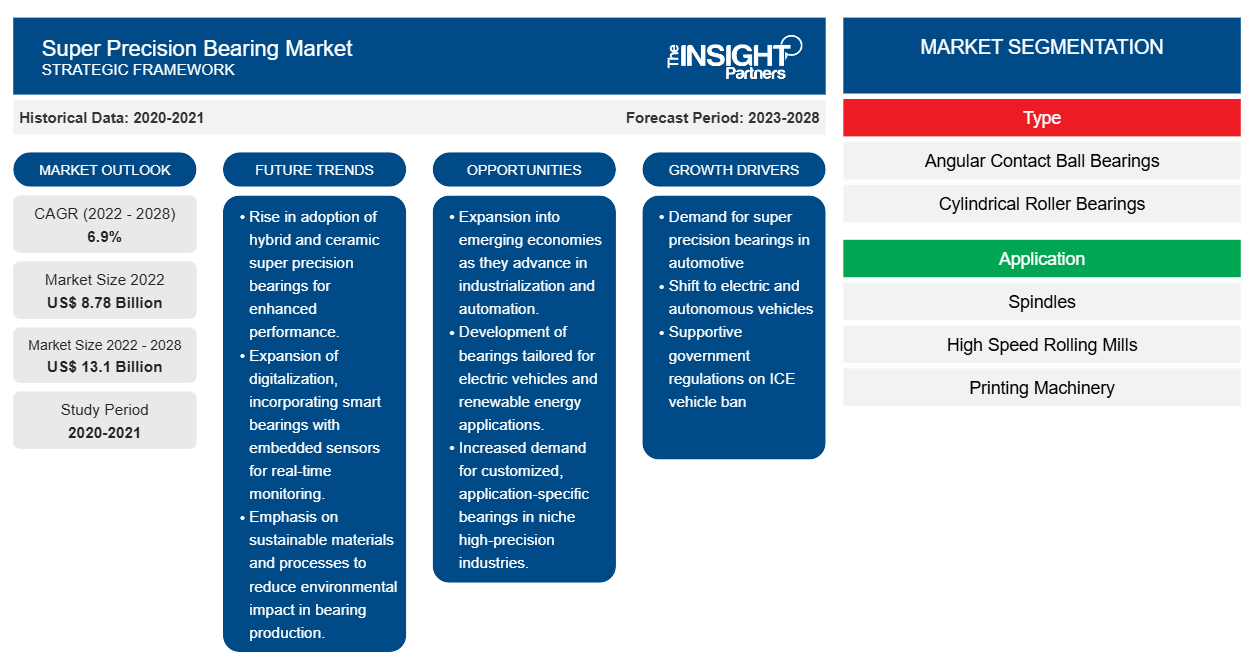

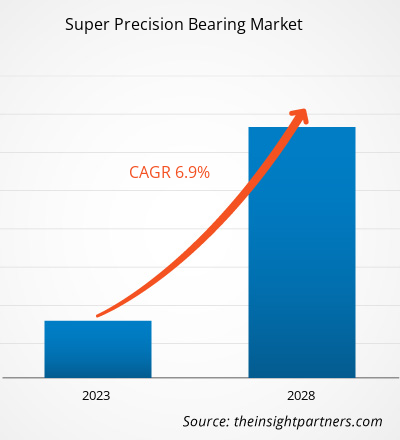

The super precision bearing market size is expected to grow from US$ 8,780.12 million in 2022 to US$ 13,100.28 million by 2028; it is estimated to register a CAGR of 6.9% from 2022 to 2028.

The super precision bearing market growth in North America is attributed to the increasing demand for super precision bearings in automotive applications. In automotive applications, super precision bearings help reduce vibration and noise, increase vehicle service life, and reduce maintenance. Due to the benefits offered by super precision bearings, their demand in the automotive industry is growing in North America. Also, roller bearings are used in transmissions, clutches, differentials, and constant velocity joints, whereas ball bearings are used in steering systems, air conditioning systems, and wheel bearings. Thus, the rising use of these bearings in vehicles is fueling the growth of super precision bearing market.

Furthermore, the changing preference for electric vehicles and autonomous vehicles will increase the demand for super precision bearings in the market. In addition, it is also seen that the government authorities have taken various initiatives to promote electric vehicles in the region. Several US states have implemented financial incentives, which include tax credits, rebates, and registration fee reductions to promote electric vehicle adoption. For instance, Colorado offered a US$ 4,000 tax credit through 2021 on the purchase of a light-duty electric vehicle. Similarly, Connecticut allows for a reduced biennial vehicle registration fee of US$ 38 for electric vehicles. Thus, government initiatives in the region will increase the demand for electric vehicles, further boosting the super precision bearing market.

Super precision bearings are used in the manufacturing of automobiles. As per the US Department of Energy, considering data from the Alternative Fuels Data Center (AFDC), the new registration of EVs increased from 1,019,260 units in 2020 to 1,454,480 units in December 2021 with a Y-o-Y growth rate of 42.70%. According to the International Energy Agency (IEA), the US registered a sale of 1,000 electric trucks in 2021. The government of the US plans to minimize purchases of gasoline-powered vehicles to reduce carbon emissions and preserve the environment. Through the Washington State bill in April 2022, the US government announced the ban on nonelectric car models by 2030. Owing to this initiative, the total carbon emissions will be reduced by 65% by 2030. Such government initiatives are accelerating the sales of electric vehicles. Therefore, the growing demand for electric passenger cars, trucks, buses, and other electric vehicles and supportive government regulations for banning ICE vehicles will increase the need for super precision bearings across the US in the coming years, which will drive the market during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Super Precision Bearing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Super Precision Bearing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on North America Super Precision Bearing Market Growth

North America is an early adopter of emerging technologies due to favorable government policies to boost innovation and reinforce infrastructure capabilities. The automotive industry in North America potentially influences the country’s economy. Unfortunately, the US was one of the worst-affected countries due to the COVID-19 pandemic, and the crisis led to a cascading impact on multiple industries. The operations of the automotive industry were put on hold, which hampered the business dynamics in the first half of 2020. In North America, 43 states reported lower auto exports in 2020 than in 2019. According to umlaut, several airlines canceled orders for new aircraft and equipment, and Airbus and Boeing reported a drop in aircraft production. Supply chain disruptions due to travel restrictions were limiting the supply and production activities of super precision bearing solutions during the pandemic.

Since 2021, automotive and aerospace industries have been improving rapidly. Factories are churning out, and many manufacturing plants are nearly back to production levels after a temporary shutdown during the pandemic. Thus, the restart in the automotive manufacturing activities will fuel the growth of the super precision bearing market during the forecast period.

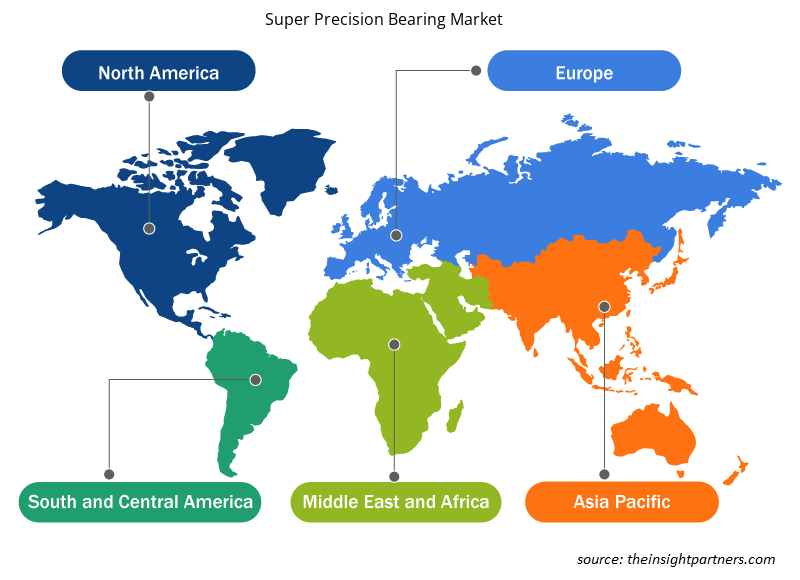

Market Insights – Super Precision Bearing Market

Based on geography, the super precision bearing market size is primarily segmented into North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America (SAM). Asia Pacific accounted for the largest super precision bearing market share in 2022, and it is expected to retain its dominance during the forecast period with the highest CAGR. North America is the second-largest contributor to the global super precision bearing market, followed by Europe.

The presence of major aircraft manufacturers such as the Boeing Company (US), Airbus, and Bombardier Inc. (Canada) is a major factor driving the sales of super precision bearings in North America. As per Simply Flying news in May 2022, Airbus is expected to grow its production from 50 A320s a month in 2022 to 75 A320s a month by 2025. The rise in the production of aircraft is fueling the need for super precision bearings that support the functioning of various components. Moreover, North America is one of the fastest-growing economies in the world, with a well-established technological industry that continues to attract investment and promote innovation.

Platform-Based Insights – Super Precision Bearing Market

Based on application, the global super precision bearing market is segmented into spindles, high speed rolling mills, printing machinery, precision ball screw, live centers, high speed turbochargers, vacuum pumps, automotive, boat gyrostabilizers, semiconductor industry, textile machinery, medical & dental, measuring machines, and aviation & defense. The spindles segment accounted for the largest super precision bearing market share in 2022. Due to their highly narrow tolerances, these bearings are particularly suitable for applications involving the highest requirements for guidance accuracy, such as bearing arrangements for main spindles in machine tools. Thus, the characteristics of super precision bearings and the presence of manufacturers make it an ideal solution for spindles in machine tools.

Super Precision Bearing Market Regional Insights

The regional trends and factors influencing the Super Precision Bearing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Super Precision Bearing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Super Precision Bearing Market

Super Precision Bearing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 8.78 Billion |

| Market Size by 2028 | US$ 13.1 Billion |

| Global CAGR (2022 - 2028) | 6.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

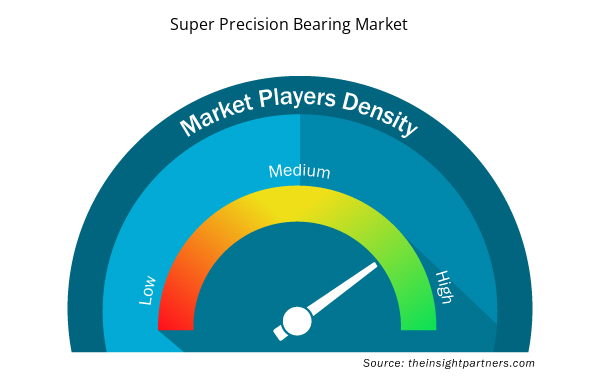

Super Precision Bearing Market Players Density: Understanding Its Impact on Business Dynamics

The Super Precision Bearing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Super Precision Bearing Market are:

- SKF AB

- Schaeffler AG

- JTEKT Corp

- The Timken Co

- Austin Engineering Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Super Precision Bearing Market top key players overview

Players operating in the super precision bearing market are mainly focused on the development of advanced and efficient systems.

- In 2021, Luoyang Huigong Bearing Technology Co Ltd launched a new bearing cross roller called CRBH9016 in the bearing cross roller series.

- In 2021, Luoyang Huigong Bearing Technology Co., Ltd developed a large-size high, precision stainless steel thin section bearing according to customer needs.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Austria, Brazil, Canada, China, Czech Republic, France, Germany, India, Italy, Japan, Mexico, Poland, Russian Federation, South Africa, South Korea, Spain, Switzerland, Taiwan, United Kingdom, United States

Frequently Asked Questions

The super precision bearing market is expected to register an incremental growth value of US$ 1,964.09 million during the forecast period.

The global market size of super precision bearing market by 2028 will be around US$ 13,100.28 million

Angular contact ball bearings segment is expected to hold a major market share of super precision bearing market in 2022.

The US is expected to hold a major market share of super precision bearing market in 2022.

India, China, and Japan are expected to register high growth rate during the forecast period.

Asia Pacific is expected to register highest CAGR in the super precision bearing market during the forecast period (2022-2028)

Growing Fluctuations in Prices of Raw Materials

SKF, NSK Ltd, Schaeffler AG, JTEKT Corp, and RBC Bearings Incorporated are the key market players expected to hold a major market share of super precision bearing market in 2022.

1. Increasing Demand from Aerospace Industry

2. Rising Investment in Super Precision Bearing Production

The estimated global market size for the super precision bearing market in 2022 is expected to be around US$ 8,780.12 million

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Super Precision Bearing Market

- SKF AB

- Schaeffler AG

- JTEKT Corp

- The Timken Co

- Austin Engineering Co Ltd

- NSK Ltd

- Nachi-Fujikoshi Corp

- NTN-SNR Roulements SA

- Luoyang Huigong Bearing Technology Co Ltd

- RBC Bearings Inc

Get Free Sample For

Get Free Sample For