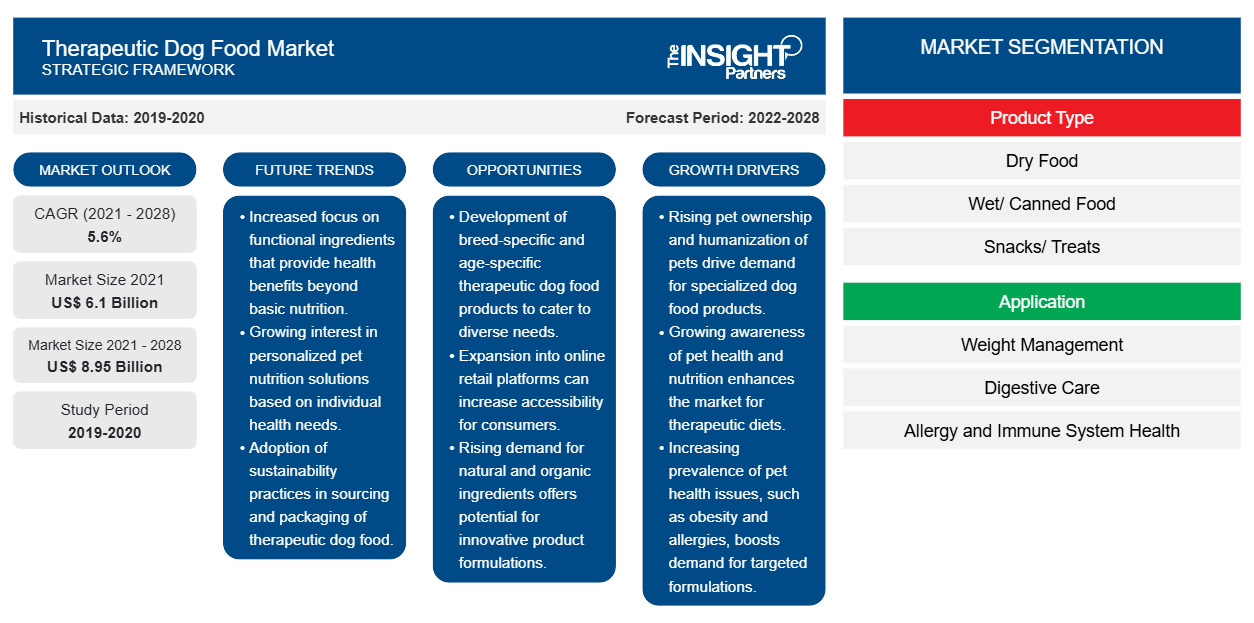

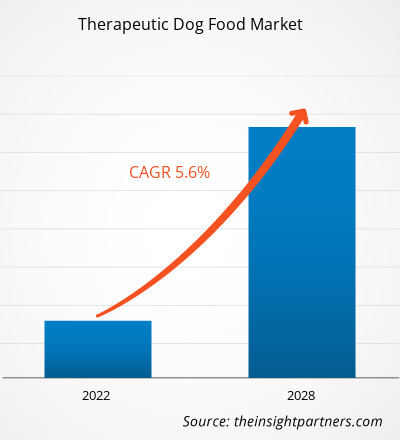

The therapeutic dog food market is projected to reach US$ 8,949.52 million by 2028 from US$ 6,095.70 million in 2021; it is estimated to grow at a CAGR of 5.6% from 2021 to 2028.

Therapeutic dog food is specifically formulated to aid in the management of various illnesses and diseases. These diets are also prescribed in the treatment of itchy skin, digestive issues, obesity, allergies, and heat diseases, among others. Pet food manufacturers are increasingly changing their product variants, making them suitable for the wellness of pets.

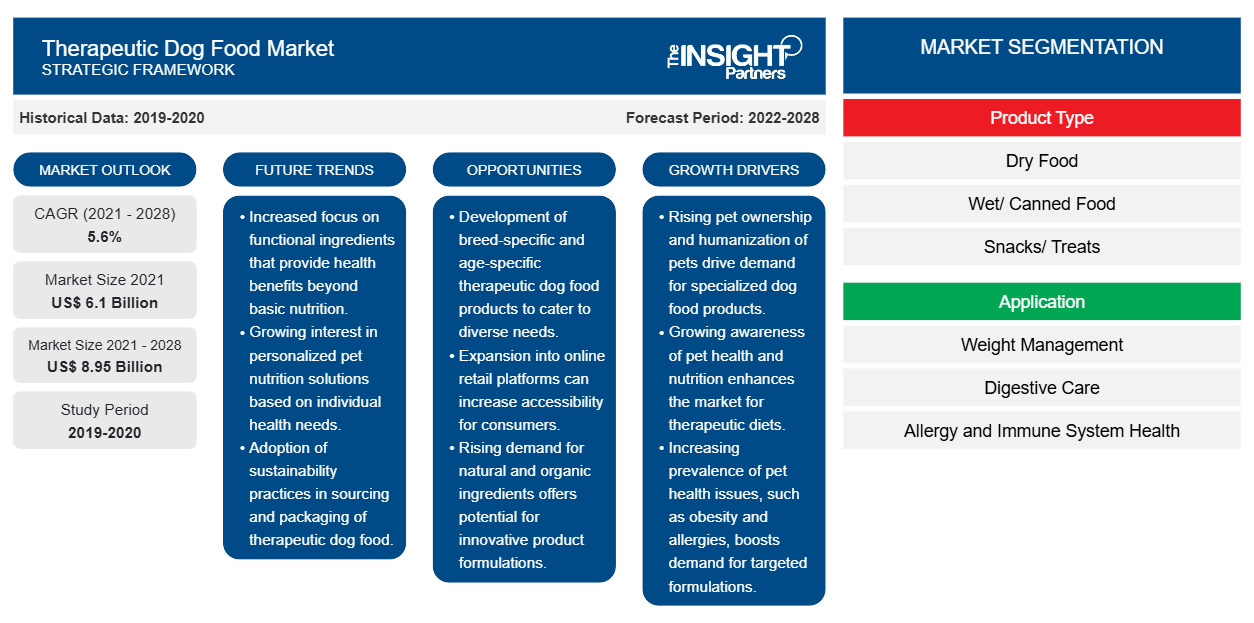

The therapeutic dog food market is segmented on the basis of product type, application , and geography. The market, by geography, is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South and Central America. The report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends, technological advancements, and market dynamics, along with the analysis of the competitive landscape of the globally leading market players.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Therapeutic Dog Food Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Therapeutic Dog Food Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Adoption of Dogs for Companionship to drive Therapeutic Dog Food market growth

Dogs are considered an apt companion for humans as they have a significant impact on their owner’s life. They promote an active lifestyle and can detect oncoming epileptic seizures much before the actual incidence. Pets help bring social, emotional, and cognitive development in children, in addition to helping adults in relieving stress and anxiety. Research studies have shown that dog owners are at 36% lower risk of dying from cardiovascular disease and 11% lower risk of getting a heart attack. As per the American Pet Products Association's 2019–2020 survey, ~63.4 million households own at least one dog in the US. Also, as per the FEDIAF, the body representing European pet food industry, the popularity of dogs is growing in the region; the count of pet dogs in the EU rose from 63.7 million in 2016 to 66.4 million in 2017. According to the Animal Wellbeing (PAW) Report 2019 by the People's Dispensary for Sick Animals (PDSA), ~50% of the UK population owns a pet, with an estimated population of 9.9 million pet dogs. 26% of adults in the country own a dog. Thus, a surging preference for dogs as a companion is fueling the therapeutic dog food market growth.

Growing Prevalence of Chronic Diseases Among Dogs Contribute Significantly to Therapeutic Dog Food Market Growth

Similar to humans, animals too suffer from chronic diseases. Arthritis, chronic kidney disease, cancer, hepatitis and other liver diseases, skin allergies, and diabetes are commonly detected chronic diseases in pets. Cancer is widespread in animals and affects dogs as well. According to the veterinary cancer society, the disease is a leading cause of death in 47% of dogs, especially dogs of age >10 years. Further, as per the Pet Cancer Facts and Figures, one in every four dogs develops cancer in its lifetime. According to the Association for Pet Obesity Prevention (APOP), ~55.8% of dogs in the US were overweight or obese in 2018. The Arthritis Foundation says ~20% of all adult dogs suffer from arthritis. Such a growing prevalence of chronic medical conditions has become a major concern among dog owners, which underlines the demand for proper care. Thus, with the elevating prevalence of chronic medical conditions in dogs, companies are focusing on offering advanced therapeutic food products to help dog owners in maintaining the overall health of their pets.

Product Type Insights

Based on product type, the global therapeutic dog food market is segmented into dry food, wet/canned food, snacks/treats, and others. In 2020, the dry food segment held the largest share of the market. Furthermore, the snacks/treats segment is expected to register the highest CAGR in the market during 2021–2028. Dry foods are perceived beneficial to their dental health. In some cases, they can decrease calculus (tartar). The choice of dry or canned foods is based on pet owner preferences and perhaps cost, unless the pet requires higher fluid intake (like cats with chronic kidney disease or pets with urinary stones) dogs which is expected to drive the market during the forecast period.

Application Insights

Based on application, the therapeutic dog food market is segmented into weight management, digestive care, allergy and immune system health, and others. The weight management segment would hold the largest market share in 2021. Further, the digestive care segment is expected to hold a significant market share in the therapeutic dog food market in the future. Recently, in January 2021, Wellness Natural Pet Food, a leading WellPet brand, launched a new line of functional pet food formulas targeting digestive health of dogs and cats. Wellness CORE Digestive Health features digestive enzymes, prebiotic fibers, and probiotics to support gut health. Such developments are likely to drive the therapeutic dog food market growth for the digestive care segment.

Product launches, and mergers and acquisitions are highly adopted strategies by the global therapeutic dog food market players. A few of the recent key market developments are listed below:

- In July 2021, General Mills acquired Tyson Food’s Pet Treats business for US$ 1.2 billion in cash. The business, which includes the Nudges, Top Chews, and True Chews product categories, is a leader in the natural meat treats industry for pets.

- In August 2021, WellPet, LLC announced several new pet food and treat products, including formulations specifically meant for puppies, kittens, and senior pets.

As per the Insurance Research Council’s October 2020 report, during the COVID-19, around 30% of Americans adopted a pet owing to increase in need for companionship. Furthermore, according to the German Kennel Club (VDH), ~20% more dogs were purchased in 2020 than the previous year. Most of the consumers in the market grappled with the onset of the pandemic. Retail and e-commerce platforms witnessed high growth due to several restrictions on the brick-and-mortar stores and the disruption of overall supply channels. Several online retailers reported strong sales of pet products. For instance, Chewy.com witnessed accelerated sales since February 2020. The company generates ~70% of its sales through subscription customers. These conditions are offering lucrative opportunities for the growth of the therapeutic dog food market in the coming years.

Therapeutic Dog Food – Market Segmentation

The therapeutic dog food market is segmented into product type, application, and geography. In terms of product type, the market is segmented into dry food, wet/canned food, snacks/treats, and others. Based on application, the therapeutic dog food market is segmented into weight management, digestive care, allergy and immune system health, and others. The market, by geography, is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South and Central America.

Therapeutic Dog Food Market Regional Insights

The regional trends and factors influencing the Therapeutic Dog Food Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Therapeutic Dog Food Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Therapeutic Dog Food Market

Therapeutic Dog Food Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 6.1 Billion |

| Market Size by 2028 | US$ 8.95 Billion |

| Global CAGR (2021 - 2028) | 5.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Therapeutic Dog Food Market Players Density: Understanding Its Impact on Business Dynamics

The Therapeutic Dog Food Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Therapeutic Dog Food Market are:

- Mars, Incorporated

- Nestlé

- Hill's Pet Nutrition, Inc.

- The J. M. Smucker Company

- GENERAL MILLS, INC.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Therapeutic Dog Food Market top key players overview

Company Profiles

- Mars, Incorporated

- Nestlé

- Hill's Pet Nutrition, Inc.

- The J. M. Smucker Company

- GENERAL MILLS, INC.

- ANIMONDA

- DARWIN PET

- SCHELL & KAMPETER, INC.

- AFFINITY PETCARE S.A

- Beaphar

- WellPet

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Initiatives by governments and private players is likely to fuel the market growth in the coming years

Product innovations is likely to act as trend the market growth in the coming years.

Dry food segment is growing in the therapeutic dog food market.

Key players in the market are Mars, Incorporated, Nestlé, Hill's Pet Nutrition, Inc., The J. M. Smucker Company, GENERAL MILLS, INC., ANIMONDA, DARWIN PET, SCHELL & KAMPETER, INC., AFFINITY PETCARE S.A, Beaphar, and WellPet among others.

Key factors driving the growth of the market are increasing adoption of dogs for companionship, growing prevalence of chronic diseases among dogs, and surge in launch of therapeutic dog food products drive the market growth. However, low sales in developing countries hampers the market growth.

Therapeutic dog food comprises of specifically formulated to aid in the management of illness and disease. These diets are formulated to treat a variety of problems such as itchy skin, digestive issues, obesity, allergies, and heat diseases.

Asia-Pacific is the lucrative for the therapeutic dog food market.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Therapeutic Dog Food Market

- Mars, Incorporated

- Nestlé

- Hill's Pet Nutrition, Inc.

- The J. M. Smucker Company

- GENERAL MILLS, INC.

- ANIMONDA

- DARWIN PET

- SCHELL & KAMPETER, INC.

- AFFINITY PETCARE S.A

- Beaphar

- WellPet

Get Free Sample For

Get Free Sample For