Surgical Robots Market Key Players and Opportunities by 2028

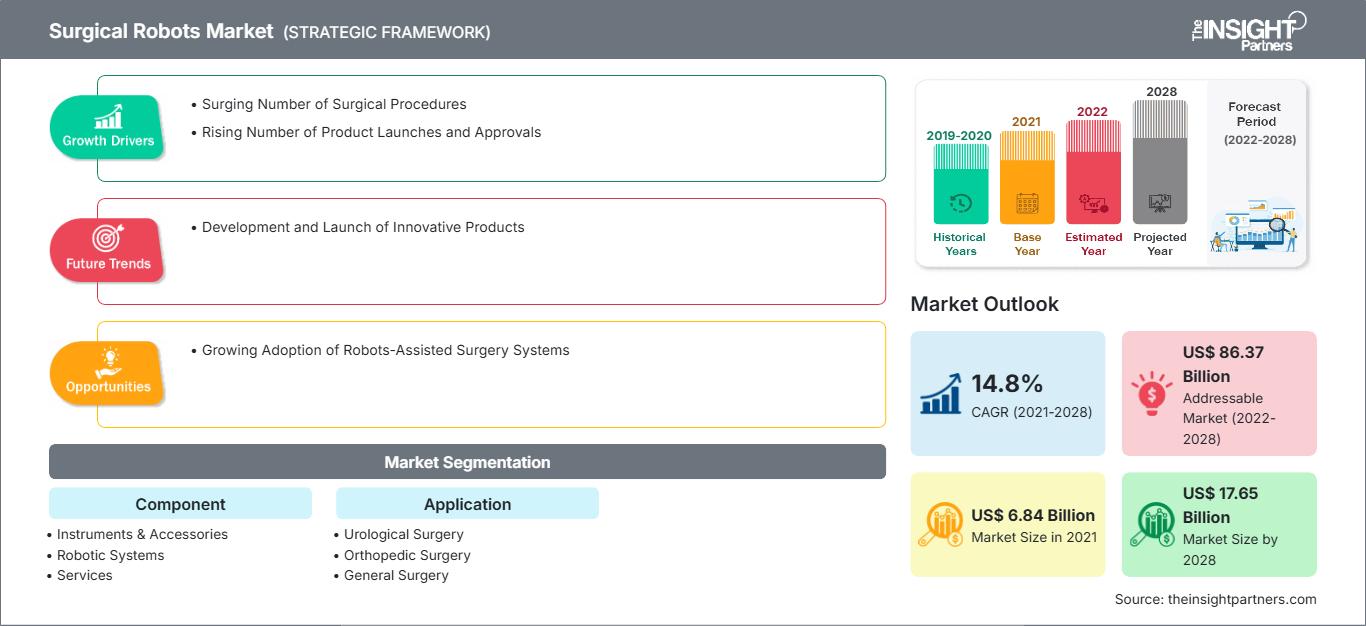

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028Surgical Robots Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Component (Instruments & Accessories, Robotic Systems, and Services), By Application (Urological Surgery, Orthopedic Surgery, General Surgery, Gynecological Surgery, Cardiothoracic Surgery, Neurosurgery, and Others) End User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

- Report Date : Aug 2022

- Report Code : TIPRE00003741

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 195

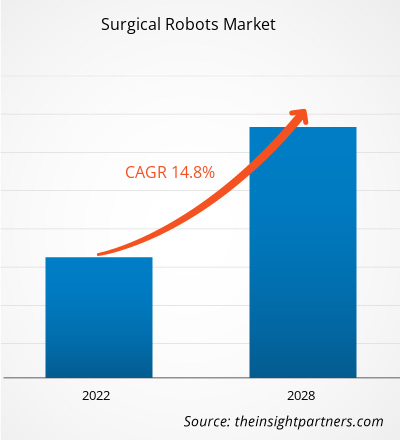

[Research Report] The surgical robots market size is projected to grow from the market is expected to reach US$ 17,647.82 million by 2028 from US$ 6,839.07 million in 2021. It is expected to grow at a CAGR of 14.8% during 2022–2028.

Market Insights and Analyst View:

Surgical robots are used in minimally invasive surgery, as they help manipulate surgical instruments in a small operation space. These are micromanipulators for minimally invasive neurosurgery. Surgical robots can be used in many surgeries, such as urological surgery, laparoscopic cholecystectomy, gall bladder excisions, etc. The scope of the surgical robots market includes components, applications, end users, and geography. The market for surgical robots is analyzed based on major countries such as North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South & Central America (SCAM).

Key driving factors such as the surging number of surgical procedures and new product launches and approvals define market growth. For Instance, in February 2023, Asensus Surgical uncovered its next-generation surgical robot platform, Luna. It is a next-generation surgical platform, instruments, and real-time intraoperative clinical intelligence. Its final component, a protected cloud platform, utilizes machine learning to deliver clinical insights. Luna enables Asensus’ vision of performance-guided surgery. Cutting-edge technology has released new realms of business with expanded therapeutics by tapping growth markets with great potential for the coming years.

However, the high cost of procedures and installation will likely hinder the market's growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surgical Robots Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growth Drivers:

Surging Number of Surgical Procedures Propels Surgical Robots Market Growth

There is a rise in the number of surgeries performed across the world. In the last few years, lung cancer incidence has increased, leading to further treatment. For Instance, in the US, lung cancer is the second most common cancer in both men and women. As per the American Cancer Society, Inc., as of 2023, approximately 238,340 adults (117,550 men and 120,790 women) in the US have been diagnosed with lung cancer, and ~127,070 (67,160 in men and 59,910 in women) have succumbed to death due to the disease. Lung Cancer accounts for 1 in 5 of all cancer deaths, making it a leading cause of cancer death in the US. These include both small cell lung cancer and NSCLC. NSCLC is the most common type of lung cancer, account 81% of all lung cancer diagnoses. For all types of lung cancer in the US, the 5-year relative survival rate is 23%, and for NSCLC, the 5-year relative survival rate for men and women is 23% and 33%, respectively. In the US, screening for lung cancer is recommended with a test called a spiral computed tomography (CT or CAT) scan. Preventive Services Task Force (USPSTF) states that people aged 50–80 and with a history of smoking 20 pack years or more should undergo lung cancer screening with LDCT scans each year. Furthermore, robotic-assisted surgery for lung cancer offers advantages over open chest surgery, as it requires a shorter hospital stay and faster recovery time. Thus, the increasing number of lung cancer incidences has resulted in the surging demand for surgical robots.

Cancer and diabetes are leading causes of mortality across the world. In 2021, in the Netherlands, as per the Dutch Cancer Registry, approximately 123,672 new cancer cases were registered in that year. Breast cancer surgeries are among the most common procedures in plastic surgery. Furthermore, according to the International Diabetes Federation (IDF), the number of people having diabetes is expected to grow from ~537 million in 2021 to 783 million by 2045.

Moreover, robots are used for bariatric surgery as well. Therefore, many governments are taking initiatives to increase awareness. For Instance, in 2021, the UK government revised the policies to care for obese patients undergoing bariatric surgery. The policies include:

- Equipping the National Health Service (NHS) for the rapidly increasing obese population in England, instructing proper operational policies required for the planning, assessment, and management of the manual handling risks for the treatment of bariatric patients

- Designing buildings and vehicles to accommodate bariatric patients safely, comfortably, and with dignity.

Such government initiatives in the country make people feel comfortable and secure. Thus, with more people opting for this procedure, the bariatric surgery devices market will likely witness notable growth in the coming years.

Several market players are adopting organic strategies to stay competitive in the market. For Instance, in October 2022, Medtronic received a CE mark for the Hugo robotic-assisted surgery (RAS) system in Europe for general surgery procedures. The CE mark for general surgery spans several specialties, including bariatric, hernia, and colorectal. Thus, growing government initiatives to improve awareness of bariatric surgeries are driving the surgical robots market.

Report Segmentation and Scope:

The “Surgical Robots Market” is segmented based on components, applications, and end users. Based on components, the surgical robots market is divided into instruments & accessories, robotic systems, and services. The instruments & accessories segment dominated the market in 2022, and the same segment is expected to grow at its highest during the forecast period. The application segment of the global surgical robots market consists of general surgery, gynecology, urology, orthopedics, interventional cardiology, and neurology, among others. The urological segment acquired the highest market value in 2022. However, gynecological surgery is expected to grow at the highest CAGR from 2022 to 2030. The surgical robot market is divided into hospitals, ambulatory surgical centers, and Others based on the end-user. The hospital market dominated the market in 2022.

Segmental Analysis:

By components, the market is divided into instruments & accessories, robotic systems, and services. The instruments & accessories segment dominated the market in 2022, and the same segment is expected to grow fastest during the forecast period. The major driving factors for the enzyme type segment's growth are the rising approvals, significance in efficacy studies, and easy availability. Additionally, rising healthcare expenditure in developing regions and increasing number of surgical methods are expected to drive market growth over the forthcoming years. Robotic surgical instruments help to enable precision during the surgical procedure. With a variety of modalities, the instruments can be used for a range of procedures. For Instance, Intuitive Surgical recently introduced a low-cost version of the DaVinci Xi in the market. It is positioned between the Si and the Xi models, and the DaVinci X maintains the thinner and more capable arms and instruments of the Xi version but with the moving part of the Si model. Though useful for abdominal surgery, The DaVinci X is also adaptable for other procedures. Da Vinci systems offer surgeons high-definition 3D vision, a magnified view, and robotic assistance. They use specialized instrumentation, including a miniaturized surgical camera and wristed instruments that help with precise dissection and reconstruction inside the body. Therefore, surgical instruments & accessories are increasingly adopted in emerging countries.

The market is segmented based on application into general surgery, gynecology, urology, orthopedics, interventional cardiology, and neurology. The urological segment acquired the highest market value in 2022. However, Gynecological surgery is expected to grow fastest from 2022-2030. This can be due to the increasing incidence rate of gynecological complications among women globally and continuous technological advancement in robotic systems. Technological advancements and demand for minimally invasive surgery further boost the surgical robot market.

The surgical robot market is divided into hospitals, ambulatory surgical centers, and Others based on the end-user. The hospital's segment accounted for the highest market share in 2022. Robots have become a vital element of many hospitals' workforces, performing different specialty surgeries such as using robots during COVID-19 to reduce exposure to pathogens. Hospital robots are transforming surgeries performed earlier and have meager chances of infections, high precision, and fewer complications. These are expected to generate demand and contribute to market growth over the forecast period. Various developed robots, such as The da Vinci Surgical Robot, are currently being implemented in hospitals to improve patient quality of care and their outcomes.

Regional Analysis - Surgical Robots Market:

Based on geography, the global bioanalytical testing services market is segmented into five regions: North America, Europe, Asia Pacific (APAC), South & Central America (SCAM), and the Middle East & Africa (MEA). In 2022, North America accounted for the most significant global surgical robots market share. Asia Pacific is expected to grow faster, with the highest CAGR from 2022–2030.

North America holds the largest share of the surgical robot market. The market in this region is split into the US, Canada, and Mexico. The market growth in the region is growing due to the rising number of surgical procedures associated with colorectal and urological conditions. The US is the most significant contributor to the surgical robots market in North America and the world.

Surgical Robots are frequently used in neonatal care units for the unique needs of tiny babies. As per the article published in Guardian News & Media Limited, in 2021, surgical robots are saving the lives of hundreds of premature babies. Telemedicine robots enable consultants to make bedside video calls used at Liverpool Women’s and Alder Hey Children’s hospitals in the UK to treat sick babies. According to the CDC, preterm birth has increased in the US, i.e., the birth rate increased from 10.1% in 2020 to 10.5% in 2021. In the US, preterm births are a severe health problem and one of the country's leading causes of infant mortality. Due to serious health problems, 17% of all infant deaths are accountable for causing more than US$25 billion per annum.

Furthermore, factors such as increasing maternal age, poor prenatal care, obesity, induced fertility, and others are responsible for the alarming rate. One of the most significant risk factors for preterm birth is maternal age in the US. For Instance, as per the March of Dimes Foundation, during 2010-2020, in the US, preterm birth rates among women 40 and older (14.5%) were highest, followed by women under age 20 (10.4%). Furthermore, the survival of infants becomes critical as thermal supports are provided for survival.

Additionally, the surgical robots market in the US is expected to grow owing to the rising demand for advanced products as they ensure newborns' better delivery during birth. Also, due to rising healthcare expenditure, the FDA has increased the number of newborn care device approvals and provides well-equipped NICU to hospitals and centers. For Instance, in May 2021, Medtronic launched the SonarMed airway monitoring system. The device constantly checks for Endotracheal Tube Obstruction and Position for Neonates and Infants, providing immediate, actionable intelligence for Clinicians.

Surgical Robots Market Regional InsightsThe regional trends and factors influencing the Surgical Robots Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Surgical Robots Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Surgical Robots Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 6.84 Billion |

| Market Size by 2028 | US$ 17.65 Billion |

| Global CAGR (2021 - 2028) | 14.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Surgical Robots Market Players Density: Understanding Its Impact on Business Dynamics

The Surgical Robots Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Surgical Robots Market top key players overview

Industry Developments and Future Opportunities - Surgical Robots Market:

Various initiatives taken by leading players operating in the surgical robots market are listed below:

- In June 2022, Stryker will open the Advanced Global Technology Center in India.

- In February 2022, Smith+Nephew, the global medical technology business, announced the commercial launch of its next-generation handheld Robotics platform, the CORI Surgical System, in Japan.

- In November 2021, Smith+Nephew announced the launch of CORI handheld Robotics, an advanced system for total and partial knee arthroplasties.

- In August 2022, THINK Surgical, Inc., an innovator in orthopedic surgical Robots, agreed to the development and distribution with Curexo, Inc., a South Korean medical Robotics company. THINK and Curexo have a strong relationship based on a historic development collaboration, and Curexo distributes THINK's TSolution One platform in Korea and Vietnam

Competitive Landscape and Key Companies - Surgical Robots Market:

Intuitive Surgical, Inc.; Medtronic; THINK Surgical, Inc.; Smith & Nephew; Johnson & Johnson Services, Inc.; Stryker; Siemens Healthcare GmbH; Asensus Surgical US, Inc.; Zimmer Biomet; Renishaw plc are the prominent surgical robots market companies. These companies focus on new technologies, existing product advancements, and geographic expansions to meet the growing consumer demand worldwide.

Frequently Asked Questions

Which segment led the surgical robots market?

What are the driving factors for the global surgical robots market across the world?

What is the market CAGR value of the surgical robots market during the forecast period?

What is the estimated surgical robots market size in 2021?

Which region is projected to be the fastest-growing region in the global surgical robots market?

What are the growth estimates for the surgical robots market till 2028?

What are surgical robots?

Who are the major players in the surgical robots market across the globe?

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For