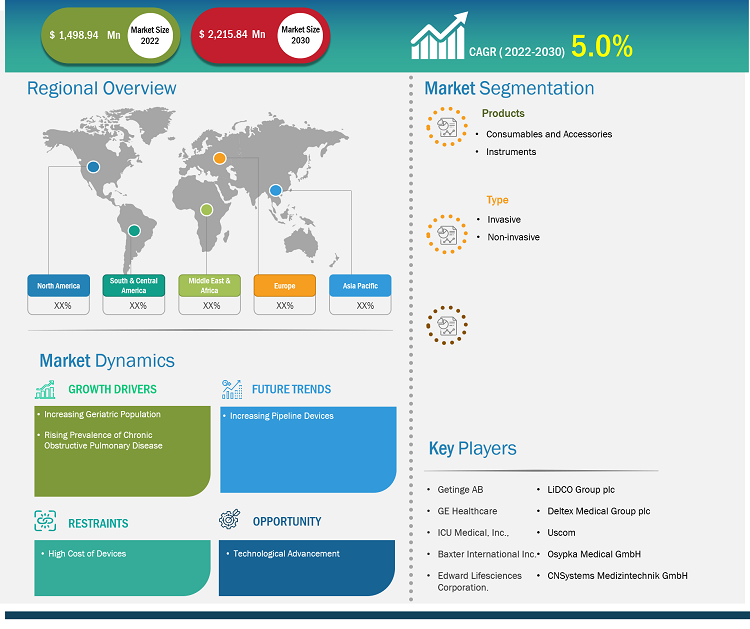

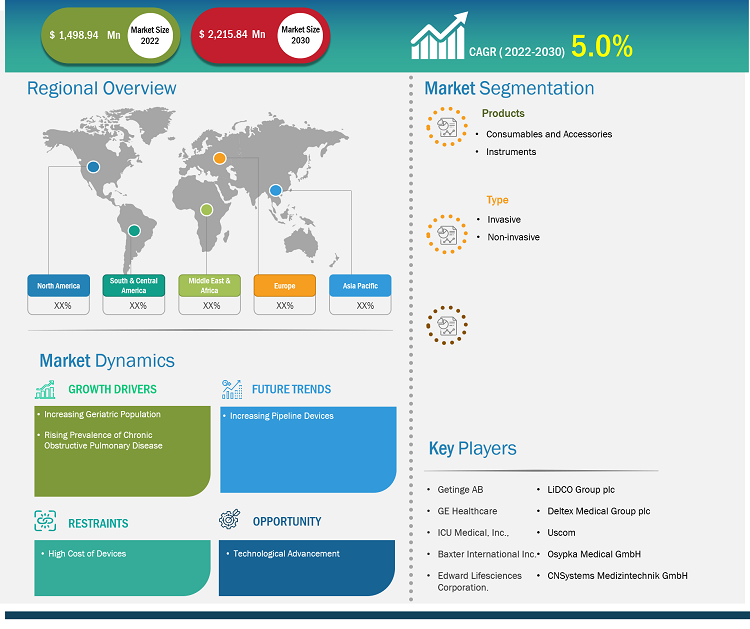

[Research Report] The cardiac output monitoring devices market size is projected to grow from US$ 1,498.94 million in 2022 to US$ 2,215.84 million by 2030; the market is anticipated to record a CAGR of 5.0% from 2022 to 2030.

Market Insights and Analyst View:

The amount of blood pumped by the heart's left or right ventricle in a minute is known as cardiac output. It is reliant on both stroke volume and heart rate. Bioimpedance, pulse contour analysis, thermodilution, FloTrac monitoring, PiCCO cardiac output monitoring, Doppler, and the Ficks principle are the foundations of cardiac output monitoring techniques. Using cardiac output monitoring devices is an important part of assessing patients in the operating room, critical care unit, and other settings. The lithium dilution approach has made continuous real-time cardiac output (CO) monitoring possible thanks to technological developments. During the projection period, the cardiac output monitoring devices market is anticipated to experience exponential growth for this technique.

Growth Drivers and Challenges:

Cardiovascular diseases (CVDs) and other significant health issues that require constant monitoring and intensive care are increasingly common in the senior population. A few of the main risk factors for CVD are age, ethnicity, and family history. Smoking, high blood pressure (hypertension), high cholesterol, obesity, inactivity, diabetes, poor diet, and alcohol consumption are additional risk factors.

As a result, during the estimated period, it is expected that the world's aging population will drive the cardiac output monitoring device market. According to the World Health Organization (WHO) projections, by 2030, there will be 1.4 billion persons over 60 in the world. With age, people become more susceptible to mobility limitations, as a result of which they require medical assistance or aid to avoid dependence on other individuals. The global population is aging rapidly, and the number of older adults is expected to increase significantly in the coming years. According to the 2020 Census, in the US, the population aged 65 and above surged at a rate nearly five times faster than the overall population growth during 1920–2020. In 2020, 55.8 million Americans, i.e., 16.8% of the total population, were aged 65 and above. Further, 13% of Brazil's population—more than 30 million seniors—is aged 60 or more; this population is expected to reach ~50 million by 2030, i.e., 24% of the country's population. Thus, the increasing geriatric population prone to CVD is a significant factor expected to drive the growth of the cardiac output monitoring devices market.

On the other hand, patients and healthcare professionals are particularly concerned about cybersecurity flaws in devices, particularly those like computerized image extraction devices (CIEDs), where there is a chance that the gadget may be reprogrammed or rendered inoperable. The Food and Drug Administration (FDA) of the US stated in 2023 that Medtronic was recalling ~350,000 implantable cardiac devices because of persistent problems with their capacity to provide high-voltage therapy when required.

An advisory on the FDA website states that "a reduced-energy shock, or no shock at all, may fail to correct a life-threatening arrhythmia, which can lead to cardiac arrest, other serious injury, or death." "If a patient with one of these devices requires additional surgical procedures to remove and replace the device, there are additional risks of harm." All cardiac resynchronization therapy defibrillators (CRT-Ds) and implanted cardioverter defibrillators (ICDs) with a glassed feedthrough produced after 2017 are covered by this recall. The use of these devices "may cause serious injuries or death," according to the FDA, which has classified this as a Class I recall. Thus, all these factors hinder market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Cardiac Output Monitoring Devices Market: Strategic Insights

Market Size Value in US$ 1,498.94 million in 2022 Market Size Value by US$ 2,215.84 million by 2030 Growth rate CAGR of 5.0% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Cardiac Output Monitoring Devices Market: Strategic Insights

| Market Size Value in | US$ 1,498.94 million in 2022 |

| Market Size Value by | US$ 2,215.84 million by 2030 |

| Growth rate | CAGR of 5.0% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The cardiac output monitoring devices market is segmented on the basis of product, type, and end user. Based on product, the market is segmented into consumables and accessories and instruments. The cardiac output monitoring devices market, by type, is segmented into invasive and non-invasive. By end user, the cardiac output monitoring devices market is segmented into hospitals, ambulatory surgical centers, and others. Based on geography, the cardiac output monitoring devices market is divided into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

In terms of revenue, the consumables and accessories category accounted for the largest share of the global market in 2022. Due to the increased demand for consumables and the rising frequency of cardiac disorders, it is expected that this category will dominate the global market. Manufacturers rent equipment to end users, who then install cardiac output monitoring devices at their facilities. The agreement states that in order for end customers to utilize these devices, they must buy disposables. As a result, throughout the projected period, there will probably be an increase in the installation base of cardiac output monitoring devices and a rise in the prevalence of cardiovascular disorders worldwide.

The market for cardiac output monitoring devices has been bifurcated into invasive and non-invasive categories based on type. Owing to its accurate and consistent outcomes, which are crucial in critical care environments, the invasive category held a significant market share in 2022. Surgical rooms and critical care units frequently use invasive devices to measure cardiac output in patients with serious cardiac and pulmonary issues. These devices, which are inserted into the patient's body through an artery or vein, allow for the direct assessment of cardiac output. The growing prevalence of cardiovascular diseases, such as heart failure, cardiac arrest, and pulmonary embolism, is expected to drive demand for invasive cardiac output monitoring devices during the forecast period.

On the basis of end user, the hospital segment dominated the cardiac output monitoring devices market in 2022 because of the large number of patients requiring cardiac monitoring as well as the availability of state-of-the-art healthcare infrastructure and medical personnel. Hospitals are equipped with modern monitoring equipment that allows for continuous monitoring of patients with cardiac issues. Improved patient outcomes, timely intervention, and early detection of cardiac issues are made possible by the use of these techniques. Additionally, the growing requirement for less invasive procedures and the increasing frequency of cardiovascular illnesses are expected to drive growth in the market for cardiac output monitoring devices in hospitals.

Regional Analysis:

Based on geography, the cardiac output monitoring devices market is primarily segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is the most significant contributor to the growth of the global market. In terms of the global market for cardiac output monitoring devices, North America held the biggest share in 2021. This can be attributed to the rising prevalence of CVDs, increasing healthcare costs, growing disposable income, rising health consciousness, and easy accessibility of cutting-edge medical technology in the region. The number of older adults in the US is expected to rise from 52 million in 2018 to 95 million by 2060, according to the Population Reference Bureau. Compared to 16% in 2018, the elderly population is projected to account for 23% of the US population overall in 2060.

Asia Pacific is expected to register the highest CAGR in the cardiac output monitoring devices market from 2022 to 2030. The market growth in this region is ascribed to increasing investments in research and development activities in countries such as China, India, Japan, and South Korea, which are emerging as key pharmaceutical and biotechnology hubs. Furthermore, the presence of a large pool of skilled researchers and scientists, along with lower operating costs compared to Western countries, makes Asia Pacific an attractive destination for medical tourism. The increasing prevalence of CVD and the need for innovative medications to address unmet medical needs are creating demand for new devices, thereby benefiting the cardiac output monitoring devices market growth in the region.

Cardiac Output Monitoring Devices Market Report Scope

Competitive Landscape and Key Companies:

Getinge AB, GE Healthcare, Baxter International Inc., Edward Lifesciences Corporation, Osypka Medical GmbH, LiDCO Group plc, Deltex Medical Group plc, ICU Medical, Inc., Uscom, and CNSystems Medizintechnik GmbH are a few prominent players operating in the cardiac output monitoring devices market. These companies focus on expanding service offerings to meet the growing consumer demand worldwide. Their global presence allows them to serve a large set of customers, subsequently allowing them to expand their market share.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Type, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market for cardiac output monitoring devices has been split into invasive and non-invasive categories based on type. Owing to its accurate and consistent outcomes, which are crucial in critical care environments, the invasive category held a significant market share in 2022. Surgical rooms and critical care units frequently use invasive devices to measure cardiac output in patients with serious cardiac and pulmonary issues. These devices, which are inserted into the patient's body through an artery or vein, allow for the direct assessment of cardiac output. The growing prevalence of cardiovascular diseases, such as heart failure, cardiac arrest, and pulmonary embolism, is expected to drive demand for invasive cardiac output monitoring devices during the forecast period.

The cardiac output monitoring devices market is expected to be valued at US$ 2,215.84 million in 2030.

On the basis of end user, the hospital segment dominated the cardiac output monitoring devices market in 2022 because of the large number of patients requiring cardiac monitoring, the availability of state-of-the-art healthcare infrastructure, and the availability of medical personnel. Hospitals are equipped with modern monitoring equipment that allows for continuous monitoring of patients with cardiac issues. Improved patient outcomes, timely intervention, and early detection of cardiac issues are made possible by the use of these techniques. Additionally, the growing requirement for less invasive procedures and the increasing frequency of cardiovascular illnesses are expected to drive growth in the market for cardiac output monitoring devices in hospitals.

The cardiac output monitoring devices market has major market players, including Getinge AB, GE Healthcare, Baxter International Inc., Edward Lifesciences Corporation, Osypka Medical GmbH, LiDCO Group plc, Deltex Medical Group plc, ICU Medical, Inc., Uscom, and CNSystems Medizintechnik GmbH.

In terms of revenue, the consumables and accessories category accounted for the largest share of the global market in 2022. Because of the increased demand for consumables and the rising frequency of cardiac disorders, it is expected that this category will dominate the global market. Manufacturers rent equipment to end users, who then install cardiac output monitoring devices at their facilities. The agreement states that in order for end customers to utilize these devices, they must buy disposables. As a result, throughout the projected period, there will probably be an increase in the installation base of cardiac output monitoring devices and a rise in the prevalence of cardiovascular disorders worldwide.

The cardiac output monitoring devices market was valued at US$ 1,498.94 million in 2022.

The amount of blood pumped by the heart's left or right ventricle in a minute is known as cardiac output. It is reliant on both stroke volume and heart rate. Bioimpedance, pulse contour analysis, thermodilution, FloTrac monitoring, PiCCO cardiac output monitoring, Doppler, and the Ficks principle are the foundations of cardiac output monitoring techniques. Using cardiac output monitoring devices is an important part of assessing patients in the operating room, critical care unit, and other settings. The lithium dilution approach has made continuous real-time cardiac output (CO) monitoring possible thanks to technological developments. Throughout the projection period, the market for cardiac output monitoring devices is anticipated to experience exponential growth for this technique.

Factors driving the market include technological advancement, an increase in the prevalence of cardiac diseases, patient awareness, and an increase in the number of unmet medical requirements in emerging and underdeveloped nations. However, the high cost of devices hinders the cardiac output monitoring devices market growth.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Cardiac Output Monitoring Devices Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Cardiac Output Monitoring Devices Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Cardiac Output Monitoring Devices Market - Global Market Analysis

6.1 Cardiac Output Monitoring Devices - Global Market Overview

6.2 Cardiac Output Monitoring Devices - Global Market and Forecast to 2030

7. Cardiac Output Monitoring Devices Market – Revenue Analysis (USD Million) – By Products, 2020-2030

7.1 Overview

7.2 Consumables and Accessories

7.3 Instruments

8. Cardiac Output Monitoring Devices Market – Revenue Analysis (USD Million) – By Type, 2020-2030

8.1 Overview

8.2 Invasive

8.3 Non-invasive

9. Cardiac Output Monitoring Devices Market – Revenue Analysis (USD Million) – By End User, 2020-2030

9.1 Overview

9.2 Hospitals

9.3 Ambulatory Surgical Centres

9.4 Others

10. Cardiac Output Monitoring Devices Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

10.1 North America

10.1.1 North America Cardiac Output Monitoring Devices Market Overview

10.1.2 North America Cardiac Output Monitoring Devices Market Revenue and Forecasts to 2030

10.1.3 North America Cardiac Output Monitoring Devices Market Revenue and Forecasts and Analysis - By Products

10.1.4 North America Cardiac Output Monitoring Devices Market Revenue and Forecasts and Analysis - By Type

10.1.5 North America Cardiac Output Monitoring Devices Market Revenue and Forecasts and Analysis - By End User

10.1.6 North America Cardiac Output Monitoring Devices Market Revenue and Forecasts and Analysis - By Countries

10.1.6.1 United States Cardiac Output Monitoring Devices Market

10.1.6.1.1 United States Cardiac Output Monitoring Devices Market, by Products

10.1.6.1.2 United States Cardiac Output Monitoring Devices Market, by Type

10.1.6.1.3 United States Cardiac Output Monitoring Devices Market, by End User

10.1.6.2 Canada Cardiac Output Monitoring Devices Market

10.1.6.2.1 Canada Cardiac Output Monitoring Devices Market, by Products

10.1.6.2.2 Canada Cardiac Output Monitoring Devices Market, by Type

10.1.6.2.3 Canada Cardiac Output Monitoring Devices Market, by End User

10.1.6.3 Mexico Cardiac Output Monitoring Devices Market

10.1.6.3.1 Mexico Cardiac Output Monitoring Devices Market, by Products

10.1.6.3.2 Mexico Cardiac Output Monitoring Devices Market, by Type

10.1.6.3.3 Mexico Cardiac Output Monitoring Devices Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Rest of Europe

10.3 Asia-Pacific

10.3.1 Australia

10.3.2 China

10.3.3 India

10.3.4 Japan

10.3.5 South Korea

10.3.6 Rest of Asia-Pacific

10.4 Middle East and Africa

10.4.1 South Africa

10.4.2 Saudi Arabia

10.4.3 Rest of Middle East and Africa

10.5 South and Central America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South and Central America

11. Pre and Post Covid-19 Impact

12. Industry Landscape

12.1 Mergers and Acquisitions

12.2 Agreements, Collaborations, Joint Ventures

12.3 New Product Launches

12.4 Expansions and Other Strategic Developments

13. Competitive Landscape

13.1 Heat Map Analysis by Key Players

13.2 Company Positioning and Concentration

14. Cardiac Output Monitoring Devices Market - Key Company Profiles

14.1 Getinge AB

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

Note - Similar information would be provided for below list of companies

14.2 GE Healthcare

14.3 ICU Medical, Inc.

14.4 Baxter International Inc.

14.5 Edward Lifesciences Corporation

14.6 LiDCO Group plc

14.7 Deltex Medical Group plc

14.8 Uscom

14.9 Osypka Medical GmbH

14.10 CNSystems Medizintechnik GmbH

15. Appendix

15.1 Glossary

15.2 About The Insight Partners

15.3 Market Intelligence Cloud

The List of Companies - Cardiac Output Monitoring Devices Market

- Getinge AB

- GE Healthcare

- Baxter International Inc.

- Edward Lifesciences Corporation

- Osypka Medical GmbH

- LiDCO Group plc

- Deltex Medical Group plc

- ICU Medical Inc.

- Uscom

- CNSystems Medizintechnik GmbH

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Cardiac Output Monitoring Devices Market

Dec 2023

Pediatric Cardiology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Transcatheter Heart Valves, Occlusion Devices, Catheters, Stents, Introducer Sheaths, and Others), Disease Indication (Congenital Heart Disease, Acquired Heart Disease, Arrhythmias, Cardiomyopathies, and Others), Surgical Procedure (Interventional Procedures, Heart Rhythm Management Procedures, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Dec 2023

Pharmaceutical Membrane Filters Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Microfiltration, Ultrafiltration, Reverse Osmosis and Nanofiltration), Design (Hollow Fiber, Spiral Wound, Tubular System and Plate and Frame), Material (Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based Membranes, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN) and Others), End User (Pharmaceutical and Biotech Industries and CROs and CDMOs), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

Dec 2023

ECG Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Dec 2023

Surgical Laser Fiber Units Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (CO2 Laser, Diode Laser, Erbium Laser, Nd:YAG Laser, Holmium Laser, Alexandrite Laser, and Others), Material (Silica-Based Fibers, Quartz Fibers, Polymer-Based Fibers, Multimode Fibers, and Others), Power (Low-Power Lasers, Medium-Power Lasers, and High-Power Lasers), Application (Urology, Dermatology, Gynecology, Cardiology, Neurology, Ophthalmology, Respiratory, Dentistry and Others), Wavelength (9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm), End User (Hospitals, Specialty Clinics, Physician Office, and Others), and Geography

Dec 2023

Therapeutic Vaccines Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Cancer Vaccines, Infectious Disease Vaccines, and Others), Technology (Allogenic Vaccines and Autologous Vaccines), End User (Hospitals, Clinics, and Others), and Geography

Dec 2023

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

Dec 2023

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

Dec 2023

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography

Get Free Sample For

Get Free Sample For