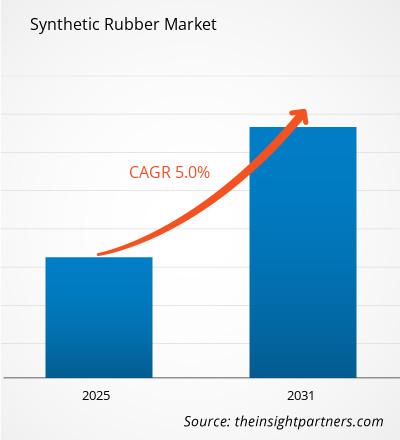

The Synthetic Rubber Market is expected to register a CAGR of 5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report presents analysis based on product type (nitrile rubber, styrene butadiene, EPDM, butyl rubber, ethylene propylene diene monomer, neoprene, and others). The report is segmented by application (adhesives and sealants, tires, wires and cables, belts and hoses, additives, and others). The report is segmented by end use industry (automotive, aerospace, building and construction, electrical and electronics, healthcare, consumer goods, and others). The global analysis is further broken-down at regional level and major countries. The market size and forecast at global, regional, and country levels for all the key market segments are covered under the scope. The report offers the value in USD for the above analysis and segments. The report provides key statistics on the market status of the key market players and offers market trends and opportunities.

Purpose of the Report

The report Synthetic Rubber Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Synthetic Rubber Market Segmentation

Product Type

- Nitrile Rubber

- Styrene Butadiene

- EPDM

- Butyl Rubber

- Ethylene Propylene Diene Monomer

- Neoprene

Application

- Adhesives and Sealants

- Tires

- Wires and Cables

- Belts and Hoses

- Additives

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Synthetic Rubber Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Synthetic Rubber Market Growth Drivers

- Rising Automotive Demand: The growing demand for automobiles, particularly in emerging economies, drives the synthetic rubber market. Synthetic rubber is used extensively in tires, seals, and gaskets, and as global automotive production increases, so does the need for high-quality, durable rubber components, boosting market growth.

- Expansion in Construction Industry: The construction sector’s demand for synthetic rubber products, such as seals, gaskets, and roofing materials, is rising. As infrastructure projects and urbanization accelerate, the need for durable, weather-resistant synthetic rubber in construction applications creates a significant driver for market expansion.

- Growth in Consumer Goods: The rising consumption of consumer goods, including footwear, electronics, and sports equipment, fuels the synthetic rubber market. With increasing demand for durable, flexible, and cost-effective materials, synthetic rubber is extensively used in the production of these goods, further driving market growth.

Synthetic Rubber Market Future Trends

- Shift to Sustainable and Eco-Friendly Materials: There is a growing trend toward the use of sustainable and environmentally friendly synthetic rubber. Manufacturers are increasingly focusing on developing bio-based, recyclable, and low-emission alternatives to traditional synthetic rubbers to meet consumer demand for greener products and comply with stricter environmental regulations.

- Technological Advancements in Rubber Production: Innovations in synthetic rubber production technologies, such as improved polymerization processes and enhanced crosslinking methods, are driving the market. These advancements result in more durable, high-performance rubbers with greater versatility, enabling their use in diverse industries, from automotive to electronics, fostering continuous market growth.

- Demand for High-Performance Rubber in EVs: With the rapid growth of the electric vehicle (EV) market, there is an increasing demand for specialized synthetic rubbers. These rubbers are used in electric vehicle components such as tires, seals, and insulation, driving demand for high-performance, heat-resistant, and durable materials tailored to EV specifications.

Synthetic Rubber Market Opportunities

- Growth in Electric Vehicle (EV) Market: The rise of electric vehicles presents an opportunity for synthetic rubber manufacturers. Specialized synthetic rubbers are needed for components such as tires, seals, and insulation in EVs, creating a growing demand as EV adoption accelerates and automotive manufacturers prioritize performance and sustainability.

- Sustainability and Recycling Innovations: Increasing demand for eco-friendly materials offers an opportunity for innovation in sustainable synthetic rubbers. Manufacturers can invest in the development of recyclable, bio-based, or low-emission synthetic rubbers, addressing the market's environmental concerns while meeting consumer preferences for greener, more sustainable products.

- Expanding Demand in Medical Sector: Synthetic rubber is increasingly used in the medical industry for applications such as gloves, seals, and tubing. As healthcare demand grows globally, particularly in emerging markets, manufacturers have the opportunity to expand their offerings in the medical sector, producing high-quality, safe rubber products for medical use.

Synthetic Rubber Market Regional Insights

The regional trends and factors influencing the Synthetic Rubber Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Synthetic Rubber Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Synthetic Rubber Market

Synthetic Rubber Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

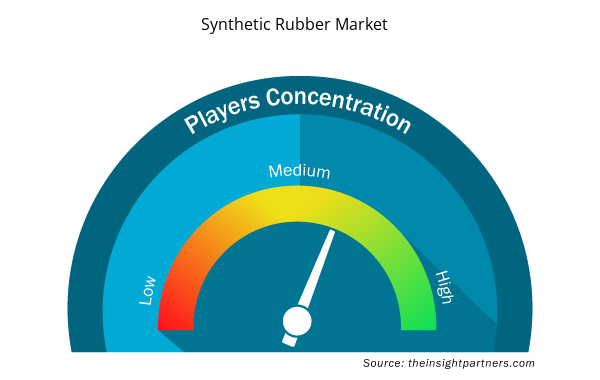

Synthetic Rubber Market Players Density: Understanding Its Impact on Business Dynamics

The Synthetic Rubber Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Synthetic Rubber Market are:

- China Petrochemical Corporation

- Denka Co Ltd

- Exxon Mobil Corporation

- Kuraray Co Ltd

- LG Chem

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Synthetic Rubber Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Synthetic Rubber Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Synthetic Rubber Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Sustainability and green technologies is expected to be the key market trends.

Based on geography, Asia Pacific held the largest share of the synthetic rubber market, due to the region's robust automotive industry, which is the largest consumer of synthetic rubber, especially for tire production. Countries like China, Japan, India, and South Korea are key contributors to this demand.

China Petrochemical Corporation; Denka Co Ltd; Exxon Mobil Corporation; Kuraray Co Ltd: LG Chem; SABIC; Synthos SA; TSRC; UBE Corporation; and Versalis SpA are some of the synthetic rubber market

The Synthetic Rubber Market is estimated to witness a CAGR of 5% from 2023 to 2031

Based on product type, the nitrile rubber segment is expected to witness the fastest growth during the forecast period

The automotive industry is driving the market growth.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies

1.Basell Polyolefins India Pvt. Ltd.

2.Chevron Phillips Chemical Company

3.China Petroleum and Chemical Corporation

4.DuPont de Nemours Inc.

5.Eastman Chemical Company

6.Exxon Mobil Corporation

7.Hexion Inc.

8.Mitsubishi Chemical Corporation

9.Nova Chemicals Corporation

- Saudi Aramco

Get Free Sample For

Get Free Sample For