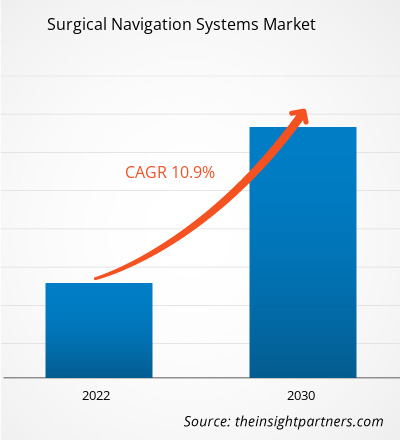

The surgical navigation systems market size is expected to grow from US$ 1,139.93 million in 2022 to US$ 2,458.83 million by 2030; it is estimated to register a CAGR of 10.09% from 2022 to 2030. Technological advancements are likely to remain key trends in the market.

Surgical Navigation Systems Market Analysis

Innovative technologically advanced product launches will provide lucrative opportunities for the market growth for surgical navigation systems in the coming years. Further, advancement in surgical planning and navigation for tumor biopsy and resection accelerates demand for surgical navigation systems that will drive market growth. Brainlab's "Cranial Navigation" is an example. For example, the "Cranial Navigation Angio" helps surgeons to identify feeding and draining veins on navigated digital subtraction angiography (DSA) data or locate a nidus object with dedicated view layouts. Brainlab's "Disposable Stylet" is designed for navigating the placement of shunts or ventricular catheters in neurosurgery that enables freehand placement. Also, the "Cirq Alignment Software" facilitates intuitive manual arm positioning with the robotic module performing automatic trajectory alignment. Such aforementioned factors act as an influential factor responsible to account considerable market growth during 2021-2031. Technological advancements are likely to remain key trends in the market.

Surgical Navigation Systems Market Overview

Augmented Reality (AR) based surgical navigation system is widely adopted in minimally invasive surgery. Philips's "Augmented Reality Surgical Navigation technology" is an example that is being developed to add additional capabilities to manage X-ray doses. The technology uses high-resolution optical cameras integrated into the flat panel X-ray detector to take images of the patient's surface. The AR-based surgical navigation system technology further combines the external view captured by the cameras and the internal 3D view of the patient acquired by the X-ray system, constructing a 3D AR view of the patient's external and internal anatomy. Such a real-time 3D view of the patient's spine aims to improve procedural planning and surgical tool navigation and reduce procedure times.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surgical Navigation Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surgical Navigation Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Surgical Navigation Systems Market Drivers and Opportunities

Rising Spinal Cord Injury (SCI) Accelerate Demand for Surgical Navigation Systems to Favor Market

According to the United Spinal Association 2024 report, people with Spinal Cord Injury (SCI) are at high risk of developing pressure injuries, which occur when underlying tissue becomes damaged due to blood loss. For example, up to 80% of people with SCI suffer from pressure sores once in their lifetime. Additionally, 65-78% of the SCI population suffer from some amount of spasticity, uncontrolled tightening, and contracting of the muscles. Therefore, with the rising incidence of SCI, it is a medical emergency that needs to be treated immediately. However, surgical treatment for SCI is challenging for surgeons to locate the exact surgical site. Medtronic's "StealthStation S8 Surgical Navigation System" is an example. The "StealthStation S8 Surgical Navigation System" includes a portfolio of over 200 navigated instruments providing the unique integrated "Stealth-Midas," bringing navigation accuracy to a new level, particularly in challenging and mobile anatomies in the cervical spine. Therefore, rising SCI cases accelerate demand for surgical navigation systems acting as the major drivers of global surgical navigation systems market share.

Innovative Product Launches Provide Lucrative Market Opportunity

- In August 2023, Orthofix Medical Inc. announced the first successful completion of the first case in the US through advanced "7D FLASH Navigation System Percutaneous Module 2.0". The Percutaneous Module 2.0 provides new planning features and increased functionality for the 7D FLASH navigation System, allowing Orthofix to serve the Minimally Invasive Surgery (MIS) spine.

- In July 2023, Stryker announced launching the "Q Guidance System" with Cranial Guidance Software, offering surgeons an image-based planning and intraoperative guidance system that assists in positioning instruments and identifying patient anatomy during cranial surgery. This software can be used for craniotomies, skull base and transsphenoidal procedures, shunt placements, and biopsies.

Therefore, innovative product launches is seen to leave a positive impact on the surgical navigation systems market, as it has an opportunity for development of technologically advanced surgical navigation systems.

Surgical Navigation Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the surgical navigation systems market analysis are type, application, and end user.

- Based on type, the surgical navigation systems market is segmented as optical navigation system, electromagnetic navigation system, hybrid navigation system, fluoroscopy navigation system, CT-based navigation system, and others. The electromagnetic navigation systems segment held the largest market share in 2022.

- By application, the market is segmented into orthopedic, ENT, neurology, dental, and others. The orthopedic segment held the largest share of the market in 2022.

- By end user, the market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment held the largest share of the market in 2022.

Surgical Navigation Systems Market Share Analysis by Geography

The geographic scope of the surgical navigation systems market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market. In North America region, the US accounts largest share for surgical navigation systems market. Presence of top manufacturers in the region and their innovative technologically advanced surgical navigation systems are the factors contributing to the dominance of the market. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Surgical Navigation Systems Market Regional Insights

The regional trends and factors influencing the Surgical Navigation Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Surgical Navigation Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Surgical Navigation Systems Market

Surgical Navigation Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,139.93 Million |

| Market Size by 2030 | US$ 2,458.83 Million |

| Global CAGR (2022 - 2030) | 10.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

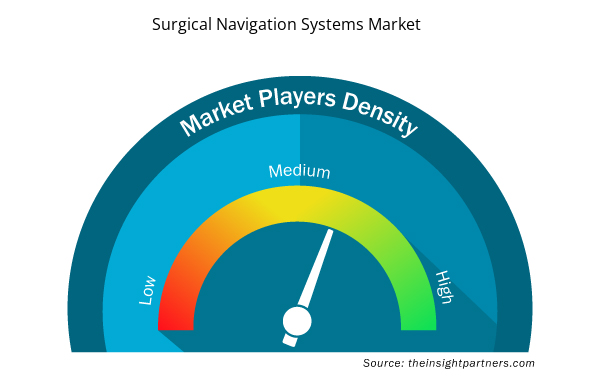

Surgical Navigation Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Surgical Navigation Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Surgical Navigation Systems Market are:

- B. Braun SE

- DePuy Synthes Inc

- Medtronic

- Siemens Healthineers

- Stryker

- Zimmer Biomet

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Surgical Navigation Systems Market top key players overview

Surgical Navigation Systems Market News and Recent Developments

The surgical navigation systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the surgical navigation systems market are listed below:

- In October 2022, SeaSpine Holdings Corporation, announced product launch of "7D FLASH Navigation System Percutaneous Spine Module". The release of Percutaneous Module represents a new application and increase functionality for its 7D FLASH Navigation System allowing SeaSpine to further penetrate the minimal invasive surgery. (Source: SeaSpine Holdings Corporation, Newsletter, October 2022)

Surgical Navigation Systems Market Report Coverage and Deliverables

The “Surgical Navigation Systems Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Surgical navigation systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Surgical navigation systems market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Surgical navigation systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the surgical navigation systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America region dominated the surgical navigation systems market in 2023.

Technological advancements to remain as a key trend for surgical navigation systems market.

Rising Spinal Cord Injury (SCI) accelerate demand for surgical navigation systems is one of the most influential factors responsible for market growth.

B. Braun SE, DePuy Synthes Inc, Medtronic, Siemens Healthineers, Stryker, Zimmer Biomet, Brainlab AG, CASCINATION, Corin Group, GE Healthcare are the key players in the surgical navigation systems market.

The CAGR for surgical navigation systems accounted 6.7% during 2023-2031.

The estimated value of surgical navigation systems market accounted US$ 11.6 billion in 2031.

Get Free Sample For

Get Free Sample For