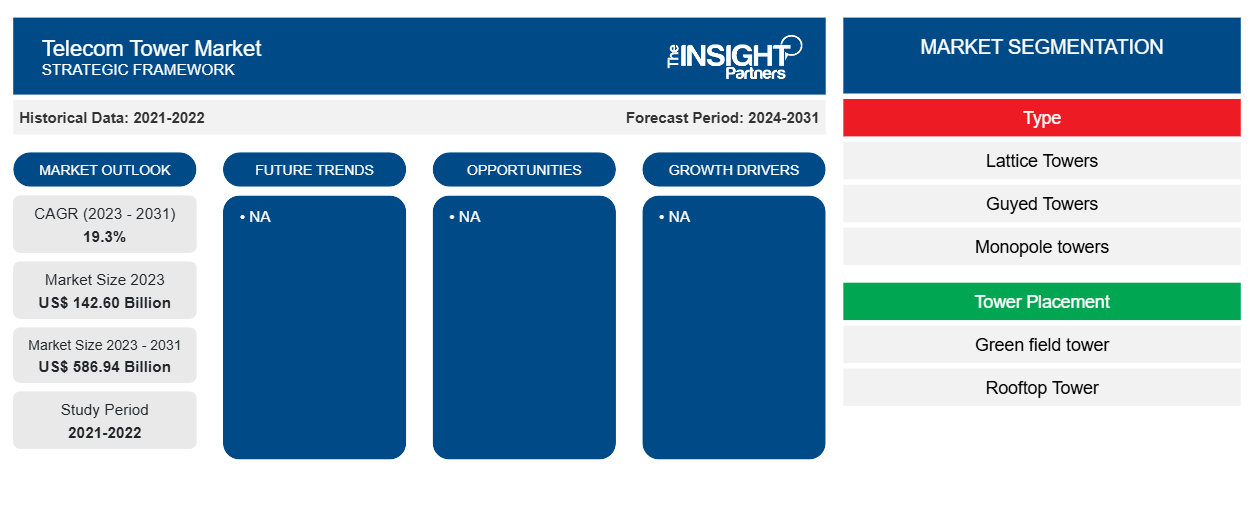

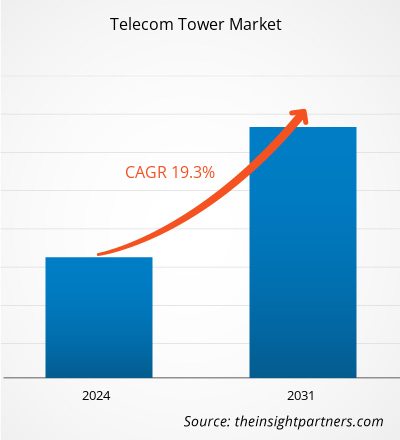

The telecom tower market size is projected to reach US$ 586.94 billion by 2031 from US$ 142.60 billion in 2023. The market is expected to register a CAGR of 19.3% in 2023–2031. Market growth is being driven by the extension of mobile networks into rural areas, as well as investments in 5G connectivity and telecoms infrastructure.

Telecom Tower Market Analysis

The worldwide telecom tower industry is expected to benefit from increasing demand for energy-efficient devices and the digital revolution in emerging economies. Advanced data networks, including 3G, 4G, and 5G, are expected to improve the worldwide telecom tower industry in the next few years. Increased collaboration between government agencies and municipal organizations is expected to drive growth in the global telecom tower market in the coming years.

Telecom Tower Market Overview

The worldwide telecom tower industry was expanding due to rising demand for mobile and wireless communication services. Telecom towers are critical infrastructure for the deployment of wireless networks, such as 4G and 5G technologies. People converse via telecommunication towers. These towers act as the hub for all electronic, mobile, radio broadcast, and television antennas. The full collection of electronic signal processing equipment and mechanical components that comprise a telecommunication tower is used to connect people via communication. These towers serve as the central point for all phone lines and cellular services. In addition, the military forces use these towers to house radar. Towers of differing heights are used for a variety of purposes and locales.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Telecom Tower Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Telecom Tower Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Telecom Tower Market Drivers and Opportunities

Surge in Mobile Communication to Favor Market

Mobile communication usage is predicted to drive future growth in the telecom tower market. Mobile communication involves leveraging technology such as mobile phones, smartphones, and tablets to connect with people in different locations. Telecom towers, such as mobile phone towers, use electrical equipment and antennas to transmit and receive signals, enabling wireless communication across large distances. In March 2023, the International Telecommunication Union reported a 5% increase in the percentage of male world population owning mobile phones from 74% in 2021 to 79% in 2022. The growing use of mobile communication is driving the growth of the telecom tower market.

Government-led Expansion is Fueling the Surge of Telecom Towers

The telecom tower industry is predicted to develop due to government-led initiatives in the telecommunications sector. Government initiatives for the telecommunications sector include policies, programs, and activities aimed at regulating, supporting, and developing the industry. Government activities in the telecommunications sector impact the regulatory, economic, and technological situation for telecom towers. The Infrastructure Investment and Jobs Act of 2021 allocates US $65 billion for broadband, with US $48.2 billion managed by NTIA's newly established Internet Connectivity and Growth office. The IIJA has required the NTIA to develop six broadband programs, the most important of which is the $42.45 billion Broadband Equity, Access, and Deployment (BEAD) Program. Thus, the market for telecom towers is expanding due to an increase in government efforts for the telecom industry.

Telecom Tower Market Report Segmentation Analysis

Key segments that contributed to the derivation of the telecom tower market analysis are type, tower placement, and deployment type.

- Based on type, the telecom tower market is divided into lattice towers, guyed towers, monopole towers, camouflage towers, and mobile cell towers. The lattice towers segment held a larger market share in 2023.

- By tower placement, the market is segmented into green field towers and rooftop towers. The greenfield towers segment held the largest share of the market in 2023.

- In terms of deployment type, the market is segmented into shared infrastructure deployment and owned deployment. The infrastructure deployment segment dominated the market in 2023.

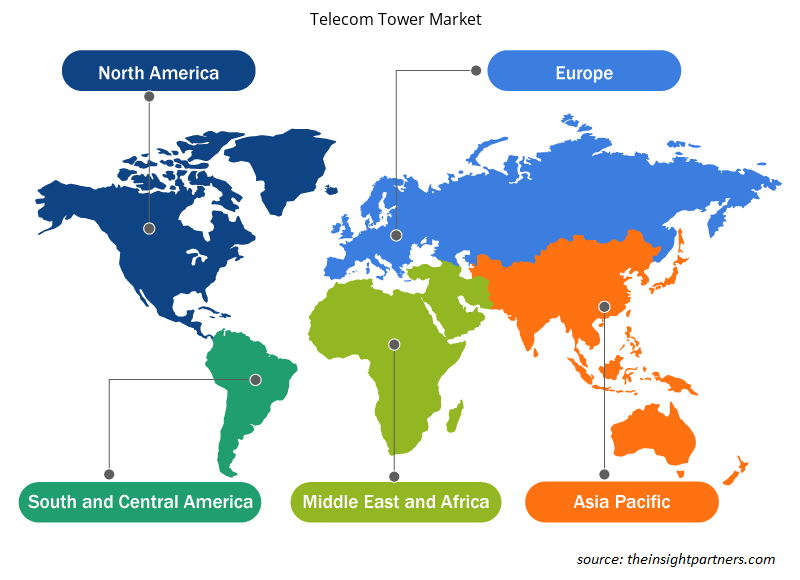

Telecom Tower Market Share Analysis by Geography

The geographic scope of the telecom tower market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. North America has dominated the telecom tower market. The US market is extremely competitive, with multiple major vendors striving for dominance. This fierce rivalry is fuelled by the country's high demand for 5G telecommunications services, prompting many enterprises to focus on expanding their operations in order to capitalize on the opportunity. The US government has a number of prominent suppliers that are involved in partnerships, acquisitions, mergers, rollouts, and coalitions. In recent years, mobile wireless services have emerged as Canada's most significant and rapidly expanding telecommunications business. The growing trend is expected to continue as sophisticated technologies such as the fifth-generation 5G network are implemented, as well as creative applications such as the Internet of Things (IoT).

Telecom Tower Market Regional Insights

The regional trends and factors influencing the Telecom Tower Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Telecom Tower Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Telecom Tower Market

Telecom Tower Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 142.60 Billion |

| Market Size by 2031 | US$ 586.94 Billion |

| Global CAGR (2023 - 2031) | 19.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Telecom Tower Market Players Density: Understanding Its Impact on Business Dynamics

The Telecom Tower Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Telecom Tower Market are:

- American Tower Corporation,

- Cellnex Telecom,

- China Tower,

- Oman Tower Company,

- Indus Tower Limited,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Telecom Tower Market top key players overview

Telecom Tower Market News and Recent Developments

The telecom tower market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In April 2023, The Indian government launched 254 '4G mobile towers in Arunachal Pradesh's LAC villages. Furthermore, these 254 towers will deliver 4G connectivity to 336 communities, including those that have been unconnected since Independence. The majority of these towers are positioned in Chinese border areas to prevent foreign telecom encroachment. Furthermore, the debut of this program is estimated to help more than 70,000 people.

(Source: Indian government, Company Website, 2023)

- In April 2023, Tawal, a subsidiary of Saudi Telecom Company (STC), agreed to acquire United Group's tower infrastructure for Euro 1.22 billion (USD 1.34 billion). The deal will encompass the United Group's infrastructure units in Bulgaria, Slovenia, and Croatia, totaling around 4,800 towers. Furthermore, this strategic acquisition is consistent with Tawal's goal of increasing its international footprint in important countries with strong development potential within the STC Group.

(Source: Tawal, Company Website, 2023)

Telecom Tower Market Report Coverage and Deliverables

The "Telecom Tower Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type , Tower Placement ; and Deployment Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

The global telecom tower market is expected to reach US$ 586.94 billion by 2031.

The key players holding majority shares in the global telecom tower market are American Tower Corporation, Cellnex Telecom, China Tower, Oman Tower Company, and Indus Tower Limited.

Data usage growth is anticipated to play a significant role in the global telecom tower market in the coming years.

The surge in mobile communication and growing secondary marketing activities by players are the major factors that propel the global telecom tower market.

The global telecom tower market was estimated to be US$ 142.60 billion in 2023 and is expected to grow at a CAGR of 19.3% during the forecast period 2023 - 2031.

Get Free Sample For

Get Free Sample For