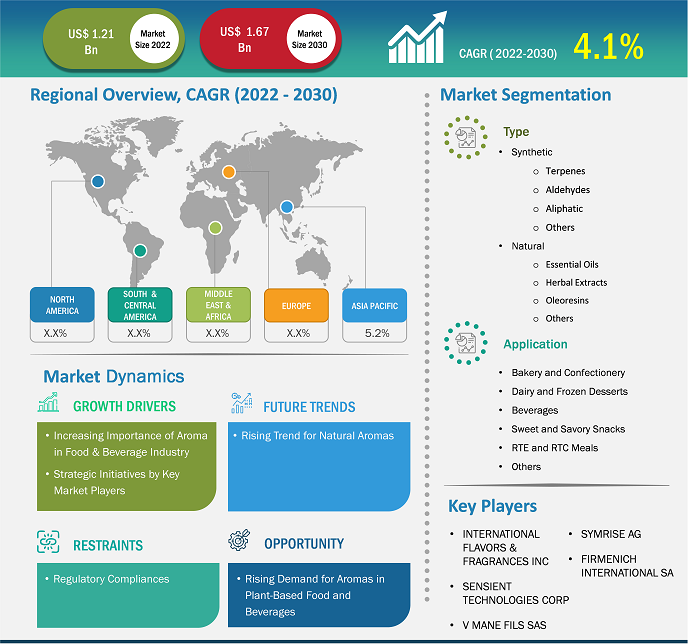

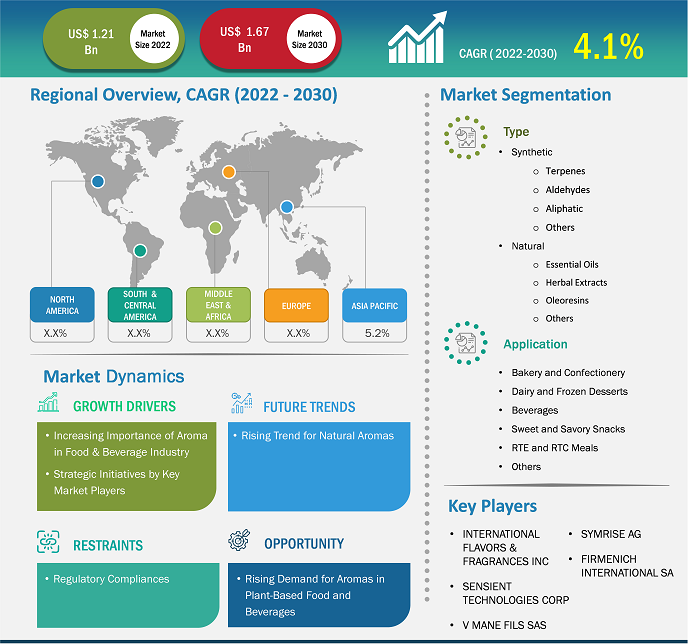

[Research Report] The aroma ingredients for food and beverages market size is projected to grow from US$ 1.21 billion in 2022 to US$ 1.67 billion by 2030; the market is estimated to register a CAGR of 4.1% from 2022 to 2030.

Market Insights and Analyst View:

Aroma ingredients are isolated from naturally sourced ingredients or chemically extracted from petroleum. These ingredients play a crucial role in shaping the flavor and aroma profile of various food and beverage items, ranging from confectionery and savory snacks to alcoholic and non-alcoholic beverages. The growing importance of aroma ingredients in the food & beverages industry and strategic initiatives by key market players are major factors driving the aroma ingredients for the food and beverages market. In addition, the increasing consumer demand for unique and exotic flavor and aroma experiences, as well as advancements in extraction and synthesis techniques, further help in shaping the market landscape. However, the regulatory constraints associated with the use of aroma ingredients in the food and beverages industry hamper the aroma ingredients for food and beverages market growth.

Growth Drivers and Challenges:

Aroma ingredient manufacturers in the food & beverages industry are significantly involved in mergers and acquisitions, collaborations, and other strategic developments to attract consumers and enhance their market position. Increasing demand for aroma ingredients from various food and beverage establishments that produce and sell bakery and confectionery, dairy, frozen desserts, and other items has resulted in key players adopting strategic initiatives to strengthen their market position globally. For instance, in November 2023, BASF SE announced the launch of two new natural aroma ingredients: Isobionics Natural alpha-Bisabolene 98 and Isobionics Natural (-)-alpha-Bisabolol 99. Such product developments are driving the aroma ingredients for the food and beverages market.

Key players in the market are expanding their production facilities and entering into agreements with distributors to strengthen their market position. For instance, in December 2021, Tilley Distribution, Inc. announced the merger with Phoenix Aromas and Essential Oils. The merger will help provide high-quality products to new and existing consumer bases with teams experienced in providing regulatory and technical support. In addition, in July 2021, Symrise AG acquired Canada-based Giraffe Foods Inc., a Canadian producer of customized sauces, dips, dressings, syrups, and beverage concentrates for B2B customers. The acquisition will expand Symrise's Flavor & Nutrition segment in North America, boosting its market position and customer base. Thus, strategic initiatives by key market players fuel the global aroma ingredients for food and beverages market growth.

The production and use of aroma ingredients in various food and beverage applications are regulated by various government agencies. Regulatory bodies such as the Food and Drug Administration (FDA) and European Food Safety Authority (EFSA) impose strict guidelines and standards on the use of aroma ingredients to ensure consumer safety and product quality. For instance, the United Nations Environment Programme has regulated the use of food aromas. This regulation provides for all necessary conditions for the correct, controlled, and safe use of flavorings and aromatic ingredients or aromas in foods. Additionally, the Food and Drug Administration (FDA) imposed a regulation on food aroma that can be used in and on food. Meeting these regulatory requirements comes with extensive testing and documentation processes, which can be time-consuming and cost-intensive for manufacturers. The approval process for aroma ingredients can be lengthy and complex, further hindering innovation and product development within the industry.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Aroma Ingredients for Food and Beverages Market: Strategic Insights

Market Size Value in US$ 1.21 billion in 2022 Market Size Value by US$ 1.67 billion by 2030 Growth rate CAGR of 4.1% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Aroma Ingredients for Food and Beverages Market: Strategic Insights

| Market Size Value in | US$ 1.21 billion in 2022 |

| Market Size Value by | US$ 1.67 billion by 2030 |

| Growth rate | CAGR of 4.1% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The "Global Aroma Ingredients for Food and Beverages Market Analysis to 2030" is a specialized and in-depth study with a major focus on market trends and growth opportunities. The report aims to provide an overview of the market with detailed market segmentation by type and application. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of aroma ingredients for food and beverages globally. In addition, the global aroma ingredients for food and beverages market report provides a qualitative assessment of various factors affecting the market performance globally. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The aroma ingredients for the food and beverages market forecast are estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the market performance.

Segmental Analysis:

The aroma ingredients for the food and beverages market are segmented on the basis of type and application. By type, the market is bifurcated into synthetic and natural. The synthetic segment is further segmented into terpenes, aldehydes, aliphatic, and others. The natural segment is further divided into essential oils, herbal extracts, oleoresins, and others. In 2022, the synthetic segment held the largest aroma ingredients for food and beverages market share. The natural segment is expected to register the highest CAGR from 2022 to 2030. Synthetic aroma ingredients are chemical compounds that mimic natural flavors found in foods and beverages. The surge in the demand for these ingredients in the food & beverages industry can be attributed to several factors. First, synthetic aroma ingredients provide consistency in flavor profile, ensuring that products taste the same every time, regardless of variations in natural ingredients. This consistency is crucial for brand identity and consumer satisfaction. Second, they offer cost-effectiveness compared to natural aroma ingredients, making them more accessible to manufacturers, particularly in large-scale production. Additionally, advancements in flavor science have led to the development of synthetic ingredients that closely replicate natural flavors, satisfying consumer preferences for familiar tastes while offering unique flavor combinations. In conclusion, concerns regarding the stability and availability of natural ingredients and regulatory pressures have further propelled the adoption of synthetic aroma ingredients in the food & beverages industry.

Regional Analysis:

The market scope focuses on five key regions—North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. Asia Pacific accounted for the largest aroma ingredients for food and beverages market share in 2022, with a market value of ~US$ 425 million. Europe accounted for the second largest share followed by North America.

In Europe, the growing demand for aroma ingredients can be attributed to the region's rich culinary traditions and increasing preference for premium and artisanal products. There is a strong cultural appreciation for culinary traditions and cuisine across Europe. Consumers in Europe value high-quality ingredients and authentic flavors, thereby driving the demand for aroma ingredients that enhance the sensory experience. This emphasis on gourmet excellence has led to a growing market for premium aroma ingredients sourced from natural and sustainable sources, catering to the discerning tastes of European consumers. Additionally, the increasing interest in healthier and more natural food options in Europe contributes to the market growth. European consumers have been embracing organic and plant-based diets, often incorporating ingredients with strong or unfamiliar tastes and fragrances, such as certain vegetables, grains, and legumes; to make these health-conscious choices more appealing, food manufacturers use aroma ingredients to mitigate any overpowering or objectionable flavors and fragrances, ensuring that products maintain wide consumer acceptance while adhering to natural and clean-label trends. This demand aligns with the broader European food quality, taste, and an awareness of sensory experience, all contributing to the adoption of aroma ingredients for food and beverages in the region.

In North America, the aroma ingredients for the food and beverages market are attributed to rising sales of convenience and packaged food products, the well-established food industry, and surging consumer preference for functional beverages. Aroma ingredients play a vital role in these products to enhance the overall aroma of the products, making them more appealing to the consumers. The growing consumer preference for natural and clean-label products has further contributed to market growth. As awareness of health and wellness continues to rise, consumers are increasingly seeking out products with natural aroma ingredients. This has led food and beverage manufacturers to incorporate aroma ingredients derived from natural sources such as fruits, herbs, and spices to meet consumer demand. In addition, the aroma ingredients for food and beverages market trends toward premiumization in the food & beverages sector have contributed to the increased demand.

Aroma Ingredients for Food and Beverages Market Report Scope

Industry Developments and Future Opportunities:

As per press releases, a few of the initiatives taken by key players operating in the aroma ingredients for food and beverages market are listed below:

- In March 2023, BASF SE announced its investment in a new plant in Zhanjiang, China, and menthol and linalool downstream plants in Ludwigshafen, Germany. This investment will expand and diversify BASF’s aroma ingredient value chain footprint in Germany and Malaysia and support customers’ growth opportunities.

Competitive Landscape and Key Companies:

International Flavors & Fragrances Inc, Sensient Technologies Corp, T Hasegawa Co Ltd, BASF SE, V Mane Fils Sas, Symrise AG, Firmenich International SA, Archer-Daniels-Midland Co, Kerry Group Plc, and Berje Inc are among the key players profiled in the aroma ingredients for food and beverages market report. The global market players focus on providing high-quality products to fulfill customer demand.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Global aroma ingredients for food and beverages market is segmented by application into bakery and confectionery, dairy and frozen desserts, beverages, sweet and savory snacks, RTE and RTC meals, and others. Aroma ingredients play a vital role in the bakery & confectionery industry by enhancing the sensory experience of products. Aroma ingredients such as natural extracts, essential oils, and flavor compounds are meticulously selected and blended to create specific flavor combinations, ranging from traditional favorites to innovative creations. Whether it is the rich aroma of vanilla in a classic cake, the delicate hint of citrus in a tart, or the comforting scent of cinnamon in a pastry, aroma ingredients add depth and complexity to baked goods and confections, enticing consumers, and elevating their enjoyment of these indulgent treat such as vanilla and mint confectioneries and candies, chewing gums, etc.

Based on type, the market is segmented into synthetic and natural. The natural segment is the fastest growing segment. Natural aroma ingredients derived from plant sources, essential oils, and other natural extracts are experiencing a surge in the demand within the food & beverages industry. There is a growing consumer preference for natural and minimally processed ingredients due to concerns about health and sustainability. Natural aroma ingredients align with this trend, as they are perceived to be healthier alternatives to synthetic counterparts. Also, the rise of clean-label products, prioritizing transparency and authenticity in ingredient sourcing, has propelled the demand for natural aroma ingredients. Consumers seek products with recognizable, natural ingredients, leading manufacturers to replace artificial flavorings with natural alternatives. Additionally, pursuing unique and exotic flavor profiles has driven the exploration and utilization of a diverse range of natural aroma ingredients, providing opportunities for innovation and differentiation in the market. Furthermore, increased awareness of the environmental impact and ethical considerations surrounding food production have fueled the demand for natural aroma ingredients, as they are often perceived to be more sustainable and environmentally friendly than synthetic alternatives.

In the food & beverages industry, aroma ingredients have become increasingly vital for enhancing the sensory experience. Consumers are becoming more discerning and seeking products that taste good and have an appealing aroma. Moreover, in an industry characterized by huge competition, differentiation is a key to capturing consumers' attention. This demand has resulted in manufacturers understanding the importance of creating high-quality aroma ingredients for food and beverages to taste delicious and evoke positive sensory responses to attract consumers. Aroma ingredients offer a unique opportunity for manufacturers to differentiate their products. By experimenting with diverse aroma profiles and incorporating novel fragrance combinations, food and beverage companies can create innovative offerings that cater to evolving consumer preferences. This emphasis on differentiation through aroma allows and builds a loyal customer base, thereby driving the demand for a wide array of aroma ingredients.

Consumers are becoming more conscious of the ingredients in their food and beverages, seeking products made with natural and authentic components. Natural aroma ingredients derived from sources such as fruits, herbs, spices, herbs, and botanicals resonate with growing consumer preferences for clean-label products. Key players in the market are developing natural aroma ingredients to cater to the growing consumer demand. For instance, in June 2021, Firmenich announced the launch of the Firgood collection, a new range of pure, 100% natural extracts obtained by a revolutionary, sustainable proprietary extraction technology. The launch was aimed to cater to the growing demand for natural ingredients.

Further, the preference for natural aroma ingredients extends beyond health considerations to encompass sensory experience and flavor authenticity. Natural aroma ingredients possess complex and nuanced flavor profiles that synthetic ingredients cannot replicate, providing a more authentic and satisfying culinary experience. The prominent players in the market are investing in developing natural aroma ingredients. For instance, in September 2022, Axxence Aromatic GmbH and the Dutch research institute Wageningen Plant Research, part of Wageningen University & Research, announced the long-term strategic research and development collaboration to develop natural ingredients.

In 2022, Asia Pacific dominated the global aroma ingredients for food and beverages market for food and beverages share. In Asia Pacific, the developed and developing countries are witnessing growth in urbanization, coupled with the rising middle-class population, offering several opportunities to the market players. The region is experiencing demand for diverse and innovative food and beverage options. The diverse and multicultural nature of Asia Pacific has resulted in diverse dietary preferences. The region reports increased demand for plant-based food products coupled with the surge in the vegan population. In addition, the changing consumer preferences toward healthy alternatives and surging environmental concerns post-COVID-19 pandemic have resulted in the demand for plant-based foods. According to the Biospringer, around 24% of consumers in Asia Pacific are limiting their meat consumption for environmental convictions. Aroma ingredients play a crucial role in enabling manufacturers to create plant-based food products with exciting and novel aroma combinations, enhancing the appeal of their products to a wider consumer base.

The major players operating in the global aroma ingredients for food and beverages market are are International Flavors & Fragrances Inc , Sensient Technologies Corp, T Hasegawa Co Ltd, BASF SE, V Mane Fils Sas, Symrise AG, Firmenich International SA, Archer-Daniels-Midland Co, Kerry Group Plc, And Berje Inc among others.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Market Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Aroma Ingredients for Food and Beverages Market Landscape

4.1 Overview

4.2 Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Competitive Rivalry

4.2.5 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers

4.3.2 Manufacturers

4.3.3 Distributors/Suppliers

4.3.4 Application

4.4 List of Vendors in the Value Chain

5. Aroma Ingredients for Food and Beverages Market – Key Market Dynamics

5.1 Aroma Ingredients for Food and Beverages Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Increasing Importance of Aroma in Food & Beverage Industry

5.2.2 Strategic Initiatives by Key Market Players

5.3 Market Restraints

5.3.1 Regulatory Compliances

5.4 Market Opportunities

5.4.1 Rising Demand for Aromas in Plant-Based Food and Beverages

5.5 Future Trends

5.5.1 Rising Trend for Natural Aromas

5.6 Impact of Drivers and Restraints:

6. Aroma Ingredients for Food and Beverages Market – Global Market Analysis

6.1 Aroma Ingredients for Food and Beverages Market Revenue (US$ Million), 2022–2030

6.2 Aroma Ingredients for Food and Beverages Market Forecast Analysis

7. Aroma Ingredients for Food and Beverages Market Analysis – by Type

7.1 Synthetic

7.1.1 Overview

7.1.2 Synthetic: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

7.1.2.1 Terpenes

7.1.2.1.1 Overview

7.1.2.1.2 Terpenes: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

7.1.2.2 Aldehydes

7.1.2.2.1 Overview

7.1.2.2.2 Aldehydes: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

7.1.2.3 Aliphatic

7.1.2.3.1 Overview

7.1.2.3.2 Aliphatic: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

7.1.2.4 Others

7.1.2.4.1 Overview

7.1.2.4.2 Others: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

7.2 Natural

7.2.1 Overview

7.2.2 Natural: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

7.2.2.1 Essential Oils

7.2.2.1.1 Overview

7.2.2.1.2 Essential Oils: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

7.2.2.2 Herbal Extracts

7.2.2.2.1 Overview

7.2.2.2.2 Herbal Extracts: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

7.2.2.3 Oleoresins

7.2.2.3.1 Overview

7.2.2.3.2 Oleoresins: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

7.2.2.4 Others

7.2.2.4.1 Overview

7.2.2.4.2 Others: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

8. Aroma Ingredients for Food and Beverages Market Analysis – by Application

8.1 Bakery and Confectionery

8.1.1 Overview

8.1.2 Bakery and Confectionery: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

8.2 Dairy and Frozen Desserts

8.2.1 Overview

8.2.2 Dairy and Frozen Desserts: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

8.3 Beverages

8.3.1 Overview

8.3.2 Beverages: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Sweet and Savory Snacks

8.4.1 Overview

8.4.2 Sweet and Savory Snacks: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

8.5 RTE and RTC Meals

8.5.1 Overview

8.5.2 RTE and RTC Meals: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9. Aroma Ingredients for Food and Beverages Market – Geographical Analysis

9.1 Overview

9.2 North America

9.2.1 North America Aroma Ingredients for Food and Beverages Market Overview

9.2.2 North America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.2.3 North America: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.2.3.1 North America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Type

9.2.4 North America: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.2.4.1 North America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Application

9.2.5 North America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Country

9.2.5.1 North America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Country

9.2.5.2 United States: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.2.5.2.1 United States: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.2.5.2.2 United States: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.2.5.3 Canada: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.2.5.3.1 Canada: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.2.5.3.2 Canada: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.2.5.4 Mexico: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.2.5.4.1 Mexico: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.2.5.4.2 Mexico: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.3 Europe

9.3.1 Europe Aroma Ingredients for Food and Beverages Market Overview

9.3.2 Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.3.3 Europe: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.3.3.1 Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Type

9.3.4 Europe: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.3.4.1 Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Application

9.3.5 Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Country

9.3.5.1 Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Country

9.3.5.2 Germany: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.3.5.2.1 Germany: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.3.5.2.2 Germany: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.3.5.3 France: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.3.5.3.1 France: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.3.5.3.2 France: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.3.5.4 Italy: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.3.5.4.1 Italy: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.3.5.4.2 Italy: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.3.5.5 United Kingdom: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.3.5.5.1 United Kingdom: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.3.5.5.2 United Kingdom: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.3.5.6 Russian Federation: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.3.5.6.1 Russian Federation: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.3.5.6.2 Russian Federation: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.3.5.7 Rest of Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.3.5.7.1 Rest of Europe: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.3.5.7.2 Rest of Europe: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.4 Asia Pacific

9.4.1 Asia Pacific Aroma Ingredients for Food and Beverages Market Overview

9.4.2 Asia Pacific: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.4.3 Asia Pacific: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.4.3.1 Asia Pacific: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Type

9.4.4 Asia Pacific: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.4.4.1 Asia Pacific: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Application

9.4.5 Asia Pacific: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Country

9.4.5.1 Asia Pacific: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Country

9.4.5.2 Australia: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.4.5.2.1 Australia: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.4.5.2.2 Australia: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.4.5.3 China: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.4.5.3.1 China: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.4.5.3.2 China: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.4.5.4 India: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.4.5.4.1 India: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.4.5.4.2 India: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.4.5.5 Japan: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.4.5.5.1 Japan: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.4.5.5.2 Japan: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.4.5.6 South Korea: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.4.5.6.1 South Korea: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.4.5.6.2 South Korea: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.4.5.7 Rest of APAC: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.4.5.7.1 Rest of APAC: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.4.5.7.2 Rest of APAC: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.5 Middle East and Africa

9.5.1 Middle East and Africa Aroma Ingredients for Food and Beverages Market Overview

9.5.2 Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.5.3 Middle East and Africa: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.5.3.1 Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Type

9.5.4 Middle East and Africa: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.5.4.1 Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Application

9.5.5 Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Country

9.5.5.1 Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Country

9.5.5.2 South Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.5.5.2.1 South Africa: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.5.5.2.2 South Africa: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.5.5.3 Saudi Arabia: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.5.5.3.1 Saudi Arabia: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.5.5.3.2 Saudi Arabia: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.5.5.4 United Arab Emirates: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.5.5.4.1 United Arab Emirates: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.5.5.4.2 United Arab Emirates: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.5.5.5 Rest of Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.5.5.5.1 Rest of Middle East and Africa: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.5.5.5.2 Rest of Middle East and Africa: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.6 South and Central America

9.6.1 South and Central America Aroma Ingredients for Food and Beverages Market Overview

9.6.2 South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.6.3 South and Central America: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.6.3.1 South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Type

9.6.4 South and Central America: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.6.4.1 South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Application

9.6.5 South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Country

9.6.5.1 South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast Analysis – by Country

9.6.5.2 Brazil: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.6.5.2.1 Brazil: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.6.5.2.2 Brazil: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.6.5.3 Argentina: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.6.5.3.1 Argentina: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.6.5.3.2 Argentina: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

9.6.5.4 Rest of South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

9.6.5.4.1 Rest of South and Central America: Aroma Ingredients for Food and Beverages Market Breakdown, by Type

9.6.5.4.2 Rest of South and Central America: Aroma Ingredients for Food and Beverages Market Breakdown, by Application

10. Aroma Ingredients for Food and Beverages Market – Impact of COVID-19 Pandemic

10.1 Pre & Post COVID-19 Impact

11. Competitive Landscape

11.1 Heat Map Analysis by Key Players

11.2 Company Positioning & Concentration

12. Industry Landscape

12.1 Overview

12.2 New Product Development

12.3 Partnerships, Expansions, and Mergers and Acquisitions

13. Company Profiles

13.1 International Flavors & Fragrances Inc

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

There are no recent developments for International Flavors & Fragrances Inc in the Aroma ingredients for the food and beverages market.

13.2 Sensient Technologies Corp

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

There are no recent developments for Sensient Technologies Corp in the Aroma ingredients for the food and beverages market.

13.3 T Hasegawa Co Ltd

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 BASF SE

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 V MANE FILS SAS

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Symrise AG

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Firmenich International SA

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Archer-Daniels-Midland Co

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Kerry Group Plc

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Berje Inc

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

LIST OF TABLES

Table 1. Aroma Ingredients for Food and Beverages Market Segmentation

Table 2. List of Vendors

Table 3. Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Table 4. Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 5. Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million) – by Application

Table 6. North America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 7. North America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 8. North America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 9. United States: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 10. United States: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 11. Canada: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 12. Canada: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 13. Mexico: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 14. Mexico: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 15. Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 16. Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 17. Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 18. Germany: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 19. Germany: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 20. France: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 21. France: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 22. Italy: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 23. Italy: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 24. United Kingdom: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 25. United Kingdom: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 26. Russian Federation: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 27. Russian Federation: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 28. Rest of Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 29. Rest of Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 30. Asia Pacific: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 31. Asia Pacific: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 32. Asia Pacific: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 33. Australia: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 34. Australia: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 35. China: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 36. China: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 37. India: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 38. India: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 39. Japan: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 40. Japan: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 41. South Korea: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 42. South Korea: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 43. Rest of APAC: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 44. Rest of APAC: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 45. Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 46. Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million) – by Application

Table 47. Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 48. South Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 49. South Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 50. Saudi Arabia: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 51. Saudi Arabia: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 52. United Arab Emirates: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 53. United Arab Emirates: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 54. Rest of Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 55. Rest of Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 56. South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 57. South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 58. South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 59. Brazil: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 60. Brazil: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 61. Argentina: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 62. Argentina: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 63. Rest of South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Type

Table 64. Rest of South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 65. Heat Map Analysis by Key Players

LIST OF FIGURES

Figure 1. Aroma Ingredients for Food and Beverages Market Segmentation, by Geography

Figure 2. Ecosystem: Aroma Ingredients for Food and Beverages Market

Figure 3. Impact Analysis of Drivers and Restraints

Figure 4. Aroma Ingredients for Food and Beverages Market Revenue (US$ Million), 2022–2030

Figure 5. Aroma Ingredients for Food and Beverages Market Share (%) – by Type (2022 and 2030)

Figure 6. Synthetic: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 7. Terpenes: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. Aldehydes: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Aliphatic: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Others: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Natural: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Essential Oils: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Herbal Extracts: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Oleoresins: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Others: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Aroma Ingredients for Food and Beverages Market Share (%) – by Application (2022 and 2030)

Figure 17. Bakery and Confectionery: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Dairy and Frozen Desserts: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Beverages: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Sweet and Savory Snacks: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. RTE and RTC Meals: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Others: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Aroma Ingredients for Food and Beverages Market Breakdown by Region, 2022 and 2030 (%)

Figure 24. North America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 25. North America: Aroma Ingredients for Food and Beverages Market Breakdown, by Type (2022 and 2030)

Figure 26. North America: Aroma Ingredients for Food and Beverages Market Breakdown, by Application (2022 and 2030)

Figure 27. North America: Aroma Ingredients for Food and Beverages Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 28. United States: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 29. Canada: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 30. Mexico: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 31. Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 32. Europe: Aroma Ingredients for Food and Beverages Market Breakdown, by Type (2022 and 2030)

Figure 33. Europe: Aroma Ingredients for Food and Beverages Market Breakdown, by Application (2022 and 2030)

Figure 34. Europe: Aroma Ingredients for Food and Beverages Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 35. Germany: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 36. France: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 37. Italy: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 38. United Kingdom: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 39. Russian Federation: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 40. Rest of Europe: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 41. Asia Pacific: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 42. Asia Pacific: Aroma Ingredients for Food and Beverages Market Breakdown, by Type (2022 and 2030)

Figure 43. Asia Pacific: Aroma Ingredients for Food and Beverages Market Breakdown, by Application (2022 and 2030)

Figure 44. Asia Pacific: Aroma Ingredients for Food and Beverages Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 45. Australia: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 46. China: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 47. India: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 48. Japan: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 49. South Korea: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 50. Rest of APAC: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 51. Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 52. Middle East and Africa: Aroma Ingredients for Food and Beverages Market Breakdown, by Type (2022 and 2030)

Figure 53. Middle East and Africa: Aroma Ingredients for Food and Beverages Market Breakdown, by Application (2022 and 2030)

Figure 54. Middle East and Africa: Aroma Ingredients for Food and Beverages Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 55. South Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 56. Saudi Arabia: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 57. United Arab Emirates: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030 (US$ Million)

Figure 58. Rest of Middle East and Africa: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 59. South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 60. South and Central America: Aroma Ingredients for Food and Beverages Market Breakdown, by Type (2022 and 2030)

Figure 61. South and Central America: Aroma Ingredients for Food and Beverages Market Breakdown, by Application (2022 and 2030)

Figure 62. South and Central America: Aroma Ingredients for Food and Beverages Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 63. Brazil: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 64. Argentina: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 65. Rest of South and Central America: Aroma Ingredients for Food and Beverages Market – Revenue and Forecast to 2030(US$ Million)

Figure 66. Company Positioning & Concentration

The List of Companies - Aroma Ingredients for Food and Beverages Market

- International Flavors & Fragrances Inc

- Sensient Technologies Corp

- T Hasegawa Co Ltd

- BASF SE

- V Mane Fils Sas

- Symrise AG

- Firmenich International SA

- Archer-Daniels-Midland Co

- Kerry Group Plc

- Berje Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Aroma Ingredients for Food and Beverages Market

Mar 2024

Wheat Bran/Offal Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Form (Flour/Meal, Flakes, and Pellets), Category (Organic and Conventional), Application (Animal Feed, Breakfast Cereals, Nutritional Bars, Beverages, Baked Goods, and Others), and Geography

Mar 2024

Blueberries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Form (Fresh, Frozen, and Dried), Category (Conventional and Organic), End Use (Food Service, Food Retail, and Food Processing), and Geography

Mar 2024

Resistant Starch Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Form (Dry and Liquid), Type (Type1, Type2, Type3, and Type4), Application [Food and Beverages (Bakery and Confectionery, Dairy and Frozen Dessert, Beverages, Sweet and Savory Snacks, and Others), Dietary Supplements, and Animal Nutrition], and Geography

Mar 2024

Demineralized Whey Powder Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (50% Demineralized Whey, 70% Demineralized Whey, 90% Demineralized Whey, and Others), Category (Conventional and Organic), Application (Bakery and Confectionery, Dairy and Frozen Desserts, Infant Nutrition, Beverages, and Others), and Geography

Mar 2024

Tallow Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Beef, Sheep, and Others), End-Use Industry (Food & Beverages, Personal Care & Cosmetics, Lubricants, Biofuel, Animal Nutrition, and Others), and Geography

Mar 2024

Frozen Belgian Waffles Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Brussels Waffles and Liege Waffles/Belgian Sugar Waffles), Nature (Flavored and Plain), Category (Conventional and Gluten-Free), End User (Foodservice and Food Retail), and Geography

Mar 2024

Frozen Bakery Products Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Bread and Rolls, Cakes and Pastries, Biscuits and Cookies, and Others), Category (Gluten-Free and Conventional), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others), and Geography

Get Free Sample For

Get Free Sample For