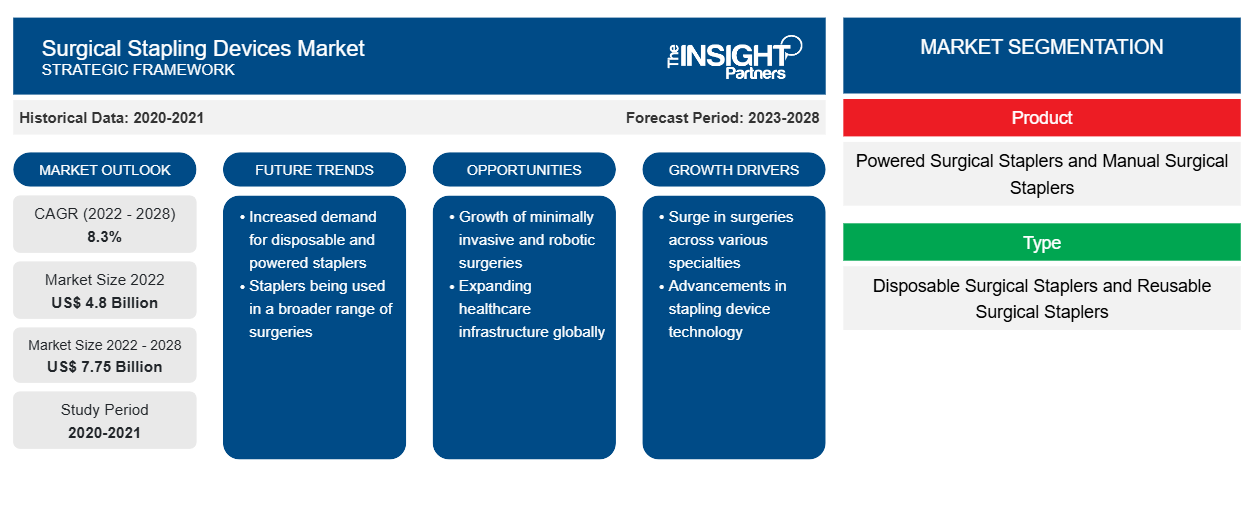

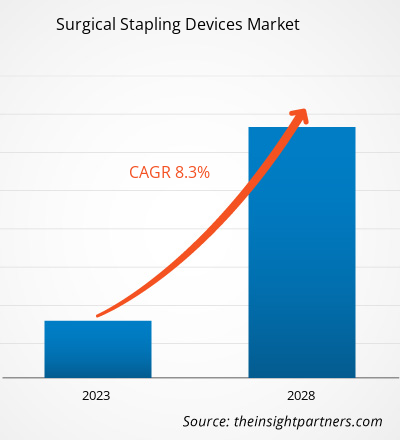

The surgical stapling devices market is expected to reach US$ 7,747.1 million by 2028 from US$ 4,795.8 million in 2022; it is estimated to grow at a CAGR of 8.3% from 2022 to 2028.

A surgical stapler or staples is a device used instead of a suture to close large wounds or incisions quickly. They are less painful than stitches and can be used in minimally invasive surgery. The devices can also be used in surgical operations to remove organs or to reconnect internal organs, as well as to close wounds where the skin is tight against the bone.

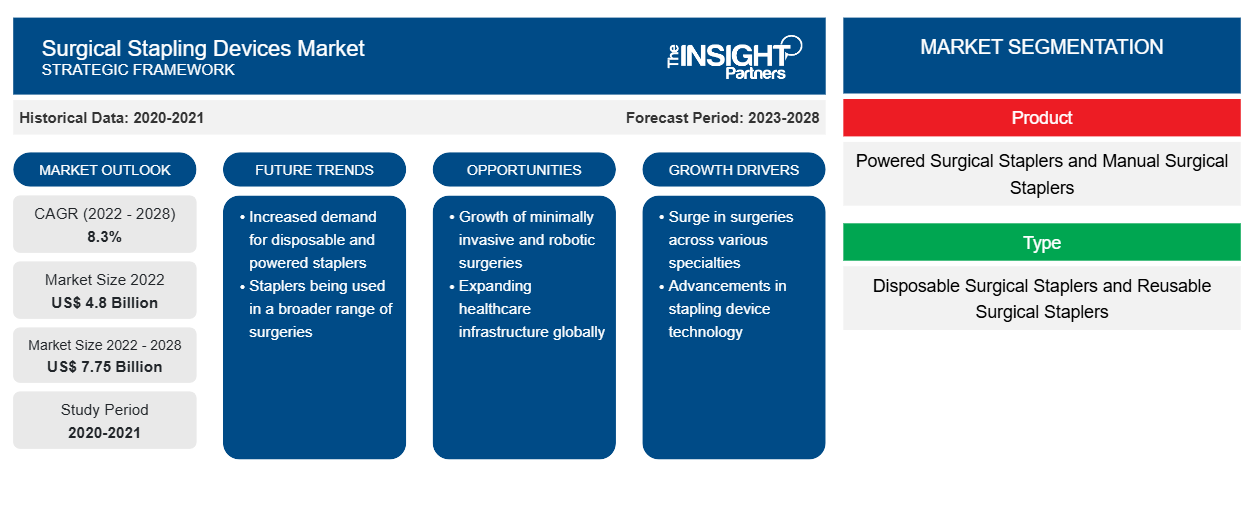

The surgical stapling devices market is segmented based on product, type, application, end user, and geography. By geography, the surgical stapling devices market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The report offers insights and in-depth analysis of the market, emphasizing on parameters such as market trends, technological advancements, and market dynamics, along with the analysis of the competitive landscape of the world's leading market players.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surgical Stapling Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surgical Stapling Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights - Surgical Stapling Devices Market

Technological Advancements

Tremendous growth in the patient population worldwide has created a demand for advanced and effective medical devices for better treatments and outcomes, which forces medical device manufacturers to innovate and develop new technologies for the upgrading of existing devices. These innovative and technologically advanced products are also meant to simplify the work of healthcare professionals. The companies are using robotics and automated technologies which accelerates the operational efficiency and reduces the surgery time along with reduction in manual setting which further reduces the complications and tissue damage. For instance, in 2021, Intuitive launches first surgical stapler with robotic assisted technology which helps in automatic adjustments while firing staples and it also provides 120° articulation in all directions. This has also increased the application areas of this surgical stapling devices in various procedures specially in minimally invasive procedures such as laparoscopy and arthroscopy. Additionally, in 2017, Medtronic has launched a smart surgical stapler named Signia stapling system which detect the tissue thickness and automatically adjust the stapler’s speed. This will help healthcare professionals to put consistent and even staples after surgery or during wound closure. Such technological advancement in the surgical stapling devices is further expected to reduce the manual errors and leakage with improved healing along with easy to reach at complicated locations. Therefore, above discussed factors are likely to anticipate the growth of surgical stapling devices market.

End user Insights

Based on product, the global surgical stapling devices market is divided into powered surgical staplers and manual surgical staplers. The powered surgical staplers segment held a larger share of surgical stapling devices market in 2022 and is anticipated to register a higher CAGR during the forecast period. Powered surgical staplers are preferred over manual staplers owing to ease of use, low risk of problems such as blood loss or spillages, shorter operating times, and lower hospital costs. The powered surgical staplers segment is driven by several advantages such as precise wound closure, stability, fewer leaks, and lower compressive force. Currently, two types of powered stapling systems are predominantly used in clinical practice—Ethicon’s GST and Medtronic’s Signia Stapling System (SIG). GST, launched in 2015, has reloaded surfaces with proprietary pocket extensions to stabilize and hold in place tissue to deploy staples with uniform height. SIG, launched in 2017, combines a Medtronic-powered stapler handle and other components (such as linear adapter, power shell, stapler insertion guide, and manual retraction tool) representing a redesign from the original Endo-GIATM iDrive powered stapler while maintaining same original stapler reloads with Tri-Staple technology. In 2021, Ethicon launched ECHELON+ Stapler with GST Reloads, a new powered surgical stapler designed to increase staple line security and reduce complications by more uniform tissue compression and better staple formation, even in challenging situations.

Product launches and mergers and acquisitions are the highly adopted strategies by the players operating in the global surgical stapling devices market. A few of the recent key product developments are listed below:

- In June 2022, Ethicon launched next generation Echelon 3000 stapler designed for exceptional access and control. It is digitally enabled device that provides surgeons with simple, one-handed powered articulation to help address the unique needs of their patients. Designed with 39% greater jaw aperture and a 27% greater articulation span,3,4 ECHELON 3000 gives surgeons better access and control over each transection, even in tight spaces and on challenging tissue.

- In December 2021, Intutive Surgical Inc received FDA clearance for 8 mm SureForm 30 Curved-Tip Stapler. and reloads for use in general, thoracic, gynecologic, urologic, and pediatric surgery.

- In March 2021, Ethicon launched of the ECHELON+ Stapler with GST Reloads, a new powered surgical stapler designed to increase staple line security and reduce complications through more uniform tissue compression and better staple formation, even in challenging situations.

The COVID-19 pandemic brought worldwide shutdown of supply and demand chains which resulted in decline in the sales in the healthcare industry during the initial stage of lockdown. According to the article titled ' Elective surgery cancellations due to the COVID-19 pandemic: global predictive modelling to inform surgical recovery plans' published in the British Journal of Surgery in May 2020, based on 12 weeks of peak disruption to hospital services due to COVID-19, around 28.4 million elective surgeries worldwide were canceled or postponed in 2020. However, going forward, the market is expected to experience a spur after the relaxation of lockdown restrictions. The Italian Society of Urology (SIU), the Spanish Urological Association (AEU), the German Society of Urology (DGU), the French Association of Urology (AFU), and the British Association of Urological Surgeons (BAUS) have collaborated to develop guidelines for performing selective diagnostic and surgical procedures.

Surgical Stapling Devices Market Regional Insights

Surgical Stapling Devices Market Regional Insights

The regional trends and factors influencing the Surgical Stapling Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Surgical Stapling Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Surgical Stapling Devices Market

Surgical Stapling Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.8 Billion |

| Market Size by 2028 | US$ 7.75 Billion |

| Global CAGR (2022 - 2028) | 8.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

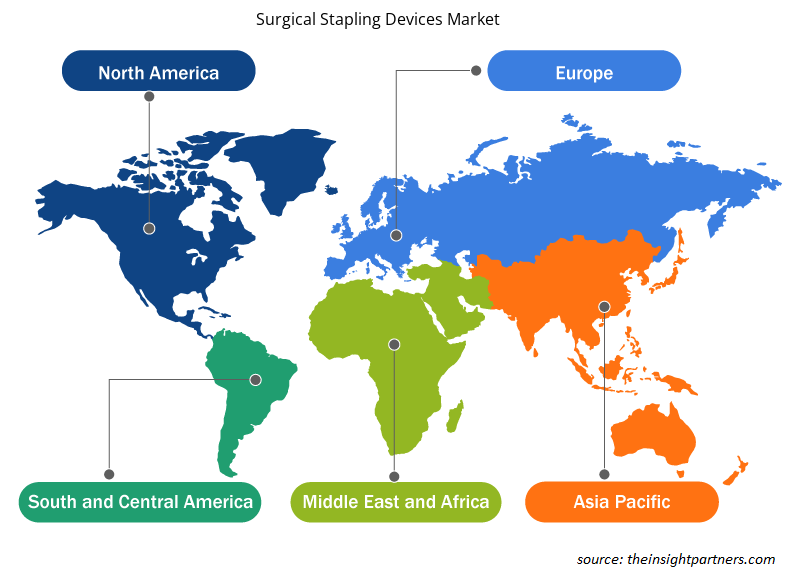

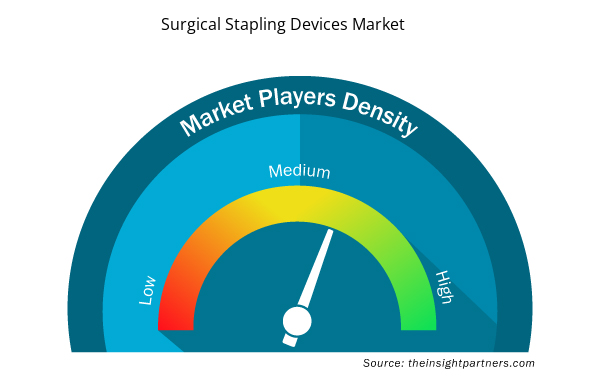

Surgical Stapling Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Surgical Stapling Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Surgical Stapling Devices Market are:

- Intuitive Surgical Inc.

- Medtronic Plc

- Ethicon USA LLC

- Frankenman International Ltd

- Panther Healthcare Medical Equipment Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Surgical Stapling Devices Market top key players overview

Surgical Stapling Devices – Market Segmentation

Based on Product, surgical stapling devices market is bifurcated into powered surgical staplers and manual surgical staplers. By type, surgical stapling devices market is segmented into disposable surgical staplers and reusable surgical staplers. By application, surgical stapling devices market segmentation is orthopedic surgery, endoscopic surgery, cardiac and thoracic surgery, abdominal and pelvic surgery, and others. Market by end user is segmented into hospitals and ambulatory surgical centers. Based on geography, the market is divided into North America (US, Canada, Mexico), Europe (France, Germany, UK, Italy, Spain, and Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, South Africa, UAE, and Rest of Middle East & Africa), South and Central America (Brazil, Argentina, and Rest of South and Central America)

Company Profiles - Surgical Stapling Devices Market

- Intuitive Surgical Inc.

- Medtronic Plc

- Ethicon USA LLC

- Frankenman International Ltd

- Panther Healthcare Medical Equipment Co Ltd

- B. Braun SE

- Grena Ltd

- Conmed Corp

- 3M Co

- Purple Surgical UK Ltd

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Type, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The factors that are driving the growth of market are the increase in wounds & surgical procedures and new product launches & strategic collaborations. On the other hand, product recalls and high cost of surgical stapling devices is likely to hinder the growth of the market during the forecast period.

A surgical stapler or staples is a device used instead of a suture to close large wounds or incisions quickly. They are less painful than stitches and can be used in minimally invasive surgery. The devices can also be used in surgical operations to remove organs or to reconnect internal organs, as well as to close wounds where the skin is tight against the bone.

The surgical stapling devices market majorly consists of the players such as Intuitive Surgical Inc., Medtronic Plc, Ethicon USA LLC, Frankenman International Ltd, Panther Healthcare Medical Equipment Co Ltd, B. Braun SE, Grena Ltd, Conmed Corp, 3M Co, and Purple Surgical UK Ltd.

The surgical stapling devices market is analyzed in the basis of product, type, application, and end use. Based on product, is segmented into powered surgical staplers and manual surgical staplers. The powered surgical staplers segment held the largest share of the surgical stapling devices market size, and it is anticipated to register the highest CAGR.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Surgical Stapling Devices Market

- Intuitive Surgical Inc.

- Medtronic Plc

- Ethicon USA LLC

- Frankenman International Ltd

- Panther Healthcare Medical Equipment Co Ltd

- B. Braun SE

- Grena Ltd

- Conmed Corp

- 3M Co

- Purple Surgical UK Ltd

Get Free Sample For

Get Free Sample For