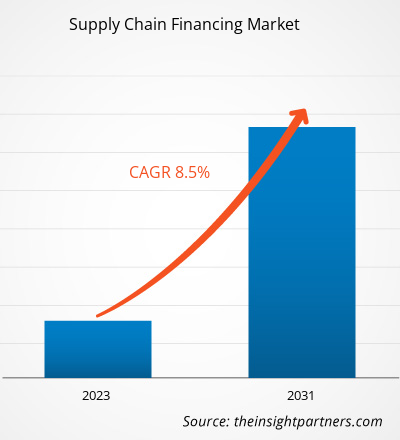

The supply chain financing market size is expected to grow from US$ 6.5 billion in 2023 to US$ 12.5 billion by 2031; it is anticipated to expand at a CAGR of 8.5% from 2023 to 2031. The market growth in the industry is being driven by various factors, including lower financing costs and improved efficiency, globalization and supply chain risk, and the rising need for working capital management.

Supply Chain Financing Market Analysis

Several factors are driving the supply chain finance market. Firstly, there is a growing need for safety and security in supplying activities, which has led to an increased demand for supply chain finance solutions. This need for safety and security is particularly prominent in the current business landscape, where disruptions and uncertainties are common. Secondly, the adoption of supply chain finance by small and medium-sized enterprises (SMEs) in developing countries is contributing to the growth of the market. SMEs are recognizing the benefits of supply chain finance in improving their financial operations and enhancing their competitiveness.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Supply Chain Financing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Supply Chain Financing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Supply Chain Financing Industry Overview

- Supply chain finance, also known as supplier finance or reverse factoring, is a financial solution that optimizes cash flow and working capital for businesses involved in supply chain activities.

- It involves a set of technology-based processes that connect buyers, suppliers, and financial institutions to lower financing costs, improve cash flow efficiency, and reduce risks. In supply chain finance, the buyer typically has a better credit rating than the seller, allowing them to access capital at a lower cost from a financial provider.

- This advantage enables buyers to negotiate better terms with sellers, such as extended payment schedules. Meanwhile, sellers can receive immediate payment from an intermediary financing body, allowing them to unload their products more quickly. The goal of supply chain finance is to provide short-term credit and optimize working capital for both buyers and sellers. It helps suppliers receive early payment on their invoices, reducing the risk of supply chain disruption and improving financial stability. Buyers benefit from increased working capital and the ability to strengthen relationships with suppliers.

Supply Chain Financing Market Driver

Rise in need for Safety and Security of Supplying Activities to Drive the Supply Chain Financing Market

- Several key factors are driving the supply chain financing market growth. First and foremost, the rise in the need for safety and security is contributing to the expansion of the supply chain financing market growth.

- The demand for supply chain finance is increasing due to market manipulation, which includes factors such as loss of investor confidence, damage to market integrity, fraudulent behavior, and pressure on financial firms to invest in supply chain finance approaches that offer better data collection, monitoring capabilities, and financial security. In the early days of international trade, exporters faced uncertainty about whether importers would pay for their goods.

- In contrast, importers were concerned about making payments without a guarantee of goods being shipped. Supply chain finance has evolved to address these risks by providing faster payments to exporters and assuring importers through letters of credit. To stay ahead of competitors, supply chain finance providers are introducing more solutions to enhance the investor interface experience. This increased focus on safety and security in supply chain activities is anticipated to bring new opportunities for the supply chain financing market forecast.

Supply Chain Financing Market Report Segmentation Analysis

Based on offering, the supply chain financing market is segmented into export and import bills, letters of credit, performance bonds, shipping guarantees, and others. The export and import bills segment is expected to hold a substantial supply chain financing market share in 2023. This can be attributed to the role of banks in facilitating the movement of documents and payments to suppliers. In the context of trade finance, an export bill for collection is a method where an exporter approaches a bank to control the movement of documents and their release. Exporters often face the risk of non-payment from importers, while importers are concerned about making payments without the guarantee of goods being shipped. Supply chain finance, particularly through the use of export bills, addresses these risks by accelerating payments to exporters and assuring importers through letters of credit (LOC). Thus, the increasing need for safety and security in international trade activities is expected to bring new supply chain financing market trends.

Supply Chain Financing Market Analysis by Geography

The scope of the supply chain financing market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant supply chain financing market share. The influence of globalization on corporate finances and supply chain risk has intensified, leading to an increased demand for supply chain financing solutions. Additionally, the increase in remote working and social distancing has posed challenges for supply chain finance in capturing data from multiple locations and sources. This has highlighted the importance of robust supply chain financing solutions to mitigate risks and ensure smooth operations.

Supply Chain Financing Market Regional Insights

The regional trends and factors influencing the Supply Chain Financing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Supply Chain Financing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Supply Chain Financing Market

Supply Chain Financing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.5 Billion |

| Market Size by 2031 | US$ 12.5 Billion |

| Global CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

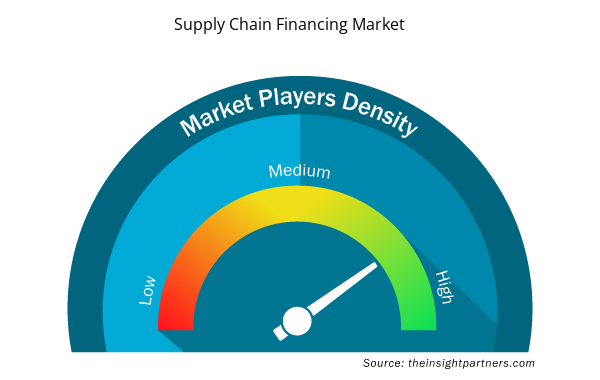

Supply Chain Financing Market Players Density: Understanding Its Impact on Business Dynamics

The Supply Chain Financing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Supply Chain Financing Market are:

- HSBC Group

- Royal Bank of Scotland plc

- Citigroup, Inc.

- JPMORGAN CHASE & CO.

- BANK OF AMERICA CORPORATION

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Supply Chain Financing Market top key players overview

The "Supply Chain Financing Market Analysis" was carried out based on offering, provider, application, and geography. In terms of offering, the market is segmented into export and import bills, letters of credit, performance bonds, shipping guarantees, and others. Based on provider, the market is segmented into banks, trading finance house and others. By application, the market is segmented into domestic and international. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Supply Chain Financing Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the supply chain financing market. A few recent key market developments are listed below:

- In August 2023, HSBC made a strategic investment of US$ 35 million in Tradeshift, a supply chain finance outfit, as part of their plans to establish a new joint venture company. The joint venture will focus on the development of embedded financial services. This investment is part of a larger funding round that is expected to raise a minimum of $70 million from HSBC and other investors. The collaboration between HSBC and Tradeshift aims to create a range of digital solutions that will be integrated into Tradeshift's platform and other platforms. These solutions will include payment and fintech services embedded into trade, e-commerce, and marketplace experiences. The joint venture will enable Tradeshift to scale its business commerce proposition globally while also allowing HSBC to deploy innovative financial services across various platforms.

(Source: HSBC, Company Website)

- In September 2023, HSBC formed a partnership with Cainiao Network Technology, a logistics unit of Alibaba Group, to introduce an innovative digital trade finance solution for online merchants. This collaboration aims to provide a streamlined and accessible trade finance process for Hong Kong merchants selling on the TMall Global e-marketplace, which Alibaba owns. The new scheme leverages real-time logistics information for credit assessment, enabling faster and more efficient loan approvals. Unlike traditional trade finance processes that require collateral or extensive financial documentation, this solution utilizes comprehensive information provided by Cainiao, including customer background, real-time inventory, and operation status, to assess creditworthiness. This marks the first time HSBC will utilize third-party data for trade finance loan approvals.

(Source: HSBC, Company Website)

Supply Chain Financing Market Report Coverage & Deliverables

The market report "Supply Chain Financing Market Size and Forecast (2021–2031)", provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Offering, Provider, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market growth in the industry is being driven by various factors, including lower financing costs and improved efficiency, globalization and supply chain risk, and the rising need for working capital management.

The supply chain financing market size is expected to grow from US$ 6.5 billion in 2023 to US$ 12.5 billion by 2031; it is anticipated to expand at a CAGR of 8.5% from 2023 to 2031.

Rising fintech solutions are impacting supply chain financing, which is anticipated to play a significant role in the global supply chain financing market in the coming years.

The key players holding majority shares in the global supply chain financing market are Citigroup, Inc, BNP Paribas, Mitsubishi UFJ Financial Group, Inc, JPMORGAN CHASE & CO., Asian Development Bank.

The global supply chain financing market is expected to reach US$ 12.5 billion by 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- HSBC Group

- Royal Bank of Scotland plc

- Citigroup, Inc.

- JPMORGAN CHASE & CO.

- BANK OF AMERICA CORPORATION

- BNP Paribas

- Eulers Herms (Allianz Trade)

- Standard Chartered

- Mitsubishi UFJ Financial Group, Inc.

- Asian Development Bank

Get Free Sample For

Get Free Sample For