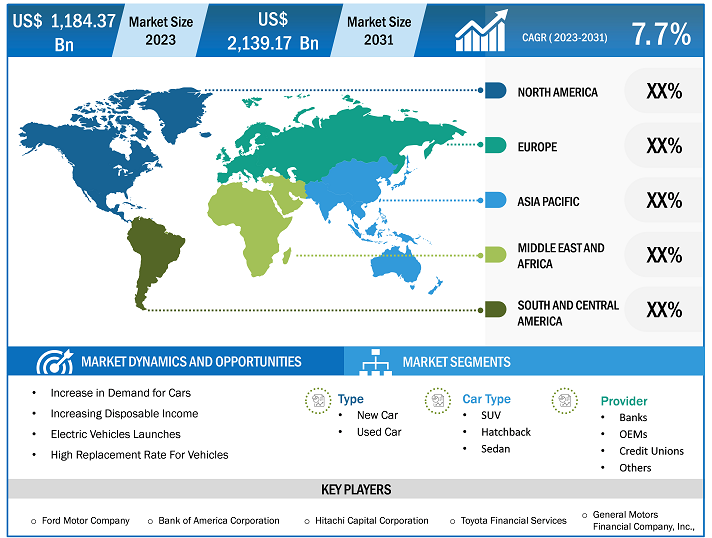

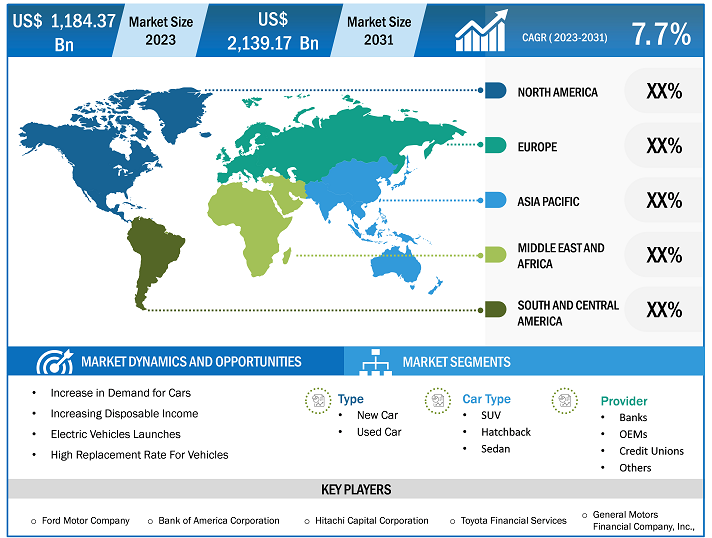

The car loan market size is expected to grow from US$ 1,184.37 billion in 2023 to US$ 2,139.17 billion by 2031; it is anticipated to expand at a CAGR of 7.7% from 2023 to 2031. The car loan market includes growth prospects owing to the current car loan market trends and their foreseeable impact during the forecast period. The car loan market is a large and expanding sector. The car loan market is growing due to factors such as an increase in demand for cars and increasing disposable income. Expanding electric vehicle launches and high replacement rate for vehicles provides lucrative opportunities for the car loan market growth. However, high interest rates restrain the market growth.

Car Loan Market Analysis

Ownership of cars, which used to be a status symbol long ago, has become a necessity in recent times. Thus, growing consumer preference for owning a vehicle is an important factor in the adoption of cars across the globe. Post-pandemic car loans have seen major transformations. The disposable income of consumers has significantly increased in many developing countries. Consequentially, the demand for vehicles has increased, bringing an increased need for car loans. Traditional and manual methods are insufficient to cater to this loan demand and digitalization is replacing at a rapid pace, bringing down the time needed to process loans from days to minutes. The widespread adaptation of digital technologies has empowered car loans by providing a quick and easy loan process.

Car Loan Industry Overview

- Car loans are secured loans where the car itself is used as a security. It is offered by lenders for used cars and new cars.

- Car loans are obtainable through credit unions, banks, and online lenders and need the vehicle to be used as security for the loan.

- A car loan is a kind of financing that can make it possible to buy a car and pay it off over time.

- The car loan market is expected to grow during the forecast period due to increasing innovations in the loan offerings by key market players.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Car Loan Market: Strategic Insights

Market Size Value in US$ 1,184.37 billion in 2023 Market Size Value by US$ 2,139.17 billion by 2031 Growth rate CAGR of 7.7% from 2023 to 2031 Forecast Period 2023-2031 Base Year 2023

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Car Loan Market: Strategic Insights

| Market Size Value in | US$ 1,184.37 billion in 2023 |

| Market Size Value by | US$ 2,139.17 billion by 2031 |

| Growth rate | CAGR of 7.7% from 2023 to 2031 |

| Forecast Period | 2023-2031 |

| Base Year | 2023 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Car Loan Market Driver

Growing Adoption Of Electric Vehicles To Provide Opportunities For The Car Loan Market

- The demand for electric vehicles is growing at a faster rate from 2021, owing to increasing investment in manufacturing plants. The growing demand for electric vehicles is primarily attributed to the increasing demand for low-emission vehicles, and growing supportive regulations for zero-emission vehicles through subsidies & tax rebates have compelled manufacturers to provide electric cars across the globe.

- As per the Global Electric Vehicle Outlook, sales of electric cars, including fully electric and plug-in hybrid vehicles, increased in 2021 to a new record of 6.6 million units. As per the same report, in China, electric car sales increased significantly in 2021 to 3.3 million, accounting for about half of the total global sales. EV sales also grew strongly in Europe by 65% to 2.3 million units, and the United States had doubled to 630,000 units in 2021.

- Bajaj Auto announced an investment worth US$ 40 million for manufacturing the Electric Vehicle plant in India with a production capacity of 500,000 electric vehicles per year.

- Thus, such growing production of electric vehicles is providing lucrative opportunities for the car loan market growth.

Car Loan Market Report Segmentation Analysis

- Based on type, the car loan market is segmented into new cars and used cars. The new car segment is expected to hold a substantial car loan market share in 2023.

- The new cars segment is also expected to hold the highest CAGR over the forecast period due to the rising disposable incomes of consumers and increasing standard of living of consumers which is increasing the need for car loans.

Car Loan Market Share Analysis By Geography

The scope of the car loan market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific is experiencing rapid growth and is anticipated to hold a significant car loan market share. The region's significant economic development, growing population, and increasing focus on risk management and insurance policies have contributed to the growth of the market in the region. The increasing demand for electric vehicles is further creating the demand for car loans. As per the report by the International Renewable Energy Agency, by 2025, around 20% of all vehicles on the road in Southeast Asia will be electric-operated, which includes 59 million two & three-wheelers and 8.9 million four-wheel cars. Also, in April 2021, the Indonesian government set a goal for adopting EVs to have a production of up to 20% of all domestic cars, which is approximately 400,000 e-cars, by 2025.

Car Loan Market Report Scope

The "Car Loan Market Analysis" was carried out based on type, car type, provider, and geography. On the basis of type, the market is segmented into new cars and used cars. Based on car type, the car loan market is segmented into SUVs, hatchbacks, and sedans. Based on provider, the market is segmented into banks, OEMs, credit unions, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Car Loan Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the car loan market. A few recent key market developments are listed below:

- In May 2023, HDFC Bank, India’s leading private sector bank, announced the launch of a mega ‘Car-loan Mela’ across North India. Over 300 bank branches in Haryana, Himachal Pradesh, and Chandigarh host the massive loan drive in partnership with leading automobile brands and regional dealerships.

[Source: HDFC Bank, Company Website]

- In May 2023, Sojitz Corporation, a pre-owned car dealer, acquired Albert Automotive Holdings Pty Ltd, a wholesale and retail used car business, to expand its reach into both foreign and domestic markets.

[Source: Sojitz Corporation, Company Website]

- In August 2021, Tata Motors partnered with Sundaram Finance to provide exclusive offers to customers electing to purchase its variety of passenger cars. Under this partnership with TATA Motors, Sundaram Finance agreed to offer 6 years of loans on the novel 'Forever' range of cars, and with 100% financing, that would require a minimum down payment.

[Source: Tata Motors, Company Website]

Car Loan Market Report Coverage & Deliverables

The car loan market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Car Loan Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Car Type, Provider and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global car loan market are Ford Motor Company, Bank of America Corporation, Hitachi Capital Corporation, Toyota Financial Services, and General Motors Financial Company, Inc.,

The global car loan market is expected to reach US$ 2,139.17 billion by 2031.

The global car loan market was estimated to be US$ 1,184.37 billion in 2023 and is expected to grow at a CAGR of 7.7 % during the forecast period 2023 - 2031.

Implementation of technologies in existing product lines is anticipated to play a significant role in the global car loan market in the coming years.

The increase in demand for cars and increasing disposable income are the major factors that propel the global car loan market.

- Ford Motor Company

- Bank of America Corporation

- Hitachi Capital Corporation

- Toyota Financial Services

- General Motors Financial Company, Inc.

- JPMorgan Chase & Co.

- Volkswagen Finance Private Limited

- Capital One

- Ally Financial Inc.

- Daimler AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Car Loan Market

Apr 2024

Trade Credit Insurance Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Enterprise Size (Large Enterprises and SMEs), Application (International and Domestic), End User (Energy, Automotive, Aerospace, Chemicals, Metals, Agriculture, Food and Beverages, Financial Services, Technology and Telecommunications, Transportation, and Others), and Geography

Apr 2024

Revenue Assurance for BFSI Market

Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Component (Solution and Services), Deployment (Cloud and On-Premise), Organization Size (Large Enterprises and SMEs), and Geography

Apr 2024

Insurance Third-Party Administrator Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Insurance Type (Healthcare, Retirement Plans, Commercial General Liability Insurers, and Other Insurance Types), End User (Large Enterprises and SMEs), and Geography

Apr 2024

Voice-based Payments Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware and Software), By Enterprise Size (Large Enterprises and Small and Medium-Sized Enterprises), By Industry (BFSI, Automotive, Healthcare, Retail, Government, and Others), and by Geography

Get Free Sample For

Get Free Sample For