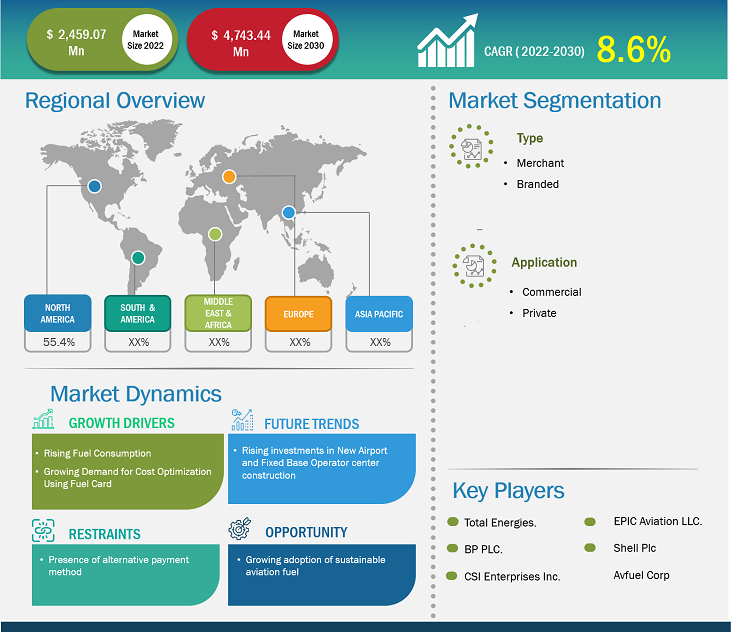

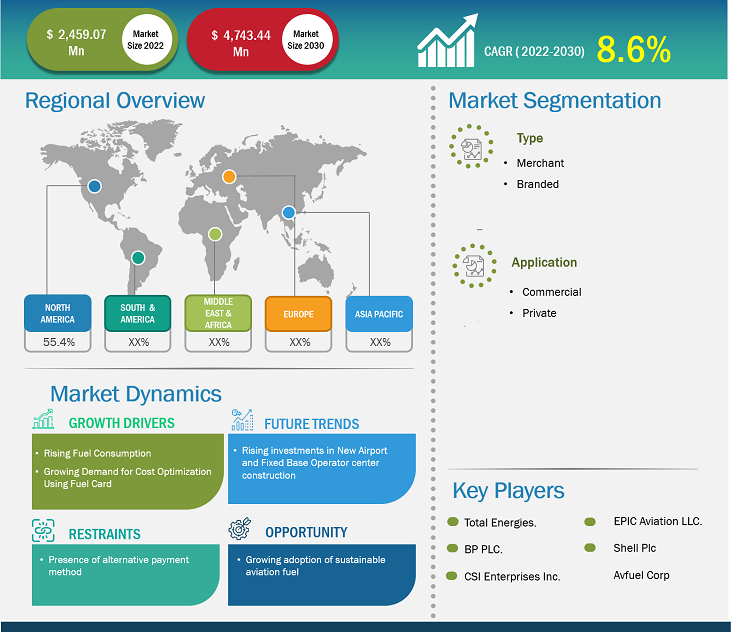

The Aviation Fuel Card Market size is projected to reach US$ 4,743.44 million by 2030 from US$ 2,459.07 million in 2022. The market is expected to register a CAGR of 8.6% in 2022–2030.

Traditionally, the aviation industry has made payments for fuel in a variety of ways, depending on the fuel industry’s and airline’s economic conditions and agreements in existence. Airlines and other aviation industries frequently purchase fuel on the spot market, either directly from oil companies or through fuel brokers. In such situations, the aviation corporation will most likely pay for the fuel with a mix of cash and credit. . Overall, the payment method used by the aviation industry to acquire fuel will be determined by a variety of criteria, such as the company's size, location, purchasing strategy, market conditions, and available possibilities. High-limit corporate cards with integrated cost management software can make it much easier to monitor fuel payments. High-limit cards allow businesses a lot more payment flexibility, which means they can keep operating without facing bank delays and fees for lending. In addition, unlike gasoline cards, which are rarely linked to cost management software, high-limit corporate credit cards from spend management companies offer a fully integrated experience. Corporate credit cards have made it simple to centralize fuel bills and streamline the overall expense management process. Rather than relying on different payment methods or refunds, a single credit card can be used for all fuel-related purchases, making it easier to track and manage spending. Consolidating fuel expenditures with a business credit card can aid in the development of stronger connections with fuel providers. Aviation companies that frequently utilize a single card for fuel transactions can have more negotiating power with fuel providers in terms of volume discounts or favourable terms. Thus, the benefits offered by other alternative methods hamper the aviation fuel card market growth.

Aviation Fuel Card Market Analysis

Many fuel producers and airline operators are taking initiatives to develop and adopt sustainable aviation fuel. In 2023, at the Dubai Airshow, officials from Boeing and Zero Petroleum signed an agreement to accelerate the development of synthetic sustainable aviation fuel (SAF). In 2023, Neste assisted the Trollhättan-Vänersborg airport and the airline Västflyg to become the world's first airline to use sustainable aviation fuel on all flights. In 2023, Emirates agreed to supply approximately 300,000 gallons of blended sustainable aviation fuel (SAF) to the airline's international hub in Dubai (DXB) through a partnership with Shell Aviation. Such initiatives are projected to increase the adoption of sustainable aviation fuel. Aviation fuel card suppliers can expand their business by offering attractive offers and discounts on the purchase of sustainable aviation fuel. This will ultimately lead to higher adoption and usage of aviation fuel cards. Further, by partnership with fixed-based operators, fuel card service providers can expand the network to supply sustainable aviation fuel. Thus, the rise in sustainable aviation fuel transactions is anticipated to have ample opportunities for the aviation fuel card market growth during the forecast period.

Aviation Fuel Card Market Overview

The role of fuel card suppliers in the ecosystem of the aviation fuel card market is crucial in ensuring the seamless functioning and reliability of fuel cards. Aviation fuel card suppliers play a significant role in providing fuel card services to end users such as commercial and private airlines. Fuel card suppliers ensure a secure and efficient role in payment processes for aviation fuel. Major fuel suppliers that provide fuel card services are termed branded fuel suppliers, which include BP plc, Shell Global, ExxonMobil, Titan Aviation Fuels, Jio-BP, AEGFUELS, and TotalEnergies Aviation. These entities are responsible for supplying aviation fuel and aviation fuel cards by themselves and hence ensuring a reliable aviation fuel card supply chain. Third parties and private companies that provide fuel card services are termed merchant fuel suppliers, which include World Fuel Services, CSI global-fleet, Aviation Pros, and Avfuel Corporation. Merchant fuel card suppliers are entities that are engaged in partnership or collaboration with major aviation fuel suppliers and ensure a seamless and secure payment process. This partnership or collaboration involves integrating systems to facilitate efficient transactions and maintain a reliable fuel supply.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Aviation Fuel Card Market: Strategic Insights

Market Size Value in US$ 2,459.07 million in 2022 Market Size Value by US$�4,743.44 million by 2030 Growth rate CAGR of 8.6% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Aviation Fuel Card Market: Strategic Insights

| Market Size Value in | US$ 2,459.07 million in 2022 |

| Market Size Value by | US$�4,743.44 million by 2030 |

| Growth rate | CAGR of 8.6% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Aviation Fuel Card Market Drivers and Opportunities

Increasing Aviation Fuel Consumption

Due to the high demand for air travel, overall fuel consumption has increased. In 2022, US airlines carried 194 million more passengers than in 2021, an increase of 30% year on year. From January to December of 2022, US airlines handled 853 million passengers, up from 658 million in 2021 and 388 million in 2020. In 2021, the European Union (EU) experienced a significant rebound in air travel as the total number of passengers reached 373 million. This figure reflects a remarkable increase of 34.9% compared to the previous year, 2020. The surge in air passenger numbers was observed in Croatia, which experienced a remarkable increase of 84% in comparison to the 2021. Furthermore, Cyprus and Greece recorded substantial growth rates of 104.8% and 85.9%, respectively. This surge in the number of passengers, particularly in countries such as Croatia, Cyprus, and Greece, highlights the growing demand for air travel and the subsequent need for fuel.

Rising Investments in New Airport and Fixed Base Operator Center Construction

Various developed and developing countries across the globe are focusing on increasing their total number of airports. In 2023, the government of Vietnam intends to build more than 30 airports by 2030 in order to enhance tourism and trade. The country has established 22 airports; however, the government is focused on constructing new airports in order to accommodate the growing number of aircraft. The Vietnamese government approved the building of the Long Thanh International Airport in 2021, with completion scheduled for 2025. The Long Thanh International Airport will be Vietnam's largest airport, with a capacity of up to 100 million people per year. The government aims to expand to more than 30 airports by 2030, which demonstrates the country's commitment to developing its aviation industry. In 2023, Saudi Arabia announced the expansion of its domestic aviation industry, which will require an investment of US$ 100 billion. In 2023, India announced investments of US$ 12 billion in airports over the next two years, including orders for hundreds of new planes to fulfill surging travel demand, which is putting a burden on current infrastructure.

Aviation Fuel Card Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Aviation Fuel Card Market analysis are type, application, and geography.

- Based on type, the Aviation Fuel Card Market has been segmented into merchant and branded. The merchant segment held a larger market share in 2022.

- By application, the Aviation Fuel Card Market has been segmented into commercial and private. The commercial segment held the largest share of the market in 2022.

Aviation Fuel Card Market Share Analysis by Geography

The geographic scope of the Aviation Fuel Card Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the Aviation Fuel Card Market in 2022, and it is expected to retain its dominance during the forecast period as well. The North America aviation fuel card industry is mainly driven by the growing awareness of the fuel card concept. Moreover, the growing aviation industry in countries such as the US and Canada is further driving the aviation fuel card market. The aviation industry is one of the notable industries in the US. As per the data published by the Airlines for America in 2023, commercial aviation accounted for 5% of US GDP and US$ 1.25 trillion in 2022. In addition, a large network of airports and fixed base operators in the US has supported the increased use of aviation fuel cards. In 2022, the US operated more than 5,100 public airports and 14,850 private airports. The air transportation industry contributes significantly to the Canadian economy. As per the International Air Transport Association (IATA), the industry contributed US$ 37 billion to Canadian GDP in 2018. Rising aviation fuel consumption and increasing aviation prices are driving the aviation fuel card market in Mexico. In June 2022, state-owned Pemex's wholesale jet fuel prices increased dramatically. The US held the largest share in the North America aviation fuel card market in 2022.

Aviation Fuel Card Market Report Scope

Aviation Fuel Card Market News and Recent Developments

The Aviation Fuel Card Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for aviation fuel card market and strategies:

- In September 2023, Air bp, the international aviation fuel products and services supplier, launched the offering of Jet-A1 fuel at Berlin Brandenburg Airport’s (BER) General Aviation (GA) terminal in a newly agreed agency collaboration with ExecuJet. (Source: Air BP, Press Release/Company Website/Newsletter)

- In October 2022, TreviPay, the global B2B payments and invoicing network, launched TreviPay Aviation Network, powered by KHI, to offer a co-branded, closed-loop card solution tailored to the needs of FBOs (fixed-base operators) and flight support service organizations who service the general and defense aviation industries, and their customers. (Source: TreviPay, Press Release/Company Website/Newsletter)

Aviation Fuel Card Market Report Coverage and Deliverables

The “Aviation Fuel Card Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Aviation Fuel Card Market Landscape

4.1 Overview

4.2 PORTER Analysis

4.3 Ecosystem Analysis

4.3.1 Fuel Card Suppliers

4.3.1.1 Branded Fuel Card Suppliers

4.3.1.2 Merchant Fuel Card Suppliers

4.3.2 End Users

4.3.3 List of Aviation Fuel Card Suppliers

5. Aviation Fuel Card Market - Key Industry Dynamics

5.1 Aviation Fuel Card Market - Key Industry Dynamics

5.2 Market Drivers

5.2.1 Rising Fuel Consumption

5.2.2 Growing Demand for the Cost Optimization Using Fuel Cards

5.3 Market Restraints

5.3.1 Presence of Alternative Payment Methods

5.4 Market Opportunities

5.4.1 Growing Adoption of Sustainable Aviation Fuel

5.5 Future Trends

5.5.1 Rising Investments in New Airport and Fixed Base Operator Center Construction

5.6 Impact of Drivers and Restraints:

6. Aviation Fuel Card Market - Global Market Analysis

6.1 Aviation Fuel Card Market Revenue (US$ Million), 2022 – 2030

6.2 Aviation Fuel Card Market Forecast and Analysis

7. Aviation Fuel Card Market Analysis - Type

7.1 Merchant

7.1.1 Overview

7.1.2 Merchant Market, Revenue and Forecast to 2030 (US$ Million)

7.2 Branded

7.2.1 Overview

7.2.2 Branded Market, Revenue and Forecast to 2030 (US$ Million)

8. Aviation Fuel Card Market Analysis – Application

8.1 Commercial

8.1.1 Overview

8.1.2 Commercial Market Revenue, and Forecast to 2030 (US$ Million)

8.2 Private

8.2.1 Overview

8.2.2 Private Market Revenue, and Forecast to 2030 (US$ Million)

9. Aviation Fuel Card Market - Geographical Analysis

9.1 Overview

9.2 North America

9.2.1 North America Aviation Fuel Card Market Overview

9.2.2 North America Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.2.3 North America Aviation Fuel Card Market Breakdown by Type

9.2.3.1 North America Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Type

9.2.4 North America Aviation Fuel Card Market Breakdown by Application

9.2.4.1 North America Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Application

9.2.5 North America Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Country

9.2.5.1 North America Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Country

9.2.5.2 US Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.2.5.2.1 US Aviation Fuel Card Market Breakdown by Type

9.2.5.2.2 US Aviation Fuel Card Market Breakdown by Application

9.2.5.3 Canada Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.2.5.3.1 Canada Aviation Fuel Card Market Breakdown by Type

9.2.5.3.2 Canada Aviation Fuel Card Market Breakdown by Application

9.2.5.4 Mexico Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.2.5.4.1 Mexico Aviation Fuel Card Market Breakdown by Type

9.2.5.4.2 Mexico Aviation Fuel Card Market Breakdown by Application

9.3 Europe

9.3.1 Europe Aviation Fuel Card Market Overview

9.3.2 Europe Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.3.3 Europe Aviation Fuel Card Market Breakdown by Type

9.3.3.1 Europe Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Type

9.3.4 Europe Aviation Fuel Card Market Breakdown by Application

9.3.4.1 Europe Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Application

9.3.5 Europe Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Country

9.3.5.1 Europe Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Country

9.3.5.2 France Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.3.5.2.1 France Aviation Fuel Card Market Breakdown by Type

9.3.5.2.2 France Aviation Fuel Card Market Breakdown by Application

9.3.5.3 Germany Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.3.5.3.1 Germany Aviation Fuel Card Market Breakdown by Type

9.3.5.3.2 Germany Aviation Fuel Card Market Breakdown by Application

9.3.5.4 Italy Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.3.5.4.1 Italy Aviation Fuel Card Market Breakdown by Type

9.3.5.4.2 Italy Aviation Fuel Card Market Breakdown by Application

9.3.5.5 UK Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.3.5.5.1 UK Aviation Fuel Card Market Breakdown by Type

9.3.5.5.2 UK Aviation Fuel Card Market Breakdown by Application

9.3.5.6 Russia Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.3.5.6.1 Russia Aviation Fuel Card Market Breakdown by Type

9.3.5.6.1.1 Russia Aviation Fuel Card Market Breakdown by Application

9.3.5.7 Rest of Europe Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.3.5.7.1 Rest of Europe Aviation Fuel Card Market Breakdown by Type

9.3.5.7.2 Rest of Europe Aviation Fuel Card Market Breakdown by Application

9.4 Asia Pacific Aviation Fuel Card Market

9.4.1 Overview

9.4.2 Asia Pacific Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.4.3 Asia Pacific Aviation Fuel Card Market Breakdown by Type

9.4.3.1 Asia Pacific Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Type

9.4.4 Asia Pacific Aviation Fuel Card Market Breakdown by Application

9.4.4.1 Asia Pacific Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Application

9.4.5 Asia Pacific Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Country

9.4.5.1 Asia Pacific Aviation Fuel Card Market Revenue and Forecasts and Analysis - By Country

9.4.5.2 Australia Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.4.5.2.1 Australia Aviation Fuel Card Market Breakdown by Type

9.4.5.2.2 Australia Aviation Fuel Card Market Breakdown by Application

9.4.5.3 China Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.4.5.3.1 China Aviation Fuel Card Market Breakdown by Type

9.4.5.3.2 China Aviation Fuel Card Market Breakdown by Application

9.4.5.4 India Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.4.5.4.1 India Aviation Fuel Card Market Breakdown by Type

9.4.5.4.2 India Aviation Fuel Card Market Breakdown by Application

9.4.5.5 Japan Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.4.5.5.1 Japan Aviation Fuel Card Market Breakdown by Type

9.4.5.5.2 Japan Aviation Fuel Card Market Breakdown by Application

9.4.5.6 South Korea Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.4.5.6.1 South Korea Aviation Fuel Card Market Breakdown by Type

9.4.5.6.2 South Korea Aviation Fuel Card Market Breakdown by Application

9.4.5.7 Rest of Asia Pacific Aviation Fuel Card Market Revenue and Forecasts to 2030 (US$ Mn)

9.4.5.7.1 Rest of Asia Pacific Aviation Fuel Card Market Breakdown by Type

9.4.5.7.2 Rest of Asia Pacific Aviation Fuel Card Market Breakdown by Application

9.5 MEA: Aviation Fuel Card Market

9.5.1 MEA: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

9.5.2 MEA: Aviation Fuel Card Market- By Type

9.5.3 MEA: Aviation Fuel Card Market- By Application

9.5.4 MEA: Aviation Fuel Card Market- by Key Country

9.5.4.1 South Africa: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

9.5.4.1.1 South Africa: Aviation Fuel Card Market- By Type

9.5.4.1.2 South Africa: Aviation Fuel Card Market- By Application

9.5.4.2 Saudi Arabia: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

9.5.4.2.1 Saudi Arabia: Aviation Fuel Card Market- By Type

9.5.4.2.2 Saudi Arabia: Aviation Fuel Card Market- By Application

9.5.4.3 UAE: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

9.5.4.3.1 UAE: Aviation Fuel Card Market- By Type

9.5.4.3.2 UAE: Aviation Fuel Card Market- By Application

9.5.4.4 Rest of MEA: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

9.5.4.4.1 Rest of MEA: Aviation Fuel Card Market- By Type

9.5.4.4.2 Rest of MEA: Aviation Fuel Card Market- By Application

9.6 SAM: Aviation Fuel Card Market

9.6.1 SAM: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

9.6.2 SAM: Aviation Fuel Card Market- By Type

9.6.3 SAM: Aviation Fuel Card Market- By Application

9.6.4 SAM: Aviation Fuel Card Market- by Key Country

9.6.4.1 Brazil: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

9.6.4.1.1 Brazil: Aviation Fuel Card Market- By Type

9.6.4.1.2 Brazil: Aviation Fuel Card Market- By Application

9.6.4.2 Argentina: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

9.6.4.2.1 Argentina: Aviation Fuel Card Market- By Type

9.6.4.2.2 Argentina: Aviation Fuel Card Market- By Application

9.6.4.3 Rest of SAM: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

9.6.4.3.1 Rest of SAM: Aviation Fuel Card Market- By Type

9.6.4.3.2 Rest of SAM: Aviation Fuel Card Market- By Application

10. Aviation Fuel Card Market – Impact of COVID-19 Pandemic

10.1 Pre & Post Covid-19 Impact

11. Competitive Landscape

11.1 Heat Map Analysis by Key Players

11.2 Company Positioning & Concentration

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 Product Development

12.4 Mergers & Acquisitions

13. Company Profiles

13.1 Shell Plc

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 BP Plc

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Associated Energy Group LLC

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Viva Energy Group Ltd

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 TITAN Aviation Fuels Inc

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 CSI Enterprises Inc

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 TotalEnergies SE

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 EPIC Aviation LLC

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Kropp Holdings Inc

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Avfuel Corp

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

13.11 Multi Service Corp

13.11.1 Key Facts

13.11.2 Business Description

13.11.3 Products and Services

13.11.4 Financial Overview

13.11.5 SWOT Analysis

13.11.6 Key Developments

14. Appendix

14.1 Word Index

List of Tables

Table 1. Aviation Fuel Card Market Segmentation

Table 2. List of Vendors in the Value Chain

Table 3. Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Million)

Table 4. Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Million) – Type

Table 5. Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 6. North America Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 7. North America Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 8. North America Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Country

Table 9. US Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 10. US Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 11. Canada Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 12. Canada Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 13. Mexico Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 14. Mexico Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 15. Europe Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 16. Europe Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 17. Europe Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Country

Table 18. France Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 19. France Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 20. Germany Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 21. Germany Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 22. Italy Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 23. Italy Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 24. UK Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 25. UK Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 26. Russia Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 27. Russia Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 28. Rest of Europe Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 29. Rest of Europe Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 30. Asia Pacific Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 31. Asia Pacific Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 32. Asia Pacific Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Country

Table 33. Australia Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 34. Australia Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 35. China Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 36. China Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 37. India Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 38. India Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 39. Japan Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 40. Japan Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 41. South Korea Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 42. South Korea Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 43. Rest of Asia Pacific Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Type

Table 44. Rest of Asia Pacific Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 45. MEA: Aviation Fuel Card Market- By Type – Revenue and Forecast to 2030 (US$ Million)

Table 46. MEA: Aviation Fuel Card Market- By Application – Revenue and Forecast to 2030 (US$ Million)

Table 47. South Africa: Aviation Fuel Card Market- By Type –Revenue and Forecast to 2030 (US$ Million)

Table 48. South Africa: Aviation Fuel Card Market- By Application –Revenue and Forecast to 2030 (US$ Million)

Table 49. Saudi Arabia: Aviation Fuel Card Market- By Type –Revenue and Forecast to 2030 (US$ Million)

Table 50. Saudi Arabia: Aviation Fuel Card Market- By Application –Revenue and Forecast to 2030 (US$ Million)

Table 51. UAE: Aviation Fuel Card Market- By Type –Revenue and Forecast to 2030 (US$ Million)

Table 52. UAE: Aviation Fuel Card Market- By Application –Revenue and Forecast to 2030 (US$ Million)

Table 53. Rest of MEA: Aviation Fuel Card Market- By Type –Revenue and Forecast to 2030 (US$ Million)

Table 54. Rest of MEA: Aviation Fuel Card Market- By Application –Revenue and Forecast to 2030 (US$ Million)

Table 55. SAM: Aviation Fuel Card Market- By Type – Revenue and Forecast to 2030 (US$ Million)

Table 56. SAM: Aviation Fuel Card Market- By Application – Revenue and Forecast to 2030 (US$ Million)

Table 57. Brazil: Aviation Fuel Card Market- By Type –Revenue and Forecast to 2030 (US$ Million)

Table 58. Brazil: Aviation Fuel Card Market- By Application –Revenue and Forecast to 2030 (US$ Million)

Table 59. Argentina: Aviation Fuel Card Market- By Type –Revenue and Forecast to 2030 (US$ Million)

Table 60. Argentina: Aviation Fuel Card Market- By Application –Revenue and Forecast to 2030 (US$ Million)

Table 61. Rest of SAM: Aviation Fuel Card Market- By Type –Revenue and Forecast to 2030 (US$ Million)

Table 62. Rest of SAM: Aviation Fuel Card Market- By Application –Revenue and Forecast to 2030 (US$ Million)

Table 63. Heat Map Analysis by Key Players

Table 64. List of Abbreviation

List of Figures

Figure 1. Aviation Fuel Card Market Segmentation, By Geography

Figure 2. PORTER Analysis

Figure 3. Ecosystem: Aviation Fuel Card Market

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. Aviation Fuel Card Market Breakdown by Geography, 2022 and 2030 (%)

Figure 6. Aviation Fuel Card Market Revenue (US$ Million), 2022 – 2030

Figure 7. Aviation Fuel Card Market Share (%) – Type, 2022 and 2030

Figure 8. Merchant Market Revenue and Forecasts To 2030 (US$ Million)

Figure 9. Branded Market Revenue and Forecasts To 2030 (US$ Million)

Figure 10. Aviation Fuel Card Market Share (%) – Application, 2022 and 2030

Figure 11. Commercial Market Revenue and Forecasts To 2030 (US$ Million)

Figure 12. Private Market Revenue and Forecasts To 2030 (US$ Million)

Figure 13. Aviation Fuel Card Market Breakdown by Region, 2022 and 2030 (%)

Figure 14. North America Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 15. North America Aviation Fuel Card Market Breakdown by Type (2022 and 2030)

Figure 16. North America Aviation Fuel Card Market Breakdown by Application (2022 and 2030)

Figure 17. North America Aviation Fuel Card Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 18. US Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 19. Canada Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 20. Mexico Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 21. Europe Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 22. Europe Aviation Fuel Card Market Breakdown by Type (2022 and 2030)

Figure 23. Europe Aviation Fuel Card Market Breakdown by Application (2022 and 2030)

Figure 24. Europe Aviation Fuel Card Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 25. France Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 26. Germany Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 27. Italy Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 28. UK Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 29. Russia Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 30. Rest of Europe Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 31. Asia Pacific Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 32. Asia Pacific Aviation Fuel Card Market Breakdown by Type (2022 and 2030)

Figure 33. Asia Pacific Aviation Fuel Card Market Breakdown by Application (2022 and 2030)

Figure 34. Asia Pacific Aviation Fuel Card Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 35. Australia Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 36. China Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 37. India Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 38. Japan Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 39. South Korea Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 40. Rest of Asia Pacific Aviation Fuel Card Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 41. MEA: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

Figure 42. MEA: Aviation Fuel Card Market Revenue Share, By Type (2022 and 2030)

Figure 43. MEA: Aviation Fuel Card Market Revenue Share, By Application (2022 and 2030)

Figure 44. MEA: Aviation Fuel Card Market Revenue Share, By Key Country (2022 and 2030)

Figure 45. South Africa: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

Figure 46. Saudi Arabia: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

Figure 47. UAE: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

Figure 48. Rest of MEA: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

Figure 49. SAM: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

Figure 50. SAM: Aviation Fuel Card Market Revenue Share, By Type (2022 and 2030)

Figure 51. SAM: Aviation Fuel Card Market Revenue Share, By Application (2022 and 2030)

Figure 52. SAM: Aviation Fuel Card Market Revenue Share, By Key Country (2022 and 2030)

Figure 53. Brazil: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

Figure 54. Argentina: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

Figure 55. Rest of SAM: Aviation Fuel Card Market – Revenue and Forecast to 2030 (US$ Million)

Figure 56. Company Positioning & Concentration

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Aviation Fuel Card Market

Dec 2023

Trade Credit Insurance Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Enterprise Size (Large Enterprises and SMEs), Application (International and Domestic), End User (Energy, Automotive, Aerospace, Chemicals, Metals, Agriculture, Food and Beverages, Financial Services, Technology and Telecommunications, Transportation, and Others), and Geography

Dec 2023

Revenue Assurance for BFSI Market

Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Component (Solution and Services), Deployment (Cloud and On-Premise), Organization Size (Large Enterprises and SMEs), and Geography

Dec 2023

Insurance Third-Party Administrator Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Insurance Type (Healthcare, Retirement Plans, Commercial General Liability Insurers, and Other Insurance Types), End User (Large Enterprises and SMEs), and Geography

Dec 2023

Voice-based Payments Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware and Software), By Enterprise Size (Large Enterprises and Small and Medium-Sized Enterprises), By Industry (BFSI, Automotive, Healthcare, Retail, Government, and Others), and by Geography

Dec 2023

Published Report - Payment Machine Mounting Systems Market

Forecast to 2027 - COVID-19 Impact and Global Analysis by Type [POS Mount (Fixed Payment Mount and Drive Extension Arm Payment Mount) and Others]; End Users [Retail Stores, Restaurant and Pubs, Hotels, Hospitals, and Others]

Get Free Sample For

Get Free Sample For