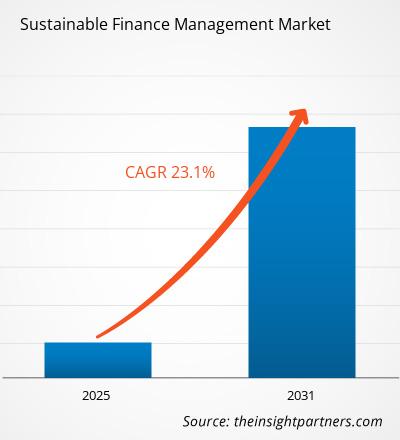

The sustainable finance management market is expected to expand at a CAGR of 23.1% from 2025 to 2031. The surge in demand for sustainable finance and increasing awareness about environmental issues are expected to be key trends in the market.

Sustainable Finance Management Market Analysis

Sustainable finance is a developing area shaped by macro-environmental variables such as climate change. Sustainable finance will have a big impact on the financial services (FS) business, particularly in terms of how consumers, both corporate and retail, investors, and workers see their FS firm or bank. Sustainability is increasingly an important concern in employee recruitment and retention. Today, most retail and corporate investors want to make a difference. They're looking for investing options that incorporate ESG factors. This has raised the pressure on firms to reach their environmental goals. Funding is essential to support solutions to environmental issues. As a result, governments and politicians are eager to create a financial environment that promotes sustainable growth.

Sustainable Finance Management Market Industry Overview

Sustainable finance is the procedure of considering environmental, social, and governance (ESG) factors when making investment decisions in the financial sector, resulting in longer-term investments in sustainable economic activities and projects. As the movement toward sustainable development gains traction, the financial sector has emerged as a key driver of sustainability. Sustainable finance is attracting the attention of various stakeholders throughout the globe. The financial world has acknowledged the critical need to address environmental, social, and governance (ESG) challenges, making sustainable finance more than a trend but a need.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sustainable Finance Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sustainable Finance Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Sustainable Finance Management Market Driver and Opportunities

Increasing Awareness About Climate Change Risks to Drive Market Growth

One of the driving drivers behind the expansion of sustainable finance is the desire to reduce climate risk. Climate change displays itself in a variety of ways, including extreme weather, water scarcity, melting icebergs, and so on. It makes it vital to create a low-carbon economy. This necessitates investment in wind farms, solar parks, electric car infrastructure, and other projects. Sustainable finance plays a significant role in this context. Further, developed countries have state-funded initiatives and innovative techniques to promote sustainable development. All these factors are expected to boost the growth of the sustainable finance management market during the forecast period.

Increasing Sustainable Investments to Create Lucrative Market Opportunities

Climate action and a structured focus on ESG are still relatively new sectors for the finance sector. Thus, investors attributed their increased interest in sustainable investing to new climate science findings, as well as the financial performance of sustainable assets. The majority of investors feel that firms should address environmental and social concerns. Further, impact investing is crucial for attaining environmental and social goals while balancing financial returns. In recent years, there has been an increase in awareness of environmental sustainability, which has boosted impact investment. All these factors are expected to create lucrative opportunities for the sustainable finance management market during the forecast period.

Sustainable Finance Management Market Report Segmentation Analysis

The key segments that contributed to the derivation of the sustainable finance management market analysis are asset class, offerings, investment style, and investment type.

- Based on asset class, the market is divided into equities, fixed-income, multi-asset, and alternatives.

- By offerings, the market is divided into equity funds, bond funds, ETFs/index funds, and alternatives/hedged funds.

- Based on investment style, the market is divided into active and passive. Portfolio managers use active investment methods to choose and manage investments based on their experience and analysis. Thus, this segment is expected to grow during the forecast period.

- On the basis of investor type, the market is divided into institutional investors and retail investors.

Sustainable Finance Management Market Share Analysis By Geography

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

Sustainable investing encompasses a extensive range of activities, from putting money into green energy projects to investing in businesses that exhibit social values like social inclusion or good governance. North America and Europe are identified as pioneers in such activities. Further, the Asia Pacific region is projected to grow at the fastest CAGR during the forecast period. This growth may be attributed to the swelling recognition among businesses and governments about the necessity of sustainable development and addressing social and environmental concerns.

Sustainable Finance Management Market Regional Insights

The regional trends and factors influencing the Sustainable Finance Management Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Sustainable Finance Management Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Sustainable Finance Management Market

Sustainable Finance Management Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 23.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

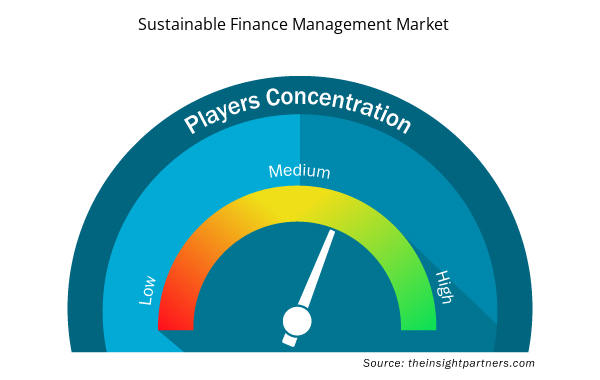

Sustainable Finance Management Market Players Density: Understanding Its Impact on Business Dynamics

The Sustainable Finance Management Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Sustainable Finance Management Market are:

- JPMorgan Chase and Co.

- Franklin Templeton Investments

- Amundi US

- The Bank of New York Mellon Corporation

- Deutsche Bank AG

- Goldman Sachs

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Sustainable Finance Management Market top key players overview

Sustainable Finance Management Market News and Recent Developments

The sustainable finance management market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the sustainable finance management market are listed below:

- KPMG and Workiva Inc. announced an enhanced alliance to deliver environmental, social, and governance (ESG) focused solutions and services. This increased collaboration expands the KPMG's ability to assist organizations in effectively implementing ESG data, process, control, and reporting capabilities, ultimately enhancing trust, mitigating risk, and unlocking new value as companies build a sustainable future. (Source: KPMG, Press Release, February 2023)

Sustainable Finance Management Market Report Coverage & Deliverables

The sustainable finance management market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Sustainable Finance Management Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Sustainable finance management market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Sustainable finance management market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Sustainable finance management market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the sustainable finance management market

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The report can be delivered in PDF/PPT format; we can also share an Excel dataset based on the request.

Some of the customization options available based on the request are additional 3–5 company profiles and a country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

BlackRock, Inc., State Street Corporation, Morgan Stanley, UBS, JPMorgan Chase and Co., Franklin Templeton Investments, Amundi US, The Bank of New York Mellon Corporation, Deutsche Bank AG, Goldman Sachs, Refinitiv, Acuity Knowledge Partners, NOMURA HOLDINGS, BNP Paribas, HSBC Group, South Pole, Tred Earth Limited, Triodos Bank UK Ltd., Stripe, Inc., and Ecofy are the major market players.

The surge in demand for sustainable finance and increasing awareness about environmental issues are the major trends in the market.

The global sustainable finance management market was estimated to grow at a CAGR of 23.1% during 2023 - 2031.

Increasing awareness about climate change risks and increasing focus on environmental and social issues are the major factors that drive the global sustainable finance management market.

Get Free Sample For

Get Free Sample For