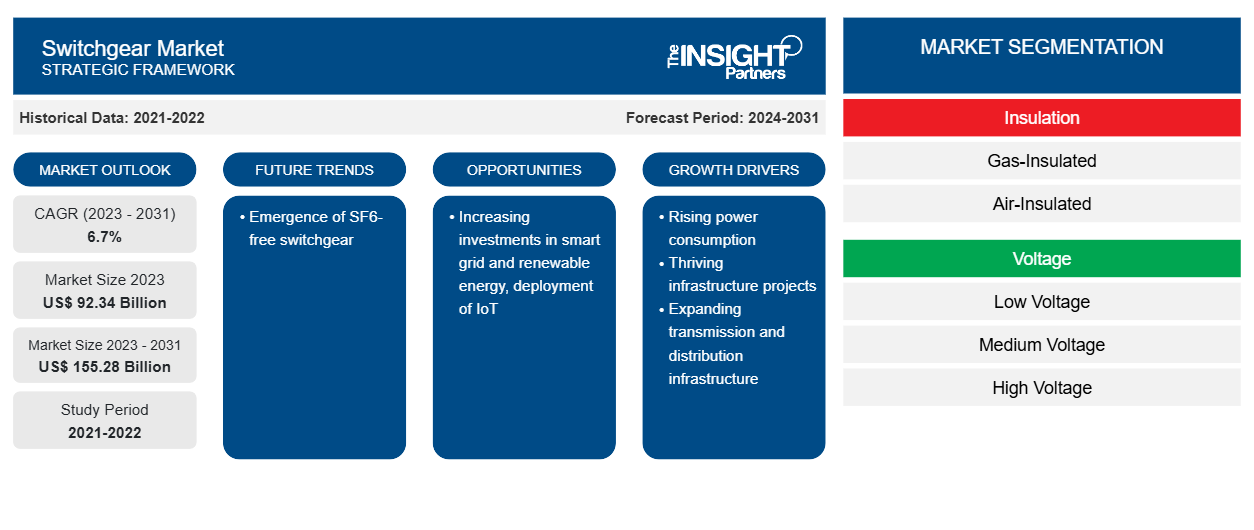

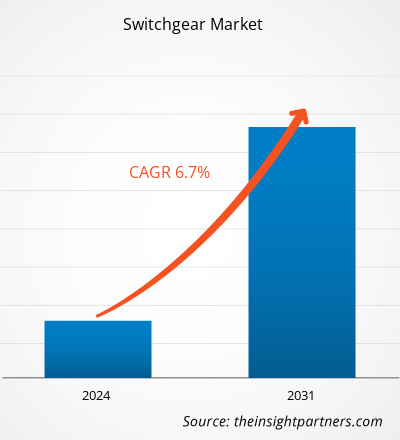

The switchgear market size is projected to reach US$ 155.28 billion by 2031 from US$ 92.34 billion in 2023. The market is expected to register a CAGR of 6.7% during 2023–2031. The emergence of SF6-free switchgear is likely to bring in new trends in the market.

Switchgear Market Analysis

Switchgear includes a wide range of switching devices that help control, protect, and isolate power systems in sectors such as commercial & residential buildings, energy & utilities, manufacturing, mining, oil & gas, railways, and water & wastewater. It also assists in regulating a power system, circuit breakers, and similar technology. Switchgear can refer to different systems and components, including switches, fuses, isolators, relays, circuit breakers, and lighting arresters. In the recent power distribution landscape components like switchgears are gaining momentum. This can be attributed to the rising upgradation in electricity grid infrastructure.

Switchgear Market Overview

The switchgear market is experiencing significant growth worldwide. This growth is attributed to the rising power consumption that requires a more robust and reliable electrical system. Switchgear plays an important role in protecting and isolating electrical circuits, thereby enhancing grid stability. Additionally, the increasing number of infrastructural projects and the expansion of transmission and distribution infrastructure are fueling the market growth. Moreover, rising investment in smart grid and renewable energy, deployment in IoT, and development in SF6-free switchgear are anticipated to create several opportunities for the switchgear market growth in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Switchgear Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Switchgear Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Switchgear Market Drivers and Opportunities

Expanding Transmission and Distribution Infrastructure

The expansion of transmission and distribution (T&D) infrastructure and the increasing integration of renewable energy in various economies propel the demand for switchgears and substations. Transmission utilities are focusing on augmenting substation capacity to further strengthen the network and enable greater integration of renewable energy. The Revamped Distribution Sector Scheme also lays importance on network modernization and upgradation in the distribution.

Further, huge investments are made by various companies in the transmission and distribution infrastructure development to improve power utilization. For instance, Gujarat Energy Transmission Corporation (GETCO) announced plans to invest US$ 11.5 billion over the next eight years to develop transmission infrastructure within the state. Similarly, in June 2024, Saudi Electricity Company (SEC) announced the completion of its preparations and the readiness of the electrical grid in Makkah and Medina—the holy sites for the Hajj season. This achievement follows the execution of 20 new projects with a total investment exceeding US$ 186 million. These projects include the establishment of new transmission and distribution networks, integration with the general grid, and the automation of distribution. Thus, the expansion of transmission and distribution infrastructure accelerates the switchgear market globally.

Increasing Investment in Smart Grid and Renewable Energy

Rising investments in smart grid and renewable energy are anticipated to present lucrative opportunities for the switchgear market. Governments of various economies are investing in the smart grid technology. For instance, in 2022, Japan announced a financing program of US$ 155 billion to spur investment in smart grids. During the same year, the Government of India established a US$ 38-billion scheme to help power distribution companies and improve distribution infrastructure.

Further, in March 2024, German network operator E.ON Group planned a US$ 9.8 billion increase to its 2024–2028 investment plan, citing the need for continued grid expansion to connect an increasing number of renewable energy facilities. Such investments in renewable energy are also fueling the market growth. According to power ministry estimates, India will endorse more than 83% increase in investments in renewable energy projects, i.e., around US$ 16.5 billion in 2024, as the country concentrates on energy transition to reduce carbon emissions. Thus, smart grids and renewable energy systems require advanced switchgear with capabilities for remote working automation and integration with digital technologies.

Switchgear Market Report Segmentation Analysis

Key segments that contributed to the derivation of the switchgear market analysis are insulation, voltage, current type, and end user.

- Based on insulation, the market is segmented into air-insulated, gas-insulated, and others. The gas-insulated segment held the largest market share in 2023.

- Based on voltage, the market is divided into high voltage, medium voltage, and low voltage. The low voltage segment held the largest market share in 2023.

- By current type, the market is bifurcated into alternating current and direct current. The alternating current segment held a larger market share in 2023.

- By end use, the market is segmented into commercial & residential buildings, energy & utilities, manufacturing, mining, oil & gas, railways, water & wastewater, and others. The energy & utilities segment dominated the market in 2023.

Switchgear Market Share Analysis by Geography

The geographic scope of the switchgear market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held a significant market share in 2023. The North America switchgear market is segmented into the US, Canada, and Mexico. The rising number of infrastructure projects of data centers, airports, and railways is contributing to the switchgear market growth in the region. Switchgear helps protect and control the electrical power supply. The US$ 25 trillion US economy relies on the vast infrastructure network. Further, Terminals 1, 2, and 3 on the south side of John F. Kennedy International Airport in New York, Queens, were reconstructed to accommodate the largest terminal of the airport worth US$ 9.5 billion in December 2021. The new 2.4-million-square-foot Terminal One was developed by a coalition of four international airlines—Japan Airlines, Lufthansa, Air France, and Korean Air Lines. The new terminal has 23 international gates, interior green space, and ~230,000 square feet of retail and leisure facilities. Switchgear ensures the reliable distribution of power to various parts of the airport.

The Gateway Program is a series of rail infrastructure projects that will renovate and expand the Northeast Corridor rail line between New Jersey, Newark, and New York City. As part of this project, which includes tunnels and rail bridges, two flood-resistant tunnels will be created under the Hudson River to enhance access to New York. The Hudson River rail tunnel serving Penn Station, New York, will be constructed alongside the rehabilitation of the existing North River Tunnel, which was rigorously damaged following Storm Sandy. The project was launched on the Tonnelle Avenue Project in November 2023 and is expected to conclude by the fall of 2025. Switchgear plays a vital role in rail infrastructure, which converts and distributes power for the railway's electrified tracks. Moreover, the data center infrastructure is growing in the region; for instance, in October 2023, JE Dunn resumed construction on a US$ 800 million Meta data center project in Temple, Texas. Similarly, in April 2023, Equinix announced its plan to construct a new data center in Montreal, Canada. Switchgear is used in data centers to protect the centers from electrical breaches.

Switchgear Market Regional Insights

The regional trends and factors influencing the Switchgear Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Switchgear Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Switchgear Market

Switchgear Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 92.34 Billion |

| Market Size by 2031 | US$ 155.28 Billion |

| Global CAGR (2023 - 2031) | 6.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Insulation

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

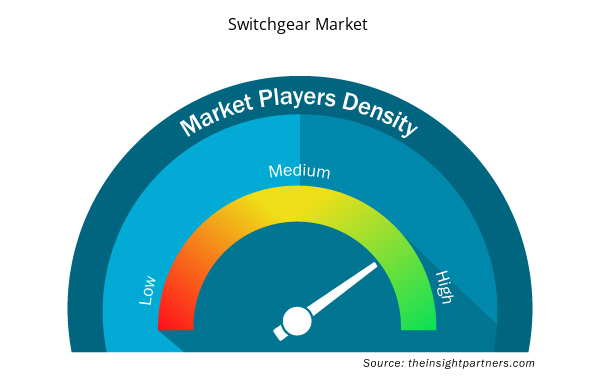

Switchgear Market Players Density: Understanding Its Impact on Business Dynamics

The Switchgear Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Switchgear Market are:

- Mitsubishi Electric Corp

- Rockwell Automation Inc

- Schneider Electric SE

- Siemens AG

- Toshiba Infrastructure Systems and Solutions Corp

- ABB Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Switchgear Market top key players overview

Switchgear Market News and Recent Developments

The switchgear market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the switchgear market are listed below:

- Fuji Electric FA Components & Systems Co., Ltd., a subsidiary of Fuji Electric Co., Ltd., announced the release of the SC-NEXT Series, a line of the industry's smallest magnetic switches. The shape and layout of components and the contact pressure of contacts have been optimized by using the company's proprietary coupled magnetic field-motion analysis. (Source: Fuji Electric, Press Release, March 2024)

- ABB, a pioneering technology leader, unveiled the 500 mm panel version of the UniGear ZS1, its latest in air-insulated medium-voltage switchgear technology, at the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC) 2023. (Source: ABB, Press Release, September 2023)

Switchgear Market Report Coverage and Deliverables

The "Switchgear Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Switchgear market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Switchgear market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Switchgear market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the switchgear market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The incremental growth expected to be recorded for the global switchgear market during the forecast period is US$ 62941.38 million.

The global switchgear market is expected to reach US$ 155,282.94 million by 2031.

The key players holding majority shares in the global switchgear market are Schneider Electric SE, Siemens AG, ABB Ltd, Siemens AG, Alstom SA, and General Electric.

Emergence of SF6-free switchgear, which is anticipated to play a significant role in the global switchgear market in the coming years.

Rising power consumption, thriving infrastructure projects, and expanding transmission and distribution infrastructure are the major factors that propel the global switchgear market.

The global switchgear market was estimated to be US$ 92,341.56 million in 2023 and is expected to grow at a CAGR of 6.7 % during the forecast period 2023 - 2030.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Switchgear Market

- Mitsubishi Electric Corp

- Rockwell Automation Inc

- Schneider Electric SE

- Siemens AG

- Toshiba Infrastructure Systems and Solutions Corp

- ABB Ltd

- Fuji Electric Co Ltd

- General Electric Co

- Hitachi Energy Ltd

- Hubbell Inc

Get Free Sample For

Get Free Sample For