The Asia Pacific green tea market is accounted to US$ 8710.7 Mn in 2018 and is expected to grow at a CAGR of 5.9% during the forecast period 2019 – 2027, to account to US$ 14568.7 Mn by 2027.

Green tea is prepared from the Camellia sinens is plant. The leaf buds and dried leaves of the Camellia sinensis plant are used in the preparation of the green tea. It is prepared by pan-frying and steaming these leaves followed by drying them. Green tea is known to be beneficial against various health issues such as depression, various types of cancers such as lung cancer, liver cancer, colon cancer, gastric cancer, and many others. Some of the scientific studies have also proven that the consumption of green tea is beneficial in enhancing the thinking skills and also is helpful in lowering cholesterol and triglycerides in the body. Moreover, The green tea bags are mainly made of filter paper or food-grade plastic, or occasionally of silk cotton or silk. The green tea bags are available with many flavors like ginger, mint and lemon amongst others. Green tea has many health benefits which include better brain function, helps reducing fats, reducing risk of cancer and many other.

Asia Pacific Green Tea Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Market Insights

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Health benefits of flavoured green trea to favor the Asia Pacific green tea market

Consumers in developed and developing regions have become more aware of their health these days. Green tea is made from leaves and buds of Camellia sinensis, and it does not involve the process of withering and oxidation. The consumption of green tea is known to prevent cancer, liver cirrhosis, obesity, blood pressure, and many other chronic diseases. drink made combining green tea and lemon offers numerous health benefits as it has several anti-inflammatory and anti-microbial properties . The demand for unique flavored, rich aroma, and taste of green tea products is driving the growth of the green tea market. Tulsi green tea is rich in phytonutrients and antioxidants that help protect body against free radicals. Also, jasmine tea is typically made from green tea leaves, and it offers similar potent health benefits as that of green tea.

However, green tea is expensive as it is more selective about the part of the tea plant that is being used. It is made using only the tea plant's new buds/leaves. Green tea leaves are not fermented and therefore do not undergo the process of oxidation as in the case of black tea. These factors make green tea expensive than the regular tea. The key players in the green tea market are experimenting with new, unique flavors, and aromas. As flavor, aroma options increase, consumers may turn to green tea products as a convenient way to benefit their health. Various flavors such as basil, jasmine, lemon, and tulsi are used in the production of green tea. Currently, the RTD green tea beverage consumption is continuously growing with the rise in disposable income and increasing buying power of consumers. Millennials are looking forward to adopting high-end and super-premium products, which is helping in the growth of premium RTD green tea products.

Type Insights

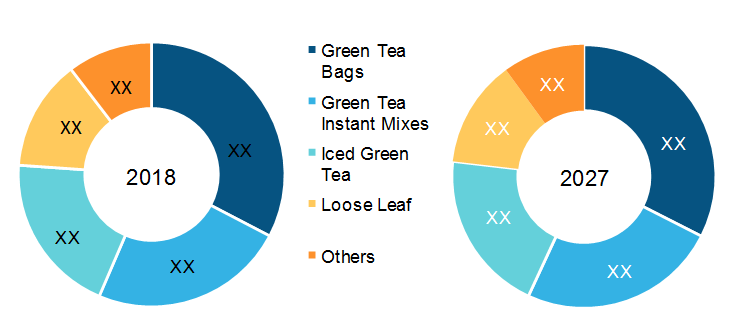

The Asia Pacific green tea market is segmented on the basis of type is segmented into green tea bags, green tea instant mixes, iced green tea, and loose leaf and others. The green tea is in demand due to its multiple health benefits. The green tea bag segment dominated the Asia Pacific green tea market. Tea bags were discovered in 1904. A tea bag is a thin porous bag, filled with tea leaves. They can be opened and empty thus allowing the full-leaf tea to be filled by the tea brewer or the consumers. The green tea bags are generally made of filter paper, food-grade plastic, or silk cotton. The instant tea was invented in the 1930's but not sold until the late 1950's. The instant green tea became popular with the introduction of innovative products in the market. Once the tea is brewed and liquefied, it is then concentrated and dried into powder form. The amount of nutrients in the instant mix is said to be the same as the green tea brewed. An instant green tea mix dissolves quickly in the liquid medium and does not leave any residue. Iced green tea offers cool refreshment during hot days, along with certain health benefits. Unflavored iced green tea contains zero calories; however, sweetened version usually have less calories compared to soft drinks or juices. nce the loose leaf tea is soaked in liquid medium, the tea leaves have room to absorb ample water and expand as they infuse it. This allows the liquid to flow through the leaves and extract a wide range of vitamins, minerals, flavors, and aromas. Capsules or the dietary supplement are included in green tea. The power of green tea to enhance the overall health has been respected by Asian cultures since a very long time.

Flavours Insights

The Asia Pacific green tea market is segmented on the basis of flavour as lemon, aloe vera, cinnamon, vanilla, basil and others. The lemon segment led the Asia Pacific green tea flavoured market. The lemon green tea consists of antioxidants, flavonoids, and other phytonutrients which helps fighting many diseases including cancer. It is also available in the form of iced lemon green tea. Adding fresh lemon juice to the green tea, increases its medicinal properties along with enhanced taste. Aloe vera is a plant which is traditionally known for its medicinal properties, which helps in boosting immunity, enhancing skin elasticity by making it more flexible and smooth. Green tea and cinnamon are meant for their flavor value and health-promoting properties. The distinct sweet and warm aromas of cinnamon enhance the richness in the flavor of green tea. Vanilla, is a significantly used as flavoring agent in most of the desserts and beverages including vanilla ice creams, milk shakes, smoothies and more are always so popular among the consumers across the Asia Pacific region. Basil green tea is consumed by the consumer as the basil has the quality to sharpen the memory while they reduce anxiety. . Green tea farming has spread throughout Asia, creating various sorts and strains such asmint green tea, tulsi green tea, and jasmine green tea. The rich antioxidant concoction of green tea with natural flavors boosts the body energy level and improves digestion. The green tea flavored with jasmine flower essence offers same health benefits as that of normal green tea along with flavored taste.

Distribution Channel Insights

The Asia Pacific green tea market is segmented on the basis of distribution channel is segmented into supermarkets and hypermarkets, convenience stores,online and others. The supermarkets & hypermarkets segment in the Asia Pacific green tea market is estimated to hold a leading share in the market. Hypermarkets and supermarkets are self-help shops giving a wide variety of green tea products such as green tea mixes, iced green tea, different flavors of green tea including basil, tulsi, honey, lemon etc. These wide range of products are placed in a very organized way in different sections and shelves to attract customers. Convenience stores are the stores that are located in a limited area and are small in size as compared to hypermarkets & supermarkets. The online portals like Big Basket, Amazon, Natures Basket, etc. have been beneficial in the growth and expansion of the Asia Pacific green tea market. Increased use of mobile phones, computers, and laptops, has helped in the growth of digital channels, both in strength and volume. The other segment of green tea distribution channel includes grocery stores, retail stores, specialty stores, food services etc. These retailers sell multiple products from various national and local brands in different packaging formats, such as glass, premium plastics and others.

India Green Tea Market, by Type

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

ASIA PACIFIC GREEN TEA MARKET SEGMENTATION

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Asia Pacific Green Tea Market, by Type

- Green tea bags

- Green Tea Instant Mixes

- Iced Green Tea

- Loose Leaf

- Others

Asia Pacific Green Tea Market, by Flavour

- Lemon

- Aloe Vera

- Cinnamon

- Vanilla

- Basil

- Others

Asia Pacific Green Tea Market, by Distribution Channel

- Supermarket and Hypermarkets

- Convenience stores

- Online

- Others

Asia Pacific Green Tea Market, by Country

- China

- India

- Japan

- South Korea

- Rest of APAC

Company Profiles

- Finlays

- Kirin Holdings Company

- Associated British Foods plc.

- Nestle, Hankook Tea

- ITO EN

- Tata Global Beverages

- Unilever

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Flavour, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Asia Pacific Green Tea Market – By Type

1.3.2 Asia Pacific Green Tea Market – ByFlavour

1.3.3 Asia Pacific Green Tea Market – By Distribution Channel

1.3.4 Asia Pacific Green Tea Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Green tea Market Landscape

4.1 Market Overview

4.1.1 Asia Pacific PEST Analysis

5. Green tea Market – Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Health Benefits of Flavored Green Tea

5.1.2 Cumulative M&A Activities and Product Launches

5.2 Market Restraints

5.2.1 Higher Price of Green Tea as Compared to Other Tea

5.3 Market Opportunities

5.3.1 Introduction of New Flavours and Attractive Packaging

5.4 Future Trends

5.4.1 Surge in Consumption of Premium RTD Green Tea Flavored Beverages

5.5 Impact Analysis

6. Green tea– Asia Pacific Market Analysis

6.1 Asia Pacific Green Tea Market Overview

6.2 Asia Pacific Green Tea Market Forecast and Analysis

7. Asia Pacific Green Tea Market Analysis – By Type

7.1 Overview

7.2 Green Tea Bags

7.2.1 Overview

7.2.2 Asia Pacific Green Tea Bags in Green Tea Market, Revenue Forecast to 2027 (US$ Mn)

7.3 Green Tea Instant Mixes

7.3.1 Overview

7.3.2 Asia Pacific Green Tea Instant Mixes in Green Tea Market, Revenue and Forecast to 2027 (US$ Mn)

7.4 Iced Green Tea

7.4.1 Overview

7.4.2 Asia Pacific Iced Green Tea in Green Tea Market, Revenue and Forecast to 2027 (US$ Mn)

7.5 Loose Leaf

7.5.1 Overview

7.5.2 Asia Pacific Loose Leaf in Green Tea Market, Revenue and Forecast to 2027 (US$ Mn)

7.6 Others

7.6.1 Overview

7.6.2 Asia Pacific Others in Green Tea Market, Revenue and Forecast to 2027 (US$ Mn)

8. Asia Pacific Green Tea Market Analysis – By Flavours

8.1 Overview

8.2 Asia Pacific Green Tea Market Breakdown, by Flavours, 2018 & 2027

8.3 Lemon

8.3.1 Overview

8.3.2 Asia Pacific Lemon in Green Tea Market, Revenue Forecast to 2027 (US$ Mn)

8.4 Aloe Vera

8.4.1 Overview

8.4.2 Asia Pacific Aloe Vera in Green Tea Market, Revenue and Forecast to 2027 (US$ Mn)

8.5 Cinnamon

8.5.1 Overview

8.5.2 Asia Pacific Cinnamon in Green Tea Market, Revenue and Forecast to 2027 (US$ Mn)

8.6 Vanilla

8.6.1 Overview

8.6.2 Asia Pacific Vanilla in Green Tea Market, Revenue and Forecast to 2027 (US$ Mn)

8.7 Basil

8.7.1 Overview

8.7.2 Asia Pacific Basil in Green Tea Market, Revenue and Forecast to 2027 (US$ Mn)

8.8 Others

8.8.1 Overview

8.8.2 Asia Pacific Others in Green Tea Market, Revenue and Forecast to 2027 (US$ Mn)

9. Asia Pacific Green Tea Market Analysis – By Distribution Channel

9.1 Overview

9.2 Asia Pacific Green Tea Market Breakdown, By Distribution Channel, 2018 & 2027

9.3 Hypermarkets and Supermarkets

9.3.1 Asia Pacific Green Tea Market Revenue Via Hypermarkets and Supermarkets Revenue and Forecast, to 2027 (US$ Mn)

9.4 Convenience Store

9.4.1 Asia Pacific Green Tea Market Revenue Via Convenience Stores Revenue and Forecast, to 2027 (US$ Mn)

9.5 Online Stores

9.5.1 Asia Pacific Green Tea Market Revenue Via Online Stores Revenue and Forecast, to 2027 (US$ Mn)

9.6 Others

9.6.1 Asia Pacific Green Tea Market Via Others Forecasts to 2027 (US$ Mn)

10. Asia Pacific Green Tea Market – Country Analysis

10.1 Overview

10.1.1 Asia Pacific Green tea Market Revenue and Forecast to 2027 (US$ Mn)

10.1.2 Asia Pacific Green Tea Market Breakdown, by Key Countries

10.1.2.1 China :Green Tea Market–Revenue and Forecast to 2027(US$ Million)

10.1.2.1.1 China :Green Tea Market by Type

10.1.2.1.2 China :Green Tea Market by Flavour

10.1.2.1.3 China :Green Tea Market by Distribution Channel

10.1.2.2 India: Green Tea Market–Revenue and Forecast to 2027(US$ Million)

10.1.2.2.1 India: Green Tea Market by Type

10.1.2.2.2 India: Green Tea Market by Flavour

10.1.2.2.3 India :Green Tea Market by Distribution Channel

10.1.2.3 Japan: Green Tea Market–Revenue and Forecast to 2027(US$ Million)

10.1.2.3.1 Japan: Green Tea Market by Type

10.1.2.3.2 Japan: Green Tea Market by Flavour

10.1.2.3.3 Japan: Green Tea Market by Distribution Channel

10.1.2.4 South Korea :Green Tea Market–Revenue and Forecast to 2027(US$ Million)

10.1.2.4.1 South Korea :Green Tea Market by Type

10.1.2.4.2 South Korea :Green Tea Market by Flavour

10.1.2.4.3 South Korea: Green Tea Market by Distribution Channel

10.1.2.5 Rest of APAC: Green Tea Market–Revenue and Forecast to 2027(US$ Million)

10.1.2.5.1 Rest of APAC: Green Tea Market by Type

10.1.2.5.2 Rest of APAC :Green Tea Market by Flavour

10.1.2.5.3 Rest of APAC: Green Tea Market by Distribution Channel

11. Company Profiles

11.1 TATA Global Beverages

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Finlays

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Unilever

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Nestlé

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products And Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Associated British Foods plc

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Kirin Holdings Company Ltd

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 ITO EN

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Hankook Tea

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

12. Appendix

12.1 About the Insight Partners

12.2 Glossary

LIST OF TABLES

Table 1. Asia Pacific Green Tea Market Revenue and Forecasts to 2027 (US$ Mn)

Table 2. Asia Pacific Green Tea Market Revenue and Forecasts to 2027 – By Type (US$ Mn)

Table 3. China Green Tea Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 4. China Green Tea Market, by Flavour – Revenue and Forecast to 2027 (USD Million)

Table 5. China Green Tea Market, by Distribution Channel – Revenue and Forecast to 2027 (USD Million)

Table 6. India Green Tea Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 7. India Green Tea Market, by Flavour – Revenue and Forecast to 2027 (USD Million)

Table 8. India Green Tea Market, by Distribution Channel – Revenue and Forecast to 2027 (USD Million)

Table 9. Japan Green Tea Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 10. Japan Green Tea Market, by Flavour – Revenue and Forecast to 2027 (USD Million)

Table 11. Japan Green Tea Market, by Distribution Channel – Revenue and Forecast to 2027 (USD Million)

Table 12. South Korea Green Tea Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 13. South Korea Green Tea Market, by Flavour – Revenue and Forecast to 2027 (USD Million)

Table 14. South Korea Green Tea Market, by Distribution Channel – Revenue and Forecast to 2027 (USD Million)

Table 15. Rest of APAC Green Tea Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 16. Rest of APAC Green Tea Market, by Flavour – Revenue and Forecast to 2027 (USD Million)

Table 17. Rest of APAC Green Tea Market, by Distribution Channel – Revenue and Forecast to 2027 (USD Million)

Table 18. Glossary of Terms, Asia Pacific Green Tea Market

LIST OF FIGURES

Figure 1. Asia Pacific Green Tea Market Segmentations

Figure 2. Asia Pacific Green Tea Market Segmentation – By Country

Figure 3. Asia Pacific Green Tea Market Overview

Figure 4. Green Tea Bags Held Largest Share In The Asia Pacific Green Tea Market By Type

Figure 5. China Dominated The Asia Pacific Green Tea Market In 2018

Figure 6. Asia Pacific Green Tea Market, Industry Landscape

Figure 7. Asia Pacific – Pest Analysis

Figure 8. Green tea Market Impact Analysis of Driver and Restraints

Figure 9. Asia Pacific Green Tea Market Forecast and Analysis, (US$ Mn)

Figure 10. Asia Pacific Green Tea Market Breakdown by Type, 2018 & 2027 (%)

Figure 11. Asia Pacific Green Tea Bags in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 12. Asia Pacific Green Tea Instant Mixes in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 13. Asia Pacific Iced Green Tea in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 14. Asia Pacific Loose Leaf in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 15. Asia Pacific Others in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 16. Asia Pacific Green Tea Market Breakdown, by Flavours, 2018 & 2027 (%)

Figure 17. Asia Pacific Lemon in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 18. Asia Pacific Aloe Vera in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 19. Asia Pacific Cinnamon in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 20. Asia Pacific Vanilla in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 21. Asia Pacific Basil in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 22. Asia Pacific Others in Green Tea Market, Revenue and Forecast, 2017–2027 (US$ Mn)

Figure 23. Asia Pacific Green Tea Market Breakdown by Distribution Channel, 2018 & 2027 (%)

Figure 24. Asia Pacific Green Tea Market Revenue Via Hypermarkets and Supermarkets Forecast, to 2027 (US$ Mn)

Figure 25. Asia Pacific Green Tea Market Revenue Via Convenience Stores Revenue and Forecasts to 2027 (US$ Mn)

Figure 26. Asia Pacific Green Tea Market Revenue Via Online Revenue and Forecasts to 2027 (US$ Mn)

Figure 27. Asia Pacific Green Tea Market Revenue Via Others Forecasts to 2027 (US$ Mn)

Figure 28. Asia Pacific Green tea Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 29. Asia Pacific Green Tea Market Breakdown by Key Countries, 2018 & 2027(%)

Figure 30. China: Green Tea Market–Revenue and Forecast to 2027 (US$ Million)

Figure 31. India: Green Tea Market–Revenue and Forecast to 2027 (US$ Million)

Figure 32. Japan :Green Tea Market–Revenue and Forecast to 2027 (US$ Million)

Figure 33. South Korea :Green Tea Market–Revenue and Forecast to 2027 (US$ Million)

Figure 34. Rest of APAC: Green Tea Market–Revenue and Forecast to 2027 (US$ Million)

The List of Companies - Asia Pacific Green Tea Market

- Finlays

- Kirin Holdings Company

- Associated British Foods plc.

- Nestle, Hankook Tea

- ITO EN

- Tata Global Beverages

- Unilever

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Asia Pacific Green Tea Market

Mar 2020

Wheat Bran/Offal Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Form (Flour/Meal, Flakes, and Pellets), Category (Organic and Conventional), Application (Animal Feed, Breakfast Cereals, Nutritional Bars, Beverages, Baked Goods, and Others), and Geography

Mar 2020

Blueberries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Form (Fresh, Frozen, and Dried), Category (Conventional and Organic), End Use (Food Service, Food Retail, and Food Processing), and Geography

Mar 2020

Resistant Starch Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Form (Dry and Liquid), Type (Type1, Type2, Type3, and Type4), Application [Food and Beverages (Bakery and Confectionery, Dairy and Frozen Dessert, Beverages, Sweet and Savory Snacks, and Others), Dietary Supplements, and Animal Nutrition], and Geography

Mar 2020

Demineralized Whey Powder Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (50% Demineralized Whey, 70% Demineralized Whey, 90% Demineralized Whey, and Others), Category (Conventional and Organic), Application (Bakery and Confectionery, Dairy and Frozen Desserts, Infant Nutrition, Beverages, and Others), and Geography

Mar 2020

Tallow Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Beef, Sheep, and Others), End-Use Industry (Food & Beverages, Personal Care & Cosmetics, Lubricants, Biofuel, Animal Nutrition, and Others), and Geography

Mar 2020

Frozen Belgian Waffles Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Brussels Waffles and Liege Waffles/Belgian Sugar Waffles), Nature (Flavored and Plain), Category (Conventional and Gluten-Free), End User (Foodservice and Food Retail), and Geography

Mar 2020

Frozen Bakery Products Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Bread and Rolls, Cakes and Pastries, Biscuits and Cookies, and Others), Category (Gluten-Free and Conventional), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others), and Geography

Get Free Sample For

Get Free Sample For