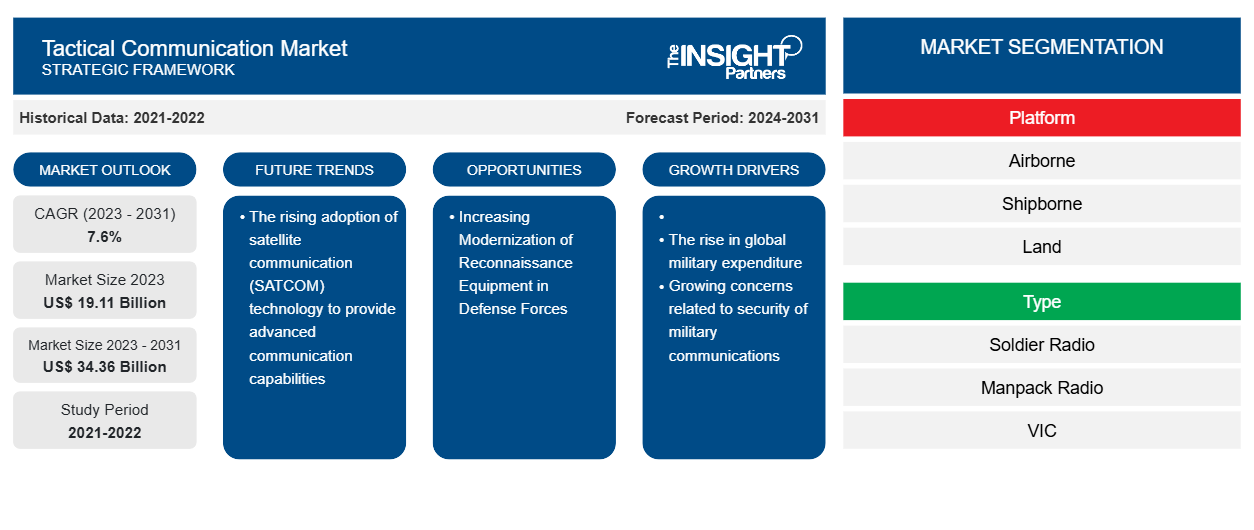

The tactical communication market size is projected to reach US$ 34.36 billion by 2031 from US$ 19.11 billion in 2023. The market is expected to register a CAGR of 7.6% during 2023–2031. The rising adoption of satellite communication (SATCOM) technology to provide advanced communication capabilities is likely to remain a key trend in the market.

Tactical Communication Market Analysis

Tactical communication is one of the highly demanded products across the aerospace and defense industry. This is mainly due to their applications such as ISR, combat, and command and control. Thus, the aerospace and defense sectors rely heavily on well-established key market players. The higher dependence of the major military entities on well-established players results in a higher percentage of contracts getting awarded to key market players operating in the market. Due to this, the entry of small or regional market players gets restricted. Moreover, this factor has been analyzed to understand the threat to the new entrants that remains low at present however, it is expected to be moderate as new entrants try to win the goodwill of their customers in the coming years.

Tactical Communication Market Overview

The major stakeholders in the global tactical communication market ecosystem include component manufacturers, tactical communication manufacturers, and end users. Tactical communication component suppliers provide products such as batteries, antennas, amplifiers, booster kits, etc. The timely supply of all these components is crucial for efficient operation across tactical communication manufacturing plants. Thus, any operational impact on these component providers directly impacts the tactical communication market. The tactical communication manufacturers offer the final integrated product to the end users. The major players operating in the market include BAE Systems, General Dynamics Mission Systems, Inc., Iridium Communications Inc., Northrop Grumman Corporation, Raytheon Technologies Corporation, L3Harris Technologies, Elbit Systems, and many more. These organizations over the years have increased their investment in the development of new and advanced tactical communication as per the growing customer needs with the help of government regulatory bodies. The government regulatory body helps the tactical communication manufacturer by providing Rolta, MIL-STD-188-100 series, MIL-STD-188-200 series, and MIL-STD-188-300 series. For soldiers distributed across wide regions in a Tactical Battlefield Area, Rolta delivers secure triple-play services for voice, data, and video communication (TBA). According to the Department of Defense (DoD) these series contain technical standards and design objectives which are common to both the long haul and tactical communications systems.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tactical Communication Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tactical Communication Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Tactical Communication Market Drivers and Opportunities

Rising Modernisation and Replacement of Aging Communication Equipment

The army futures command is focusing on network modernization as one of its main goals. The new capabilities are designed to boost the service's capacity and resiliency to compete in high-end battles against near-peer opponents. The Army is pursuing a series of two-year capability sets to fulfill its network goals. According to the service, each set includes many design goals, including a unified network, a shared operational environment, joint interoperability/coalition accessibility, and command post mobility/survivability. Defense communication encompasses all areas of armed forces' information and data transfer for well-organized operations, military surveillance, command, and control. Furthermore, communication relies on a complex and large network of physical components and software to transfer information to individuals across geographic boundaries. For secure data transfer and network infrastructure, evolving communication technologies such as SATCOM, which is high-frequency communication, and ultra-high frequency communication are replacing traditional tactical communication systems.

Increasing Modernization of Reconnaissance Equipment in Defense Forces

In the military business, rapid technological advancements are breeding disruptive technologies. For instance, the Manpack and Leader Radio tactical data radios have been given Full-Rate Production (FRP) contracts by the US Army. The FRP award comes after two years of operational trial with the 82nd Airborne Division's 1st Brigade Combat Team, according to the Program Executive Office (PEO) C3T, which is in charge of the procurement process. In January 2021, an initial operational test and evaluation (IOT&E) at Fort Bragg helped affirm a choice to move through with the FRP decision.

Tactical Communication Market Report Segmentation Analysis

Key segments that contributed to the derivation of the tactical communication market analysis are platform, type, technology, and application.

- Based on platform, the tactical communication market is segmented into airborne, shipborne, land, and underwater. The land segment held a larger market share in 2023.

- Based on type, the tactical communication market is segmented into [soldier radio, manpack radio, VIC (vehicular intercommunication radio), HCDR (high capacity data radio), and others. The soldier radio segment held a larger market share in 2023.

- Based on technology, the tactical communication market is segmented into time-division multiplexing (TDM) and next-generation network (NGN). The TDM segment held a larger market share in 2023.

- Based on application, the tactical communication market is segmented into ISR, combat, and command & control. The combat segment held a larger market share in 2023.

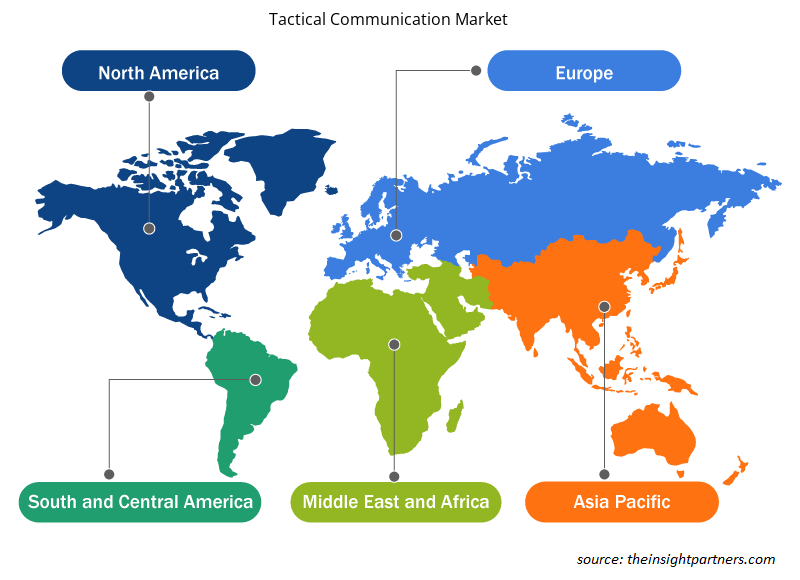

Tactical Communication Market Share Analysis by Geography

The geographic scope of the tactical communication market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2023 followed by Europe and Asia Pacific regions. Further, Asia Pacific is likely to witness highest CAGR in the coming years. The US dominated the North American tactical communication market in 2023. The US has the largest defense budget in the world and a large amount of budget is contributed towards the adoption and procurement of upgraded technologies, safety, security, and many more that are further augmenting the demand for tactical communication in the country. According to SIPRI, the country's military spending reached from US$ 801 billion in 2021 to US$ 916 billion in 2023. Moreover, bBetween 2012 and 2021, US funding for military research and development (R&D) increased by 24%, while funding for arms purchases decreased by 6.4%. In 2021 spending on both decreased. However, the increase in military expenditure is driving the procurement of tactical communication systems among the country’s armed forces.

Tactical Communication Market Regional Insights

The regional trends and factors influencing the Tactical Communication Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Tactical Communication Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Tactical Communication Market

Tactical Communication Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 19.11 Billion |

| Market Size by 2031 | US$ 34.36 Billion |

| Global CAGR (2023 - 2031) | 7.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Tactical Communication Market Players Density: Understanding Its Impact on Business Dynamics

The Tactical Communication Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Tactical Communication Market are:

- BAE Systems PLC

- General Dynamics Corporation

- Iridium Communications

- Northrop Grumman Corporation

- Raytheon Company

- Thales Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Tactical Communication Market top key players overview

Tactical Communication Market News and Recent Developments

The tactical communication market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the tactical communication market are listed below:

- The U.S. Army awarded L3Harris Technologies (NYSE:LHX) full-rate Manpack and Leader radio production orders under the Handheld, Manpack & Small Form Fit (HMS) program. These orders, totaling more than US$ 247 million, deliver critical cryptographic modernized communications with resilient waveforms to help ensure the Army’s Integrated Tactical Network can survive in the modern battlespace. (Source: L3Harris Technologies Inc, Press Release, Oct 2023)

- CODAN and Domo Tactical Communications (DTC) are proud to announce the unveiling of the new Sentry Mesh 6161-L radio, completing the Sentry Series product family and enhancing CODAN and DTC’s product offering following on its commitment of innovation and providing full communications solutions. The Sentry Series product family includes HF, VHF, MANET, and interoperability solutions. (Source: Domo Tactical Communications, Press Release, Feb 2023)

Tactical Communication Market Report Coverage and Deliverables

The “Tactical Communication Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Tactical communication market market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Tactical communication market market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Tactical communication market market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the tactical communication market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Platform, Type, Technology, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America region dominated the tactical communication market in 2023.

The rise in global military expenditure, growing concerns related to security of military communications, and the rising modernisation and replacement of aging communication equipment are some of the factors driving the growth for tactical communication market.

The rising adoption of satellite communication (SATCOM) technology to provide advanced communication capabilities is one of the major trends of the market.

Thales Group, Ultra Electronics, Viasat Inc, Airbus SAS, Rohde & Schwarz, ASELSAN AS, L3Harris Technologies Inc, Codan Communications, Elbit Systems Ltd, and Domo Tactical Communications (DTC) are some of the key players profiled under the report.

The estimated value of the tactical communication market by 2031 would be around US$ 34.36 billion.

The tactical communication market is likely to register of 7.6% during 2023-2031.

Get Free Sample For

Get Free Sample For