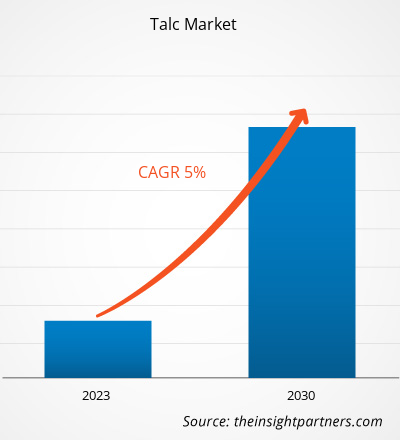

[Research Report] The talc market size is expected to grow from US$ 1,987.43 million in 2022 to US$ 2,932.29 million by 2030; it is estimated to record a CAGR of 5.0% from 2022 to 2030.

Market Insights and Analyst View:

Talc is a hydrated magnesium silicate. Talc deposits are formed from the transformation of high magnesium rocks by siliceous hydrothermal fluids. Most of the talc originates from the alteration of dolomite or ultramafic intrusive rocks. It is always found in combination with other minerals, generally carbonates and chlorite. Each talc deposit has a unique morphology and mineralogy, but all types of talc exhibit the following unique properties—softness, water repellency, chemical inertness, platyness, and an affinity for organic substances. These properties make talc suitable as multi-functional filler and process enabler in a wide range of applications from plastics to paper and ceramics to paint. Talc is used as an anti-sticking agent, anti-caking agent, lubricant, a carrier, a thickener, a strengthening filler, a smooth filler, and an adsorbent. The major driver for the growth of the talc market is growing demand from various end-use industries such as ceramics, plastics, paints and coatings, food, and agriculture. The ceramics segment is the most attractive segment and creates lucrative opportunities in the global talc market. The plastics industry is another essential consumer of talc. Talc is mainly used as a filler in plastics.

Growth Drivers and Challenges:

Talc is commonly used in the pulp & paper industry as a pitch control agent, coating pigment, and functional filler. It helps enhance the runnability of a paper machine. Talc is used to recycle paper and produce new paper, pulp, and cardboard. The properties of talc prevent pitch agglomeration within the production machine. Talc is used as a filler to give smoothness, porosity, and opacity to paper. Also, in paper production, talc use enhances the quality of finished products and reduces production costs. Furthermore, talc is used in various end-use industries such as paints & coatings, plastics, agriculture, and food. In the paint industry, talc use reduces the use of primary pigment in paint production, which reduces manufacturing costs. Talc reinforces the paint film and improves the durability and stain resistance of paint. Owing to its rust-inhibitive and corrosion-resistance properties, the finish lasts longer. Also, talc as an extender increases the viscosity of a paint. The strong growth of the construction, automotive, and industrial sectors propel demand for paints & coatings. Talc is mined from the earth. It may contain asbestos, which is a highly toxic substance. Asbestos is found underground, and its veins can often be found in talc deposits, leading to a risk of cross-contamination. Hence, there are high chances of asbestos-contaminated talc present in different products. Long-term exposure to asbestos can increase the risks of cancers, particularly mesothelioma (lung cancer), ovarian cancer, and laryngeal cancer.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Talc Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The global talc market is divided on the basis of deposit type and end-use industry. Based on deposit type, the talc market is segmented into talc chlorite and talc carbonate. Based on end-use industry, the talc market is segmented into plastics, pulp & paper, ceramics, paints & coatings, rubber, pharmaceuticals, food, and others. By geography, the global talc market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The North America talc market is further segmented into the US, Canada, and Mexico. The market in Europe is subsegmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. The Asia Pacific talc market is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The Middle East & Africa market is further segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The South & Central America talc market is further segmented into Brazil, Argentina, and the Rest of South & Central America.

Segmental Analysis:

Based on deposit type, the talc market is segmented into talc chlorite and talc carbonate. The talc carbonate segment held a larger market share in 2022. Talc-carbonate ore bodies mainly contain talc carbonate and chlorite traces. These deposits are often found in metamorphic rocks and can be considered a subtype of metamorphic deposits. In talc carbonate deposits, the formation of talc is often linked to the alternation of pre-existing rocks rich in magnesium-rich minerals. Talc replaces these minerals under the influence of metamorphic conditions, leading to the development of talc-rich rocks. Talc-carbonate ores are processed to remove associated minerals and produce pure talc concentrate. Based on end-use industry, the talc market is segmented into plastics, pulp & paper, ceramics, paints & coatings, rubber, pharmaceuticals, food, and others. The talc market share of the pulp & paper segment was notable in 2022. In the pulp & paper industry, talc is used as a paper filler, since it has a minimal negative effect on sheet strength but improves ink receptivity by a large margin. It also enhances opacity and brightness and reduces gloss. Talc can be used in paper recycling and the new production of paper, pulp, and cardboard as filler. Talc use improves the properties of the finished products and reduces production costs.

Regional Analysis:

The talc market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global talc market, which accounted for ∼US$ 950 million in 2022. North America is also a major contributor, holding a significant global talc market share. The North America talc market is expected to reach over US$ 300 million by 2030. Europe is anticipated to record a considerable CAGR of over 5% from 2022 to 2030. Australia, China, India, Japan, and South Korea are the key contributors to the talc market in Asia Pacific. Asia Pacific is one of the largest crude and processed talc-producing regions globally. The region is home to major manufacturers producing lightweight plastics for automotive components. Rapid industrialization and a surge in disposable income of the middle-class population of emerging economies are expected to drive the demand for talc in Asia Pacific. According to the International Organization of Motor Vehicle Manufacturers (OICA), the vehicle production in Asia-Oceania increased from 44.2 million in 2020 to 46.7 million vehicles in 2021.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the talc market are listed below:

- In February 2021, Magris Resources Canada Inc. announced to have entered into a definitive stalking horse agreement to acquire substantially all the assets of Imerys Talc America Inc., Imerys Talc Vermont Inc., and Imerys Talc Canada Inc.

The regional trends and factors influencing the Talc Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Talc Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Talc Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.99 Billion |

| Market Size by 2030 | US$ 2.93 Billion |

| Global CAGR (2022 - 2030) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Deposit Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Talc Market Players Density: Understanding Its Impact on Business Dynamics

The Talc Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Talc Market top key players overview

COVID-19 Pandemic Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, business shutdowns, and travel restrictions in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemical & materials industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies reported delays in product deliveries and a slump in their product sales in 2020. Due to the pandemic-induced economic recession, consumers became cautious and selective in purchasing decisions. Consumers significantly reduced nonessential purchases due to lower incomes and uncertain earning prospects, especially in developing regions. Many talc manufacturers reported declining profits due to reduced consumer demand during the initial phase of the pandemic. However, by the end of 2021, many countries were fully vaccinated, and governments announced relaxation in certain regulations, including lockdowns and travel bans. There has been a rise in disposable income of the population, due to which the focus on purchasing new furniture and renovation has increased, which boosted the demand for talc. All these factors boost the growth of the talc market across different regions.

Competitive Landscape and Key Companies:

Elementis Plc, Golcha Minerals Pvt Ltd, Imerys SA, IMI Fabi SpA, Liaoning Aihai Talc Co Ltd, Minerals Technologies Inc, Nippon Talc Co Ltd, SCR-Sibelco NV, Sun Minerals Pvt Ltd, and Xilolite SA are among the prominent players operating in the global talc market. These players offer high-quality talc and cater to many consumers across the world.

Frequently Asked Questions

Can you list some of the major players operating in the global talc market?

In 2022, which deposit type segment accounted for the largest share in the talc market?

Which end use industry segment is expected to account for the fastest growth in the global talc market?

In 2022, which end use industry segment accounted for the largest share in the talc market?

What is the key driver for the growth of the global talc market?

In 2022, which region held the largest share of the global talc market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For