The air purification market is expected to grow from US$ 23,809.52 million in 2021 to US$ 73437.36 million by 2028. It is estimated to grow at a CAGR of 17.7% from 2021 to 2028.

The increase in airborne diseases owing to the rise in air pollution is a key factor attributed to the market's growth. Furthermore, growing awareness among the consumer about using air purifiers, a rise in disposable income, and an improved standard of living are the prominent factors boosting the market growth. The growing trend toward adopting portable and smart air purifiers is further propelling the market dynamics over the forecast period. The supportive government initiatives pertaining to emission standards, enforcement of workforce health and safety regulations, and amendment of existing air purity policies further strengthen the market dynamics for the air purification market. For instance, in August 2021, India had planned to re-establish the new national ambient air quality standards (NAAQS) in 2022.

The new standards include ultra-fine particulate matter constituents, which fall below PM2.5 under more pollutants. Also, in September 2021, The World Health Organization (WHO) introduced new Global Air Quality Guidelines (AQGs) to protect populations' health by reducing levels of key air pollutants that contribute to climate change. Thus, such initiatives further augment the need for air purification products, driving the market outlook over the forecast period.

The global demand for portable air filters is a key trend that is proliferating the market. Lifestyle change directly impacts people's health, augmenting the need for air purification products. Portable air purifiers employ a HEPA-13 filter, a carbon filter, and an antimicrobial coating on said filters to prevent bacterial growth. These filters are quite effective and trending in terms of adoption. The rising pollution level and an increasing number of airborne diseases have accelerated the demand for portable air filters. The Simon Fraser University researchers study finds that having a portable air cleaner in the home can reduce the negative impacts of air pollution on brain development in children. The ongoing investments in portable air filters are aiding the market to flourish.

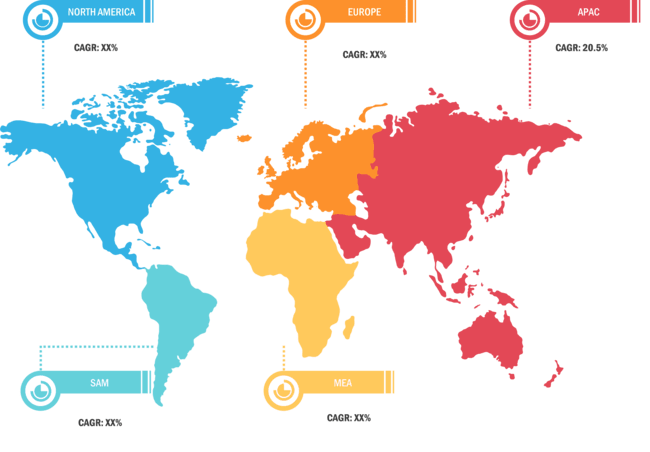

The air purification market study primarily focuses on two segments, namely, product type and application. The product type segment is further sub-segmented into Activated Carbon Filtration, High-efficiency Particulate Air (HEPA), Ionizer Purifiers, Ultraviolet Germicidal Irradiation (UVGI), and others. The application segment is further segmented into commercial, residential, and industrial. By geography, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Air Purification Market: Strategic Insights

Market Size Value in US$ 23,809.52 Million in 2021 Market Size Value by US$ 73437.36 Million by 2028 Growth rate CAGR of 17.7% from 2021 to 2028 Forecast Period 2021-2028 Base Year 2021

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Air Purification Market: Strategic Insights

| Market Size Value in | US$ 23,809.52 Million in 2021 |

| Market Size Value by | US$ 73437.36 Million by 2028 |

| Growth rate | CAGR of 17.7% from 2021 to 2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Impact of COVID-19 Pandemic on Air Purification Market

Denmark, Poland, and France are among the countries with high air pollution levels. The environment is positively impacted by government regulations in various European countries regarding developing environmentally friendly buildings in the residential and commercial sectors. The region is a major manufacturing and industrial center for industrial equipment, automotive, construction, energy, and power industries. However, due to business lockdowns, travel bans, and supply chain disruptions in 2020, some of these industries have declined in the region, significantly reducing air pollution. However, growing concerns about the safety of SARS-CoV-2 have increased the demand for air purifications.

Government-imposed lockdowns kept people indoors in 2020, boosting sales of residential air purifications. Various international air purification manufacturers see the pandemic as an opportunity. For example, South Korean air purification giant, Coway, has expanded into Europe due to the growing demand for air purifications in the region. The company took over the integration team from Serviceplan and the unit from the Plan.Net agency. Therefore, increasing air pollution and pollution caused by viruses and bacteria provide growth opportunities for the Europe air purification market players.

Market Insights - Air Purification Market

Rising Urbanization & Industrialization is propelling the market growth

The increase in urbanization would necessarily augment the need for large-scale air filter products in residential and commercial applications, which would help drive market growth over the forecast period. The countries in developing economies are predominantly experiencing the rise in urbanization at a faster pace. The rise in population is also aiding people in shifting toward urbanization, helping the market grow. As per the World Bank Group, the world's urban population will increase by 1.5 times to 6 billion in 2045. Also, according to the World Economic Forum, the world's population in cities is expected to rise from 55% in 2022 to 80% by 2050. The countries in Asia Pacific have unprecedented opportunities to catalyze economic development through increased urbanization in the coming years. The growing income and spending capacity of people in developing economies and increasing demand in various end-use sectors such as automotive, healthcare & medical, building & construction, manufacturing, and energy & utilities are the major factors driving the growth of the air purification market. The rise in urbanization includes expanding schools, colleges, hospitals, commercial complexes, residential houses, and other factors, wherein the need for clean air emerges, which helps drive the market. The increase in urbanization led to enormous indoor and outdoor air pollution, which is further escalating the demand for air purifiers

Product Type - based Insights

Based on Product Type, the air purification market is segmented into Activated Carbon Filtration, High-efficiency Particulate Air (HEPA), Ionizer Purifiers, Ultraviolet Germicidal Irradiation (UVGI), and others. The HEPA segment accounted for the largest market share in 2021 due to growing demand from various industries, including semiconductors and microelectronics.

Application - based Insights

Based on application, the air purification market is segmented into commercial, residential, and industrial. The commercial segment accounted for the largest market share in 2021.

Air Purification Market Report Scope

Players operating in the air purification market are mainly focused on the development of advanced and efficient products.

- In November 2019, Philips India, a subsidiary of Royal Philips, launched the air purifiers-800 series in the Indian market. This has led Philips to provide air purifiers across several price segments.

- In May 2021, Daikin launched Air Purifiers, portable room air purifiers designed to enhance the indoor air quality for the Middle East and Africa. Two models are introduced by the company, namely the premium and economy models.

List of Companies

- ACTIVEPURE TECHNOLOGIES LLC

- WHIRLPOOL CORPORATION

- CAMFIL

- DAIKIN INDUSTRIES, LTD.

- HONEYWELL INTERNATIONAL, INC.

- IQAIR NORTH AMERICA, INC.

- KONINKLIJKE PHILIPS N.V.

- LG ELECTRONICS, INC

- PANASONIC CORPORATION

- UNILEVER PLC.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The estimated market size for the air purification market was US$ 23,809.52 million in 2021.

The incremental growth of the air purification market is 17.7% during 2022 to 2028.

Rising adoption of portable residential air filter are the key trending factors driving the market growth.

Rising urbanization & industrialization and supportive government regulations and policies for improving the air quality are the key factors driving the air purification market over the forecast period.

The key companies operating in the air purification market that are profiled in the report include Whirlpool Corporation; Camfil; DAIKIN INDUSTRIES, Ltd.; Honeywell International Inc.; Koninklijke Philips N.V.; LG Electronics; Panasonic Corporation; Unilever PLC; ActivePure Technologies, LLC.; IQAir.

China, Germany, and South Korea are the prominent countries registered the highest growth rate of 23.1%, 22.6%, and 20.7% respectively, during the forecast period.

High-efficiency Particulate Air (HEPA) segment is holding larger market share during the forecast period.

Asia Pacific region is the fastest growing regional air purification market.

The global market size for air purification market will be US$ 73,437.36 million in 2028.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Global Air Purification Market – By Product Type

1.3.2 Global Air Purification Market – By Application

1.3.3 Global Air Purification Market – By Geography

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Air Purification Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 North America

4.2.2 Europe

4.2.3 APAC

4.2.4 MEA

4.2.5 SAM

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Air Purification Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Urbanization & Industrialization is propelling the market growth

5.1.2 Supportive Government Regulations and Policies for improving the Air Quality Drives the Market Growth

5.2 Key Market Restraints

5.2.1 Low cost substitutes may hamper the growth of the market

5.3 Key Market Opportunities

5.3.1 Rise in Sale of Air purification Products from Emerging Countries holds potential opportunity for growth of the market

5.4 Trends

5.4.1 Rising adoption of Portable Residential Air Filter

5.5 Impact analysis of Drivers and Restraints

6. Air Purification Market – Global Market Analysis

6.1 Air Purification Market Global Overview

6.2 Global Air Purification Market Forecast and Analysis

6.3 Market Positioning- Top Five Players

7. Air Purification Market Revenue and Forecast to 2028 – Product Type

7.1 Overview

7.2 Air Purification Market, By Product Type (2021 And 2028)

7.3 Air Purification Market, By Product Type (2021 And 2028)

7.4 Activated Carbon Filtration

7.4.1 Overview

7.4.2 Activated Carbon Filtration: Air Purification Market Revenue and Forecast To 2028 (US$ Million)

7.5 High-efficiency Particulate Air (HEPA)

7.5.1 Overview

7.5.2 High-efficiency Particulate Air (HEPA): Air Purification Market Revenue and Forecast To 2028 (US$ Million)

7.6 Ionizer Purifiers

7.6.1 Overview

7.6.2 Ionizer Purifiers: Air Purification Market Revenue and Forecast To 2028 (US$ Million)

7.7 Ultraviolet Germicidal Irradiation (UVGI)

7.7.1 Overview

7.7.2 Ultraviolet Germicidal Irradiation (UVGI): Air Purification Market Revenue and Forecast To 2028 (US$ Million)

7.8 Others

7.8.1 Overview

7.8.2 Others: Air Purification Market Revenue and Forecast To 2028 (US$ Million)

8. Global Air Purification Market Analysis – By Application

8.1 Overview

8.2 Air Purification Market, By Application (2021 And 2028)

8.3 Commercial

8.3.1 Overview

8.3.2 Commercial: Air Purification Market Revenue and Forecast To 2028 (US$ Million)

8.4 Residential

8.4.1 Overview

8.4.2 Residential: Air Purification Market Revenue and Forecast To 2028 (US$ Million)

8.5 Industrial

8.5.1 Overview

8.5.2 Industrial: Air Purification Market Revenue and Forecast To 2028 (US$ Million)

9. Air Purification Market – Geographic Analysis

9.1 Overview

9.2 North America: Air purification

9.2.1 North America: Air purification – Revenue, and Forecast to 2028 (US$ Million)

9.2.2 North America Air Purification Market Breakdown, By Product Type

9.2.3 North America Air Purification Market Breakdown, By Application

9.2.4 North America Air Purification Market Breakdown, by Country

9.2.4.1 US Air Purification Market, Revenue and Forecast to 2028

9.2.4.1.1 US Air Purification Market Breakdown, By Product Type

9.2.4.1.2 US Air Purification Market Breakdown, By Application

9.2.4.2 Canada Air Purification Market, Revenue and Forecast to 2028

9.2.4.2.1 Canada Air Purification Market Breakdown, By Product Type

9.2.4.2.2 Canada Air Purification Market Breakdown, By Application

9.2.4.3 Mexico Air Purification Market, Revenue and Forecast to 2028

9.2.4.3.1 Mexico Air Purification Market Breakdown, By Product Type

9.2.4.3.2 Mexico Air Purification Market Breakdown, By Application

9.3 Europe: Air Purification Market

9.3.1 Overview

9.3.2 Europe Air Purification Market Revenue and Forecast to 2028 (US$ million)

9.3.3 Europe Air Purification Market Breakdown, By Product Type

9.3.4 Europe Air Purification Market Breakdown, By Application

9.3.5 Europe Air Purification Market Breakdown, by Country

9.3.5.1 Germany Air Purification Market, Revenue and Forecast to 2028

9.3.5.1.1 Germany Air Purification Market Breakdown, By Product Type

9.3.5.1.2 Germany Air Purification Market Breakdown, By Application

9.3.5.2 France Air Purification Market, Revenue and Forecast to 2028

9.3.5.2.1 France Air Purification Market Breakdown, By Product Type

9.3.5.2.2 France Air Purification Market Breakdown, By Application

9.3.5.3 Italy Air Purification Market, Revenue and Forecast to 2028

9.3.5.3.1 Italy Air Purification Market Breakdown, By Product Type

9.3.5.3.2 Italy Air Purification Market Breakdown, By Application

9.3.5.4 UK Air Purification Market, Revenue and Forecast to 2028

9.3.5.4.1 UK Air Purification Market Breakdown, By Product Type

9.3.5.4.2 UK Air Purification Market Breakdown, By Application

9.3.5.5 Russia Air Purification Market, Revenue and Forecast to 2028

9.3.5.5.1 Russia Air Purification Market Breakdown, By Product Type

9.3.5.5.2 Russia Air Purification Market Breakdown, By Application

9.3.5.6 Rest of Europe Air Purification Market, Revenue and Forecast to 2028

9.3.5.6.1 Rest of Europe Air Purification Market Breakdown, By Product Type

9.3.5.6.2 Rest of Europe Air Purification Market Breakdown, By Application

9.4 APAC: Air Purification Market

9.4.1 Overview

9.4.2 APAC Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.4.3 APAC Air Purification Market Breakdown, By Product Type

9.4.4 APAC Air Purification Market Breakdown, By Application

9.4.5 APAC Air Purification Market Breakdown, by Country

9.4.5.1 Australia Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.4.5.1.1 Australia Air Purification Market Breakdown, By Product Type

9.4.5.1.2 Australia Air Purification Market Breakdown, By Application

9.4.5.2 China Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.4.5.2.1 China Air Purification Market Breakdown, By Product Type

9.4.5.2.2 China Air Purification Market Breakdown, By Application

9.4.5.3 India Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.4.5.3.1 India Air Purification Market Breakdown, By Product Type

9.4.5.3.2 India Air Purification Market Breakdown, By Application

9.4.5.4 Japan Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.4.5.4.1 Japan Air Purification Market Breakdown, By Product Type

9.4.5.4.2 Japan Air Purification Market Breakdown, By Application

9.4.5.5 South Korea Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.4.5.5.1 South Korea Air Purification Market Breakdown, By Product Type

9.4.5.5.2 South Korea Air Purification Market Breakdown, By Application

9.4.5.6 Rest of APAC Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.4.5.6.1 Rest of APAC Air Purification Market Breakdown, By Product Type

9.4.5.6.2 Rest of APAC Air Purification Market Breakdown, By Application

9.5 MEA: Air Purification Market

9.5.1 Overview

9.5.2 MEA Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.5.3 MEA Air Purification Market Breakdown, By Product Type

9.5.4 MEA Air Purification Market Breakdown, By Application

9.5.5 MEA Air Purification Market Breakdown, By Country

9.5.5.1 Saudi Arabia Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.5.5.1.1 Saudi Arabia Air Purification Market Breakdown, By Product Type

9.5.5.1.2 Saudi Arabia Air Purification Market Breakdown, By Application

9.5.5.2 UAE Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.5.5.2.1 UAE Air Purification Market Breakdown, By Product Type

9.5.5.2.2 UAE Air Purification Market Breakdown, By Application

9.5.5.3 South Africa Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.5.5.3.1 South Africa Air Purification Market Breakdown, By Product Type

9.5.5.3.2 South Africa Air Purification Market Breakdown, By Application

9.5.5.4 Rest of MEA Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.5.5.4.1 Rest of MEA Air Purification Market Breakdown, By Product Type

9.5.5.4.2 Rest of MEA Air Purification Market Breakdown, By Application

9.6 SAM: Air Purification Market

9.6.1 Overview

9.6.2 SAM Air Purification Market, Revenue and Forecast to 2028 (US$ million)

9.6.3 SAM Air Purification Market Breakdown, By Product Type

9.6.4 SAM Air Purification Market Breakdown, By Application

9.6.5 SAM Air Purification Market Breakdown, by Country

9.6.5.1 Brazil Air Purification Market, Revenue and Forecast to 2028

9.6.5.1.1 Brazil Air Purification Market Breakdown, By Product Type

9.6.5.1.2 Brazil Air Purification Market Breakdown, By Application

9.6.5.2 Argentina Air Purification Market, Revenue and Forecast to 2028

9.6.5.2.1 Argentina Air Purification Market Breakdown, By Product Type

9.6.5.2.2 Argentina Air Purification Market Breakdown, By Application

9.6.5.3 Rest of SAM Air Purification Market, Revenue and Forecast to 2028

9.6.5.3.1 Rest of SAM Air Purification Market Breakdown, By Product Type

9.6.5.3.2 Rest of SAM Air Purification Market Breakdown, By Application

10. Impact of COVID-19 Pandemic on Air Purification Market

10.1 Overview

10.2 North America: Impact Assessment of COVID-19 Pandemic

10.3 Europe: Impact Assessment of COVID-19 Pandemic

10.4 APAC: Impact Assessment of COVID-19 Pandemic

10.5 MEA: Impact Assessment of COVID-19 Pandemic

10.6 SAM: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Market Initiative

11.2 New Development

12. Company Profiles

12.1 Whirlpool Corporation

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Camfil

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 DAIKIN INDUSTRIES, Ltd.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Honeywell International Inc.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Koninklijke Philips N.V.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 LG Electronics

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Panasonic Corporation

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Unilever PLC

12.8.1 Business Description

12.8.2 Products and Services

12.8.3 Financial Overview

12.8.4 SWOT Analysis

12.8.5 Key Developments

12.9 ActivePure Technologies, LLC.

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 IQAir

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. Global Air Purification Market, Revenue and Forecast, 2019–2028 (US$ Million)

Table 2. North America Air Purification Market, Revenue and Forecast To 2028 – By Product Type (US$ million)

Table 3. North America Air Purification Market, Revenue and Forecast To 2028 – By Application (US$ million)

Table 4. North America Air Purification Market, Revenue and Forecast To 2028 – By Country (US$ million)

Table 5. US Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 6. US Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 7. Canada Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 8. Canada Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 9. Mexico Air Purification Market Breakdown, By Product Type

Table 10. Mexico Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 11. Europe Air Purification Market, Revenue and Forecast To 2028 – By Product Type (US$ million)

Table 12. Europe Air Purification Market, Revenue and Forecast To 2028 – By Application (US$ million)

Table 13. Europe Air Purification Market, Revenue and Forecast To 2028 – By Country (US$ million)

Table 14. Germany Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 15. Germany Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 16. France Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 17. France Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 18. Italy Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 19. Italy Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 20. UK Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 21. UK Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 22. Russia Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 23. Russia Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 24. Rest of Europe Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 25. Rest of Europe Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 26. APAC Air Purification Market, Revenue and Forecast To 2028 – By Product Type (US$ million)

Table 27. APAC Air Purification Market, Revenue and Forecast To 2028 – By Application (US$ million)

Table 28. APAC Air Purification Market, Revenue and Forecast To 2028 – By Country (US$ million)

Table 29. Australia Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 30. Australia Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 31. China Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 32. China Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 33. India Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 34. India Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 35. Japan Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 36. Japan Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 37. South Korea Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 38. South Korea Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 39. Rest of APAC Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 40. Rest of APAC Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 41. MEA Air Purification Market, Revenue and Forecast To 2028 – By Product Type (US$ million)

Table 42. MEA Air Purification Market, Revenue and Forecast To 2028 – By Application (US$ million)

Table 43. MEA Air Purification Market, Revenue and Forecast to 2028 – By Country (US$ million)

Table 44. Saudi Arabia Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 45. Saudi Arabia Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 46. UAE Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 47. UAE Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 48. South Africa Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 49. South Africa Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 50. Rest of MEA Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 51. Rest of MEA Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 52. SAM Air Purification Market, Revenue and Forecast To 2028 – By Product Type (US$ million)

Table 53. SAM Air Purification Market, Revenue and Forecast To 2028 – By Application (US$ million)

Table 54. SAM Air Purification Market, Revenue and Forecast To 2028 – By Country (US$ million)

Table 55. Brazil Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 56. Brazil Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 57. Argentina Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 58. Argentina Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 59. Rest of SAM Air Purification Market, Revenue and Forecast to 2028 – By Product Type (US$ million)

Table 60. Rest of SAM Air Purification Market, Revenue and Forecast to 2028 – By Application (US$ million)

Table 61. List of Abbreviation

LIST OF FIGURES

Figure 1. Air Purification Market Segmentation

Figure 2. Air Purification Market Segmentation – Geography

Figure 3. Air Purification Market Overview

Figure 4. Air Purification Market, By Product Type

Figure 5. Air Purification Market, By Application

Figure 6. Air Purification Market, By Region

Figure 7. North America: PEST Analysis

Figure 8. Europe: PEST Analysis

Figure 9. APAC: PEST Analysis

Figure 10. MEA: PEST Analysis

Figure 11. SAM: PEST Analysis

Figure 12. Air Purification Market Ecosystem Analysis

Figure 13. Expert Opinion

Figure 14. Air Purification Market: Impact Analysis of Drivers and Restraints

Figure 15. Geographic Overview of Air Purification Market

Figure 16. Global Air Purification Market, Forecast and Analysis (US$ Million)

Figure 17. Market Positioning- Top Five Players

Figure 18. Air Purification Market, By Product Type (2021 and 2028)

Figure 19. Air Purification Market, By Product Type (2021 and 2028)

Figure 20. Activated Carbon Filtration: Air Purification Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. High-efficiency Particulate Air (HEPA): Air Purification Market Revenue and Forecast to 2028 (US$ Million)

Figure 22. Ionizer Purifiers: Air Purification Market Revenue and Forecast to 2028 (US$ Million)

Figure 23. Ultraviolet Germicidal Irradiation (UVGI): Air Purification Market Revenue and Forecast to 2028 (US$ Million)

Figure 24. Others: Air Purification Market Revenue and Forecast to 2028 (US$ Million)

Figure 25. Air Purification Market, By Application (2021 and 2028)

Figure 26. Commercial: Air Purification Market Revenue and Forecast to 2028 (US$ Million)

Figure 27. Residential: Air Purification Market Revenue and Forecast to 2028 (US$ Million)

Figure 28. Industrial: Air Purification Market Revenue and Forecast to 2028 (US$ Million)

Figure 29. Global Air Purification Market Revenue Share, By Region (2021 & 2028)

Figure 30. North America Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 31. North America Air Purification Market Breakdown, By Product Type, 2021 & 2028 (%)

Figure 32. North America Air Purification Market Breakdown, By Application, 2021 & 2028 (%)

Figure 33. North America Air Purification Market Breakdown, by Country, 2021 & 2028 (%)

Figure 34. US Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 35. Canada Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 36. Mexico Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 37. Europe Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 38. Europe Air Purification Market Breakdown, By Product Type, 2021 & 2028 (%)

Figure 39. Europe Air Purification Market Breakdown, By Application, 2021 & 2028 (%)

Figure 40. Europe Air Purification Market Breakdown, by Country, 2018 & 2027(%)

Figure 41. Germany Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 42. France Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 43. Italy Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 44. UK Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 45. Russia Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 46. Rest of Europe Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 47. APAC Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 48. APAC Air Purification Market Breakdown, By Product Type, 2021 & 2028 (%)

Figure 49. APAC Air Purification Market Breakdown, By Application, 2021 & 2028 (%)

Figure 50. APAC Air Purification Market Breakdown, by Country, 2021 & 2028 (%)

Figure 51. Australia Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 52. China Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 53. India Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 54. Japan Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 55. South Korea Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 56. Rest of APAC Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 57. MEA Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 58. MEA Air Purification Market Breakdown, By Product Type, 2021 & 2028 (%)

Figure 59. MEA Air Purification Market Breakdown, By Application, 2021 & 2028 (%)

Figure 60. MEA Air Purification Market Breakdown, By Country, 2021 & 2028 (%)

Figure 61. Saudi Arabia Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 62. UAE Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 63. South Africa Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 64. Rest of MEA Air Purification Market, Revenue and Forecast To 2028 (US$ million)

Figure 65. SAM Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 66. SAM Air Purification Market Breakdown, By Product Type, 2021 & 2028 (%)

Figure 67. SAM Air Purification Market Breakdown, By Application, 2021 & 2028 (%)

Figure 68. SAM Air Purification Market Breakdown, by Country, 2021 & 2028 (%)

Figure 69. Brazil Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 70. Argentina Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 71. Rest of SAM Air Purification Market, Revenue and Forecast to 2028 (US$ million)

Figure 72. Impact of COVID-19 Pandemic on North American Country Markets

Figure 73. Impact of COVID-19 Pandemic on European Country Markets

Figure 74. Impact of COVID-19 Pandemic on APAC Country Markets

Figure 75. Impact of COVID-19 Pandemic on MEA Country Markets

Figure 76. Impact of COVID-19 Pandemic on SAM Country Markets

The List of Companies - Air Purification Market

- Whirlpool Corporation

- Camfil

- DAIKIN INDUSTRIES, Ltd.

- Honeywell International Inc.

- Koninklijke Philips N.V.

- LG Electronics

- Panasonic Corporation

- Unilever PLC

- ActivePure Technologies, LLC.

- IQAir

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Air Purification Market

Sep 2022

High Heat Bearing Market

Size and Forecast (2021–2031), Country Share, Trend, and Growth Opportunity Analysis Report Coverage: by Type [Plain Bearings (Spherical Plain Bearings, Rod Ends, and Bushings), Roller Bearings, and Deep Groove Ball Bearings], Industry (Metal Processing, Aerospace, Defense, Food and Beverages, Energy and Power, Manufacturing, Automotive, and Others), and Geography

Sep 2022

Electromechanical Joining Servo Press Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Stroke (Upto 100 mm, 101-200 mm, 201-400 mm, 401-600 mm and Above 601 mm), Application (Automotive Industry, Electric and Electronic Industry, Medical Device Manufacturing and Others), and Geography

Sep 2022

Indexable Inserts Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Insert Shape (Round, Square, Triangle, Rhombic, and Others), Application (Milling, Drilling, Turning, Threading, and Others), Size (Up to 10 mm, 10-20 mm, and Above 20 mm), Insert Material (Carbide, Ceramic and Composites, PCD Inserts, and Others), Industry (Aerospace and Defense, General Industry, Oil and Gas, Power Generation, Automotive, Electric and Electronics, Medical, and Others), and Geography

Sep 2022

End Mills Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material (Carbide, Steel, and Others), Type (Square Nose, Ball Nose, and Others), Diameter Size (Upto 4 mm, 4–6 mm, 6–8 mm, 8–12 mm, and Above 12 mm), End-Use Industry (Automotive, Heavy Machinery, Semiconductor and Electronics, Medical and Healthcare, Energy, Aerospace and Others), and Geography

Sep 2022

Plain Bearings Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Spherical Bearings (Radial, Angular, and Thrust), Rod Ends (Female Thread, Male Thread, and Welding Shank), and Bushings], Application (Agriculture, Construction, Industrial Vehicles, Automotive and Transportation, Aerospace and Defense, Energy and Power, and Others), and Geography

Sep 2022

Thermostatic Mixers Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Mounting Type (Deck Mount and Wall Mount), Application (Residential and Commercial), Design Type (Concealed and Exposed), and Geography

Sep 2022

Sep 2022

Trenchless Pipe Relining Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage - by Method (Cured in Place Pipe, Pull-in-Place, Pipe Bursting, and Internal Pipe Coating), End User (Residential, Commercial, Industrial, and Municipal), and Diameter (Below DN 50, DN 51–DN 150, DN 151–DN 250, and Above DN 251), and Geography

Get Free Sample For

Get Free Sample For