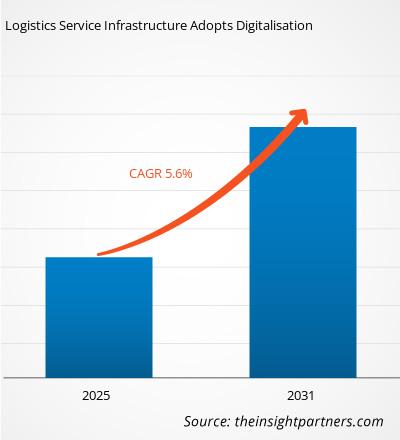

The logistics services market is projected to reach US$1,758.22 billion by 2031 from US$1077.47 million in 2021 it is estimated to grow at a CAGR of 5.6% from 2021 to 2031.

The increasing reliance on improving operational efficiency, along with the rising popularity of outsourcing logistics operations and selected supply chain processes to reduce operating costs, has gained momentum across a variety of sectors. In addition, the advent of third-party logistics and fourth-party logistics companies has increased the global demand for logistics service providers. Freight forwarding, freight management, consulting, route optimization, network analysis, project management, inventory and storage management, and supply chain consultancy are among the key services provided by leading logistics companies. Also, the diverse benefits associated with the use of technologically driven logistics services, such as real-time tracking and monitoring, analytics, forecasting, and planning, further add to the profitability for the market participants. The logistics service industry is extremely fragmented due to the existence of several businesses that specialize in various logistical services and the existence of a large client base. Domestic businesses from several rising economies, such as Asia and Africa, are further boosting the market rivalry with steady, competitive logistics service pricing. Supply chain networks are continually changing, thereby opening new trade corridors. Organizations and economies that can take advantage of these new trade corridors are likely to profit the most from the global trade progress. A portion of these opportunities is expected to come from the sharing of a comprehensive set of best practices that are widely used in developed markets but have limited or no implementation in many developing countries. Strategy and consultation for people management, such as a managerial accounting system, diversity management, knowledge sharing, KPIs from prior liberalization processes, and developing strong Corporate Social Responsibility (CSR) practices. Due to continuous investments, new product developments, and modern technology integration, the global logistics services industry is expected to expand rapidly in the coming years. The logistics services market is dominated by a few well-known global players that continually invest in R&D to provide the best service to their customers. In terms of geographic development and technology improvements, logistics service providers, particularly third-party service providers, are experiencing tremendous growth. For example, 3PL organizations are now employing a variety of software-based solutions in their operations to lower inefficiencies and costs. In addition, implementing voice recognition software in the communications of warehouse management systems supports order processing and inventory recording, reducing the need for staff and their training. Asia Pacific holds a majority share of the logistics services market, and it is projected to register the highest CAGR in the market during the forecast period.

Impact of COVID-19 Pandemic on Logistics Services Market

The outbreak of COVID-19 affected the world economy during late 2021 and in 2021, including: Flight cancellations, travel bans, and quarantines that have led to significant slowdowns in overall supply chain and logistics activities around the world. Logistics companies involved in the movement, storage and flow of goods are directly affected by the COVID 19 pandemic. However, some industries are struggling with pandemics, while others are thriving, such as healthcare and pharmaceuticals. E-commerce and daily necessities will also have a positive impact on the global logistics industry in the event of COVID 19. In addition, increasing demand for medical and FMCG supplies such as hospital supplies, gloves, disinfectants, vaccines, and fresh foods is driving the growth of the logistics market amid the COVID-19 pandemic.

Lucrative Regions for Logistics Services Providers

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Logistics Services Market: Market Insights

Growth of E-Commerce Industry with Rise in Reverse Logistic Operations

E-commerce refers to the buying and selling of goods over the Internet. In addition to the regular function of delivering products to consumers, logistics service providers also cater to the needs of the e-commerce industry by managing and monitoring the supply chain of its e-commerce business. This allows these businesses to focus on marketing and other business operations. The benefits of logistics to the e-commerce industry have significantly increased the acceptance of logistics services worldwide. According to the latest United Nations Conference on Trade and Development (UNCTAD) report, released in April 2021, the global e-commerce sales reached US$ 25.6 trillion in 2021, accounting for ~30% of the global gross domestic product (GDP). In 2021, the value of the global B2B e-commerce business was US$ 21 trillion, and it accounted for ~83% of the overall e-commerce of the world; furthermore, the value of B2C e-commerce was US$4.4 trillion. This growth is ascribed to a rapid surge in cross-border shopping. More than 1.4 billion people shopped online in 2021; enterprises in the US, China, and Japan dominate the global e-commerce sales.

Mode of Transportation-Based Market Insights

Efficient transportation is the physical movement of goods in a relatively safe manner, at the right time, in the right condition, and in a cost-effective manner. Transportation plays role in moving goods from the place of manufacturing or storage to the place of use or distribution, and the point of final consumption. Based on the mode of transportation, the logistics services market is segmented into roads, railroads, waterways, and air routes. The criteria for selecting the shipping mode are defined by the physical characteristics of the goods and shipment in transit. In certain situations, environmental factors such as road and railroad destruction can have a significant impact on the type of choice.

Logistic Providers-Based Market Insights

The global logistics services market, by component type, is segmented into First & Second Party Logistics, Third Party Logistics, Fourth Party Logistics, and Fifth Party Logistics. A third-party logistics provider (3PL) provides logistics services to companies for a part or, sometimes, all of their supply chain management functions. Outsourcing logistics to third-party supply chain managers is an ongoing trend. The logistics services market is currently estimated at US$ 1077.46 billion, and a major share of the logistics services is outsourced to third-parties. However, the levels of outsourcing vary significantly between countries. Generally, outsourcing is a preferred logistics activity in the UK and the US, while China and India hold significant potential for the future growth of third-party logistics businesses.

Organization Size-Based Market Insights

Logistics services are essential for businesses that involve the transportation of goods from one place to other, and to avoid the complications related to the process, various SMEs and large organizations are adopting logistics services. With rapid developments in technologies, several small & medium, and large enterprises are opting for logistics services, which allows them to shift their focus on core competencies, company restructuring, and cost reduction. Based on organization size, the global logistics service market is segmented into small & medium enterprises, and large enterprises.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

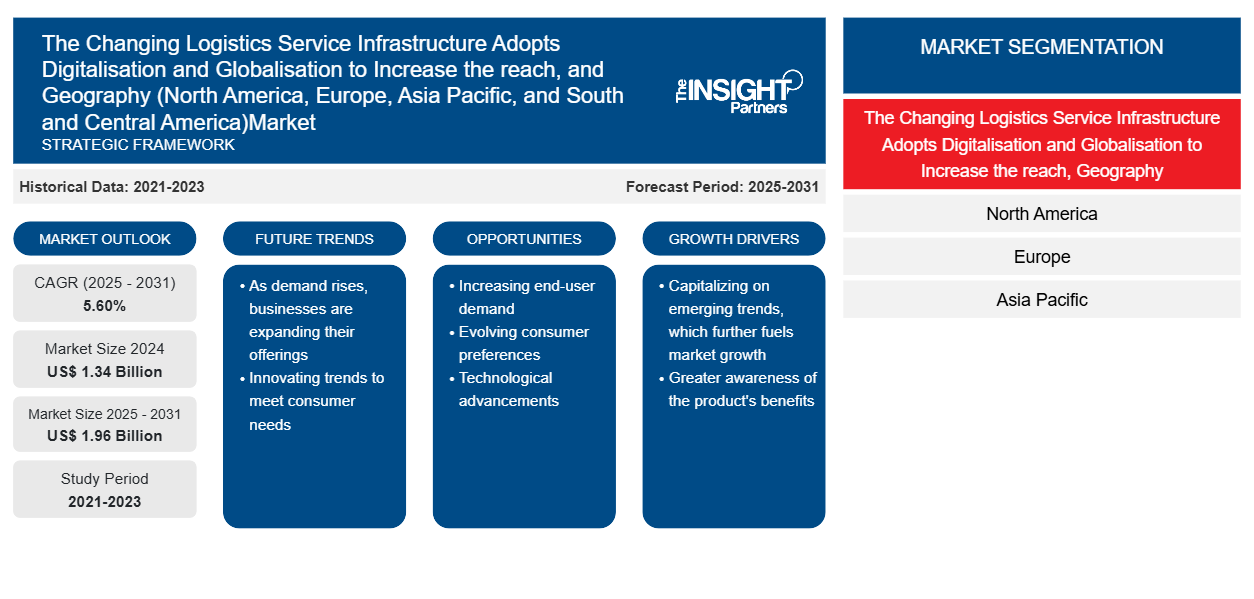

The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Product development is the commonly adopted strategy by companies to expand their product portfolio. FedEx, Maersk, DHL, UPS, Expeditors, among others, are the key players implementing such strategies to enlarge their customer base and revenue share in the logistics services market, which in turn allows them to maintain their brand name. A few of the recent key developments are mentioned below:

- In November 2021, A. P. Moller - Maersk, a global integrator of container logistics, signed a definite agreement with Saudi Ports Authority to establish 205,000 sq. m. integrated logistics park, which will offer their customers an extensive infrastructure for warehousing and distribution, cold storage, and e-commerce. The facility will also serve as a hub for transshipments, petrochemical consolidation, air freight, and container cargo.

- In January 2021, FedEx and Microsoft announced a new cross-platform logistics solution for the e-commerce industry. This new offering is aimed at increasing merchant competitiveness in the e-commerce space by improving customer engagement and providing enhanced shipping options.

The logistics services market is segmented on the basis of Mode of Transportation, Logistics Providers, Organization size, and End-users. Based on Mode of Transportation, the market is segmented into Roadways, Waterways, Rail and, Airways; based in Logistics Providers, the market is bifurcated into First & Second Party Logistics, Third Party Logistics, Fourth Party Logistics, and Fifth Party Logistics; by Organization size, the market is segmented into Small and Medium enterprises and Large enterprises, and by End-users the market is further segmented into Government & Public Utilities, Healthcare, Industrial Manufacturing, Retail & Consumer Goods, and Aerospace & Defense, and Others

CEVA Logistics; Panalpina World Transport (Holding) Ltd.; United Parcel Service (UPS); C.H. Robinson Worldwide, Inc.; A.P. MOLLER – MAERSK; Nippon Express; FedEx; DB Schenker; DHL International GmbH; and KUEHNE + NAGEL are a few major players operating in the global logistics services market.

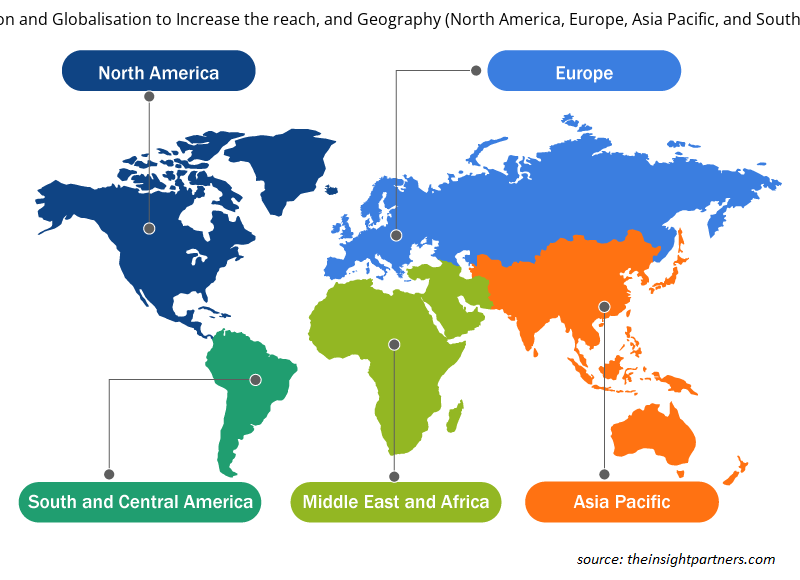

Report ScopeThe Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market Regional Insights

The regional trends and factors influencing the The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market

The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.34 Billion |

| Market Size by 2031 | US$ 1.96 Billion |

| Global CAGR (2025 - 2031) | 5.60% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, Geography

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market Players Density: Understanding Its Impact on Business Dynamics

The The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market are:

- CEVA LOGISTICS

- PANALPINA WORLD TRANSPORT (HOLDING) LTD

- UNITED PARCEL SERVICE (UPS)

- C.H. ROBINSON WORLDWIDE, INC

- A.P. MOLLER - MAERSK

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America) Market Scope and Analysis

- The Changing Logistics Service Infrastructure Adopts Digitalisation and Globalisation to Increase the reach, and Geography (North America, Europe, Asia Pacific, and South and Central America) Market Size and Share

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

- CEVA LOGISTICS

- PANALPINA WORLD TRANSPORT (HOLDING) LTD

- UNITED PARCEL SERVICE (UPS)

- C.H. ROBINSON WORLDWIDE, INC

- A.P. MOLLER – MAERSK

- NIPPON EXPRESS

- FEDEX

- DB SCHENKER

- DHL INTERNATIONAL GMBH

- KUEHNE + NAGEL

Get Free Sample For

Get Free Sample For