The Africa fuel dispenser market was valued at US$ 49.96 million in 2022 and is projected to reach US$ 64.23 million by 2030; it is expected to register a CAGR of 3.20% during 2022–2030.

Analyst Perspective:

The Africa fuel dispenser market was dominated by Nigeria and Egypt, with market shares of 34.60% and 20.19%, respectively, in 2022. Nigeria and Egypt's economies are among the top economies in the region. Nigeria's natural gas deposit was ~208.62 trillion cubic feet in 2022. The Nigerian government is heavily investing in compressed natural gas for adoption in the automotive and transportation sectors. Egypt has taken significant steps to convert automobiles to compressed natural gas (CNG). For example, in January 2021, the government of Egypt announced its plan to boost the number of automobiles powered by compressed natural gas. Egypt's natural gas output is considered to be self-sufficient.

Market Overview:

A fuel dispenser is essential gas station equipment, offering a safe and efficient way to pump gasoline, diesel, or other fuel types into automobiles. It properly measures and dispenses fuel, guaranteeing that consumers only pay for what they receive.

The surging demand for fuel in Africa, catalyzed by robust economic growth and growing urbanization, is poised to propel the Africa fuel dispenser market to new heights. As economies expand, there is a simultaneous surge in energy consumption across various sectors. Urbanization amplifies this demand, necessitating a sophisticated fuel distribution infrastructure. The increase in urban centers and hubs of economic activity intensifies the need for efficient transportation networks, thereby driving the growth of Africa fuel dispenser market. The increased reliance on automobiles and public transport in urban areas underscores the critical role that fuel dispensing systems play in meeting the escalating fuel requirements. Modernizing fuel retail infrastructure in numerous African nations represents a strategic shift poised to significantly impact and drive the Africa fuel dispenser market across the region.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Africa Fuel Dispenser Market: Strategic Insights

Market Size Value in US$ 49.96 million in 2022 Market Size Value by US$ 64.23 million by 2030 Growth rate CAGR of 3.20% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Africa Fuel Dispenser Market: Strategic Insights

| Market Size Value in | US$ 49.96 million in 2022 |

| Market Size Value by | US$ 64.23 million by 2030 |

| Growth rate | CAGR of 3.20% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

The surging demand for fuel in Africa, catalyzed by robust economic growth and increased urbanization, is poised to propel the Africa fuel dispenser market to new heights. As economies expand, there is a proportional surge in energy consumption across various sectors. Urbanization amplifies this demand, necessitating a sophisticated fuel distribution infrastructure. The increase in urban centers and hubs of economic activity intensifies the need for efficient transportation networks, thereby driving the demand for fuel dispensers. The increased reliance on automobiles and public transport in urban areas highlights the critical role that fuel dispensing systems play in meeting the escalating fuel requirements. The table below shows the constant demand for fuel from South Africa throughout 2022. This trend is anticipated to offer promising growth opportunities for the Africa fuel dispenser market in the coming years.

January to December South Africa Fuel Sales Volume / Consumption (2022)

Volume in Million Liters | |||||

Product name | Q1- January to March | Q2 - April to June | Q3 - July to September | Q4 - October to December | Grand Total |

Diesel (All grades) | 3231.73 | 3133.18 | 3243.82 | 3108.58 | 12717.32 |

Petrol (All grades) | 2341.86 | 2236.06 | 2215.98 | 2390.95 | 9184.86 |

Jet Fuel | 348.61 | 337.00 | 366.94 | 425.58 | 1478.14 |

Paraffin | 305.53 | 299.68 | 300.79 | 271.88 | 1177.89 |

Furnace Oil | 146.34 | 144.65 | 138.67 | 164.36 | 594.04 |

LPG | 90.98 | 86.75 | 68.72 | 76.92 | 323.38 |

Aviation Gasoline | 1.49 | 1.23 | 0.90 | 1.06 | 4.69 |

Grand Total | 6466.58 | 6238.57 | 6335.84 | 6439.36 | 25480.37 |

Simultaneously, the industrialization sweeping across the continent amplifies the necessity for a seamless and continuous fuel supply. Industries, essential components of economic development, demand a reliable energy source for manufacturing processes and transportation. This heightened industrial activity increases the need for strategically located fuel dispensers near industrial zones. The economic landscape of Africa is dynamically evolving, and this presents a strategic opportunity for stakeholders in the Africa fuel dispenser market. Investing in advanced technologies and expanding the fuel distribution network to accommodate the burgeoning demand align with the trajectory of economic development in the region. As the nexus between economic growth, urbanization, and industrialization propels the demand for fuel dispensers, proactive industry players stand to capitalize on this increasing Africa fuel dispenser market growth, fostering innovation, infrastructure development, and sustainable economic progress across Africa.

Segmental Analysis:

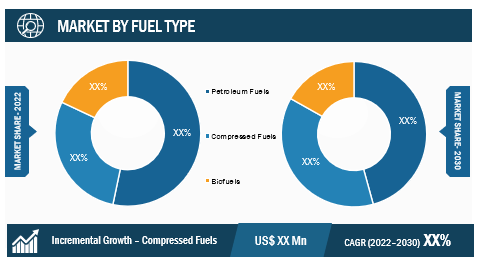

The Africa fuel dispenser market is characterized by a diverse range of fuel types, each catering to unique demands and regional preferences. The fuel types include petroleum fuels, compressed fuels, and biofuels. This segmentation reflects the continent’s dynamic energy landscape and the ongoing transition toward cleaner and more sustainable fuel options. Diesel fuel dispensers continue to play a crucial role in supporting the transportation, industrial, and agricultural sectors. The consistent demand for diesel underscores its significance in powering various vehicles and machinery. Fuel dispensers for gasoline remain essential for private and commercial vehicles. Despite the growing interest in alternative fuels, petrol maintains a significant market share, particularly in urban areas. The adoption of CNG as a cleaner alternative is gaining traction. Countries in Africa, such as Egypt, lead in CNG infrastructure development, with a growing number of CNG-powered vehicles and an expanding network of refueling stations. Ethanol-blended fuels are becoming increasingly popular, with biofuel dispensers accommodating the demand for cleaner alternatives. Initiatives such as Sunbird Bioenergy’s use of cassava feedstock in Zambia signify a growing interest in sustainable biofuels, which is boosting the growth of Africa fuel dispenser market share of Zambia.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Regional Analysis:

The Africa fuel dispenser market was dominated by Nigeria and Egypt, with market shares of 34.60% and 20.19%, respectively, in 2022. Nigeria and Egypt’s economies are among the top economies in the region. In addition, the marine transportation industry in Nigeria is developing rapidly. Nigeria’s maritime trade has a direct connection to the country’s oil & gas industry. Nigeria, Africa’s largest oil producer, exports petroleum products, including crude oil, refined petroleum, and liquefied natural gas (LNG), via maritime channels. Nigeria is Africa’s largest ship-owning country, with 291 vessels totaling 7.94 million deadweight tons. Nigerian-owned vessels ranked 30th in vessel value, accounting for 0.56% of global fleet value. As a result, there is a rise in growth Africa fuel dispenser market share in the marine sector of Nigeria.

Apart from Nigeria and Egypt, Algeria and Kenya are a few notable African countries where the demand is growing. Algeria is Africa's largest crude oil and natural gas producer. Algeria has an estimated 159 trillion cubic feet of proven natural gas reserves at the start of 2023. Algeria produced more natural gas in 2021 compared to any previous year. Kenya is one of Africa's fastest-developing economies. In the third quarter of 2023, Kenya's GDP rose 5.9% yearly, compared to 4.3% growth in the same quarter of 2022. As the country’s demand for fuel grows, fuel consumption also increases continuously. Such increased fuel consumption increases the Africa fuel dispenser market growth.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Key Player Analysis:

Tiger Pump; Ehad Fuel Equipment; FTI Group Ltd.; SAMD; Smartflow; Galileo Technologies SA; Eaglestar Energy Technology Co., Ltd.; Dover Fuelling Stations; Prowalco; and Gilbarco Veeder-Root are the prominent market participants in the Africa fuel dispenser market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the Africa fuel dispenser market. The market initiative is a strategy adopted by Africa fuel dispenser market players to expand their footprint across the world and to meet the growing customer demand. The market players present mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by the key players are listed below:

Year | News |

April 2022 | Helmerich & Payne (H&P) invested US$ 33 million in Galileo Technologies, bolstering the company's unique technological platform aimed at decarbonizing the energy supply chain. |

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Fuel Type, Dispenser System, End-users, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Africa fuel dispenser market is experiencing a notable trend as key players are actively launching new clean fuel dispensers, marking a significant shift toward environmentally friendly and sustainable technologies. This trend reflects the industry's commitment to meeting the rising demand for cleaner energy solutions, aligning with global environmental initiatives.

The Africa fuel dispenser market was dominated by Nigeria and Egypt, with market shares of 34.60% and 20.19%, respectively, in 2022. Nigeria and Egypt’s economies are among the top economies in the region. Nigeria's natural gas deposit is estimated at 208.62 trillion cubic feet as of 2022. The Nigerian government is heavily investing in compressed natural gas for adoption in the automotive and transportation sectors.

TSG Group, Dover Fueling Solutions, SAMD Africa, Prowalco, Smartflow, and Gilbarco Veeder Root are the top key market players operating in the Africa fuel dispenser market.

The prospect of rural market expansion offers a significant avenue for growth in the fuel dispenser market in Africa, presenting a unique opportunity to address the fueling needs of underserved populations in remote areas. This strategic expansion into rural regions aligns with broader economic development goals and provides tangible benefits for both fuel retailers and the local communities.

The surging demand for fuel in Africa, catalyzed by robust economic growth and increased urbanization, is poised to propel the fuel dispenser market to new heights. As economies expand, there is a proportional surge in energy consumption across various sectors. Urbanization amplifies this demand, necessitating a sophisticated fuel distribution infrastructure.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Africa Fuel Dispenser Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 Raw Material and Component Supplier:

4.3.2 Equipment Manufacturer:

4.3.3 End Users

4.3.4 Service Providers:

4.3.5 List of Vendors in the Value Chain

5. Africa Fuel Dispenser Market – Key Market Dynamics

5.1 Africa Fuel Dispenser Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Rise in Demand for Fuel

5.2.2 Modernization of Fuel Retail Infrastructure

5.2.3 Growth of Automotive Industry

5.3 Market Restraints

5.3.1 Economic Constraints

5.3.2 Rise in Adoption of Electric Vehicles (EVs)

5.4 Market Opportunities

5.4.1 Rural Market Expansion

5.4.2 Integration of Advanced Technologies

5.5 Future Trends

5.5.1 Rise in Adoption of Clean Technologies

5.6 Impact of Drivers and Restraints:

6. Africa Fuel Dispenser Market Analysis

6.1 Africa Fuel Dispenser Market Revenue (US$ Million), 2022–2030

6.2 Africa Fuel Dispenser Market Revenue (US$ Million), 2022–2030

6.3 Africa Fuel Dispenser Market Forecast and Analysis

7. Africa Fuel Dispenser Market Analysis – by Fuel Type

7.1 Petroleum Fuels

7.1.1 Overview

7.1.2 Petroleum Fuels: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

7.2 Compressed Fuels

7.2.1 Overview

7.2.2 Compressed Fuels: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

7.3 Biofuels

7.3.1 Overview

7.3.2 Biofuels: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

8. Africa Fuel Dispenser Market Analysis – by Dispenser System

8.1 Submersible

8.1.1 Overview

8.1.2 Submersible: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

8.2 Suction

8.2.1 Overview

8.2.2 Suction: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

9. Africa Fuel Dispenser Market Analysis – by End-users

9.1 Automotive

9.1.1 Overview

9.1.2 Automotive: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

9.2 Industrial

9.2.1 Overview

9.2.2 Industrial: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

9.3 Aerospace and Defence

9.3.1 Overview

9.3.2 Aerospace and Defence: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Marine

9.4.1 Overview

9.4.2 Marine: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Others

9.5.1 Overview

9.5.2 Others: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10. Africa Fuel Dispenser Market – Country Analysis

10.1 Africa

10.1.1 Africa Fuel Dispenser Market Breakdown by Countries

10.1.2 Africa Fuel Dispenser Market Revenue and Forecast and Analysis – by Country

10.1.2.1 Africa Fuel Dispenser Market Revenue and Forecast and Analysis – by Country

10.1.2.2 Tanzania: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.2.1 Tanzania: Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.2.2 Tanzania: Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.2.3 Tanzania: Africa Fuel Dispenser Market Breakdown by End-users

10.1.2.3 Kenya: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.3.1 Kenya: Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.3.2 Kenya: Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.3.3 Kenya: Africa Fuel Dispenser Market Breakdown by End-users

10.1.2.4 Ethiopia: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.4.1 Ethiopia: Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.4.2 Ethiopia: Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.4.3 Ethiopia: Africa Fuel Dispenser Market Breakdown by End-users

10.1.2.5 Senegal: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.5.1 Senegal: Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.5.2 Senegal: Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.5.3 Senegal: Africa Fuel Dispenser Market Breakdown by End-users

10.1.2.6 Morocco: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.6.1 Morocco: Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.6.2 Morocco: Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.6.3 Morocco: Africa Fuel Dispenser Market Breakdown by End-users

10.1.2.7 Democratic Republic of Congo: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.7.1 Democratic Republic of Congo: Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.7.2 Democratic Republic of Congo: Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.7.3 Democratic Republic of Congo: Africa Fuel Dispenser Market Breakdown by End-users

10.1.2.8 Cote d Ivoire (Ivory Coast): Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.8.1 Cote d Ivoire (Ivory Coast): Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.8.2 Cote d Ivoire (Ivory Coast): Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.8.3 Cote d Ivoire (Ivory Coast): Africa Fuel Dispenser Market Breakdown by End-users

10.1.2.9 Algeria: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.9.1 Algeria: Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.9.2 Algeria: Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.9.3 Algeria: Africa Fuel Dispenser Market Breakdown by End-users

10.1.2.10 Nigeria: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.10.1 Nigeria: Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.10.2 Nigeria: Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.10.3 Nigeria: Africa Fuel Dispenser Market Breakdown by End-users

10.1.2.11 Egypt: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.11.1 Egypt: Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.11.2 Egypt: Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.11.3 Egypt: Africa Fuel Dispenser Market Breakdown by End-users

10.1.2.12 Rest of Africa: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.12.1 Rest of Africa: Africa Fuel Dispenser Market Breakdown by Fuel Type

10.1.2.12.2 Rest of Africa: Africa Fuel Dispenser Market Breakdown by Dispenser System

10.1.2.12.3 Rest of Africa: Africa Fuel Dispenser Market Breakdown by End-users

11. Africa Fuel Dispenser Market – Impact of COVID-19 Pandemic

11.1 Pre & Post COVID-19 Impact

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 Product Development

13. Competitive Landscape

13.1 Heat Map Analysis by Key Players

13.2 Company Positioning and Concentration

14. Company Profiles

14.1 TSG Solutions Group SAS

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 FTI Group Ltd

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Jachart Pty Ltd

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Galileo Technologies SA

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Eaglestar Energy Technology Co Ltd

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Dover Fueling Solutions

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Prowalco Tatsuno Pty Ltd

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Gilbarco Inc

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Southern Africa Master Distributors Pty Ltd

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Smartflow Technologies Ltd

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

List of Tables

Table 1. Africa Fuel Dispenser Market Segmentation

Table 2. List of Vendors

Table 3. Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Table 4. Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 5. Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 6. Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 7. Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Country

Table 8. Tanzania: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 9. Tanzania: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 10. Tanzania: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 11. Kenya: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 12. Kenya: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 13. Kenya: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 14. Ethiopia: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 15. Ethiopia: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 16. Ethiopia: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 17. Senegal: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 18. Senegal: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 19. Senegal: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 20. Morocco: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 21. Morocco: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 22. Morocco: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 23. Democratic Republic of Congo: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 24. Democratic Republic of Congo: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 25. Democratic Republic of Congo: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 26. Cote d Ivoire (Ivory Coast): Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 27. Cote d Ivoire (Ivory Coast): Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 28. Cote d Ivoire (Ivory Coast): Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 29. Algeria: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 30. Algeria: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 31. Algeria: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 32. Nigeria: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 33. Nigeria: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 34. Nigeria: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 35. Egypt: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 36. Egypt: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 37. Egypt: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 38. Rest of Africa: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Fuel Type

Table 39. Rest of Africa: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by Dispenser System

Table 40. Rest of Africa: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million) – by End-users

Table 41. Heat Map Analysis by Key Players

List of Figures

Figure 1. Africa Fuel Dispenser Market Segmentation, by Country

Figure 2. PEST Analysis

Figure 3. January to December South Africa Fuel Sales Volume / Consumption (2022)

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. Africa Fuel Dispenser Market Revenue (US$ Million), 2022–2030

Figure 6. Africa Fuel Dispenser Market Share (%) – by Fuel Type, 2022 and 2030

Figure 7. Petroleum Fuels: Africa Fuel Dispenser Market– Revenue and Forecast to 2030 (US$ Million)

Figure 8. Compressed Fuels: Africa Fuel Dispenser Market– Revenue and Forecast to 2030 (US$ Million)

Figure 9. Biofuels: Africa Fuel Dispenser Market– Revenue and Forecast to 2030 (US$ Million)

Figure 10. Africa Fuel Dispenser Market Share (%) – by Dispenser System, 2022 and 2030

Figure 11. Submersible: Africa Fuel Dispenser Market– Revenue and Forecast to 2030 (US$ Million)

Figure 12. Suction: Africa Fuel Dispenser Market– Revenue and Forecast to 2030 (US$ Million)

Figure 13. Africa Fuel Dispenser Market Share (%) – by End-users, 2022 and 2030

Figure 14. Automotive: Africa Fuel Dispenser Market– Revenue and Forecast to 2030 (US$ Million)

Figure 15. Industrial: Africa Fuel Dispenser Market– Revenue and Forecast to 2030 (US$ Million)

Figure 16. Aerospace and Defense: Africa Fuel Dispenser Market– Revenue and Forecast to 2030 (US$ Million)

Figure 17. Marine: Africa Fuel Dispenser Market– Revenue and Forecast to 2030 (US$ Million)

Figure 18. Others: Africa Fuel Dispenser Market– Revenue and Forecast to 2030 (US$ Million)

Figure 19. Africa Fuel Dispenser Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 20. Tanzania: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Kenya: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Ethiopia: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Senegal: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Morocco: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. Democratic Republic of Congo: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 26. Cote d Ivoire (Ivory Coast): Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 27. Algeria: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 28. Nigeria: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 29. Egypt: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 30. Rest of Africa: Africa Fuel Dispenser Market – Revenue and Forecast to 2030 (US$ Million)

Figure 31. Company Positioning and Concentration

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Jan 2024

Industial Rainscreen Cladding Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Cladding Material (Ceramic, Timber, Composite Materials, Metals, and Others), Construction Type (New Construction and Renovation), and Geography

Jan 2024

Commercial Rainscreen Cladding Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Cladding Material (Ceramic, Timber, Composite Materials, Metals, and Others), Construction Type (New Construction and Renovation), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Jan 2024

Residential Rainscreen Cladding Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Cladding Material (Ceramic, Timber, Composite Materials, Metals, and Others), Construction Type (New Construction and Renovation), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Jan 2024

Ring Cross Belt Sorter Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Capacity (Below 5000 units/hr, 5000-15000 units/hr , and above 15000 units/hr), End-Use Industry (Airports, E-Commerce, Retail and Fashion, Food and Beverages, Manufacturing, Automotive, Logistics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Jan 2024

Linear Cross Belt Sorter Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Capacity (Below 5000 Units/Hr, 5000-15000 Units/Hr, and Above 15000 Units/Hr), End-Use Industry (Airports, E-Commerce, Retail, and Fashion; Food and Beverages; Manufacturing; Automotive; Logistics; and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Jan 2024

Coordinate Grinding Machinery Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage : By Industry (Medical, Mold and Die Industry, Aerospace and Defense, Automotive, Electronics and Electrics, Industrial Machinery and Others), Machine Technology (CNC or NC Machine and Conventional Machine), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Jan 2024

Cylindrical Grinding Machine Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage:By Type (External, Internal, and Others), Industry (Medical, Mold and Die Industry, Aerospace and Defense, Automotive, Electrics and Electronics, Industrial Machinery, and Others), Machine Technology (CNC or NC Machine and Conventional Machines), and Geography

Jan 2024

Aluminium Formwork Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Offering (Solution, Services), Type (Slab Formwork, Wall Formwork, Corner Formwork, Beam Formwork, Others), Application (Industrial, Commercial, Residential), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Get Free Sample For

Get Free Sample For