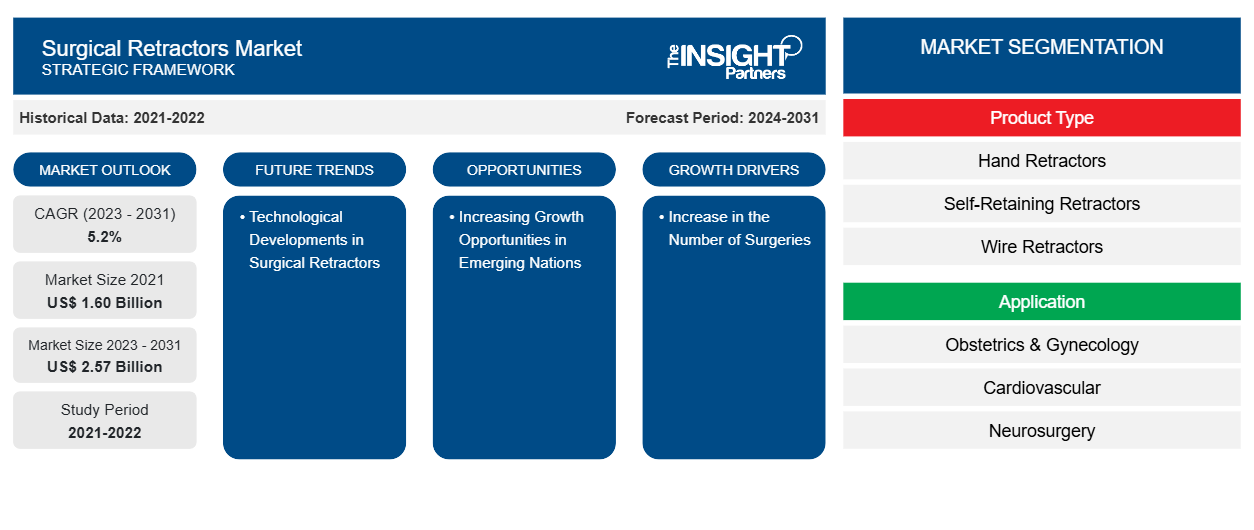

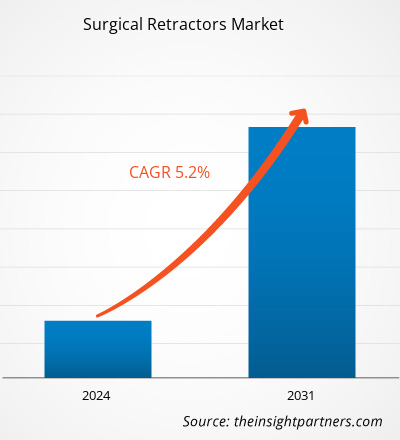

The surgical retractors market size in 2021 stood at US$ 1.60 billion and is projected to reach US$ 2.57 billion by 2031. The market is expected to register a CAGR of 5.2% in 2023–2031. Technological developments in surgical retractors are likely to remain key surgical retractors market trends.

Surgical Retractors Market Analysis

The growing demand for surgical treatments and improvements in surgical techniques are the factors supporting the expansion of the surgical retractors market. Surgical retractors are becoming increasingly popular in a variety of surgical specialties as they are essential for providing optimal surgical exposure and enabling accurate and safe procedures. Furthermore, the market has grown as a result of the aging population and the increasing incidence of chronic diseases, both of which often need surgical interventions for diagnosis and treatment.

Surgical Retractors Market Overview

Surgical retractors are used to separate the ends of surgical incisions or wounds. These instruments are used physically or robotically in performing surgical procedures. In the field of the healthcare industry, research and developments have been growing with functional space and leading the players to introduce new products in the market. The innovations for surgical products have enabled players to manufacture non-minimally invasive products. Several market players are engaged in designing and manufacturing uniquely engineered table-mounted retractor systems that are used in surgeries. For instance, the Mini-Bookler is the world’s first table-mounted system, which was launched by the Mediflex Surgical Products. The system was specially designed for adult and neonatal small incision surgery. In addition, increasing usage of hand retractors that permit an assistant to move tissue away from the surgical instruments and safeguard the vital structures in the procedure also contribute to the growth of the market in the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surgical Retractors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surgical Retractors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Surgical Retractors Market Drivers and Opportunities

Increase in the Number of Surgeries Drives the Market Growth

The number of cardiovascular, general, orthopedic, gynecological, and cancer surgeries performed in hospitals is increasing worldwide. Surgery is becoming more and more common because of the growing number of trauma, hip and knee replacements, and chronic conditions, such as cardiovascular disease, that require surgery. As per the National Library of Medicine, a total of 310 million major surgeries were performed every year worldwide, out of which ~40-50 million were performed in the US and ~20 million in Europe. In addition, as per the German Society for Thoracic and Cardiovascular Surgery registry data published in 2023, a total of 93,913 procedures were categorized as heart surgery procedures in the classical sense. Of these, 27,994 procedures were isolated coronary artery bypass grafting procedures, and 38,492 procedures involved isolated heart valve procedures in 2022. In 2022, 356 isolated heart transplantations, 228 isolated lung transplantations, and 5 combined heart-lung transplantations were performed in the country. Similarly, new government statistics reveal that the number of hip replacement procedures performed in the US has grown substantially, and these procedures have become common in young people. Therefore, the large number of surgical procedures being performed is anticipated to fuel the demand for surgical retractors, thereby driving the growth of the market.

Increasing Growth Opportunities in Emerging Nations to Favor Market Growth

Emerging nations, such as China, Brazil, Mexico, and India, offer substantial development opportunities for players operating in the market. The rapid expansion of healthcare infrastructure and rising public and private healthcare spending in these nations are contributing factors to the increasing demand for surgical retractors in emerging nations. Expanding medical tourism in developing countries, due to the low cost of surgical treatment choices as well as advanced and sophisticated medical technology devices and other equipment, also offers new growth opportunities for surgical retractor players. In addition, a sharp increase in target surgical procedures throughout these countries, along with a growing number of highly skilled surgeons, is expected to fuel the overall market growth. Rapid expansion in healthcare infrastructure and modernization of healthcare facilities are also witnessed in developing nations. Thus, these factors support the rise in the procurement of surgical instruments and medical equipment, thereby offering growth opportunities to the market in the future.

Surgical Retractors Market Report Segmentation Analysis

Key segments that contributed to the derivation of the surgical retractors market analysis are product type, application, and end user.

- Based on product type, the surgical retractors market is divided into hand retractors, self-retaining retractors, wire retractors, and others. The hand retractors segment held the largest market share in 2023. In addition, the self-retaining retractors segment is anticipated to register the highest CAGR during the forecast period.

- By application, the market is segmented into obstetrics & gynecology, cardiovascular, neurosurgery, orthopedic surgery, reconstructive surgery, wound closure, and others. The obstetrics & gynecology segment held the largest share of the market in 2023. In addition, reconstructive surgery segment is projected to register the highest CAGR during the forecast period.

- Based on end user, the surgical retractors market is divided into ambulatory care centers; hospitals, clinics, & surgical centers; and maternity & fertility centers. The hospitals, clinics, & surgical centers segment held the largest market share in 2023. In addition, the maternity & fertility centers segment is anticipated to register the highest CAGR during the forecast period.

Surgical Retractors Market Share Analysis by Geography

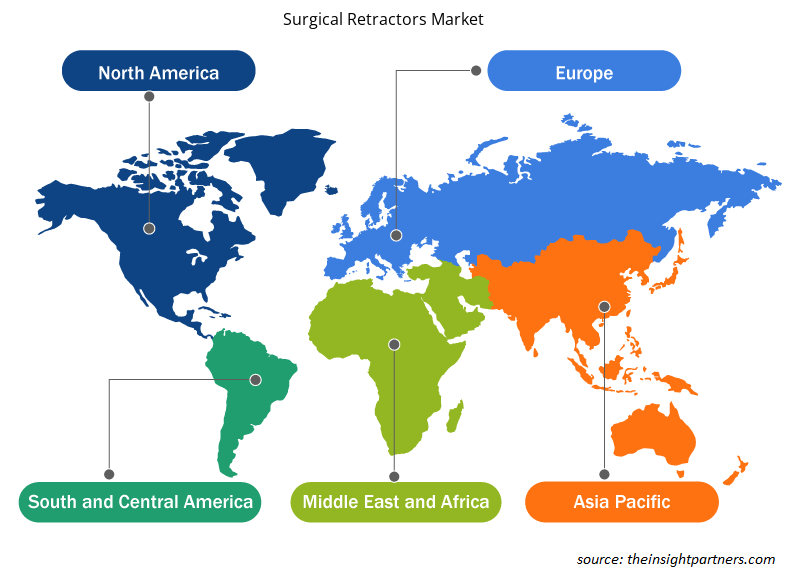

The geographic scope of the surgical retractors market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the surgical retractors market. North America market is growing due to a number of factors, including the well-developed healthcare facility centers equipped with modern-age equipment and instruments, an increasing number of plastic surgeries, and rising number of surgical procedures. In addition, the demand for the market in the region is anticipated to grow significantly during the forecast period owing to growing incidences of chronic diseases such as cardiovascular diseases, diabetes, surgical wounds, and other chronic diseases, as well as the availability of technologies for a robust medical infrastructure. According to the Journal of Thoracic Disease, ~530,000 general thoracic surgeries are performed yearly in the US by ~4,000 cardiothoracic surgeons. According to the American Joint Replacement Registry (AJRR), it is estimated that ~3.48 million people will require knee replacement by 2030.

Asia Pacific is anticipated to grow with the highest CAGR in the coming years. The growth of the surgical retractors market in this region is primarily due to rising geriatric population, increasing chronic diseases, and growing healthcare expenditure.

Surgical Retractors Market Regional Insights

Surgical Retractors Market Regional Insights

The regional trends and factors influencing the Surgical Retractors Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Surgical Retractors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Surgical Retractors Market

Surgical Retractors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.60 Billion |

| Market Size by 2031 | US$ 2.57 Billion |

| Global CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Surgical Retractors Market Players Density: Understanding Its Impact on Business Dynamics

The Surgical Retractors Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Surgical Retractors Market are:

- Arthrex, Inc.

- B. Braun Melsungen AG

- CooperSurgical, Inc.

- Integra LifeSciences Corporation

- Globus Medical, Inc.

- Medline Industries, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Surgical Retractors Market top key players overview

Surgical Retractors Market News and Recent Developments

The surgical retractors market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for surgical retractors and strategies:

- Orthofix Medical launched two access retractor systems for minimally invasive spine procedures. The commercial launch of the Lattus lateral access system and the Fathom pedicle-based retractor system bolsters the company’s access solutions portfolio. The Lattus system is easy to use and provides versatility. The blade retraction strength, along with the ‘down-and-out’ splay feature, allows surgeons to access challenging anatomy. (Source: Orthofix Medical Inc., Press Release, 2023)

- JUNE Medical has launched the Galaxy II LUX – the world’s first self-retaining ring retractor with light. The Galaxy II LUX combines the award-winning Galaxy II retractor with Vivo Surgical’s KLARO light that can be mounted on the retractor via a purpose-designed clip. It provides surgeons with a revolutionary solution, giving them better access and a clearer view of the surgical site, and eliminating the disadvantages of using overhead lighting or personal headtorches. The lightweight, self-retaining retractor features unique cam locks that allow single-handed adjustment on the frame, and there are multiple frames and hooks to suit a range of procedures. (Source: JUNE Medical, Press Release, 2020)

Surgical Retractors Market Report Coverage and Deliverables

The “Surgical Retractors Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- HVAC Sensors Market

- Hydrolyzed Collagen Market

- Electronic Health Record Market

- Electronic Shelf Label Market

- Non-Emergency Medical Transportation Market

- Enteral Nutrition Market

- Oxy-fuel Combustion Technology Market

- Advanced Planning and Scheduling Software Market

- Hair Wig Market

- Transdermal Drug Delivery System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type ; Application ; End User , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For