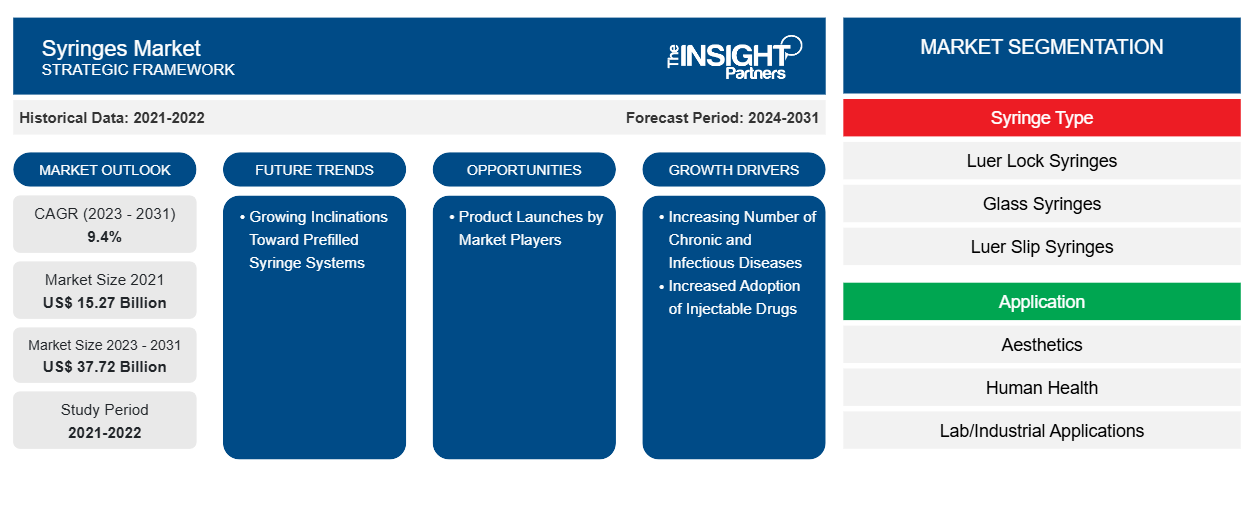

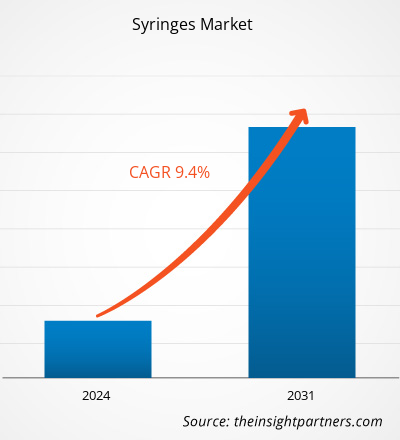

The syringes market size in 2021 stood at US$ 15.27 billion and is projected to reach US$ 37.72 billion by 2031. The market is expected to register a CAGR of 9.4% in 2023–2031. Growing inclinations towards prefilled syringe systems and autoinjectors are likely to remain key syringes market trends.

Syringes Market Analysis

The expansion of the healthcare industry, growing incidence of chronic and infectious diseases, increase in vaccination administration rates globally, rising preference for injections due to their faster actions, and growing popularity of disposable syringes are some of the major factors supporting the growth of the syringes market. Syringes are now often utilized in clinical research labs, drug manufacturing, and hospitals. They are being used more and more to deliver a variety of healthcare medications and remove bodily fluids needed for research or disease diagnosis purposes. In addition, the sales of medical syringes are positively impacted by the thriving insulin syringes industry and the growing market penetration of prefilled syringes in emerging nations. Therefore, the growing incidence of infectious and chronic diseases is likely to continue to boost syringe sales during the forecast period.

Syringes Market Overview

A syringe is a piston-like medical instrument that has significant importance in healthcare. Syringes play a major role in the administration of nutritional supplements, vaccines, and medicines. The product has widespread applicability, from injecting of liquid nutritionals into a feeding tube to conducting vaccination. The US healthcare system witnesses massive investments regarding new product introductions. Further, the majority number of players are engaged in business activities such as innovation of products, sales and research partnerships, and product approvals. In addition, cancer is a huge healthcare burden globally. According to the Centers for Disease Control and Prevention, ~1,603,844 new cancer cases were diagnosed in 2020, with 602,347 cancer deaths in the US. For every 100,000 individuals, 403 new cancer cases were reported. Additionally, as per the International Agency for Research on Cancer, new cancer cases were projected to reach 30.2 million by 2040. Syringes are used during numerous stages of cancer treatment, and all these factors are likely to accelerate market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Syringes Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Syringes Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Syringes Market Drivers and Opportunities

Increasing Number of Chronic and Infectious Diseases to Drive the Market Growth

Chronic diseases including cardiovascular disease, diabetes, and cancer, are among the major causes of death in adults. Infectious diseases are also the top causes of death in children and adults. Globally, about one in three of all adults suffer from multiple chronic conditions. In the US, six in ten adults have a chronic disease, and four in ten adults have two or more. Chronic and infectious diseases require continuous diagnosis using various medical tests requiring the use of syringes. The growing aging population and changes in social behavior and lifestyle contribute to some of the common long-term health conditions. As per the World Health Organization, the prevalence of chronic lifestyle diseases is expected to increase by 57% by the end of 2026. Diabetes is one of the major worldwide health issues of the 21st century. According to the International Diabetes Federation, ~537 million people were living with diabetes in 2021, and the number is anticipated to reach 738 million by 2045 globally. According to a report by the Centers for Disease Control and Prevention, over 37 million Americans (~1 in 10) have diabetes, and nearly 90–95% of them have type 2 diabetes. The growing adoption of injectable drugs for the treatment of chronic and infectious diseases is anticipated to drive the demand and adoption of syringes, thereby driving market growth.

Product Launches by Market Players to Favor Market Growth

Various market players focus on product launches or strategic collaborations for the development of advanced products that help in the treatment of chronic disorders with ease. There have been various recent developments, such as product launches, mergers, and acquisitions in recent years. A few of them are mentioned below:

In October 2022, Terumo Pharmaceutical Solutions, a division of Terumo Corporation, launched a ready-to-fill polymer syringe for challenging biotech drugs with larger volumes. The PLAJEX 2.25 mL with Tapered Needle is particularly designed to meet the biotechnology market, making it appropriate for complex drug applications, such as high-viscosity biotech medications.

In September 2022, Becton, Dickinson and Company introduced a next-generation glass prefillable syringe that establishes a new standard in performance for vaccine prefillable syringes with new and tightened specifications. The new BD effivax glass prefillable syringe has been designed in collaboration with prominent pharmaceutical companies to meet the complex and progressing needs of vaccine manufacturing.

Thus, a surge in product launches is likely to create considerable growth opportunities for the syringes market in the future.

Syringes Market Report Segmentation Analysis

Key segments that contributed to the derivation of the syringes market analysis are ingredient type, form, and indication.

- Based on syringe type, the syringes market is divided into Luer lock syringes, glass syringes, Luer slip syringes, others. The Luer lock syringes segment held the largest market share in 2023. In addition, the glass syringes segment is anticipated to register the highest CAGR during the forecast period.

- By application, the market is segmented into aesthetics, human health, lab/industrial applications, other applications. The human health segment held the largest share of the market in 2023. In addition, the aesthetics segment is projected to register the highest CAGR during the forecast period.

- In terms of usability, the market is categorized into sterilizable/reusable syringes, disposable syringes. The disposable syringes segment held the largest market share in 2023 and is anticipated to register the highest CAGR during the forecast period.

- Based on end user, the syringes market is divided into hospital and clinics, blood collection centres, diabetic care centres, other end user. The hospital and clinics segment held the largest market share in 2023. In addition, the diabetic care centres segment is anticipated to register the highest CAGR during the forecast period.

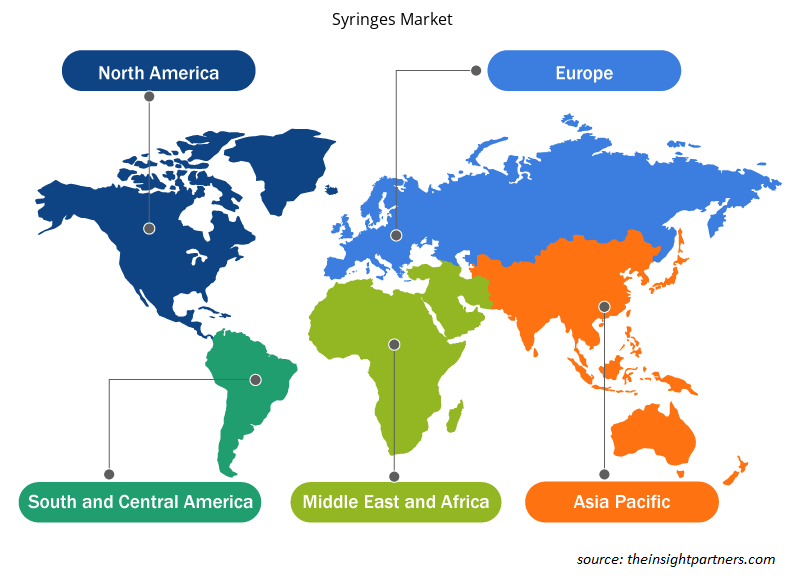

Syringes Market Share Analysis by Geography

The geographic scope of the syringes market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the syringes market. North America market is expanding due to a number of factors, including the rising prevalence of chronic and lifestyle illnesses, an increase in product approvals, rising awareness regarding specialized syringes, rising advancements in injectable devices, and an increase in approvals for biologics. West Pharmaceutical Services, Inc., a company that produces innovative solutions for injectable drug administration, revealed its new pre-fillable Daikyo Crystal Zenith 2.25mL Insert Needle Syringe System at the BIO International Convention in June 2022. Daikyo Crystal Zenith is a technologically advanced cyclic olefin polymer containment and delivery system that offers a replacement for glass, reducing the risk of breakage and mitigating the chance of particulates, contamination, and extractable.

Asia Pacific is anticipated to grow with the highest CAGR in the coming years. Growing technological advancements, a rapidly aging population, increasing focus from international players on the region, fast urbanization, and supportive regulatory frameworks for the approval of novel injectables are supporting the growth of the market in the region.

Syringes Market Regional Insights

The regional trends and factors influencing the Syringes Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Syringes Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Syringes Market

Syringes Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 15.27 Billion |

| Market Size by 2031 | US$ 37.72 Billion |

| Global CAGR (2023 - 2031) | 9.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Syringe Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

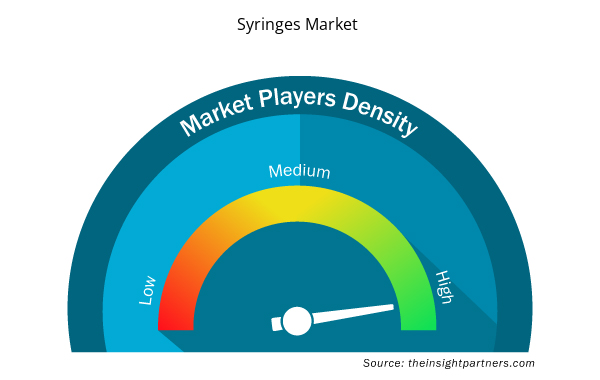

Syringes Market Players Density: Understanding Its Impact on Business Dynamics

The Syringes Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Syringes Market are:

- BD

- Baxter International Inc.

- Terumo Corporation

- Vita Needle Company

- Cardinal Health Inc.

- Nipro

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Syringes Market top key players overview

Syringes Market News and Recent Developments

The syringes market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for syringes and strategies:

- In November 2023, Terumo India, the Indian arm of Terumo Corporation, launched Insulin Syringe, a sterile delivery device for patients requiring regular insulin injections, thereby raising the bar for patient comfort and therapy compliance. These syringes, along with the company’s Pen needles - FineGlide, are also available as standalone products in all major pharmacies across India. (Source: Terumo Corporation, Press Release, 2023)

- In January 2022, ICU Medical Inc. completed the acquisition of Smiths Medical from Smiths Group plc. The addition of Smiths Medical’s business, including syringe and ambulatory infusion devices, vascular access, and vital care products, to the ICU Medical portfolio creates a leading infusion therapy company with a more robust global reach. (Source: ICU Medical, Press Release, 2022)

Syringes Market Report Coverage and Deliverables

The “Syringes Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Syringe Type , Application , Usability , and End User and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, Egypt, France, Germany, India, Italy, Japan, Mexico, Morocco, RoAPAC, RoE, RoMEA, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, Turkey, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For