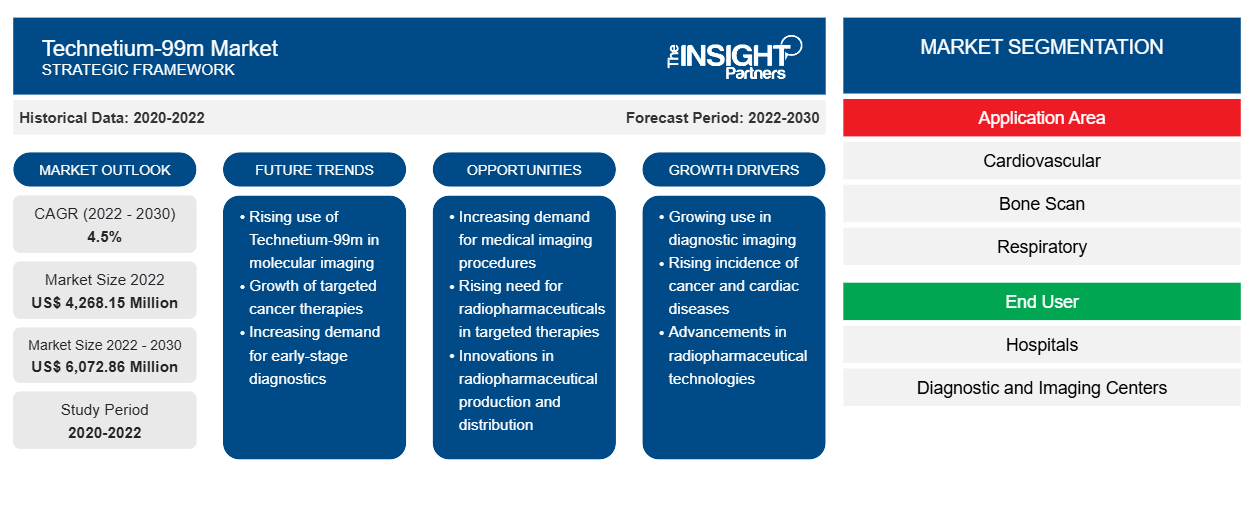

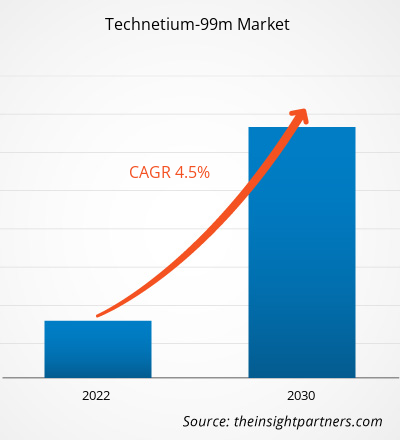

[Research Report] The technetium-99m market size is expected to grow from US$ 4,268.15 million in 2022 to US$ 6,072.86 million by 2030; it is anticipated to record a CAGR of 4.5% from 2022 to 2030.

Technetium-99m Market Insights and Analyst View:

Technetium-99m is a metastable nuclear isomer of technetium-99, an isotope of technetium. Technetium-99m is among the most commonly used medical radioisotopes in medical diagnostic procedures globally. Key factors driving the market are the high prevalence of chronic diseases and advancements in nuclear imaging techniques. However, the short shelf-life of radiopharmaceuticals hinders the technetium-99m market

Growth Drivers and Restraints:

The high prevalence of chronic diseases such as cardiovascular diseases (CVDs), respiratory diseases, and cancer cases will boost the demand for single-photon emission computed tomography (SPECT) diagnostic procedures, fueling the technetium-99m market growth. According to the Washington State Department of Health, technetium-99m is used in diagnostic procedures related to skeleton and heart muscles. It is also used in medical studies related to the lungs, liver, spleen, bone marrow, kidney, brain, thyroid, gall bladder, salivary glands, heart blood pool, infection, and others. Thus, a high prevalence of chronic diseases will increase the adoption of technetium-99m for diagnosis.

According to the American College of Cardiology Foundation, the CVD-related death counts increased from 12.4 million deaths in 1990 to 19.8 million deaths in 2022. Ischemic heart disease remains the leading cause of global CVD mortality. Similarly, according to the International Agency for Research on Cancer (IARC), the prevalence of cancer cases is high globally. It is estimated that there were 19.3 million cancer cases worldwide in 2020, and the number of cases is expected to reach ~30.2 million cancer cases by 2040. Further, the World Health Organization (WHO) states that more than 1.71 billion people globally suffer from musculoskeletal conditions. An effective medical examination is a must for treating chronic diseases, and some medical imaging procedures also include nuclear substances that are used for diagnosis and examination purposes. Radiopharmaceuticals such as technetium-99m and iodine-123 are used in SPECT, and similarly, fluorine-18 and copper-64 are used in positron emission tomography (PET). Thus, with a surge in the prevalence of chronic diseases, the demand for medical imaging is also increasing the technetium-99m market size.

However, the short shelf-life of radiopharmaceuticals hampers the market growth. The shelf-life of radiopharmaceuticals depends mainly on the radioisotopes' half-life, radiochemical stability, and the concentration of radionuclide impurities in the preparation. Most radiopharmaceutical preparations contain radioisotopes with very short half-lives. For example, technetium-based and SPECT preparations must be used within 6 hours of preparation. The shelf-life of a multidose radiopharmaceutical preparation after aseptic withdrawal of the first dose depends on microbiological considerations. In case of a short half-life of radionuclides, the diagnostic radiopharmaceuticals are usually prepared in the hospital radiopharmacy departments just before the administration to patients. For example, the physical half-life of technetium-99m is 6 hours and does not remain in the body for long. Therefore, short-lived radiopharmaceuticals are becoming a matter of concern in long-term procedures, which is a major factor restraining the technetium-99m market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Technetium-99m Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Technetium-99m Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The technetium-99m market analysis is drawn by considering the following segments: application area and end user. Based on application area, the market is segmented into cardiovascular, bone scan, respiratory, tumor imaging, and others. In terms of end user, the market is categorized into hospitals, diagnostic and imaging centers, and others. The scope of the technetium-99m market report covers North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on application area, the technetium-99m market is segmented into cardiovascular, bone scan, respiratory, tumor imaging, and others. The cardiovascular segment held the largest technetium-99m market share in 2022. The bone scan segment is anticipated to register the highest CAGR during 2022–2030.

Based on end user, the market is segmented into hospitals, diagnostic and imaging centers, and others. In 2022, the diagnostic and imaging centers segment held the largest technetium-99m market share, and the hospitals segment is anticipated to register the highest CAGR during 2022–2030.

Regional Analysis:

Geographically, the global technetium-99m market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa.

In 2022, North America held the largest global share in the market. The availability of advanced healthcare infrastructure, the presence of major market players, the rising incidence and prevalence of target conditions, and product innovations introduced by key players operating in the region are likely to introduce new technetium-99m market trends in the coming years. According to the International Agency for Research on Cancer (IARC), the number of cancer cases in the US is expected to increase from 2.28 million cases in 2020 to 3.12 million cases in 2040. Therefore, an increase in chronic diseases, including cancer, will fuel the demand for medical imaging, thereby boosting the market growth. Additionally, the Centers for Medicare & Medicaid Services (CMS) in the US has adopted standards associated with human laboratory research under the Clinical Laboratory Improvement Amendments (CLIA), which has favorably improved the technetium-99m market performance.

Industry Developments and Future Opportunities:

A few initiatives taken by key players operating in the global market are listed below:

- In November 2023, the International Atomic Energy Agency (IAEA) announced a new coordinated research project (CRP) to create a global network of producers and researchers to develop a new generation of Technetium-99m kits and radiopharmaceuticals. The CRP is anticipated to create standard processes and guidelines for the manufacturing, quality control, and preclinical testing of innovative technetium-99m radiopharmaceuticals. The CRP will also concentrate on the most therapeutically relevant supplies in demand and the implementation of innovative radiolabeling strategies.

- In February 2023, BWXT Medical completed the key Tc-99m generator program milestone with Laurentis. Laurentis Energy Partners and BWXT Medical Ltd. have installed and commissioned an innovative isotope system at Ontario Power Generation's (OPG) Darlington Nuclear Generating Station, enabling them to generate molybdenum-99 (Mo-99) isotopes. Mo-99 is used to generate Technetium-99 metastable (Tc-99m), one of the most often used diagnostic imaging agents in nuclear medicine, which aids in detecting conditions such as cancer and heart disease. Darlington will be the first commercial power reactor to produce Mo-99.

- In February 2022, Theragnostics announced that the company received the US FDA approval for its radiodiagnostic imaging drug NephroScan (Technetium Tc 99m Succimer injection kit). NephroScan is a proprietary kit for the preparation of technetium Tc 99m succimer injection, which acts as an aid for the diagnosis of renal parenchymal disorders in term neonates and adult patients.

- In March 2021, NorthStar Medical Radioisotopes LLC and Ion Beam Applications SA (IBA) announced a collaboration to increase the global availability of technetium-99m (Tc-99m), the most widely used medical radioisotope. The agreement allows businesses outside the US to use NorthStar's patented non-uranium-based Mo-99 generated using IBA's accelerators and beamlines. Furthermore, the collaboration builds on an existing agreement under which IBA will supply NorthStar with up to eight Rhodotron TT 300-HE electron beam accelerators. This aids in the production of non-uranium-based Mo-99, allowing NorthStar's FDA-approved and commercially accessible RadioGenix System (technetium Tc 99m generator) to manufacture Tc-99m in the US.

Technetium-99m Market Regional Insights

Technetium-99m Market Regional Insights

The regional trends and factors influencing the Technetium-99m Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Technetium-99m Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Technetium-99m Market

Technetium-99m Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,268.15 Million |

| Market Size by 2030 | US$ 6,072.86 Million |

| Global CAGR (2022 - 2030) | 4.5% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Application Area

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Technetium-99m Market Players Density: Understanding Its Impact on Business Dynamics

The Technetium-99m Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Technetium-99m Market are:

- Lantheus Medical Imaging Inc

- Curium

- Jubilant Pharma Company

- NorthStar Medical Radioisotopes LLC

- Sun Pharmaceutical Industries Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Technetium-99m Market top key players overview

Competitive Landscape and Key Companies:

Lantheus Medical Imaging Inc, Curium, Jubilant Pharma Company, NorthStar Medical Radioisotopes LLC, Sun Pharmaceutical Industries Inc, Advancing Nuclear Medicine, NTP Radioisotopes SOC Ltd, Northwest Medical Isotopes LLC, SHINE Technologies LLC, and Cardinal Health are among the prominent players profiled in the technetium-99m market report. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application Area, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Key factors driving the market are the high prevalence of chronic diseases and advancements in nuclear imaging techniques.

Technetium-99m is a metastable nuclear isomer of technetium-99, an isotope of technetium. Technetium-99m is among the most commonly used medical radioisotopes in medical diagnostic procedures globally.

The technetium-99m market majorly consists of the players, including Lantheus Medical Imaging Inc, Curium, Jubilant Pharma Company, NorthStar Medical Radioisotopes LLC, Sun Pharmaceutical Industries Inc, Advancing Nuclear Medicine, NTP Radioisotopes SOC Ltd, Northwest Medical Isotopes LLC, SHINE Technologies LLC, and Cardinal Health.

The technetium-99m market was valued at US$ 4,268.15 million in 2022.

Based on end user, the market is segmented into hospitals, diagnostic and imaging centers, and others. In 2022, the diagnostic and imaging centers segment held the largest technetium-99m market share, and the hospitals segment is anticipated to register the highest CAGR during 2022–2030.

The technetium-99m market is expected to be valued at US$ 6,072.86 million in 2030.

Based on application area, the technetium-99m market is segmented into cardiovascular, bone scan, respiratory, tumor imaging, and others. The cardiovascular segment held the largest technetium-99m market share in 2022. The bone scan segment is anticipated to register the highest CAGR during 2022–2030.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Technetium-99m Market

- Lantheus Medical Imaging Inc

- Curium

- Jubilant Pharma Company

- NorthStar Medical Radioisotopes LLC

- Sun Pharmaceutical Industries Inc

- Advancing Nuclear Medicine

- NTP Radioisotopes SOC Ltd

- Northwest Medical Isotopes LLC

- SHINE Technologies LLC

- Cardinal Health

Get Free Sample For

Get Free Sample For