Americas Ventilators Market to Grow at a CAGR of 12.4% to reach US$ 6,076.31 million from 2022 to 2030

The Americas ventilators market size is projected to grow from US$ 2,392.03 million in 2022 to US$ 6,076.31 million by 2030; it is estimated to record a CAGR of 12.4% during 2022–2030.

Market Insights and Analyst View:

Ventilators are the medical device used by patients having breathing difficulty. These devices work by efficiently exchanging oxygen and CO2 in the body. Different ventilator types are available in the market. The ventilators can be used in different healthcare settings such as emergency rooms, intensive care units, and hospitals. The devices are essential to treat patients suffering from respiratory failure, pneumonia, acute respiratory distress syndrome, and other conditions. During the COVID-19 pandemic, ventilators were in high demand as they are essential for treating patients affected by severe infection and lung damage from the virus. Additionally, the increasing prevalence of respiratory disorders and rising technological advancements and innovations in ventilators are expected to create opportunities for market growth in the coming years. Moreover, rising demand for portable and compact ventilators with enhanced functionality is expected to fuel the Americas ventilators market growth in the coming years.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Growth Drivers and Opportunities:

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Chronic obstructive pulmonary disease (COPD), asthma, acute lower respiratory tract infections, tuberculosis, lung cancer, and other respiratory diseases can cause severe illness, acute respiratory failure, or death. Urbanization, pollution, unhealthy lifestyle, and high tobacco consumption are among the factors leading to the surge in the number of respiratory and cardiovascular disease cases.

As per the American Lung Association data of 2023, lung cancer is one of the major causes of cancer deaths in the US. More than 357 deaths are recorded due to lung cancer every day. In addition, lung cancer is one of the most common cancer types and a major cause of death due to cancer in Brazil. As per a study, “Demographic and Clinical Outcomes of Brazilian Patients with Stage III or IV Non–Small-Cell Lung Cancer,” more than 18,700 new cases of lung cancer were diagnosed among men and more than 12,500 cases among women in Brazil during 2018–2019.

COPD is anticipated to become the leading cause of death across the world in the next 15 years. According to the National Center for Biotechnology Information, it is a disease spectrum that includes bronchitis and emphysema and is becoming a significant health and economic crisis. COPD is the third leading cause of death by disease in the US. As per the 2023 American Lung Association data, ~34 million Americans suffer from chronic lung diseases such as asthma and COPD. Per the Office of Disease Prevention and Health Promotion, in the US, ~14.8 million adults were diagnosed with COPD in 2020. Similarly, in 2022, 4.6% of the adult population in the US was diagnosed with COPD, emphysema, or chronic bronchitis. Similarly, as per Statistics Canada, 2 million people have COPD, which can impair a person's capacity to breathe.

According to the Centers for Disease Control and Prevention (CDC), ~24.8 million people in the US had asthma in 2018. Moreover, as per Asthma and Allergy Foundation of America, asthma resulted in about 1.5 million emergency department (ED) visits in 2019 and 4.9 million doctors’ office visits. The Asthma and Allergy Foundation of America 2023 states that ~26 million people in the US had asthma in 2022, i.e., about 1 in 13 people in the country. Per the same source, ~3,517 death cases were recorded due to asthma in 2021.

A ventilator assists the patient affected by respiratory diseases or other such conditions in breathing, as these disorders make breathing difficult or impossible. Therefore, the treatment of respiratory diseases requires mechanical ventilation. Thus, the growing prevalence of respiratory diseases propels the demand for ventilators in American countries.

A major complication associated with the use of mechanical ventilators is their tendency to disrupt normal cardiopulmonary physiology. Medical staff members carefully measure the amount, type, speed, and force of the air the ventilator pushes into and pulls out of the lungs. Moreover, continuous exposure to a significantly high volume of oxygen can prove harmful to the lungs. Exceeding force of air might also weaken the lungs by damaging lung tissue; this is called ventilator-associated lung injury (VALI). The VALI can lead to pneumothorax injuries, pulmonary edema, hypoxemia, and other problems. In addition, it can cause bronchopleural fistula, pneumothorax, nosocomial pneumonia, and other complications that decrease cardiac output, cause gastric problems, and renal impairment. According to a study by the American Society of Microbiology, 80% of nosocomial pneumonia cases are associated with mechanical ventilation, known as ventilator-associated pneumonia (VAP). As per Airway Safety Movement Campaign data, ~250,000 and 300,000 VAP cases are reported in the US each year.

Other ventilator complications are delirium, immobility, and vocal cord problems. Moreover, the breathing tube in the airway could allow the entry of bacteria into the lungs, which would infect the lungs' alveoli. The tube also makes it harder to cough away debris that could irritate the lungs of patients and cause infection. Thus, complications associated with the use of ventilators hinder the growth of the Americas ventilators market size.

Report Segmentation and Scope:

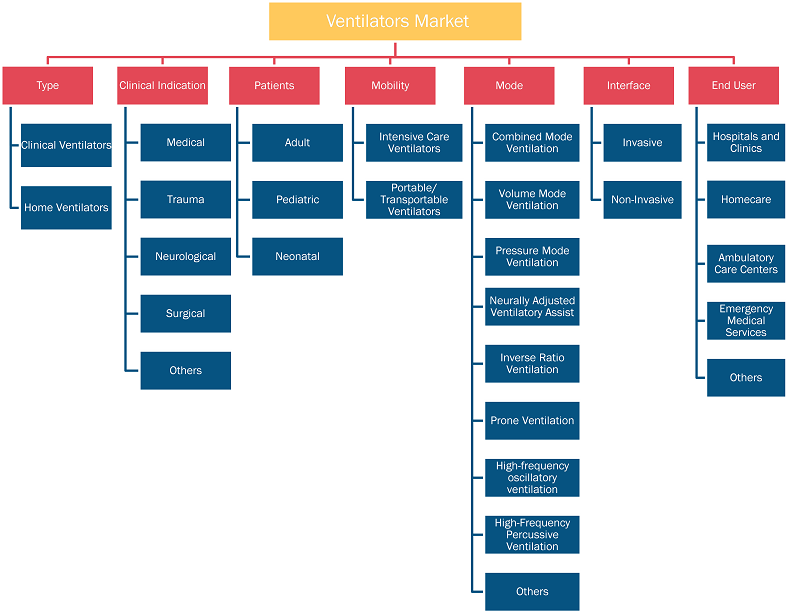

Based on product type, the ventilators market is bifurcated into clinical ventilators and home ventilators. Based on clinical indication, the ventilators market is segmented into medical, trauma, neurological, surgical, and others. By patients, the market is segmented into adult, pediatric, and neonatal. Based on mobility, the ventilators market is bifurcated into intensive care ventilators and portable/transportable ventilators. Based on mode, the ventilators market is segmented into combined mode ventilation, volume mode ventilation, pressure mode ventilation, neurally adjusted ventilatory assists, inverse ration ventilation, prone ventilation, high-frequency oscillatory ventilation, high-frequency percussive ventilation, and others. Based on interface, the ventilators market is bifurcated into invasive and non invasive. Based on end user, the ventilators market is segmented into hospitals and clinics, homecare, ambulatory care centers, emergency medical services, and Others. Based on country, the market is segmented into the US, Canada, Mexico, Brazil, Argentina, Chile, Peru, Colombia, and the Rest of Americas.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

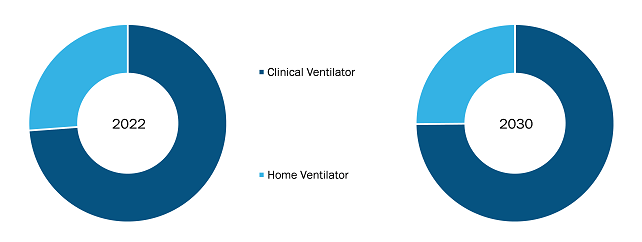

By type, the Americas ventilators market is bifurcated into clinical ventilators and home ventilators. The clinical ventilator segment held a larger market share in 2022. However, the home ventilators segment is anticipated to register a higher CAGR during the forecast period. The number of patients who need homecare ventilation is growing rapidly. Studies have indicated that patients on ventilators are no profit centers for hospital administrations, which induced hospitals to move such patients to other alternative care settings. Thus, the usage of portable and transport ventilators became a preferable choice for hospitals and patients. The use of portable ventilators in homecare settings reduces a patient’s cost of a stay in the hospital and enhances the life quality of patient.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Based on clinical indication, the Americas ventilators market is segmented into medical, trauma, neurological, surgical, and others. The medical segment held the largest market share in 2022 and is anticipated to register the highest CAGR during the forecast period.

The ventilators market, by end user, is segmented into hospitals and clinics, homecare, ambulatory care centers, emergency medical services, and others. The hospitals and clinics segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR in the market during the forecast period. The hospitals and clinics segment is expected to hold a major share of the Americas ventilators market in the coming years owing to the availability of various types of medical ventilators and the growing adoption rate of these devices in hospital settings. The increasing prevalence of respiratory diseases and COVID-19 is also anticipated to propel the market growth for the segment in the future.

Country Analysis:

The US dominates the Americas ventilators market. The US ventilators market size was US$ 1,791.79 million in 2022, and the market is projected to reach US$ 4,464.17 million by 2030; it is expected to register a CAGR of 12.1% during the forecast period. The market growth in the US is attributed to the increasing prevalence of respiratory disorders. According to the Bronchitis Facts and Statistics published in November 2022, bronchitis is a common reason for the hospitalization of adults in the US. About 1 in 20 US adults suffer from acute bronchitis yearly, and ∼10 million people (i.e., 3% of the population) are affected by chronic bronchitis. Thus, the rising number of patients suffering from respiratory disorders will generate the need for supplemental oxygen, thereby inducing the demand for respiratory care devices.

Due to the COVID-19 pandemic, respiratory devices company under the Advanced Medical Technology Association (AdvaMed), an American medical device trade association in the US, boosted their ventilator production from 700 ventilators per week to 2,000–3,000 ventilators per week and is expected to reach 5,000–7,000 per week. In addition, immediate product approvals during this pandemic are also likely to favor the growth of the market. For instance, in April 2020, Medtronic received US Food and Drug Administration (FDA) approval to launch and market its PB560 ventilator immediately. The US government ordered ventilators to cater to rising demand during the COVID-19 pandemic beginning. The government signed ventilator contracts with ventilator manufacturers in April 2020. Therefore, the growing prevalence of respiratory diseases, the presence of major market players in the US, and government efforts to cater to the need for ventilators enhance the Americas ventilators market growth in the US.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the Americas ventilators market are mentioned below.

- In July 2021, Mindray, a global leader in developing and providing advanced medical devices, hosted a virtual launch event to introduce a new turbine-based ventilator, the SV300 Pro. The new SV300 Pro brings the company’s latest state-of-the-art functions and technologies into a compact device to address difficult clinical challenges. To ensure SV300 Pro is ready for emergencies, such as cardiac arrest, the innovative CPRV, a specially developed ventilation mode, is integrated for CPR procedures.

- In May 2020, Vyaire Medical Inc. and Spirit AeroSystems entered into a new manufacturing and supply collaboration to build critical care ventilators at a converted facility in Wichita, Kan. The temporary special partnership allows Vyaire to ramp up production of critical care ventilators quickly. The partnership advances earlier action taken by Vyaire to accelerate the production of ventilators and other related respiratory equipment at its primary production facilities based in North America.

COVID-19 Impact:

The COVID-19 pandemic adversely affected economies and industries in various countries across the world. Lockdowns, travel restrictions, and business shutdowns in Americas affected the growth of several sectors, including the healthcare sector. The COVID-19 pandemic had a significant impact on the ventilators market as well. As healthcare systems across the region focused on managing the growing COVID-19 cases, elective procedures such as certain surgeries were deferred or canceled, resulting in a temporary decline in demand for various medical devices. However, the increasing number of cases and complications of COVID-19 propelled the demand for ventilators in the region. This sudden upsurge in demand and limited supply created a huge burden on manufacturing units for the production of ventilators. Several global manufacturers from different industries came together to produce ventilators to deal with the pandemic. In March 2020, GE Healthcare and Ford Motor Company came together to scale up the production of ventilators — a move aimed to arm clinicians with vital medical equipment to treat COVID-19 patients. Equipped with the essential functions required to treat COVID-19, the new system will be built specifically to address the urgent needs of the pandemic. Such collaborations in the region during the pandemic are expected to impact the market growth positively. During post- COVID-19 pandemic, the production of ventilators has been reduced drastically as there are sufficient ventilators manufactured and procured by the hospitals.

Competitive Landscape and Key Companies:

Medtronic Plc, Koninklijke Philips NV, Hamilton Medical AG, Dragerwerk AG & Co KGaA, Vyaire Medical Inc, Getinge AB, ResMed Inc, ICU Medical Inc, Nihon Kohden Corp, and Shenzhen Mindray Bio-Medical Electronics Co Ltd are a few companies operating in the Americas ventilators market. These companies focus on new product launches and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which helps them serve a large and varied clientele and subsequently expand their market share. The report offers a trend analysis of the ventilators market, emphasizing parameters such as technological advancements, market dynamics, and competitive landscape analysis of leading market players worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Clinical Indication, Patients, Mobility, Mode, Interface, End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States

Frequently Asked Questions

The factors driving the growth of the Americas ventilators market include the growing prevalence of respiratory diseases and the rapidly increasing geriatric population.

The Americas ventilators market is expected to be valued at US$ 6,076.31 million by 2030.

A ventilator is an automatic breathing system that transfers breathable air into and out of the lungs to provide breaths to a patient having breathing difficultly. The unit performs by adding oxygen to the bloodstream and removing carbon dioxide from the bloodstream. This helps a patient with respiratory problems get the right oxygen quantity. It also helps the patient's body to heal since it eliminates the extra energy of labored breathing.

The Americas ventilators market was valued at US$ 2,392.03 million in 2022.

The Americas ventilators market majorly consists of the players, including Medtronic Plc, Koninklijke Philips NV, Hamilton Medical AG, Dragerwerk AG & Co KGaA, Vyaire Medical Inc, Getinge AB, ResMed Inc, ICU Medical Inc, Nihon Kohden Corp, and Shenzhen Mindray Bio-Medical Electronics Co Ltd.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Americas Ventilators Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Americas Ventilators Market – Market Landscape

4.1 Overview

4.1.1 Americas PEST Analysis

5. Americas Ventilators Market

5.1 Market Drivers

5.1.1 Growing Prevalence of Respiratory Diseases

5.1.2 Rapidly Increasing Geriatric Population

5.2 Market Restraints

5.2.1 Adverse Effects on Cardiopulmonary Function and Complications Associated with Ventilator Use

5.3 Market Opportunities

5.3.1 Technological Innovations in Ventilators

5.4 Future Trends

5.4.1 Growing Demand for Portable and Compact Ventilators with Enhanced Functionalities

5.5 Impact analysis

6. Americas Ventilators Market – Regional Analysis

6.1 Americas Ventilators Market Revenue Forecast and Analysis

7. Americas Ventilators Market – Revenue and Forecast to 2030 – by Type

7.1 Overview

7.2 Americas Ventilators Market Revenue Share, by Type 2022 & 2030 (%)

7.3 Clinical Ventilators

7.3.1 Overview

7.3.2 Clinical Ventilators: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Home Ventilators

7.4.1 Overview

7.4.2 Home Ventilators: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

8. Americas Ventilators Market – Revenue and Forecast to 2030 – by Clinical Indication

8.1 Overview

8.2 Americas Ventilators Market Revenue Share, by Clinical Indication 2022 & 2030 (%)

8.3 Medical

8.3.1 Overview

8.3.2 Medical: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Trauma

8.4.1 Overview

8.4.2 Trauma: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Neurological

8.5.1 Overview

8.5.2 Neurological: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Surgical

8.6.1 Overview

8.6.2 Surgical: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

9. Americas Ventilators Market Analysis and Forecasts to 2028 – by Patients

9.1 Overview

9.2 Americas Ventilators Market, by Patients 2022 & 2030 (%)

9.3 Adult

9.3.1 Overview

9.3.2 Adult: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Neonatal

9.4.1 Overview

9.4.2 Neonatal: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Pediatric

9.5.1 Overview

9.5.2 Pediatric: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

10. Americas Ventilators Market – Revenue and Forecast to 2030 – by Mobility

10.1 Overview

10.2 Americas Ventilators Market Revenue Share, by Mobility 2022 & 2030 (%)

10.3 Intensive Care Ventilators

10.3.1 Overview

10.3.2 Intensive Care Ventilators: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

10.4 Portable/ Transportable Ventilators

10.4.1 Overview

10.4.2 Portable/ Transportable Ventilators: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

11. Americas Ventilators Market – Revenue and Forecast to 2030 – by Mode

11.1 Overview

11.2 Americas Ventilators Market Revenue Share, by Mode 2022 & 2030 (%)

11.3 Combined Mode Ventilation

11.3.1 Overview

11.3.2 Combined Mode Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

11.4 Volume Mode Ventilation

11.4.1 Overview

11.4.2 Volume Mode Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

11.5 Pressure Mode Ventilation

11.5.1 Overview

11.5.2 Pressure Mode Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

11.6 Neurally Adjusted Ventilatory Assists

11.6.1 Overview

11.6.2 Neurally Adjusted Ventilatory Assists: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

11.7 Inverse Ratio Ventilation

11.7.1 Overview

11.7.2 Inverse Ratio Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

11.8 Prone Ventilation

11.8.1 Overview

11.8.2 Prone Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

11.9 High Frequency Oscillatory Ventilation

11.9.1 Overview

11.9.2 High Frequency Oscillatory Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

11.10 High-Frequency Percussive Ventilation

11.10.1 Overview

11.10.2 High-Frequency Percussive Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

11.11 Others

11.11.1 Overview

11.11.2 Others: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

12. Americas Ventilators Market – Revenue and Forecast to 2030 – by Interface

12.1 Overview

12.2 Americas Ventilators Market Revenue Share, by Interface 2022 & 2030 (%)

12.3 Invasive

12.3.1 Overview

12.3.2 Invasive: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

12.4 Non-Invasive

12.4.1 Overview

12.4.2 Non-Invasive: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

13. Americas Ventilators Market – Revenue and Forecast to 2030 – by End User

13.1 Overview

13.2 Americas Ventilators Market Revenue Share, by End User 2022 & 2030 (%)

13.3 Hospital and Clinics

13.3.1 Overview

13.3.2 Hospital and Clinics: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

13.4 Homecare

13.4.1 Overview

13.4.2 Homecare: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

13.5 Ambulatory Care Centers

13.5.1 Overview

13.5.2 Ambulatory Care Centers: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

13.6 Emergency Medical Services

13.6.1 Overview

13.6.2 Emergency Medical Services: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

13.7 Others

13.7.1 Overview

13.7.2 Others: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

14. Americas Ventilators Market – Revenue and Forecast to 2030 – Geographic Analysis

14.1 Americas Ventilators Market, Revenue and Forecast to 2030

14.1.1 Overview

14.1.2 Americas Ventilators Market Revenue and Forecast to 2030 (US$ Mn)

14.1.3 Americas Ventilators Market, by Type

14.1.4 Americas Ventilators Market, by Clinical Indication

14.1.5 Americas Ventilators Market, by Patients

14.1.6 Americas Ventilators Market, by Mobility

14.1.7 Americas Ventilators Market, by Mode

14.1.8 Americas Ventilators Market, by Interface

14.1.9 Americas Ventilators Market, by End User

14.1.10 Americas Ventilators Market by Country

14.1.10.1 US

14.1.10.1.1 Overview

14.1.10.1.2 US Ventilators Market Revenue and Forecast to 2030 (US$ Mn)

14.1.10.1.3 US Ventilators Market, by Type

14.1.10.1.4 US Ventilators Market, by Clinical Indication

14.1.10.1.5 US Ventilators Market, by Patients

14.1.10.1.6 US Ventilators Market, by Mobility

14.1.10.1.7 US Ventilators Market, by Mode

14.1.10.1.8 US Ventilators Market, by Interface

14.1.10.1.9 US Ventilators Market, by End User

14.1.10.2 Canada

14.1.10.2.1 Overview

14.1.10.2.2 Canada Ventilators Market Revenue and Forecast to 2030 (US$ Mn)

14.1.10.2.3 Canada Ventilators Market, by Type

14.1.10.2.4 Canada Ventilators Market, by Clinical Indication

14.1.10.2.5 Canada Ventilators Market, by Patients

14.1.10.2.6 Canada Ventilators Market, by Mobility

14.1.10.2.7 Canada Ventilators Market, by Mode

14.1.10.2.8 Canada Ventilators Market, by Interface

14.1.10.2.9 Canada Ventilators Market, by End User

14.1.10.3 Mexico

14.1.10.3.1 Overview

14.1.10.3.2 Mexico Ventilators Market Revenue and Forecast to 2030 (US$ Mn)

14.1.10.3.3 Mexico Ventilators Market, by Type

14.1.10.3.4 Mexico Ventilators Market, by Clinical Indication

14.1.10.3.5 Mexico Ventilators Market, by Patients

14.1.10.3.6 Mexico Ventilators Market, by Mobility

14.1.10.3.7 Mexico Ventilators Market, by Mode

14.1.10.3.8 Mexico Ventilators Market, by Interface

14.1.10.3.9 Mexico Ventilators Market, by End User

14.1.10.4 Brazil

14.1.10.4.1 Overview

14.1.10.4.2 Brazil Ventilators Market Revenue and Forecast to 2030 (US$ Mn)

14.1.10.4.3 Brazil Ventilators Market, by Type

14.1.10.4.4 Brazil Ventilators Market, by Clinical Indication

14.1.10.4.5 Brazil Ventilators Market, by Patients

14.1.10.4.6 Brazil Ventilators Market, by Mobility

14.1.10.4.7 Brazil Ventilators Market, by Mode

14.1.10.4.8 Brazil Ventilators Market, by Interface

14.1.10.4.9 Brazil Ventilators Market, by End User

14.1.10.5 Argentina

14.1.10.5.1 Overview

14.1.10.5.2 Argentina Ventilators Market Revenue and Forecast to 2030 (US$ Mn)

14.1.10.5.3 Argentina Ventilators Market, by Type

14.1.10.5.4 Argentina Ventilators Market, by Clinical Indication

14.1.10.5.5 Argentina Ventilators Market, by Patients

14.1.10.5.6 Argentina Ventilators Market, by Mobility

14.1.10.5.7 Argentina Ventilators Market, by Mode

14.1.10.5.8 Argentina Ventilators Market, by Interface

14.1.10.5.9 Argentina Ventilators Market, by End User

14.1.10.6 Chile

14.1.10.6.1 Overview

14.1.10.6.2 Chile Ventilators Market Revenue and Forecast to 2030 (US$ Mn)

14.1.10.6.3 Chile Ventilators Market, by Type

14.1.10.6.4 Chile Ventilators Market, by Clinical Indication

14.1.10.6.5 Chile Ventilators Market, by Patients

14.1.10.6.6 Chile Ventilators Market, by Mobility

14.1.10.6.7 Chile Ventilators Market, by Mode

14.1.10.6.8 Chile Ventilators Market, by Interface

14.1.10.6.9 Chile Ventilators Market, by End User

14.1.10.7 Colombia

14.1.10.7.1 Overview

14.1.10.7.2 Colombia Ventilators Market Revenue and Forecast to 2030 (US$ Mn)

14.1.10.7.3 Colombia Ventilators Market, by Type

14.1.10.7.4 Colombia Ventilators Market, by Clinical Indication

14.1.10.7.5 Colombia Ventilators Market, by Patients

14.1.10.7.6 Colombia Ventilators Market, by Mobility

14.1.10.7.7 Colombia Ventilators Market, by Mode

14.1.10.7.8 Colombia Ventilators Market, by Interface

14.1.10.7.9 Colombia Ventilators Market, by End User

14.1.10.8 Peru

14.1.10.8.1 Overview

14.1.10.8.2 Peru Ventilators Market Revenue and Forecast to 2030 (US$ Mn)

14.1.10.8.3 Peru Ventilators Market, by Type

14.1.10.8.4 Peru Ventilators Market, by Clinical Indication

14.1.10.8.5 Peru Ventilators Market, by Patients

14.1.10.8.6 Peru Ventilators Market, by Mobility

14.1.10.8.7 Peru Ventilators Market, by Mode

14.1.10.8.8 Peru Ventilators Market, by Interface

14.1.10.8.9 Peru Ventilators Market, by End User

14.1.10.9 Rest of Americas

14.1.10.9.1 Overview

14.1.10.9.2 Rest of Americas Ventilators Market Revenue and Forecast to 2030 (US$ Mn)

14.1.10.9.3 Rest of Americas Ventilators Market, by Type

14.1.10.9.4 Rest of Americas Ventilators Market, by Clinical Indication

14.1.10.9.5 Rest of Americas Ventilators Market, by Patients

14.1.10.9.6 Rest of Americas Ventilators Market, by Mobility

14.1.10.9.7 Rest of Americas Ventilators Market, by Mode

14.1.10.9.8 Rest of Americas Ventilators Market, by Interface

14.1.10.9.9 Rest of Americas Ventilators Market, by End User

15. Pre and Post COVID-19 Impact

15.1 Pre and Post COVID-19 Impact

16. Ventilators Market – Industry Landscape

16.1 Overview

16.2 Growth Strategies in Americas Ventilators Market

16.3 Organic Growth Strategies

16.3.1 Overview

16.4 Inorganic Growth Strategies

16.4.1 Overview

17. Company Profiles

17.1 Medtronic Plc

17.1.1 Key Facts

17.1.2 Business Description

17.1.3 Products and Services

17.1.4 Financial Overview

17.1.5 SWOT Analysis

17.1.6 Key Developments

17.2 Koninklijke Philips NV

17.2.1 Key Facts

17.2.2 Business Description

17.2.3 Products and Services

17.2.4 Financial Overview

17.2.5 SWOT Analysis

17.2.6 Key Developments

17.3 Hamilton Medical AG

17.3.1 Key Facts

17.3.2 Business Description

17.3.3 Products and Services

17.3.4 Financial Overview

17.3.5 SWOT Analysis

17.3.6 Key Developments

17.4 Dragerwerk AG & Co KGaA

17.4.1 Key Facts

17.4.2 Business Description

17.4.3 Products and Services

17.4.4 Financial Overview

17.4.5 SWOT Analysis

17.4.6 Key Developments

17.5 Vyaire Medical Inc

17.5.1 Key Facts

17.5.2 Business Description

17.5.3 Products and Services

17.5.4 Financial Overview

17.5.5 SWOT Analysis

17.5.6 Key Developments

17.6 Getinge AB

17.6.1 Key Facts

17.6.2 Business Description

17.6.3 Products and Services

17.6.4 Financial Overview

17.6.5 SWOT Analysis

17.6.6 Key Developments

17.7 ResMed Inc

17.7.1 Key Facts

17.7.2 Business Description

17.7.3 Products and Services

17.7.4 Financial Overview

17.7.5 SWOT Analysis

17.7.6 Key Developments

17.8 ICU Medical Inc

17.8.1 Key Facts

17.8.2 Business Description

17.8.3 Products and Services

17.8.4 Financial Overview

17.8.5 SWOT Analysis

17.8.6 Key Developments

17.9 Nihon Kohden Corp

17.9.1 Key Facts

17.9.2 Business Description

17.9.3 Products and Services

17.9.4 Financial Overview

17.9.5 SWOT Analysis

17.9.6 Key Developments

17.10 Shenzhen Mindray Bio-Medical Electronics Co Ltd

17.10.1 Key Facts

17.10.2 Business Description

17.10.3 Products and Services

17.10.4 Financial Overview

17.10.5 SWOT Analysis

17.10.6 Key Developments

18. Appendix

18.1 About The Insight Partners

18.2 Glossary of Terms

List of Tables

Table 1. Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Type

Table 2. Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Clinical Indication

Table 3. Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Patients

Table 4. Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mobility

Table 5. Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mode

Table 6. Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Interface

Table 7. Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 8. US Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Type

Table 9. US Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Clinical Indication

Table 10. US Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Patients

Table 11. US Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mobility

Table 12. US Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mode

Table 13. US Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Interface

Table 14. US Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 15. Prevalence of Chronic Obstructive Pulmonary Diseases (COPD) in Canada

Table 16. Canada Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Type

Table 17. Canada Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Clinical Indication

Table 18. Canada Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Patients

Table 19. Canada Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mobility

Table 20. Canada Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mode

Table 21. Canada Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Interface

Table 22. Canada Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 23. Mexico Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Type

Table 24. Mexico Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Clinical Indication

Table 25. Mexico Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Patients

Table 26. Mexico Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mobility

Table 27. Mexico Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mode

Table 28. Mexico Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Interface

Table 29. Mexico Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 30. Brazil Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Type

Table 31. Brazil Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Clinical Indication

Table 32. Brazil Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Patients

Table 33. Brazil Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mobility

Table 34. Brazil Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mode

Table 35. Brazil Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Interface

Table 36. Brazil Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 37. Argentina Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Type

Table 38. Argentina Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Clinical Indication

Table 39. Argentina Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Patients

Table 40. Argentina Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mobility

Table 41. Argentina Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mode

Table 42. Argentina Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Interface

Table 43. Argentina Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 44. Chile Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Type

Table 45. Chile Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Clinical Indication

Table 46. Chile Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Patients

Table 47. Chile Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mobility

Table 48. Chile Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mode

Table 49. Chile Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Interface

Table 50. Chile Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 51. Colombia Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Type

Table 52. Colombia Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Clinical Indication

Table 53. Colombia Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Patients

Table 54. Colombia Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mobility

Table 55. Colombia Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mode

Table 56. Colombia Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Interface

Table 57. Colombia Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 58. Peru Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Type

Table 59. Peru Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Clinical Indication

Table 60. Peru Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Patients

Table 61. Peru Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mobility

Table 62. Peru Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mode

Table 63. Peru Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Interface

Table 64. Peru Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 65. Rest of Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Type

Table 66. Rest of Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Clinical Indication

Table 67. Rest of Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Patients

Table 68. Rest of Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mobility

Table 69. Rest of Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Mode

Table 70. Rest of Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – Interface

Table 71. Rest of Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 72. Recent Organic Growth Strategies in Americas Ventilators Market

Table 73. Recent Inorganic Growth Strategies in the Americas Ventilators Market

Table 74. Glossary of Terms

List of Figures

Figure 1. Ventilators Market Segmentation

Figure 2. Ventilators Market, by Region

Figure 3. Key Insights

Figure 4. Americas: PEST Analysis

Figure 5. Americas Ventilators Market- Key Industry Dynamics

Figure 6. Americas Ventilators Market: Impact Analysis of Drivers and Restraints

Figure 7. Americas Ventilators Market – Revenue Forecast and Analysis – 2020–2030

Figure 8. Americas Ventilators Market Revenue Share, by Type 2022 & 2030 (%)

Figure 9. Clinical Ventilators: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Home Ventilators: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Americas Ventilators Market Revenue Share, by Clinical Indication 2022 & 2030 (%)

Figure 12. Medical: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Trauma: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Neurological: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Surgical: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Others: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Americas Ventilators Market, by Patients 2022 & 2030 (%)

Figure 18. Adult: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Neonatal: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Pediatric: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Americas Ventilators Market Revenue Share, by Mobility 2022 & 2030 (%)

Figure 22. Intensive Care Ventilators: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Portable/ Transportable Ventilators: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Americas Ventilators Market Revenue Share, by Mode 2022 & 2030 (%)

Figure 25. Combined Mode Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 26. Volume Mode Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 27. Pressure Mode Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 28. Neurally Adjusted Ventilatory Assists: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 29. Inverse Ratio Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 30. Prone Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 31. High Frequency Oscillatory Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 32. High-Frequency Percussive Ventilation: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 33. Others: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 34. Americas Ventilators Market Revenue Share, by Interface 2022 & 2030 (%)

Figure 35. Invasive: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 36. Non-Invasive: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 37. Americas Ventilators Market Revenue Share, by End User 2022 & 2030 (%)

Figure 38. Hospital and Clinics: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 39. Homecare: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 40. Ambulatory Care Centers: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 41. Emergency Medical Services: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 42. Others: Americas Ventilators Market – Revenue and Forecast to 2030 (US$ Million)

Figure 43. Americas Ventilators Market, By Region, 2022 ($Mn)

Figure 44. Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn)

Figure 45. Americas Ventilators Market, By Key Countries, 2022 And 2030 (%)

Figure 46. US Ventilators Market Revenue And Forecast to 2030 (US$ Mn)

Figure 47. Canada Ventilators Market Revenue And Forecast to 2030 (US$ Mn)

Figure 48. Mexico Ventilators Market Revenue And Forecast to 2030 (US$ Mn)

Figure 49. Brazil Ventilators Market Revenue And Forecast to 2030 (US$ Mn)

Figure 50. Argentina Ventilators Market Revenue And Forecast to 2030 (US$ Mn)

Figure 51. Chile Ventilators Market Revenue And Forecast to 2030 (US$ Mn)

Figure 52. Colombia Ventilators Market Revenue And Forecast to 2030 (US$ Mn)

Figure 53. Peru Ventilators Market Revenue And Forecast to 2030 (US$ Mn)

Figure 54. Rest of Americas Ventilators Market Revenue And Forecast to 2030 (US$ Mn)

Figure 55. Pre and Post COVID-19 Impact on Americas Ventilators Market

Figure 56. Growth Strategies in Americas Ventilators Market

The List of Companies - Americas Ventilators Market

- Medtronic Plc

- Koninklijke Philips NV

- Hamilton Medical AG

- Dragerwerk AG & Co KGaA

- Vyaire Medical Inc

- Getinge AB

- ResMed Inc

- ICU Medical Inc

- Nihon Kohden Corp

- Shenzhen Mindray Bio-Medical Electronics Co Ltd.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Americas Ventilators Market

Aug 2023

Antimicrobial Surgical Suture Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Triclosan Antimicrobial Suture and Chlorhexidine Antimicrobial Suture), Raw Materials (Polyglactin 910 Antimicrobial Suture, Poliglecaprone 25, and Polyglycolic Acid), Application (Cardiovascular Surgery, General Surgery, Ophthalmic Surgery, Gynecological Surgery, Orthopedic Surgery, Plastic Surgery, Veterinary Surgery, Dental Surgery, and Others), End User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2023

Smart Hospital Beds Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Patient Weight (Less than 70 lb, 70 to 150 lb, 150 to 400 lb, 400 to 500 lb, Greater than 500 lb); Offering (Products and Accessories, Software and Solutions, and Services); Application (Fall Prevention, Pressure Injury Prevention, Patient Deterioration and Monitoring, and Others); End User (Hospitals, Clinics and Nursing Homes, Ambulatory Surgical Centers, Medical Laboratories, Long Term Care Centers, and Others), and Geography

Aug 2023

Heart Transplant Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Surgery Type (Orthotopic Heart Transplant and Heterotopic Heart Transplant), Type (Donor Live Heart and Artificial Hearts), End User (Hospitals, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2023

Breath Analyzer Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Fuel Cell Technology, Semiconductor Sensor, Infrared Spectroscopy, and Others), Application (Drug Abuse Detection, Alcohol Detection, and Medical Applications), End User (Law Enforcement Agencies, Hospitals & Diagnostic Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2023

Osteoarthritis Therapy Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Therapy Type (TENS, Occupational Therapy, Physical Therapy, Platelet-Rich Plasma Therapy and Stromal Vascular Fraction, Prolotherapy, and Others), Disease Indication (Knee Osteoarthritis, Spine Osteoarthritis, Foot and Ankle Osteoarthritis, Shoulder Osteoarthritis, Hand Osteoarthritis, and Others), End User (Hospitals and Clinics, Specialty Clinics, Ambulatory Surgical Centers, Homecare, and Others), and Geography

Aug 2023

Surgical Navigation Systems Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Optical Navigation System, Electromagnetic Navigation System, Hybrid Navigation System, Fluoroscopy Navigation System, CT-Based Navigation System, and Others), Application (Orthopedic, ENT, Neurology, Dental, and Others), End User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography

Aug 2023

Skull Clamp Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Three-Pin Skull Clamp, Four-Pin Skull Clamp, and Two-Pin Skull Clamp), Application (Surgery and Medical Imaging), Material (Stainless Steel, Aluminum Alloy, Titanium, and Radiolucent), Accessories (Skull Pins, Headrest, and Others), End User (Hospitals, Specialty Clinics, and Ambulatory Surgical Centers), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2023

Teleradiology Services Market

Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Deployment Type (Cloud-based, Web-based), Modality (MRI, CT-Scan, X-ray, Ultrasound, Others), Application (Musculoskeletal System, Gastroentrology, Cardiology, Oncology, Neurology, Others), End User (Hospitals and Clinics, Diagnostic and Imaging Centers, Others), and Geography

Get Free Sample For

Get Free Sample For