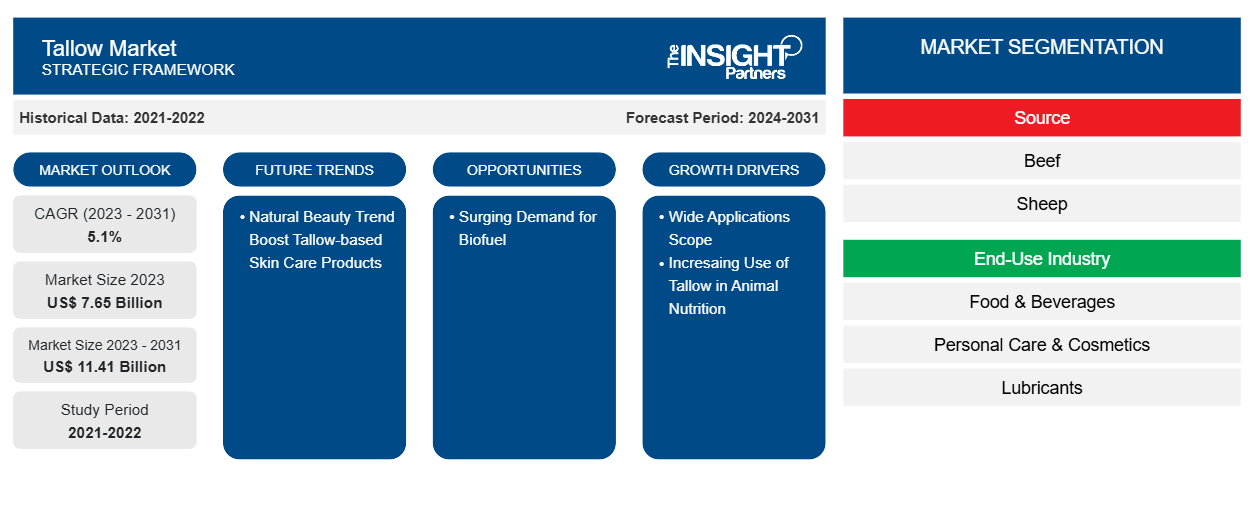

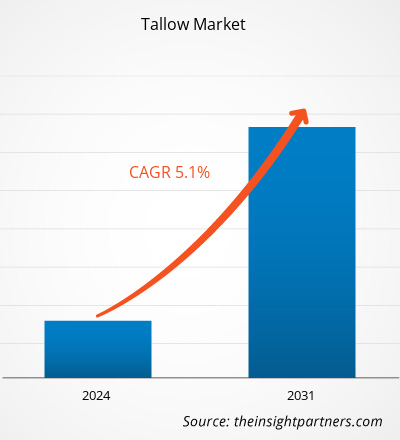

The tallow market size is projected to reach US$ 11.41 billion by 2031 from US$ 7.65 billion in 2023. The market is expected to register a CAGR of 5.1% during 2023–2031. The increasing preference for beauty products made from natural ingredients is likely to emerge as a key trend in the market during the forecast period.

Tallow Market Analysis

Tallow is used by various end-use industries such as food & beverages, personal care, home care, biofuel, lubrication, and animal feed owing to its varied benefits. Tallow, produced from animal fats, is a productive and long-lasting feedstock for manufacturing biofuels such as biodiesel. Its usage in biodiesel results in lower carbon emissions compared to regular diesel. Thus, rising demand and production of biofuel are expected to create opportunities for the tallow market during the forecast period.

Tallow Market Overview

Tallow is a rendered fat obtained from beef, sheep, camels, horses, buffaloes, lambs, and other animals. It is widely used in food, lubricants, chemicals, biofuel, soaps & detergents, animal feed, and pet food industries. There are different types of tallow such as edible tallow, inedible tallow, and technical tallow. Edible tallow is derived by cooking edible portions of bovine and lamb meat carcasses and is widely used in the food & beverage and animal nutrition industries. Inedible tallow is obtained by rendering the fat from inedible meat wastes. It is used in various non-food applications such as soap making, candles, biofuels, lubricants, and animal feed. Tallow is one of the significant byproducts of the meat processing industry with a wide range of applications across various end-use industries. This factor significantly drives the global tallow market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tallow Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tallow Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Tallow Market Drivers and Opportunities

Increasing Use of Tallow for Animal Nutrition

Tallow is extensively used as an animal feed and pet food ingredient. The primary benefit of using fats in animal diets is their energy contribution. Fats provide the most concentrated energy of all food/feed materials, containing about 37 kJ of energy per gram. Tallow is typically pressed into cakes and used for animal feed, especially for dogs and hogs, or as fish bait. In tallow, less than 3% of free fatty acids are present. Its triglyceride structure is robust against oxidative rancidity because of its increased amount of saturated fatty acids. Therefore, it is safe to add to poultry meals at a level of 3–4%. It is a helpful feed ingredient for poultry in the summer when they require a quick supply of energy in the form of fats to prevent heat stress and the birds' consequent death. It is also beneficial in treating ascites in birds, particularly during the winter. Thus, tallow is significantly used as a poultry feed ingredient.

Polyunsaturated fatty acids called essential fatty acids (EFA) need to be included in the diet of pets since their bodies are unable to synthesize these vital nutrients. Pet adoption is significantly increasing worldwide. Thus, the rising adoption of pets across the world and increasing awareness about pet health among pet owners boost the demand for pet food, which propels the requirement for animal fat such as tallow.

Surging Demand for Biofuel

The limited availability of fossil fuel-based resources, rising awareness about curbing carbon emissions, increasing need for cleaner fuel, and stringent government regulations on the desulfurization of petroleum products are expected to propel the demand for biofuel. Biofuels reduce reliance on fossil fuels and decrease greenhouse gas emissions. As the feedstock material used to produce biofuels can be regenerated more quickly than conventional fossil fuels, they are considered renewable.

Tallow, produced from animal fats, is a productive and long-lasting feedstock for manufacturing biofuels such as biodiesel. Its usage in biodiesel results in lower carbon emissions compared to regular diesel. According to the North America Renderers Association (NARA), in 2020, the US imported 351,300 mt rendered fat, a jump of 13 % from 2019. These imports are fueled by demand from the renewable fuel sector, including renewable diesel, biodiesel, and co-processed diesel.

Tallow Market Report Segmentation Analysis

Key segments that contributed to the derivation of the tallow market analysis are source and end-use industry.

- Based on source, the tallow market is segmented into beef, sheep, and others. The beef segment held the largest market share in 2023.

- By end-use industry, the tallow market is segmented into food & beverages, personal care & cosmetics, lubricants, biofuel, animal nutrition, and others. The biofuel segment held the largest share of the market in 2023.

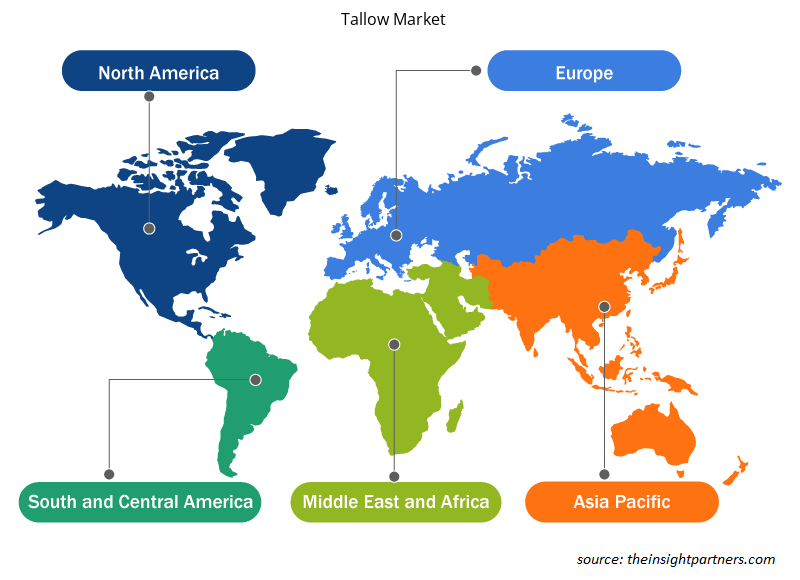

Tallow Market Share Analysis by Geography

The geographic scope of the tallow market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

North America held a significant market share in 2023. North America is one of the prominent regions for the tallow market due to its increasing demand among various industries such as fuel, cosmetics & personal care, food & beverages, and lubricants. The demand for biodiesel is increasing across the region due to the upsurging adoption of environment-friendly practices because of global warming, growing carbon footprint, and other environmental impacts caused by the combustion of traditional fuels.

Moreover, according to the Environment and Energy Study Institute, CO2 accounts for ∼70% of total aircraft emissions. Thus, the demand for biodiesel across the aviation industry is growing, as it helps reduce the carbon footprint compared to the other industries. Thus, the increasing use of tallows in biodiesel production drives the tallow market growth in North America.

According to the report published by the US Department of Agriculture's National Agricultural Statistics Service (NASS), as of March 2024, there were 74.6 million hogs and pigs on the US farms, up 1% from March 2023. The growing livestock industry in the region boosts the demand for animal feed ingredients such as tallow. Tallow is considered a nutrient for animal feed that is high in energy. Tallow added to the poultry feed can assist in increasing the birds' energy levels and reducing dustiness in their diet.

Tallow Market Regional Insights

The regional trends and factors influencing the Tallow Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Tallow Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Tallow Market

Tallow Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 7.65 Billion |

| Market Size by 2031 | US$ 11.41 Billion |

| Global CAGR (2023 - 2031) | 5.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Source

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

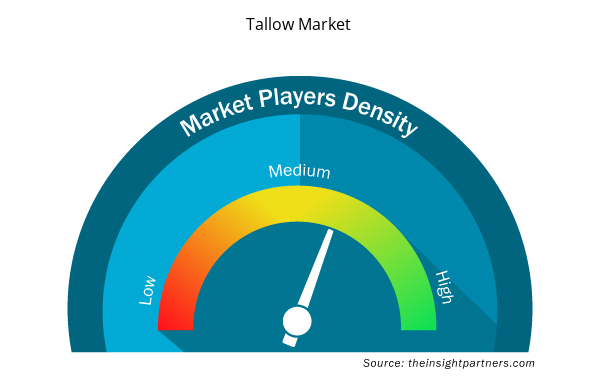

Tallow Market Players Density: Understanding Its Impact on Business Dynamics

The Tallow Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Tallow Market are:

- Cargill Inc

- Dalian Daping Oil Chemicals Co. Ltd

- ECSA Chemicals SA

- Minerva SA

- NH Foods Australia Pty Ltd

- Craig Mostyn Grou

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Tallow Market top key players overview

Tallow Market News and Recent Developments

The tallow market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A key recent development in the tallow market is mentioned below:

- Darling International Inc. completed its acquisition of VION Ingredients, a division of VION Holding NV (a member of the VION Food Group), for ∼USD 1.7 billion in cash. (Source: Darling International Inc, Company Website, January 2024)

Tallow Market Report Coverage and Deliverables

The "Tallow Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Tallow market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Tallow market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Tallow market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the tallow market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The wide application scope of tallow and the surging use of tallow in the animal nutrition industry are major factors contributing to the market growth.

The market size is projected to reach US$ 11.41 million by 2031.

Cargill Inc, Dalian Daping Oil Chemicals Co. Ltd, ECSA Chemicals SA, Minerva SA, NH Foods Australia Pty Ltd, Craig Mostyn Group, Tassie Tallow, Leo Group Ltd, Maine Tallow Company, and Pridham Pty Lt are a few of the key players operating in the market.

The increasing preference for beauty products made from natural ingredients is likely to emerge as a key trend in the market in the future.

North America accounted for the largest share of the market in 2023.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Tallow Market

- AGRI INTERNATIONAL

- BAKER COMMODITIES, INC.

- Cargill, Incorporated

- Dalian Daping Oil Chemicals Co. Ltd

- ECSA Chemicals SA

- Leo Group Ltd

- Maine Tallow Company

- Minerva SA

- NH Foods Australia Pty Ltd

- Craig Mostyn Group

Get Free Sample For

Get Free Sample For