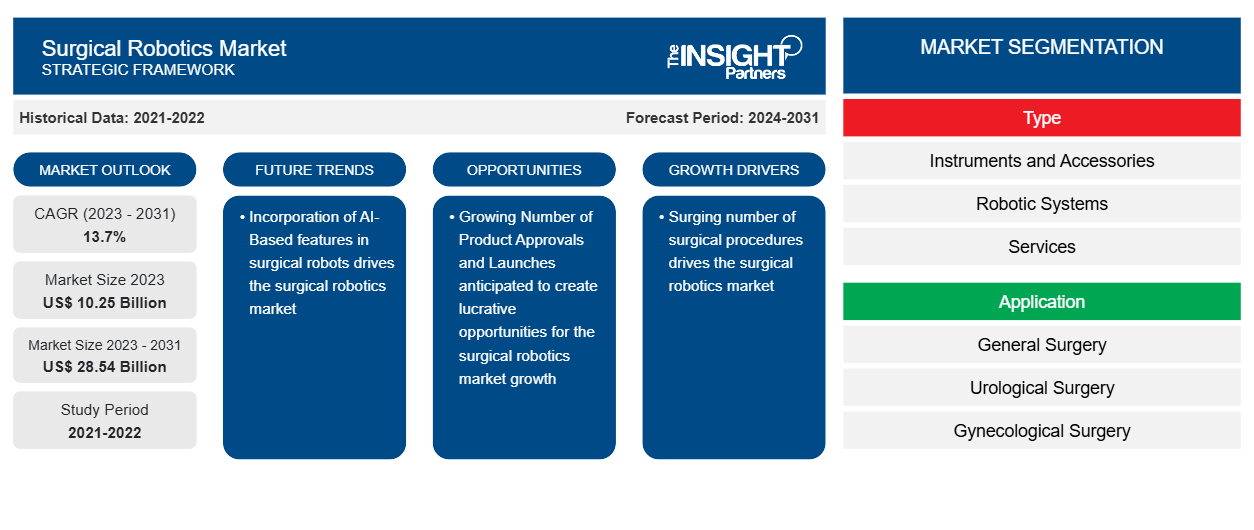

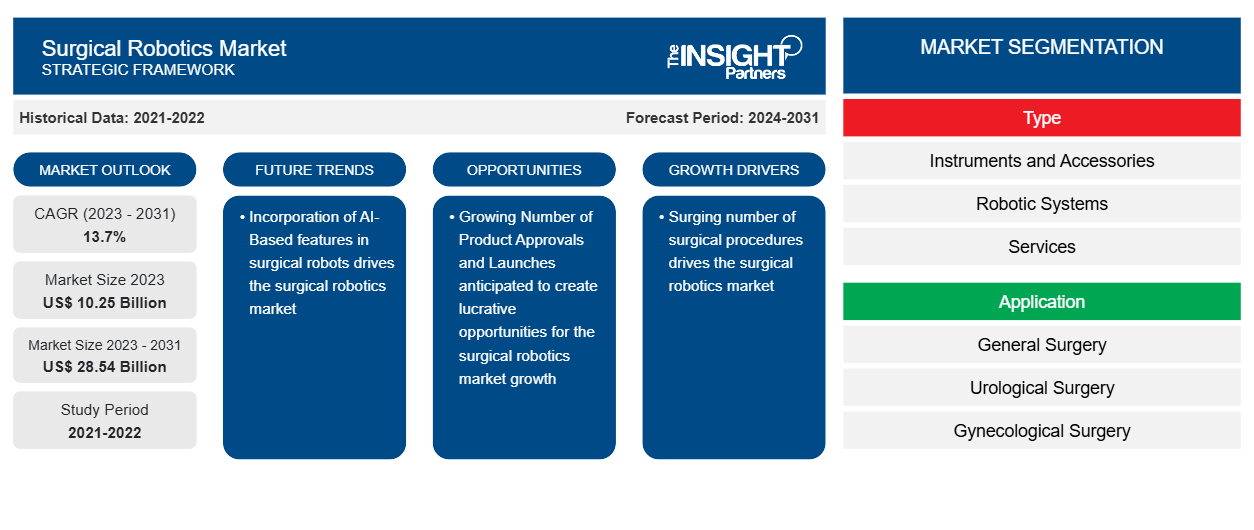

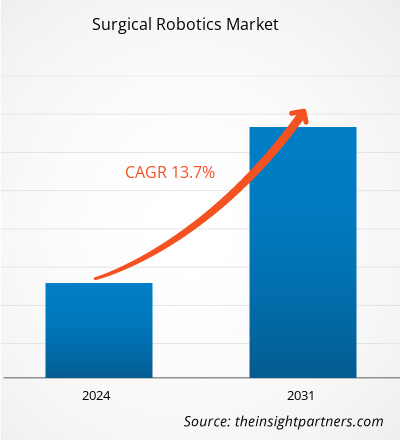

The surgical robotics market size is projected to reach US$ 28.54 billion by 2031 from US$ 10.25 billion in 2023. The market is expected to register a CAGR of 13.7% during 2023–2031. The incorporation of AI-based features in surgical robots is likely to bring new trends to the market in the coming years.

Surgical Robotics Market Analysis

The surging number of surgical procedures and the growing prevalence of chronic diseases are the factors favoring the surgical robotics market progress. A surge in government initiatives to promote the adoption of advanced medical devices and systems by healthcare providers and organizations is expected to fuel the market in the coming years. Further, product approvals accelerate the emergence of new technology in the market. In March 2024, Intuitive Surgical, Inc., a global pioneer of robotic-assisted surgery, received the US Food and Drug Administration (FDA) 510(k) clearance for da Vinci 5—the company’s next-generation multiport robotic system. Da Vinci 5’s design includes over 150 engineering enhancements. Thus, a growing number of product approvals attributable to favorable regulatory scenario in developed economies are anticipated to create lucrative opportunities for the surgical robotics market growth during the forecast period.

Surgical Robotics Market Overview

The surgical robots market players are focused on developing new products to grow their geographic reach and enhance capacities to cater to a greater than existing customer base with cutting-edge technology that meets evolving surgical needs. The integration of artificial intelligence in surgical robots helps provide real-time analysis, decision support, and predictive analysis. During surgeries, such robots can reduce human errors, identify critical areas, and optimize surgical planning. For instance, in May 2023, Smith+Nephew, the global medical technology company, introduced two key products for its robotics and digital surgery portfolio—Personalized Planning powered by AI and RI.INSIGHTS Data Visualization Platform. Advanced AI analytics platform integrated with the CORI Surgical System will offer personalization when performing joint replacement procedures. Similarly, in July 2024, Medtronic launched Touch Surgery Live Stream—an AI platform for robotic surgery. Touch Surgery Live Stream includes 14 new AI algorithms designed to enhance its digital capabilities within post-operative analysis. The algorithms deliver AI-powered surgical insights for laparoscopic and robotic-assisted surgery. Also, in August 2023, the Centre for Artificial Intelligence and Robotics (CAIR), a research center under the Chinese Academy of Sciences, completed three successful trials on MicroNeuro—which is fitted with a flexible endoscope and leverages AI and precision control to perform accurate and precise surgeries on brain tissue. Such developments will ensure surgical safety, reduce surgeon’s labor-intensive tasks, and enable unprecedented novel surgical treatments leading to improved surgical outcomes for patients. Therefore, the development of AI-based surgical robots is expected to bring new trends in the surgical robotics market in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surgical Robotics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surgical Robotics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Surgical Robotics Market Drivers and Opportunities

Growing Prevalence of Chronic Diseases Favors Surgical Robotics Market Growth

In the last 25 years, the incidence of chronic diseases has increased worldwide owing to lifestyle changes, which result in an increase in the number of surgeries. For instance, colorectal cancer is one of the most commonly found and lethal cancers developed in individuals due to the combined influence of genetic and environmental factors. According to the World Health Organization (WHO), colorectal cancer was identified as the third most common cancer and the second highest death-causing cancer, with ~1,926,425 global cases in 2022. Furthermore, the mortality and incidence rates of this cancer vary worldwide, and approximately 904,019 deaths in 2022 were associated with it. Colorectal cancer is the third most common type of cancer in men and the second most common cancer in women. Robotic surgery offers improved ergonomics and optics for the operating surgeon owing to the unique wristed instruments. For colorectal cancer, robotic-assisted surgeries allow precision, minimally invasive options, and better patient outcomes, making it a preferred surgery option for patients suffering from colorectal cancer. Therefore, the increasing incidences of colorectal cancer have resulted in the surging demand for surgical robots.

According to the 2021 National Health Statistics Reports from the Centers for Disease Control and Prevention, the incidence of obesity has reached 41.9% among adults and 19.7% among children and adolescents aged 2–19 years old. Further, it has been stated that severe obesity, corresponding to a body mass index (BMI) of 40 or higher, is present in 9.2% of adults in the US. Robotic surgery for obesity has advantages over conventional surgery owing to its 3D vision and precise, intuitive multi-range instruments that add more safety to the patients.

Thus, the rise in the prevalence of chronic conditions fuels the surgical robotics market growth.

Growing Number of Product Approvals and Launches to Create Market Opportunities

Product approvals accelerate the emergence of new technology in the market. In March 2024, Intuitive Surgical, Inc., a global pioneer of robotic-assisted surgery, received the US Food and Drug Administration (FDA) 510(k) clearance for da Vinci 5—the company’s next-generation multiport robotic system. Da Vinci 5’s design includes over 150 engineering enhancements. Similarly, in February 2024, Virtual Incision Corporation received the US Food and Drug Administration (FDA) marketing authorization for the MIRA Surgical System (MIRA), the world’s first miniaturized robotic-assisted surgery (miniRAS) device, for use in adults undergoing colectomy procedures. In addition, in October 2021, Medtronic plc received the CE mark for the Hugo robotic-assisted surgery (RAS) system, authorizing the system’s sale in Europe.

Recent Launches/Approvals of Surgical Robots

Month and Year | Company | Description |

June 2024 | SS Innovations | SS Innovations, the developer of India’s first indigenous surgical robotic system, launched SSI Mantra 3. The system is developed to improve surgical precision, efficiency, and patient outcomes. It features 5 slimmer robotic arms and an immersive 3D HD headset that provides surgeons with unmatched optics, as well as a vision cart that provides 3D 4K vision to the entire team for precision and control. |

June 2024 | Meril Life Sciences Pvt. Ltd. | Meril, an India-based medical devices company, has launched an indigenously developed surgical robotic technology—MISSO—which will assist doctors during knee replacement surgeries in real time. |

July 2022 | Siemens Healthineers AG | Siemens Healthineers has added CorPath GRX, the FDA-cleared and CE-marked robotic system, to its coronary and peripheral interventions portfolio in India. Such recent developments will contribute to the healthcare sector in India significantly. Cutting-edge technology has opened up new realms of business with advanced therapeutics by tapping adjacent growth markets with great potential for the coming years. |

June 2022 | Smith + Nephew | Smith+Nephew, the global medical technology company, announced that the first robotic-assisted surgery using the LEGION CONCELOC Cementless Total Knee System was performed by Dr. Cyna Khalily—an orthopedic surgeon specializing in hip and knee reconstructive surgery in Louisville, KY. |

April 2022 | SSI Innovations | In India, SS Innovations announced the price range of the SSI multi-arm revolutionary telerobotic assistance surgical system from US$ 0.54 million to US$ 0.68 million (INR 40–50 million). |

February 2022 | Smith + Nephew | Smith + Nephew launched a Next Generation Robotic System in Japan; the CORI surgical system is designed to enhance the surgical experience for high precision and best results in knee arthroplasty. |

January 2022 | Smith + Nephew | Smith+Nephew announced that it had expanded the indications on its Cori Surgical System to include total hip arthroplasty. According to the company, the new indication with RI.Hip Navigation might help maximize accuracy and reproducibility by providing patient-specific component alignment for PTH. |

Source: Press Release and Company Websites

Thus, a growing number of product approvals attributable to favorable regulatory scenarios in developed economies are anticipated to create lucrative opportunities for the surgical robotics market growth during the forecast period.

Surgical Robotics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the surgical robotics market analysis are type, application, material, and end user.

- Based on type, the surgical robotics market is segmented into instruments and accessories, robotic systems, and services. The instruments and accessories segment are further segmented into energy instruments, forceps, needle drivers, clip appliers, irrigators, and others. The robotic systems segment is subsegmented into laparoscopy robotic systems, orthopedic robotic systems, neurological robotic systems, and others. The instruments and accessories segment held the largest share of the market in 2023.

- By application, the market is segmented into general surgery, urological surgery, gynecological surgery, orthopedic surgery, cardiovascular surgery, thoracic surgery, neurosurgery, and others. The general surgery segment accounted for the largest share of the market in 2023.

- By material, the market is segmented into plastics, metal, and aluminum. The metal segment accounted for the largest share of the market in 2023.

- Based on end user, the surgical robotics market is segmented into hospitals, ambulatory surgical centers, and specialty clinics. The hospitals segment dominated the market in 2023.

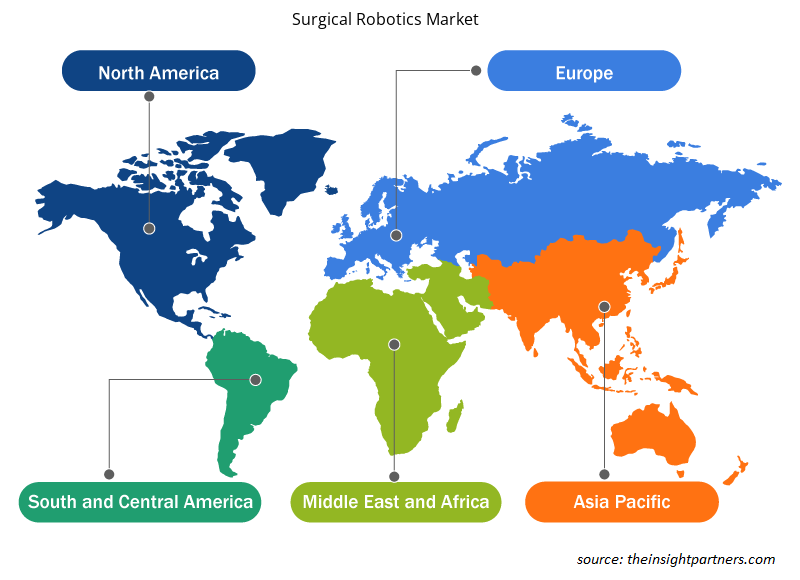

Surgical Robotics Market Share Analysis by Geography

The geographic scope of the surgical robotics market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. In terms of revenue, North America dominated the market in 2023. The North America surgical robotics market has been analyzed on the basis of the US, Canada, and Mexico. The surgical robotics market in the US is expected to grow owing to a receiving approval of technologically advanced products in the market. For instance, in February 2024, Zimmer Biomet Holdings announced U.S. Food and Drug Administration (FDA) 510(k) clearance of the ROSA Shoulder System for robotic-assisted shoulder replacement surgery. Similarly, in June 2024, Moon Surgical, a French-American pioneer in surgical innovation, received clearance from the FDA for the commercial version of its unique Maestro surgical system. In addition, the presence of various market leaders operating in the US contributes notably to the expansion of the surgical robotics market size.

Surgical Robotics Market Regional Insights

The regional trends and factors influencing the Surgical Robotics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Surgical Robotics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Surgical Robotics Market

Surgical Robotics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 10.25 Billion |

| Market Size by 2031 | US$ 28.54 Billion |

| Global CAGR (2023 - 2031) | 13.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

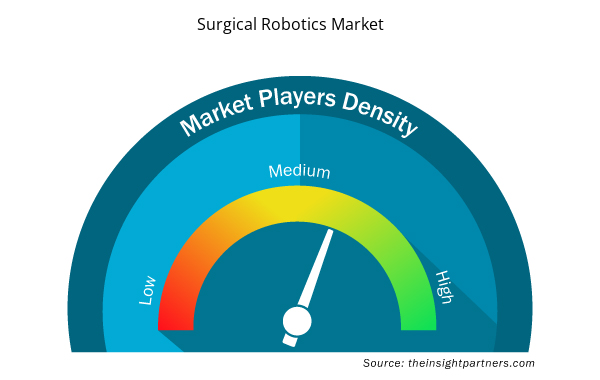

Surgical Robotics Market Players Density: Understanding Its Impact on Business Dynamics

The Surgical Robotics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Surgical Robotics Market are:

- STERIS, Stryker

- Medtronic

- Renishaw

- Johnson & Johnson

- CMR Surgical

- Smith & Nephew Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Surgical Robotics Market top key players overview

Surgical Robotics Market News and Recent Developments

The surgical robotics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A key development in the surgical robotics market is listed below:

- Johnson & Johnson MedTech announced that DePuy Synthes launched a proprietary dual-use robotics and standalone navigation platform developed in collaboration with eCential Robotics. The VELYS Active Robotic-Assisted System received 510(k) clearance from the US Food and Drug Administration (FDA) and is intended for use in planning and instrumenting spinal fusion procedures in the cervical, thoracolumbar, and sacroiliac spine. (Source: Johnson & Johnson, Company Website, August 2024)

Surgical Robotics Market Report Coverage and Deliverables

The "Surgical Robotics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Surgical robotics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Surgical robotics market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Surgical robotics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the surgical robotics market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- High Speed Cable Market

- Industrial Inkjet Printers Market

- Health Economics and Outcome Research (HEOR) Services Market

- Nuclear Waste Management System Market

- Photo Editing Software Market

- Radiopharmaceuticals Market

- 3D Mapping and Modelling Market

- Influenza Vaccines Market

- Equipment Rental Software Market

- Medical Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

STERIS, Stryker, Medtronic, Renishaw, Johnson & Johnson, CMR Surgical, Smith & Nephew Plc, Zimmer Biomet, Intutive Surgical Inc, THINK Surgical Inc, Titan Medical Inc., Vicarious Surgical, Asensus Surgical Inc, Moon Surgical, Momentis Surgical, Virtual Incision, and EndoQuest Robotics Inc are among the key players operating in the market.

The surgical robotics market is anticipated to record a CAGR of 13.7% during 2023–2031.

The incorporation of AI-based features in surgical robots is expected to be a key trend in the surgical robotics market in the coming years.

The surgical robotics market value is estimated to reach US$ 28.54 billion by 2031.

The surging number of surgical procedures and the growing prevalence of chronic diseases are the noteworthy factors bolstering the market growth.

North America dominated the market in 2023.

Trends and growth analysis reports related to Life Sciences : READ MORE..

List of Companies - Surgical Robotics Market

- Stryker Corp

- Medtronic Plc

- CMR Surgical Ltd

- Smith & Nephew Plc

- Zimmer Biomet Holdings Inc

- Renishaw Plc

- Intutive Surgical Inc

- Johnson & Johnson

- THINK Surgical Inc

- EPTAM Precision

Get Free Sample For

Get Free Sample For