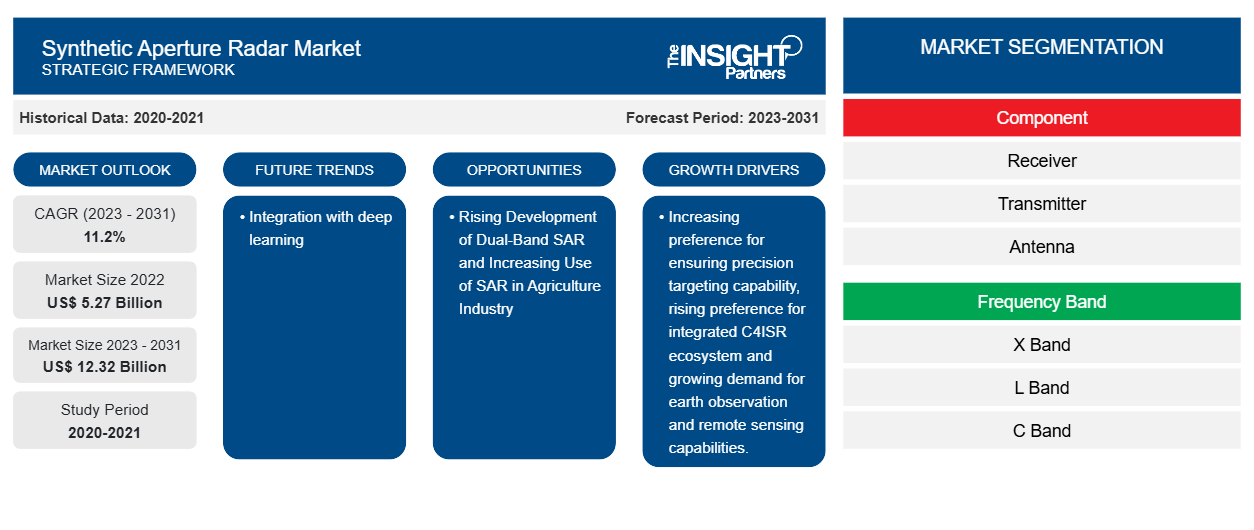

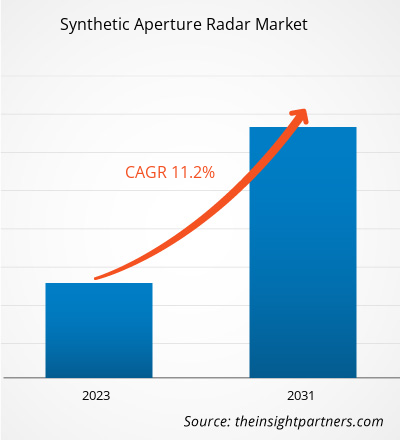

The synthetic aperture radar market size is projected to reach US$ 12.32 billion by 2030 from US$ 5.27 billion in 2022. The market is expected to register a CAGR of 11.2% during 2022–2030. Integration with deep learning is likely to remain a key trend in the market.

Synthetic Aperture Radar Market Analysis

Various reasons fuel the synthetic aperture radar market growth. Factors such as the rising demand for advanced technologies that offer enhanced environmental awareness, the increasing need for efficient surveillance and communication networks, the growing deployment of space-based radars, and the increasing utilization of SAR for environmental awareness and mapping purposes play a crucial role in market expansion. Moreover, the rising development of dual-band SAR is expected to bring new synthetic aperture radar market trends in the coming years.

Synthetic Aperture Radar Market Overview

Synthetic Aperture Radar (SAR) is an innovative remote sensing technique that employs radar technology to generate high-resolution images of the Earth's surface. Optical sensors rely on sunlight; however, SAR utilizes its energy source to illuminate the target area and capture the reflected energy. This active data collection approach enables SAR to operate effectively under any lighting conditions, day or night, and in all kinds of weather, making it a useful and valuable tool for numerous applications. The functioning of SAR involves leveraging the flight trajectory of the radar platform, be it an aircraft or a satellite, to simulate a large antenna electronically. The radar system emits radio waves toward the Earth's surface and records the signals that bounce back, a process known as backscattering. This process is repeated multiple times during transmit/receive cycles, with the resulting data being electronically stored. Subsequently, the stored data is meticulously processed to generate a comprehensive and high-resolution image of the observed terrain.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Synthetic Aperture Radar Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Synthetic Aperture Radar Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Synthetic Aperture Radar Market Drivers and Opportunities

Rising Preference for Integrated C4ISR Ecosystem to Favor Market

The market is driven by the increasing preference for an integrated Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) ecosystem. Traditionally, C4ISR systems have relied on separate stand-alone units, each equipped for specific functions and mission requirements. This approach often leads to the use of separate systems and displays for collecting and analyzing information, resulting in a rigorous and time-consuming process. To address these challenges, defense agencies are leaning toward adopting an enterprise integration approach. This approach advocates for the integration of secure and interoperable C4ISR networks and systems to streamline the entire process. In this integrated C4ISR approach, governments take responsibility for designing enterprise blueprints and intersystem interfaces. At the same time, vendors deliver individual systems and sub-components that can be seamlessly integrated into the overall C4ISR environment.

Rising Development of Dual-Band SAR

Dual-band synthetic aperture radar (SAR) technology operates in two frequency bands simultaneously, allowing for enhanced imaging capabilities and improved image quality compared to single-band SAR systems. The use of dual-band SAR offers several advantages. Firstly, it enables better target discrimination and identification, as the combination of two different frequency bands provides more detailed and accurate imaging. This is particularly valuable in applications such as military surveillance, border control, and maritime monitoring, where the ability to distinguish between objects and detect subtle changes is crucial. Secondly, dual-band SAR technology enhances the system's ability to penetrate and detect objects under challenging environmental conditions. Utilizing two different frequency bands, SAR systems can overcome limitations posed by factors such as vegetation cover, weather conditions, and surface roughness. Thus, dual-band synthetic aperture radar (SAR) technology has emerged as a significant advancement in the synthetic aperture radar market, presenting new opportunities for market growth and expansion.

Synthetic Aperture Radar Market Report Segmentation Analysis

Key segments that contributed to the derivation of the synthetic aperture radar market analysis are the component, frequency band, application, platform, and mode.

- Based on the components, the synthetic aperture radar market is divided into receiver, transmitter, and antenna. The antenna segment will hold a significant market share in 2022.

- By frequency band, the market is segmented into X band, L band, C band, S band, and others. The X band segment held the largest market share in 2022.

- In terms of application, the market is segmented into commercial and defense. The defense segment is expected to grow with the highest CAGR over the forecast period.

- In terms of platform, the market is segmented into ground and airborne. The airborne segment is expected to grow with the highest CAGR over the forecast period.

- In terms of mode, the market is segmented into single and multi. The multi-segment is expected to grow with the highest CAGR over the forecast period.

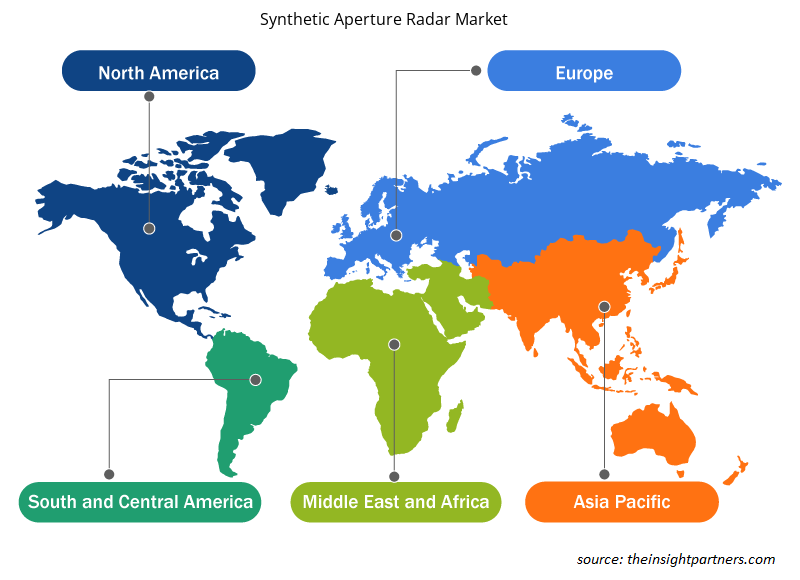

Synthetic Aperture Radar Market Share Analysis by Geography

The geographic scope of the synthetic aperture radar market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North American market has gained prominence in the region for several reasons. The US dominated the synthetic aperture radar market share in 2022. Synthetic aperture radar technology is widely used in various applications, including military & defense, monitoring, exploration, agriculture, urban planning, infrastructure development, and natural resource management. Various factors drive the demand for synthetic aperture radar technology. In military applications, synthetic aperture radar (SAR) is used for surveillance, detection of surface features, and topographical mapping. The US military is replacing its legacy systems with advanced synthetic aperture radars, which is contributing to the growth of the market. Additionally, the need for geospatial information is increasing in sectors such as agriculture, urban planning, infrastructure development, and natural resource management. Synthetic aperture radar provides valuable data for these applications, further fuelling the synthetic aperture radar market growth.

Synthetic Aperture Radar Market Regional Insights

The regional trends and factors influencing the Synthetic Aperture Radar Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Synthetic Aperture Radar Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Synthetic Aperture Radar Market

Synthetic Aperture Radar Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5.27 Billion |

| Market Size by 2030 | US$ 12.32 Billion |

| Global CAGR (2023 - 2031) | 11.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Synthetic Aperture Radar Market Players Density: Understanding Its Impact on Business Dynamics

The Synthetic Aperture Radar Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Synthetic Aperture Radar Market are:

- Northrop Grumman Corp

- ASELSAN AS

- BAE Systems Plc

- Israel Aerospace Industries Ltd

- Leonardo SpA

- Lockheed Martin Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Synthetic Aperture Radar Market top key players overview

Synthetic Aperture Radar Market News and Recent Developments

The synthetic aperture radar market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the synthetic aperture radar market are listed below:

- Israel Aerospace Industries (IAI) launched Singapore's DS-SAR radar satellite, showcasing the company's expertise in the development of observation satellites. With a track record of 35 years in creating advanced-generation satellites, including OptSat and TecSAR, IAI has leveraged its experience to create the DS-SAR satellite. This satellite features a synthetic aperture radar sensor payload, which enables the collection of extensive and high-resolution data regardless of weather conditions, day or night. The launch of DS-SAR reinforces IAI's position in the market and highlights its ability to deliver cutting-edge solutions in the field of satellite technology. (Source: Israel Aerospace Industries (IAI), Press Release, July 2023)

- BAE Systems' research and development organization, FAST Labs, was granted a US$ 14 million contract by the Defense Advanced Research Projects Agency (DARPA) for the MAX program. This partnership aims to develop cutting-edge technology that facilitates the implementation of advanced signal processing and computation on smaller military platforms. The project aligns with BAE Systems' commitment to innovation and its focus on providing state-of-the-art solutions for the defense industry. Through this collaboration, BAE Systems aims to enhance military capabilities by enabling the deployment of advanced technologies on smaller military platforms, ultimately contributing to the company's growth and success in the defense sector. (Source: BAE Systems, Press Release, August 2020)

Synthetic Aperture Radar Market Report Coverage and Deliverables

The “Synthetic Aperture Radar Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Synthetic aperture radar market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Synthetic aperture radar market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Synthetic aperture radar market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the synthetic aperture radar market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Frequency Band, Application, Platform, Mode, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America is expected to dominate the synthetic aperture radar market with the highest market share in 2022.

The synthetic aperture radar market size is projected to reach US$ 12.32 billion by 2030.

The leading players operating in the synthetic aperture radar market are Northrop Grumman Corp, ASELSAN AS, BAE Systems Plc, Israel Aerospace Industries Ltd, Leonardo SpA, Lockheed Martin Corp, Raytheon Technologies Corp, Thales SA, General Atomics Aeronautical Systems Inc, and Saab AB.

The global synthetic aperture radar market is expected to grow at a CAGR of 11.2% during the forecast period 2023 - 2030.

The major factors driving the synthetic aperture radar market are increasing preference for ensuring precision targeting capability, rising preference for integrated C4ISR ecosystem and growing demand for earth observation and remote sensing capabilities.

Integration with deep learning is anticipated to play a significant role in the global synthetic aperture radar market in the coming years.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Synthetic Aperture Radar Market

- Northrop Grumman Corp

- ASELSAN AS

- BAE Systems Plc

- Israel Aerospace Industries Ltd

- Leonardo SpA

- Lockheed Martin Corp

- Raytheon Technologies Corp

- Thales SA

- General Atomics Aeronautical Systems Inc

- Saab AB

Get Free Sample For

Get Free Sample For