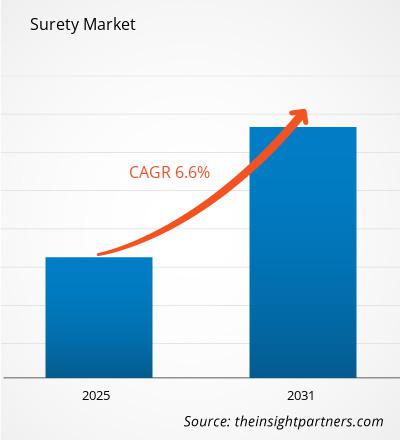

The surety market size is projected to reach US$ 35.52 billion by 2031 from US$ 21.14 billion in 2023. The market is expected to register a CAGR of 6.7% in 2023–2031. Growing digitalization and increasing focus on sustainable development are likely to remain a key surety market trend.

Surety Market Analysis

The surety market is growing at a rapid pace due to the growing number of construction activities and digital transformation in bonding processes. The market is expanding steadily, driven by the availability of customized bonds and growing adoption surety for managing financial risks. Moreover, the growing use of advanced technologies and increased focus on environmental, social, and governance (ESG) factors are providing lucrative opportunities for market growth.

Surety Market Overview

Surety is financial guarantees or bonds, a pledge to be liable for another's debt, default, or failure. It is a three-party agreement in which one party (the surety) guarantees the performance or obligations of another (the principal) to a third party (the obligee). A surety functions as an assurance that a person or organization will accept responsibility for meeting financial commitments if the debtor defaults and is unable to pay. The party that guarantees the debt is known as the surety or guarantor. Sureties can be obtained by issuing surety bonds, which are legal contracts that require one party to pay if the other fails to live up to the arrangement. These bonds are highly used by the construction, real estate, finance, and transportation industries to safeguard the oblige against the principal's noncompliance.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surety Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surety Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Surety Market Drivers and Opportunities

Digital Transformation in Bonding Processes is Driving the Market

Digital transformation has become one of the noticeable drivers in recent years. The digital revolution of bonding operations is replacing the traditional paper-based system, which supports users in reducing the additional operational costs are driving the market. Traditional paper-based systems are being replaced by digital platforms that simplify bond applications, approvals, and issuances. Middle-market construction companies can consider using these digital solutions to decrease paperwork, increase efficiency, and shorten bond application processing times.

Growing Use of Advanced Technologies

Technology will become increasingly crucial in the surety industry. Surety organizations are heavily investing in advanced technologies such as artificial intelligence, blockchain, and big data analytics to streamline and improve their operations. For instance, blockchain is used to streamline surety bond issuance and claims processing, while big data analytics can help uncover possible hazards and fraud. Thus, significant benefits offered by advanced technologies are creating lucrative opportunities in the market during the forecast period.

Surety Market Report Segmentation Analysis

Key segments that contributed to the derivation of the surety market analysis are bond type.

- Based on bond type, the surety market is divided into contract surety bond, commercial surety bond, fidelity surety bond, and court surety bond. The contract surety bond segment held a larger market share in 2023.

Surety Market Share Analysis by Geography

The geographic scope of the surety market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In terms of revenue, North America accounted for the largest surety market share, due to the growing industrialization and increasing number of small businesses in the US and Canada. These countries have a strong economy and favorable support from the government in promoting and establishing start-ups is boosting the market. Surety bonds are highly adopted by small businesses to obtain contracts to assure their customer that the particular work will be performed and completed on time. Surety bonds, issued by surety businesses, are required for a variety of governmental and commercial transactions. The growing number of small enterprises in the North American construction industry, together with the presence of a significant number of surety market participants in the US and Canada, is predicted to drive the surety market.

Surety Market Regional Insights

The regional trends and factors influencing the Surety Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Surety Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Surety Market

Surety Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 21.14 Billion |

| Market Size by 2031 | US$ 35.52 Billion |

| Global CAGR (2023 - 2031) | 6.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Bond Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

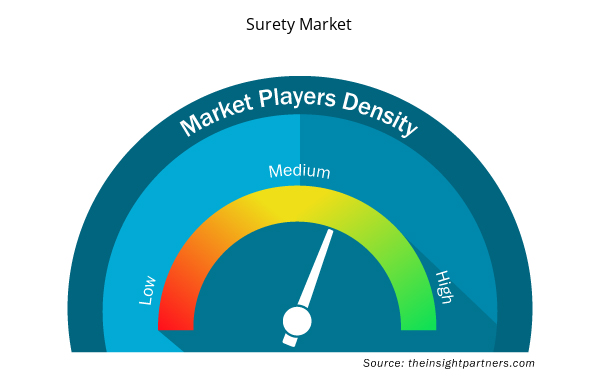

Surety Market Players Density: Understanding Its Impact on Business Dynamics

The Surety Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Surety Market are:

- Crum & Forster

- CNA Financial Corporation

- American Financial Group, Inc.

- The Travelers Indemnity Company

- Liberty Mutual Insurance Company

- The Hartford

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Surety Market top key players overview

Surety Market News and Recent Developments

The surety market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for telecom billing and revenue management and strategies:

- Core Specialty Insurance Holdings, Inc., a property and casualty insurer, will acquire American Surety in a stock and cash transaction, forming a Bond, Credit, and Guarantee subsegment alongside Specialty Casualty, Property & Short-Tail, and Fronted Programs. This acquisition deal is expected to be completed in Q1 2024. (Source: Core Specialty Insurance Holdings, Inc., Press Release, 2023)

Surety Market Report Coverage and Deliverables

The “Surety Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Bond Type , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global surety market was estimated to be US$ 21.14 billion in 2023 and is expected to grow at a CAGR of 6.7% during the forecast period 2023 - 2031.

The growing number of construction and infrastructure projects, rising concerns related to financial security among consumers, and increasing adoption of surety bonds among investors and project owners are the major factors that propel the global surety market.

The rising public-private partnerships (PPPs) in emerging economies and rising demand for green bonds among customers to play a significant role in the global surety market in the coming years.

The key players holding majority shares in the global surety market are Crum & Forster, CNA Financial Corporation, American Financial Group, Inc., The Travelers Indemnity Company, and Liberty Mutual Insurance Company.

The global surety market is expected to reach US$ 35.52 billion by 2031.

The incremental growth expected to be recorded for the global surety market during the forecast period is US$ 14.38 billion.

Get Free Sample For

Get Free Sample For