The Americas disposable surgical gloves market size was valued at US$ 1,201.54 million in 2022 and is projected to reach US$ 2,187.30 million by 2030; it is estimated to record a CAGR of 7.8% from 2022 to 2030.

Market Insights and Analyst View:

The increased demand for surgical gloves has led to the Americas disposable surgical gloves market growth. The demand was significantly raised during the COVID-19 pandemic and has continued since the outbreak. A significant rise in the sales of surgical gloves across the region was observed post-pandemic. In addition, the development in the healthcare industry in the Americas has widely contributed to the growth of the Americas disposable surgical gloves market. Similarly, technological developments have led to the introduction of nitrile gloves, which have positively impacted the Americas disposable surgical gloves market growth. Nitrile gloves show excellent chemical-resistant properties and are completely latex-free. Thus, nitrile gloves gained popularity during the pandemic, which increased the demand for disposable surgical gloves in the region.

Growth Drivers:

The proper treatment of injuries, infections, and diseases requires surgical care. Hence, the number of surgical procedures, including cataract surgery, cesarean section, coronary artery bypass, and hysterectomy, among others, is growing rapidly. Furthermore, hip and knee replacement and obstetric surgeries are among the most common conditions that require surgical procedures for treatment. As per a study titled “Trauma of major surgery: A global problem that is not going away,” published in September 2020, ~40–50 million major surgeries are performed each year in the US. Per the article “The 10 Most Common Surgeries in the US,” every year in the country, ~3 million people have cataract surgery, 1.3 million women give birth by Caesarean section, and over a million Americans have joint replacement surgery—including 720,000 knee replacement surgeries and 330,000 hip replacement surgeries. In addition, 670,000 people have certain types of broken bone surgeries; 454,000 people undergo stent surgeries; 500,000 women have hysterectomies; and 395,000 people undergo coronary artery bypass graft operations in the US yearly.

As per the Global Health Intelligence analysis, ~18.82 million surgical procedures were performed in 2020 in Brazil. According to SurgiScope, in Brazil, the top 10 procedures most performed in 2021 include small surgical procedures and surgery on the skin, subcutaneous tissue, and mucous membranes, accounting for ~10.32 million surgical procedures, ~1.55 million musculoskeletal system surgeries, ~1.23 million obstetric surgeries, and ~0.66 million circulatory system surgeries.

Gloves are personal protective wear that creates a barrier between germs and the human body. Disposable gloves are used during surgeries to reduce the risk of blood and other body fluid contamination as well as the risk of spreading germs to the atmosphere. The disposable surgical gloves block and prevent the transmission of disease-causing germs/contamination between surgeons and patients during surgical procedures in hospitals. Therefore, gloves play a crucial role in avoiding infections among patients and healthcare workers and are widely used during surgical procedures. Thus, an increasing number of surgical procedures drive the Americas disposable surgical gloves market.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Americas Disposable Surgical Gloves Market: Strategic Insights

Market Size Value in US$ 1,201.54 million in 2022 Market Size Value by US$ 2,187.30 million by 2030 Growth rate CAGR of 7.8% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Americas Disposable Surgical Gloves Market: Strategic Insights

| Market Size Value in | US$ 1,201.54 million in 2022 |

| Market Size Value by | US$ 2,187.30 million by 2030 |

| Growth rate | CAGR of 7.8% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The Americas disposable surgical gloves market is segmented on the basis of product type, form, and end user. Based on product type, the Americas disposable surgical gloves market is classified into latex, nitrile, vinyl, neoprene, polyisoprene, and others. Based on the form, the Americas disposable surgical gloves market is divided into powder and powder-free. Based on end user, the Americas disposable surgical gloves market is classified into hospitals and clinics, ambulatory surgical centers, and others. Geographically, the Americas disposable surgical gloves market is segmented into the US, Canada, Brazil, Mexico, Argentina, and the Rest of Americas.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

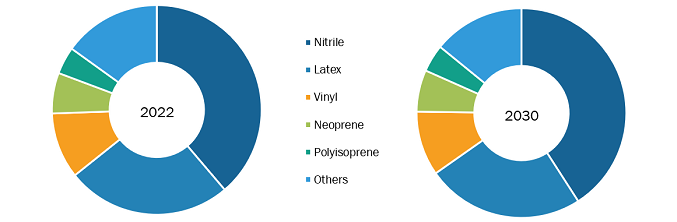

The Americas disposable surgical gloves market, by product type, is categorized into latex, nitrile, vinyl, neoprene, polyisoprene, and others. The nitrile segment held the largest market share in 2022 and is anticipated to register the highest CAGR during the forecast period. Nitrile gloves are made from synthetic rubber latex derived from acrylonitrile butadiene copolymer. The nitrile gloves are accepted as a substitute for natural latex rubber (latex-free) as they duplicate the properties of natural rubber latex and prevent allergies. The nitrile gloves are comfortable to wear, which is the most significant advantage over natural gloves. Also, as nitrile is a flexible rubber, it allows wearers to experience optimal tactile sensitivity. In addition, nitrile gloves conform to hands as they are warmed by body heat, offering excellent dexterity, which is important for medical professionals. It prevents type IV allergy and is suitable for people with excessive sweating. Nitrile gloves are resistant to friction, wear, and tear and offer excellent strength and chemical protection compared to other gloves. These gloves are three to five times more puncture-resistant than latex and more elastic than vinyl. The nitrile gloves are suitable for instrument management, medical explorations, and contact with cytostatic products. Due to its temperature tolerance, durability, and strength, it is an exceptional product type for manufacturing surgical gloves, specifically for people with latex allergies.

Nitrile surgical gloves are preferred in high-risk settings such as dealing with patients having infectious diseases or during surgeries involving blood and other bodily fluids. Considering the high risk associated with surgical procedures and operating room settings, surgical gloves are tested thoroughly to meet the guidelines specified by the FDA. Nitrile gloves are preferred due to superior barrier protection and durability. As nitrile gloves are latex-free, this promotes acceptance among individuals sensitive to latex or natural rubber and further decreases the odds of allergic reactions. Dentists prefer this product type due to its strength and durability, especially with the sharp tools they use. Dentists and hygienists can maintain a safe barrier between themselves and their patients with durable nitrile gloves. In addition, nitrile surgical gloves have a longer shelf life than latex and vinyl varieties, allowing hospitals, dental facilities, healthcare facilities, and other organizations requiring surgical gloves to stock PPE, improving cost-effectiveness. Thus, the market for the nitrile gloves segment is expected to grow significantly during the forecast period.

Americas Disposable Surgical Gloves Market, by Product Type – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Based on form, the Americas disposable surgical gloves market is divided into powder and powder-free. The powder-free segment held a larger market share in 2022 and is expected to register a higher CAGR during the forecast period. Powder-free disposable gloves offer multiple advantages as they contain fewer chemicals and endotoxins. These gloves are less allergenic, less drying, and more skin tolerant. Latex powder-free surgical gloves offer extraordinary dexterity and improve comfort and flexibility. Powder-free gloves have been developed to reduce the risk of latex allergy and sensitivity for users and patients. The latex protein content in these gloves is minimal, thereby reducing skin allergies. These gloves minimize the transfer of latex protein particles to the skin and airways due to the chlorine-washing process, while the low-protein varieties further reduce the risk. Therefore, for healthcare facilities where latex is still the most appropriate glove product type, powder-free, low-protein latex gloves must be used. Ansell and Cardinal Health are among the players offering powder-free disposable gloves in the market.

Based on end user, the Americas disposable surgical gloves market is segmented into hospitals and clinics, ambulatory surgical centers, and others. The hospitals and clinics segment held the largest market share in 2022 and is anticipated to register the highest CAGR during the forecast period. The hospitals and clinics segment is expected to hold a major share in the disposable surgical gloves market as these facilities are the primary healthcare centers for people seeking diagnosis and treatment. The requirement for surgical gloves in hospitals and clinics is increasing due to the rise in hospital visits and readmissions because of chronic diseases. Wearing gloves helps protect patients and healthcare professionals from healthcare-associated infections. The demand for surgical gloves is also influenced by growing awareness regarding the safety and health measures associated with treating patients and emergency response incidents. The risks associated with the transmission of bloodborne pathogens and viruses have led to increased adoption of surgical gloves in these facilities. The high patient footfall and the need to maintain sterile conditions during surgical procedures necessitate the use of disposable surgical gloves. The emphasis on infection control and preventing cross-contamination in hospital environments also fuels the demand for these medical gloves.

In addition, developing healthcare infrastructure in emerging markets, rising healthcare expenditure, lucrative reimbursement policies, and increasing emphasis on better patient outcomes contribute to the growth of the hospital and clinics segment.

Country Analysis:

Based on country, the Americas disposable surgical gloves market is divided into the US, Canada, Brazil, Mexico, Argentina, and the Rest of Americas. Among the analyzed countries, the US is the largest as well as the fastest growing country in the region considering the disposable surgical gloves market. There has been a tremendous increase in the demand for disposable surgical gloves in the healthcare sector due to the rising prevalence of infectious diseases, such as COVID-19, along with a rise in the number of surgical procedures in the country. Per the Healthgrades Marketplace, LLC article titled “The 10 Most Common Surgeries in the US,” each year in the country, approximately 500,000 angioplasties; 460,000 cholecystectomies; and 395,000 coronary artery bypass grafts are performed. Each procedure necessitates the usage of disposable gloves while performing surgeries.

In addition, the disposable surgical gloves market growth in the US is driven by a rise in medical testing, increased awareness of healthcare-acquired diseases, and growing government efforts to increase the production of gloves. For instance, in May 2021, the Department of Defense, in coordination with the Department of Health and Human Services, awarded US$ 226.3 million in contracts and contract modifications to several glove manufacturers to expand the capacity of domestic production of nitrile gloves.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the Americas disposable surgical gloves market are listed below:

- In May 2023, Ansell received the highest recyclability certification from Institut Cyclos-HTP (CHI), a globally recognized organization that assesses and certifies the recyclability of packaging and goods, confirming a AAA rating for the SMART Pack packaging for surgical gloves. SMART Pack dispenser boxes are up to 50% smaller than key competitors in the market, making them a great space saver on hospital shelves.

- In September 2022, Cardinal Health built a second state-of-the-art surgical glove manufacturing plant in Rayong, Thailand, with a ceremonial blessing and groundbreaking event at the new site. The new facility is 720,000 square feet and expanded Cardinal Health’s surgical glove manufacturing footprint in Rayong to more than 1.3 million square feet of manufacturing space. The company’s manufacturing investment in Rayong supports current and future state customer inventory needs for the Protexis surgical glove portfolio.

- In October 2020, Mölnlycke globally launched its Biogel PI UltraTouch S surgical glove, which is an innovative product that addresses the problem of allergic contact dermatitis among surgical teams. The FDA has approved the Biogel PI UltraTouch S surgical gloves to reduce the potential for sensitizing users to chemical additives. Allergic reactions are no longer a barrier to the surgical gloves' performance, allowing healthcare professionals to focus on elective care procedures.

Competitive Landscape and Key Companies:

Ansell Ltd, Ambiderm SA de CV, B. Braun SE, Degasa SA de CV, Cardinal Health Inc, Top Glove Corp Bhd, Medline Industries LP, Molnlycke Health Care AB, Sterimed Medical Devices Pvt Ltd, and Henry Schein Inc are the prominent disposable surgical gloves manufacturer in the market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Form, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Americas disposable surgical gloves market was analyzed based on countries such as US, Canada, Brazil, Mexico, Argentina, and the Rest of SCAM. The US is estimated to be the largest among the above-listed countries. The market growth in the country is attributed to the demand for disposable surgical gloves due to the increasing number of surgical procedures.

The Americas disposable surgical gloves market is segmented on the basis of product type, form, and end user. The market is segmented based on product type: nitrile, latex, vinyl, neoprene, polyisoprene, and others. On the basis of form, the market is classified into powder and powder-free. Based on end users, the market is segmented into hospitals and clinics, ambulatory surgical centers, and others.

The Americas disposable surgical gloves market is expected to grow at a compound annual growth rate of 7.8% from 2022 to 2030 to reach US$ 2,187.30 million by 2030.

Growing consumption and distribution of disposable surgical gloves and increasing number of surgical procedures are driving the growth of the Americas disposable surgical gloves market. However, latex allergy and high waste production hinders the market growth.

Companies operating in the market are Ansell Ltd, Ambiderm SA de CV, B. Braun SE, Degasa SA de CV, Cardinal Health Inc, Top Glove Corp Bhd, Medline Industries LP, Molnlycke Health Care AB, Sterimed Medical Devices Pvt Ltd, and Henry Schein Inc.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Americas Disposable Surgical Gloves Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 Americas PEST Analysis

5. Americas Disposable Surgical Gloves Market - Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Increasing Number of Surgical Procedures

5.1.2 Growing Consumption and Distribution of Disposable Surgical Gloves

5.2 Key Market Restraints

5.2.1 Latex Allergy and High Waste Production

5.3 Key Market Opportunities

5.3.1 Rising Adoption of Powder-free Gloves

5.4 Key Future Trends

5.4.1 Growing Medical Tourism

5.5 Impact Analysis:

6. Americas Disposable Surgical Gloves Market - Regional Market Analysis

6.1 Americas Disposable Surgical Gloves Market Revenue (US$ Mn), 2022 – 2030

7. Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 – by Product Type

7.1 Overview

7.2 Americas Disposable Surgical Gloves Market Revenue Share, by Product Type 2022 & 2030 (%)

7.3 Latex

7.3.1 Overview

7.3.2 Latex: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

7.3.3 Americas Disposable Surgical Gloves Market, For Latex by Product Type, 2020 - 2030 (US$ Million) – 2020 - 2030 (US$ Million)

7.4 Nitrile

7.4.1 Overview

7.4.2 Nitrile: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

7.5 Vinyl

7.5.1 Overview

7.5.2 Vinyl: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

7.5.3 Americas Disposable Surgical Gloves Market, For Vinyl by Product Type, 2020 - 2030 (US$ Million) – 2020 - 2030 (US$ Million)

7.6 Neoprene

7.6.1 Overview

7.6.2 Neoprene: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

7.6.3 Americas Disposable Surgical Gloves Market, by Neoprene – 2020 - 2030 (US$ Million)

7.7 Polyisoprene

7.7.1 Overview

7.7.2 Polyisoprene: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

7.8 Others

7.8.1 Overview

7.8.2 Others: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

8. Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 – by Form

8.1 Overview

8.2 Americas Disposable Surgical Gloves Market Revenue Share, by Form 2022 & 2030 (%)

8.3 Powder

8.3.1 Overview

8.3.2 Powder: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Powder-Free

8.4.1 Overview

8.4.2 Powder-Free: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

9. Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 – by End User

9.1 Overview

9.2 Americas Disposable Surgical Gloves Market Revenue Share, by End User 2022 & 2030 (%)

9.3 Hospitals and Clinics

9.3.1 Overview

9.3.2 Hospitals and Clinics: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Ambulatory Surgical Centers

9.4.1 Overview

9.4.2 Ambulatory Surgical Centers: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Others

9.5.1 Overview

9.5.2 Others: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

10. Americas Disposable Surgical Gloves Market - Regional Analysis

10.1 Americas Disposable Surgical Gloves Market, Revenue and Forecast To 2030

10.1.1 Overview

10.1.2 Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.3 Americas: Americas Disposable Surgical Gloves Market, by Product Type, 2020–2030 (US$ Million)

10.1.3.1 Americas: Americas Disposable Surgical Gloves Market, For Latex by Product Type, 2020 - 2030 (US$ Million)

10.1.3.2 Americas: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type, 2020 - 2030 (US$ Million)

10.1.3.3 Americas: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type, 2020 - 2030 (US$ Million)

10.1.4 Americas: Americas Disposable Surgical Gloves Market, by Form, 2020–2030 (US$ Million)

10.1.5 Americas: Americas Disposable Surgical Gloves Market, by End User, 2020–2030 (US$ Million)

10.1.6 Americas: Americas Disposable Surgical Gloves Market, by Country

10.1.6.1 US

10.1.6.1.1 Overview

10.1.6.2 US: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.2.1 US: Americas Disposable Surgical Gloves Market, by Product Type, 2020–2030 (US$ Million)

10.1.6.2.1.1 US: Americas Disposable Surgical Gloves Market, For Latex by Product Type, 2020 - 2030 (US$ Million)

10.1.6.2.1.2 US: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type, 2020 - 2030 (US$ Million)

10.1.6.2.1.3 US: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type, 2020 - 2030 (US$ Million)

10.1.6.2.2 US: Americas Disposable Surgical Gloves Market, by Form, 2020–2030 (US$ Million)

10.1.6.2.3 US: Americas Disposable Surgical Gloves Market, by End User, 2020–2030 (US$ Million)

10.1.6.3 Canada

10.1.6.3.1 Overview

10.1.6.3.2 Canada: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.3.3 Canada: Americas Disposable Surgical Gloves Market, by Product Type, 2020–2030 (US$ Million)

10.1.6.3.3.1 Canada: Americas Disposable Surgical Gloves Market, For Latex by Product Type, 2020 - 2030 (US$ Million)

10.1.6.3.3.2 Canada: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type, 2020 - 2030 (US$ Million)

10.1.6.3.3.3 Canada: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type, 2020 - 2030 (US$ Million)

10.1.6.3.4 Canada: Americas Disposable Surgical Gloves Market, by Form, 2020–2030 (US$ Million)

10.1.6.3.5 Canada: Americas Disposable Surgical Gloves Market, by End User, 2020–2030 (US$ Million)

10.1.6.4 Brazil

10.1.6.4.1 Overview

10.1.6.4.2 Brazil: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.4.3 Brazil: Americas Disposable Surgical Gloves Market, by Product Type, 2020–2030 (US$ Million)

10.1.6.4.3.1 Brazil: Americas Disposable Surgical Gloves Market, For Latex by Product Type, 2020 - 2030 (US$ Million)

10.1.6.4.3.2 Brazil: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type, 2020 - 2030 (US$ Million)

10.1.6.4.3.3 Brazil: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type, 2020 - 2030 (US$ Million)

10.1.6.4.4 Brazil: Americas Disposable Surgical Gloves Market, by Form, 2020–2030 (US$ Million)

10.1.6.4.5 Brazil: Americas Disposable Surgical Gloves Market, by End User, 2020–2030 (US$ Million)

10.1.6.5 Mexico

10.1.6.5.1 Overview

10.1.6.5.2 Mexico: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.5.3 Mexico: Americas Disposable Surgical Gloves Market, by Product Type, 2020–2030 (US$ Million)

10.1.6.5.3.1 Mexico: Americas Disposable Surgical Gloves Market, For Latex by Product Type, 2020 - 2030 (US$ Million)

10.1.6.5.3.2 Mexico: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type, 2020 - 2030 (US$ Million)

10.1.6.5.3.3 Mexico: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type, 2020 - 2030 (US$ Million)

10.1.6.5.4 Mexico: Americas Disposable Surgical Gloves Market, by Form, 2020–2030 (US$ Million)

10.1.6.5.5 Mexico: Americas Disposable Surgical Gloves Market, by End User, 2020–2030 (US$ Million)

10.1.6.6 Argentina

10.1.6.6.1 Overview

10.1.6.6.2 Argentina: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.6.3 Argentina: Americas Disposable Surgical Gloves Market, by Product Type, 2020–2030 (US$ Million)

10.1.6.6.3.1 Argentina: Americas Disposable Surgical Gloves Market, For Latex by Product Type, 2020 - 2030 (US$ Million)

10.1.6.6.3.2 Argentina: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type, 2020 - 2030 (US$ Million)

10.1.6.6.3.3 Argentina: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type, 2020 - 2030 (US$ Million)

10.1.6.6.4 Argentina: Americas Disposable Surgical Gloves Market, by Form, 2020–2030 (US$ Million)

10.1.6.6.5 Argentina: Americas Disposable Surgical Gloves Market, by End User, 2020–2030 (US$ Million)

10.1.6.7 Rest of Americas

10.1.6.7.1 Overview

10.1.6.7.2 Rest of Americas: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.7.3 Rest of Americas: Americas Disposable Surgical Gloves Market, by Product Type, 2020–2030 (US$ Million)

10.1.6.7.3.1 Rest of Americas: Americas Disposable Surgical Gloves Market, For Latex by Product Type, 2020 - 2030 (US$ Million)

10.1.6.7.3.2 Rest of Americas: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type, 2020 - 2030 (US$ Million)

10.1.6.7.3.3 Rest of Americas: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type, 2020 - 2030 (US$ Million)

10.1.6.7.4 Rest of Americas: Americas Disposable Surgical Gloves Market, by Form, 2020–2030 (US$ Million)

10.1.6.7.5 Rest of Americas: Americas Disposable Surgical Gloves Market, by End User, 2020–2030 (US$ Million)

11. Americas Disposable Surgical Gloves Market – Industry Landscape

11.1 Overview

11.2 Growth Strategies

11.2.1 Overview

12. Company Profiles

12.1 Ansell Ltd

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Ambiderm SA de CV

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 B. Braun SE

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Degasa SA de CV

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Cardinal Health Inc

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Top Glove Corp Bhd

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Medline Industries LP

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Molnlycke Health Care AB

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Sterimed Medical Devices Pvt Ltd

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Henry Schein Inc

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About Us

13.2 Glossary of Terms

List of Tables

Table 1. Americas Disposable Surgical Gloves Market Segmentation

Table 2. Americas Disposable Surgical Gloves Market, For Latex by Product Type, 2020 - 2030 (US$ Million) – Revenue and Forecast to 2030 (US$ Million)

Table 3. Americas Disposable Surgical Gloves Market, For Vinyl by Product Type, 2020 - 2030 (US$ Million) – Revenue and Forecast to 2030 (US$ Million)

Table 4. Americas Disposable Surgical Gloves Market, by Neoprene – Revenue and Forecast to 2030 (US$ Million)

Table 5. Americas: Americas Disposable Surgical Gloves Market, by Product type – Revenue and Forecast to 2030 (US$ Million)

Table 6. Americas: Americas Disposable Surgical Gloves Market, For Latex by Product Type – Revenue and Forecast to 2030 (US$ Million)

Table 7. Americas: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 8. Americas: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 9. Americas: Americas Disposable Surgical Gloves Market, by Form – Revenue and Forecast to 2030 (US$ Million))

Table 10. Americas: Americas Disposable Surgical Gloves Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 11. US: Americas Disposable Surgical Gloves Market, by Product type – Revenue and Forecast to 2030 (US$ Million)

Table 12. US: Americas Disposable Surgical Gloves Market, For Latex by Product Type – Revenue and Forecast to 2030 (US$ Million)

Table 13. US: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 14. US: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 15. US: Americas Disposable Surgical Gloves Market, by Form – Revenue and Forecast to 2030 (US$ Million))

Table 16. US: Americas Disposable Surgical Gloves Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 17. Canada: Americas Disposable Surgical Gloves Market, by Product type – Revenue and Forecast to 2030 (US$ Million)

Table 18. Canada: Americas Disposable Surgical Gloves Market, For Latex by Product Type – Revenue and Forecast to 2030 (US$ Million)

Table 19. Canada: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 20. Canada: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 21. Canada: Americas Disposable Surgical Gloves Market, by Form – Revenue and Forecast to 2030 (US$ Million))

Table 22. Canada: Americas Disposable Surgical Gloves Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 23. Brazil: Americas Disposable Surgical Gloves Market, by Product type – Revenue and Forecast to 2030 (US$ Million)

Table 24. Brazil: Americas Disposable Surgical Gloves Market, For Latex by Product Type – Revenue and Forecast to 2030 (US$ Million)

Table 25. Brazil: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 26. Brazil: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 27. Brazil: Americas Disposable Surgical Gloves Market, by Form – Revenue and Forecast to 2030 (US$ Million))

Table 28. Brazil: Americas Disposable Surgical Gloves Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 29. Mexico: Americas Disposable Surgical Gloves Market, by Product type – Revenue and Forecast to 2030 (US$ Million)

Table 30. Mexico: Americas Disposable Surgical Gloves Market, For Latex by Product Type – Revenue and Forecast to 2030 (US$ Million)

Table 31. Mexico: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 32. Mexico: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 33. Mexico: Americas Disposable Surgical Gloves Market, by Form – Revenue and Forecast to 2030 (US$ Million))

Table 34. Mexico: Americas Disposable Surgical Gloves Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 35. Argentina: Americas Disposable Surgical Gloves Market, by Product type – Revenue and Forecast to 2030 (US$ Million)

Table 36. Argentina: Americas Disposable Surgical Gloves Market, For Latex by Product Type – Revenue and Forecast to 2030 (US$ Million)

Table 37. Argentina: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 38. Argentina: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 39. Argentina: Americas Disposable Surgical Gloves Market, by Form – Revenue and Forecast to 2030 (US$ Million))

Table 40. Argentina: Americas Disposable Surgical Gloves Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 41. Rest of Americas: Americas Disposable Surgical Gloves Market, by Product type – Revenue and Forecast to 2030 (US$ Million)

Table 42. Rest of Americas: Americas Disposable Surgical Gloves Market, For Latex by Product Type – Revenue and Forecast to 2030 (US$ Million)

Table 43. Rest of Americas: Americas Disposable Surgical Gloves Market, For Vinyl by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 44. Rest of Americas: Americas Disposable Surgical Gloves Market, For Neoprene by Product Type – Revenue and Forecast to 2030 (US$ Million

Table 45. Rest of Americas: Americas Disposable Surgical Gloves Market, by Form – Revenue and Forecast to 2030 (US$ Million))

Table 46. Rest of Americas: Americas Disposable Surgical Gloves Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 47. Recent Organic Growth Strategies in Americas Disposable Surgical Gloves Market

Table 48. Glossary of Terms, Americas Disposable Surgical Gloves Market

List of Figures

Figure 1. Americas Disposable Surgical Gloves Market Segmentation, By Region

Figure 2. Key Insights

Figure 3. Americas - PEST Analysis

Figure 4. Americas Disposable Surgical Gloves Market - Key Industry Dynamics

Figure 5. Impact Analysis of Drivers and Restraints

Figure 6. Americas Disposable Surgical Gloves Market Revenue (US$ Mn), 2022 – 2030

Figure 7. Americas Disposable Surgical Gloves Market Revenue Share, by Product Type 2022 & 2030 (%)

Figure 8. Latex: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Nitrile: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Vinyl: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Neoprene: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Polyisoprene: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Others: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Americas Disposable Surgical Gloves Market Revenue Share, by Form 2022 & 2030 (%)

Figure 15. Powder: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Powder-Free: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Americas Disposable Surgical Gloves Market Revenue Share, by End User 2022 & 2030 (%)

Figure 18. Hospitals and Clinics: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Ambulatory Surgical Centers: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Others: Americas Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Americas Disposable Surgical Gloves Market, by Key Country – Revenue 2022 (US$ Mn)

Figure 22. Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 23. Americas: Americas Disposable Surgical Gloves Market, By Key Countries, 2022 And 2030 (%)

Figure 24. US: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 25. Canada: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 26. Brazil: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 27. Mexico: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 28. Argentina: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 29. Rest of Americas: Americas Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

The List of Companies - Americas Disposable Surgical Gloves Market

- Ansell Ltd

- B. Braun SE

- Cardinal Health Inc

- Top Glove Corp Bhd

- Medline Industries LP

- Molnlycke Health Care AB

- Degasa SA de CV

- Ambiderm SA de CV

- Sterimed Medical Devices Pvt Ltd

- Henry Schein Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Americas Disposable Surgical Gloves Market

Nov 2023

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

Nov 2023

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

Nov 2023

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography

Nov 2023

Ovo-Sexing Technology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technique (Non-Invasive Imaging, Genetic Editing, Volatile Analysis, Sex Reversal, and Liquid-Based Analysis), End User (Hatcheries and Poultry Farms), and Geography (US, Germany, France, Italy, Spain, Rest of Europe, Israel, and ROW)

Nov 2023

Dental Laser Treatment Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Hard Tissue, Soft Tissue, and Others), End User (Hospitals, Dental Clinics, Dental-Owned Practices, and Others), Clinical Indication [Conservative Dentistry, Root Canal (Endodontic Treatment), Oral Surgery, Implantology, Peri-Implantitis, Periodontics, and Others], and Geography

Nov 2023

Microbiology CRO Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Clinical, Medical Device, and Others), Service Type (Assay Development, Custom Viral Stock Production, Microbial Testing, and Others), Microorganisms (Bacteria, Fungi, Viruses, and Parasites), End User (Biotech and Pharmaceutical Companies, Medical Device Companies, and Others), and Geography

Nov 2023

Infusion Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Infusion Pumps Pumps [Volumetric Pumps, Syringe Pumps, Insulin Pumps, Patient Control Analgesia (PCA) Pumps, Enteral Pumps, Implantable Pumps, and Elastomeric Pumps] and Infusion Sets [Vented Infusion Sets and Non-Vented Infusion Sets], Application (Diabetes, Oncology, Pain Management, Hematology, Pediatrics, Gastroenterology, and Others), End User (Hospitals and Specialty Clinics, Homecare Settings, Ambulatory Surgical Centers, and Others), and Geography

Nov 2023

Antimicrobial Surgical Suture Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Triclosan Antimicrobial Suture and Chlorhexidine Antimicrobial Suture), Raw Materials (Polyglactin 910 Antimicrobial Suture, Poliglecaprone 25, and Polyglycolic Acid), Application (Cardiovascular Surgery, General Surgery, Ophthalmic Surgery, Gynecological Surgery, Orthopedic Surgery, Plastic Surgery, Veterinary Surgery, Dental Surgery, and Others), End User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Get Free Sample For

Get Free Sample For