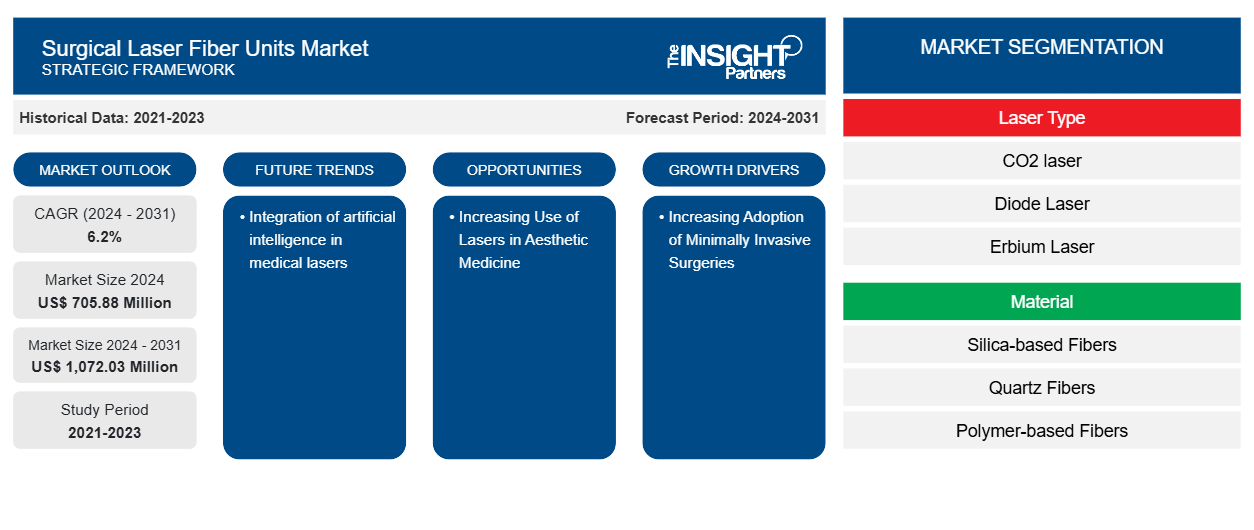

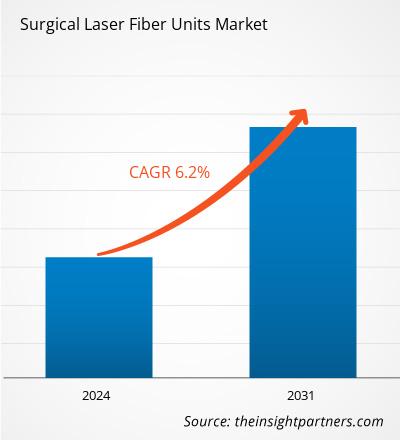

The surgical laser fiber units market size is projected to reach US$ 1,072.03 million by 2031 from US$ 705.88 million in 2024; the market is estimated to record a CAGR of 6.2% during 2024–2031. Integration of artificial intelligence in medical lasers is likely to bring significant future trends in the market in the coming years.

Surgical Laser Fiber Units Market Analysis

Several market players are launching innovative medical laser fibers in the market, which is likely to boost the global surgical laser fiber units market growth. A few recent product launches in the global surgical laser fiber units market are as follows:

• In August 2023, InnoVoyce launched a new 300-micron fiber designed to deliver greater flexibility and control during vocal repair procedures. With the assistance of a new delivery system, physicians can improve these aspects to target treatment areas and minimize the risk of damage to surrounding tissue.

• In February 2023, Honeywell introduced 25 decitex ultra-fine fiber to its Spectra Medical Grade (MG) BIO portfolio at MD&M West. This fiber is designed for minimally invasive cardiovascular and orthopedic devices, offering greater strength and improved longevity than traditional materials such as polyester and nylon.

Furthermore, innovative laser hair removal devices introduced by market players such as Lumenis help in improving efficacy and minimizing patient discomfort, addressing the demand for long-lasting hair removal solutions. Endovenous Laser Treatment (EVLT) devices use laser fibers to deliver energy directly into the vein, causing it to close and be reabsorbed by the body. Companies such as AngioDynamics offer advanced laser systems specifically for vascular applications. Therefore, as laser therapy enhances patient experiences and treatment outcomes in aesthetic procedures, the demand for effective medical laser fibers is expected to rise substantially.

Surgical Laser Fiber Units Market Overview

The demand for laser fibers in China is rapidly growing due to a rising number of robotic surgical procedures, an increasing aging population, and surging technological advancements. Benign prostate hyperplasia (BPH) is among the common diseases observed in aging males. It is reported that BPH occurs in 25% to 65% of men aged over 40 years. If BPH is left untreated, it may lead to serious complications such as renal insufficiency and failure, urinary tract infection, acute urinary retention (AUR), and bladder stones. The Urological Chinese Oncology Group (UCOG) aims to develop a robotic surgery approach for prostate cancer biopsies. As robotic surgery and minimally invasive techniques are gaining traction in the medical field, especially in oncology, the demand for advanced surgical laser fiber units that offer precision, flexibility, and safety during procedures such as prostate cancer biopsies is propelling in tandem. This trend in robotic surgeries and its integration with laser technologies drive the demand for high-performance laser fibers in urological, oncological, dermatology, gynecology, cardiology, neurology, and ophthalmology applications.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surgical Laser Fiber Units Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Surgical Laser Fiber Units Market Drivers and Opportunities

Increasing Adoption of Minimally Invasive Surgeries Fuels Market

Surgeons performing minimally invasive surgeries benefit from medical laser fibers as they enable precise delivery of laser energy to target tissues, minimize damage and scarring, and cauterize blood vessels to reduce bleeding. The advancement of surgical equipment has expanded the scope of minimally invasive surgical procedures, increasing the demand for these lasers. Recently, fiber lasers have gained popularity in photonics due to their robustness and reliability, making them ideal for surgical applications. According to the National Institute of Diabetes, Digestive and Kidney Diseases, over 20 million endoscopic surgeries are performed annually in the US, making it the most common type of minimally invasive surgery. As low surgically intensive procedures become standard, the use of laser fiber technology to treat various conditions particularly in gynecology, urology, ophthalmology, and dentistry is rising. For example, Typenex Medical, LLC offers Fibernex Laser Fibers for endoscopic surgeries.

The surging popularity of laser-based minimally invasive procedures such as LASIK drives the demand for medical laser fibers. According to an article from myvision.org, LASIK is one of the most commonly performed laser eye procedures in the US, and over 20 million LASIK procedures were performed in 2022. The shift toward laser-based treatments in various medical fields drives the adoption of medical laser fibers, as they provide the flexibility, precision, and effectiveness required for low-intensity surgeries. Thus, with the growing adoption of advanced laser technologies by healthcare providers to enhance patient outcomes and reduce recovery times, the need for high-quality medical laser fibers is propelling, thereby driving its market growth.

Increasing Use of Lasers in Aesthetic Medicine Offers Lucrative Market Opportunities

As consumers become more aware of their appearance, noninvasive and minimally invasive procedures—such as laser skin resurfacing, hair removal, and tattoo removal—are gaining popularity. This trend toward aesthetic laser treatments is expected to drive investment in laser technologies and fibers, expanding their use in cosmetic and dermatological practices. As per the American Society of Plastic Surgeons (ASPS) report published in 2022, 2.915 billion skin treatment procedures, including laser hair removal, laser treatment of leg veins, IPL treatment, and laser tattoo removal, were performed in 2022. According to the ASPS 2022 report, the number of laser vein treatments, specifically sclerotherapy, grew by 22% from 2020 to 2022.

Laser therapies, including fractional CO2 and erbium laser treatments, are commonly used for skin resurfacing and rejuvenation. These procedures employ medical laser fibers to target skin imperfections such as wrinkles, scars, and pigmentation. For instance, companies such as Candela Medical have developed advanced laser systems that use these fibers to deliver precise energy for effective skin rejuvenation.

Surgical Laser Fiber Units Market Report Segmentation Analysis

Key segments that contributed to the derivation of the surgical laser fiber units market analysis are laser type, material, power, application, wavelength, and geography

- The global medical laser fiber units market, based on laser type, is segmented into CO2 lasers, diode lasers, erbium lasers, Nd:Yag lasers, holmium lasers, alexandrite lasers, and others. The CO2 laser segment held the largest share of the surgical laser fiber units market in 2024, and it is expected to register the highest CAGR during 2024–2031.

- In terms of material, silica-based fibers, quartz fibers, polymer-based fibers, multimode fibers, and others. The silica-based fibers segment held the largest share in the surgical laser fiber units market in 2024.

- The global surgical laser fiber units market, based on power, is segmented into low-power lasers, medium-power lasers, and high-power lasers. The high-power lasers segment dominated the surgical laser fiber units market in 2024.

- The global surgical laser fiber units market, based on application, is segmented into urology, dermatology, ophthalmology, cardiovascular, respiratory, neurology, and others. The ophthalmology segment held the largest share of the market in 2024.

- Based on wavelength, the surgical laser fiber units market is segmented as 9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm. The 9,301 nm and above segment held the largest share of the market in 2024.

- The surgical laser fiber units market, based on end user, is segmented into hospitals, specialty clinics, ambulatory surgery centers, and others. The hospitals segment dominated the market in 2024.

Surgical Laser Fiber Units Market Share Analysis by Geography

The geographical scope of the surgical laser fiber units market report is mainly divided into 5 major regions: North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America. North America dominated the market in 2024. According to estimates released by the Centers for Disease Control and Prevention (CDC) in 2023, ~610,000 people die due to cardiovascular diseases in the US, accounting for 1 in every 4 mortalities. Such a high prevalence of heart diseases drives the need for medical laser systems, which are used to treat coronary artery disease, hypertrophic cardiomyopathy, ventricular and supraventricular arrhythmias, and congenital heart disease. The laser angioplasty procedure is performed to reduce the plaque in the coronary arteries.

The surging adoption of laser treatments in aesthetic procedures, such as hair laser removal treatment and laser skin treatment, is likely to influence the surgical laser fiber units market growth in the US during the forecast period.

Surgical Laser Fiber Units Market Regional InsightsThe regional trends and factors influencing the Surgical Laser Fiber Units Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Surgical Laser Fiber Units Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Surgical Laser Fiber Units Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 705.88 Million |

| Market Size by 2031 | US$ 1,072.03 Million |

| Global CAGR (2024 - 2031) | 6.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Laser Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Surgical Laser Fiber Units Market Players Density: Understanding Its Impact on Business Dynamics

The Surgical Laser Fiber Units Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Surgical Laser Fiber Units Market top key players overview

Surgical Laser Fiber Units Market News and Recent Developments

The surgical laser fiber units market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Richards Packaging Income Fund today announced the acquisition of all outstanding shares of Insight Medical Technologies ("Insight Medical") through its subsidiary, Clarion Medical Technologies Inc. Insight Medical is a Calgary-based distributor of vision care products that serves optometry and ophthalmology clinics across Canada. The total purchase price for this acquisition is US$ 5.3 million and will be funded using cash on hand. (Source: Clarion Medical Technologies Inc, Company Website, June 2024).

- Biolitec AG, based in Vienna, Austria, unveiled two new products from its Elves Radial family of endolaser vein system devices, which are designed for the minimally invasive laser treatment of insufficient veins. This announcement coincided with the 23rd European Venous Forum, held in Berlin, Germany, from June 22–24, 2023. The company launched the Elves Radial 2ring Pro laser fiber and the single-wavelength Leonardo 1940 laser. (Source: Biolitec AG, Company Website, June 2023).

Surgical Laser Fiber Units Market Report Coverage and Deliverables

The "Surgical Laser Fiber Units Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Surgical laser fiber units market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Surgical laser fiber units market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Surgical laser fiber units market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the surgical laser fiber units market

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the surgical laser fiber units market?

What would be the estimated value of the surgical laser fiber units market by 2031?

What are the future trends in the surgical laser fiber units market?

Which are the leading players operating in the surgical laser fiber units market?

What are the factors driving the surgical laser fiber units market growth?

Which region dominated the surgical laser fiber units market in 2024?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For