Valvular heart disease is the most common form of structural heart disease. According to the Cleveland Clinic, heart valve disease affects ~2.5% of people in the US. These include valve regurgitation (leaky) or stenosis (narrowing). Mitral regurgitation is the most common valvular disease in the United States, although aortic stenosis is also very common. More than 2 million people in the US have a leaking heart valve. In addition, ~1.4 million adults and 1 million children in the United States have a congenital heart defect. Congenital heart disease is the most common birth abnormality in the United States. It affects almost 1% of births annually (~40,000 babies). According to the American Heart Association, in 2022, 1 in 500 people in the US may have hypertrophic cardiomyopathy. Cardiomyopathy has many causes, including coronary artery disease, consequences of a viral infection, environmental influences (e.g., alcohol), and hereditary causes.

Structural Heart Market Regional Insights

The regional trends and factors influencing the Structural Heart Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Structural Heart Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Structural Heart Market

Structural Heart Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 14.25 Billion |

| Market Size by 2031 | US$ 28.48 Billion |

| Global CAGR (2023 - 2031) | 8.00% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Structural Heart Market Players Density: Understanding Its Impact on Business Dynamics

The Structural Heart Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Structural Heart Market are:

- Abbott Laboratories

- Medtronic Plc

- Boston Scientific Corp

- Artivion Inc.

- Edwards Lifesciences Corp

- Lepu Medical Technology Beijing Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Structural Heart Market top key players overview

Structural Heart Market News and Recent Developments

The structural heart market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the structural heart market are listed below:

- Medtronic announced the relaunch of its Harmony Transcatheter Pulmonary Valve (TPV) System, a minimally invasive alternative to open-heart surgery for congenital heart disease patients with native or surgically repaired right ventricular outflow tract (RVOT). (Source: Medtronic, Press Release, February 2023)

- Genesis MedTech Group (Genesis or Group) has completed the acquisition of JC Medical (JCM), a structural heart company that is primarily engaged in the design and development of transcatheter valve replacement products for the minimally invasive treatment of structural heart diseases. The acquisition means that Genesis will be able to add J-Valve, a minimally invasive transcatheter aortic valve replacement (TAVR) device for both aortic regurgitation and stenosis patients, to its product portfolio. This addition will greatly improve Group's ability to better meet the needs of patients, interventional cardiologists, and cardiac surgeons. (Source: Genesis MedTech Group, Press Release, February 2022)

Structural Heart Market Report Coverage and Deliverables

The “Structural Heart Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Structural heart market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Structural heart market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Structural heart market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the structural heart market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Dropshipping Market

- Piling Machines Market

- Small Internal Combustion Engine Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Pressure Vessel Composite Materials Market

- Smart Mining Market

- Identity Verification Market

- Dried Blueberry Market

- Medical Enzyme Technology Market

- Latent TB Detection Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Procedure, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to register a CAGR of 8.00% during 2023–2031.

Abbott Laboratories, Medtronic Plc, Boston Scientific Corp, Artivion Inc., Edwards Lifesciences Corp, Lepu Medical Technology Beijing Co Ltd, Braile Biomedica Industry, Commerce and Representations Ltd, Aran Biomedical Teoranta, Micro Interventional Devices Inc, Corcym UK Ltd.

Key factors driving the market are the availability of innovative structural heart services and the high demand for structural heart products.

Technological advancements in structural heart devices will likely remain a key trend in the market.

North America dominated the structural heart market in 2023

Get Free Sample For

Get Free Sample For