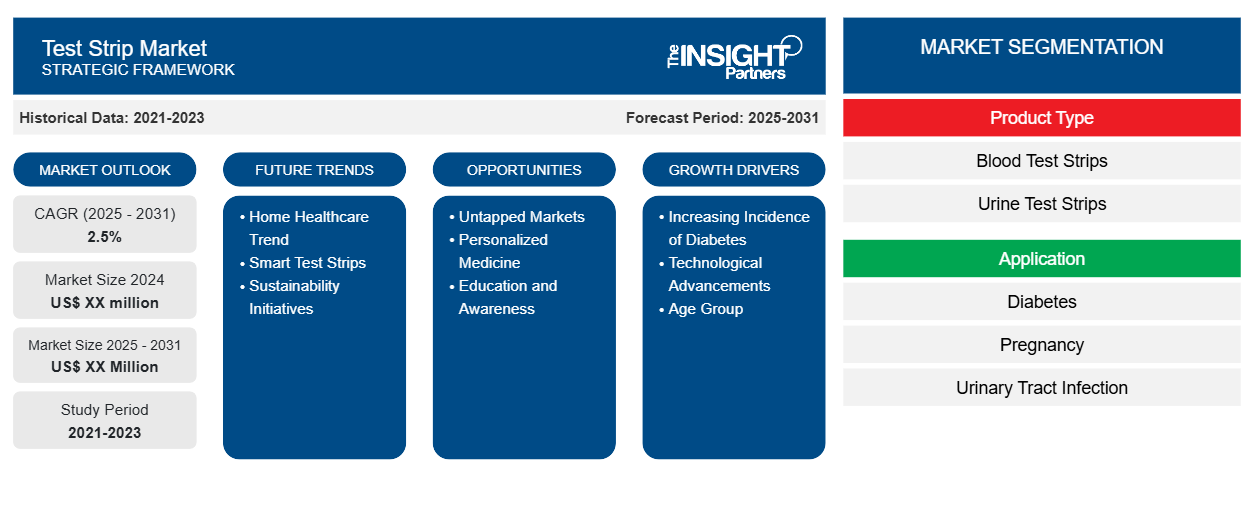

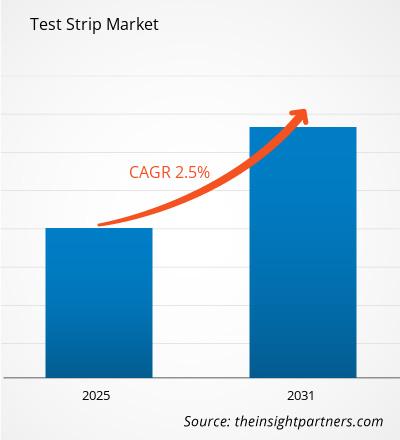

The Test Strip Market is expected to register a CAGR of 2.5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Product Type (Blood Test Strips, Urine Test Strips). The report is further segmented based on Application (Diabetes, Pregnancy, Urinary Tract Infection, Others). Futher, it is segmented based on End User (Hospitals & Clinics, Home Care, Diagnostic Laboratories). The global analysis is further broken-down at regional level and major countries. The report offers the value in USD for the above analysis and segments.

Purpose of the Report

The report Test Strip Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Test Strip Market Segmentation

Product Type

- Blood Test Strips

- Urine Test Strips

Application

- Diabetes

- Pregnancy

- Urinary Tract Infection

- Others

End User

- Hospitals & Clinics

- Home Care

- Diagnostic Laboratories

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Test Strip Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Test Strip Market Growth Drivers

- Increasing Incidence of Diabetes: Growing incidence of diabetes worldwide is a major driver of demand for test strips. An increasing number of patients present high demand for continued monitoring, and healthcare providers and manufacturers are focusing on introducing advanced and easier-to-use testing solutions that will fulfill this growing demand.

- Technological Advancements: Test strip innovations are upgrading in terms of precision and usability. Improvement in terms of compatibility with smartphones and faster results is compelling patients to adopt these, thus fueling market growth.

- Age Group: The elderly population, susceptible to chronic diseases such as diabetes, drives the demand for test strips. This age group expects easy and efficient monitoring solutions to manage their health well.

Test Strip Market Future Trends

- Home Healthcare Trend: The trend toward home healthcare fosters a culture of self-monitoring of one's health. Test strips represent available, home-based testing that align with customer's desire for home-based, point-of-care solutions and are strong positives driving market growth.

- Smart Test Strips: Smart technology in test strips is changing the market. Smart strips could sync with mobile apps, give real-time data analysis, and therefore improve management of conditions by providing real-time individualized insight.

- Sustainability Initiatives: Growing environmental concerns push manufacturers to adopt sustainable practices. Eco-friendly test strips and packaging are becoming popular, appealing to environmentally conscious consumers and promoting brand loyalty.

Test Strip Market Opportunities

- Untapped Markets: Expanding healthcare access across emerging markets offers great opportunities. As awareness about diabetes increases, the demand for low-cost and reliable test strips will be quite high in these markets, which will make the market grow substantially.

- Personalized Medicine: The advancement towards personalized medicine will create an opportunity for customized test strips. Tailor-made solutions for patients will improve their involvement and adherence with medicine, thus expanding the market further.

- Education and Awareness: Investments into education and awareness can heighten the demand for test strips. Educating the consumer on the importance of regular testing leads companies to enhance market penetration and brand loyalty.

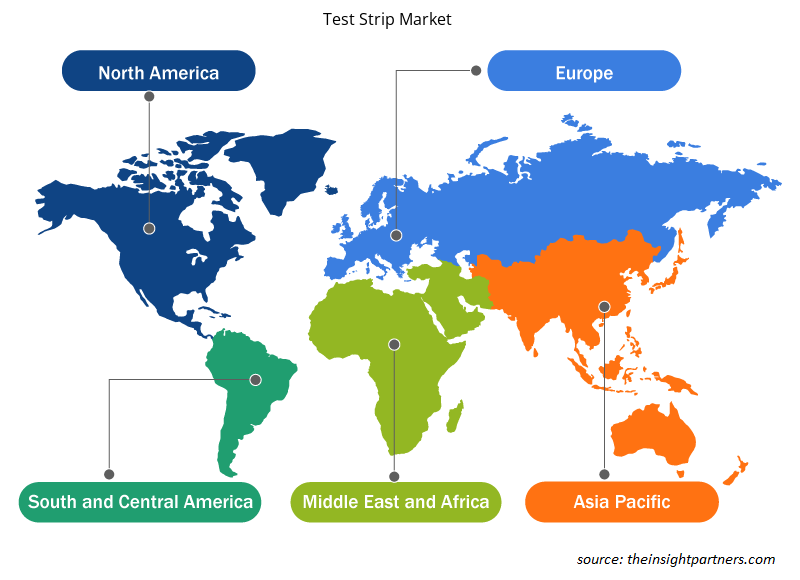

Test Strip Market Regional Insights

The regional trends and factors influencing the Test Strip Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Test Strip Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Test Strip Market

Test Strip Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 2.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

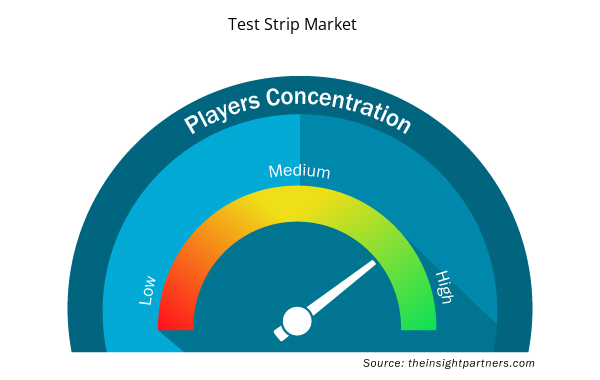

Test Strip Market Players Density: Understanding Its Impact on Business Dynamics

The Test Strip Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Test Strip Market are:

- F. Hoffmann-La Roche AG

- Abbott Laboratories

- Lifescan

- Bayer AG

- B Braun

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Test Strip Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Test Strip Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Test Strip Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Hydrogen Storage Alloys Market

- Industrial Inkjet Printers Market

- Fill Finish Manufacturing Market

- Radiopharmaceuticals Market

- Sexual Wellness Market

- Volumetric Video Market

- Hydrocephalus Shunts Market

- Equipment Rental Software Market

- Fishing Equipment Market

- Artificial Intelligence in Defense Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

F. Hoffmann-La Roche AG and Abbott Laboratories are some of the major players operating in the market.

Asia Pacific region accounted for the highest CAGR in the test strip market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global test strip market from 2021 to 2031, and it also determines the prevailing opportunities.

The major factors driving the test strip market are:

1. Increasing Incidence of Diabetes.

2. Age Group.

North America region dominated the test strip market in 2023.

The Test Strip Market is estimated to witness a CAGR of 2.5% from 2023 to 2031

Trends and growth analysis reports related to Life Sciences : READ MORE..

- F. Hoffmann-La Roche AG

- Abbott Laboratories

- Lifescan

- Bayer AG

- B Braun

- Siemens AG

- Arkray

- Henry Schein Inc.

- ACON Laboratories, Inc.

- TaiDoc Technology Corporation

Get Free Sample For

Get Free Sample For