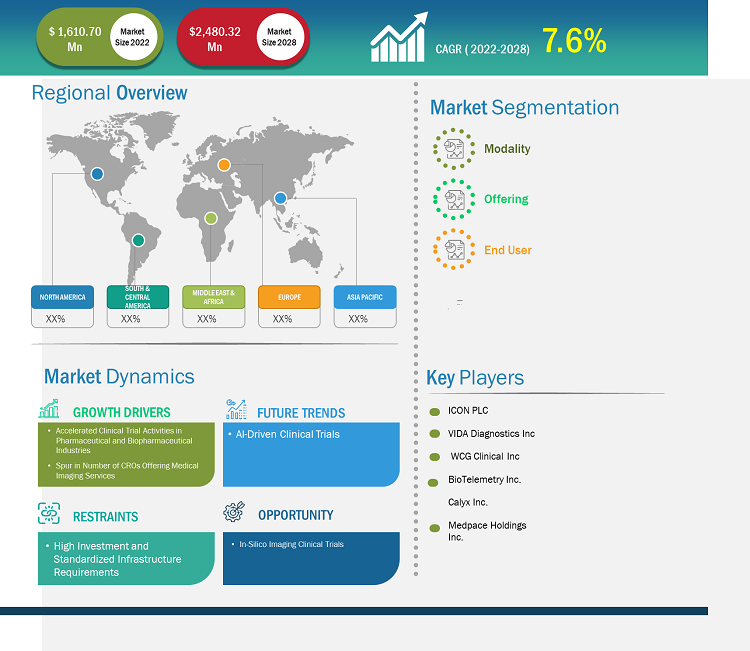

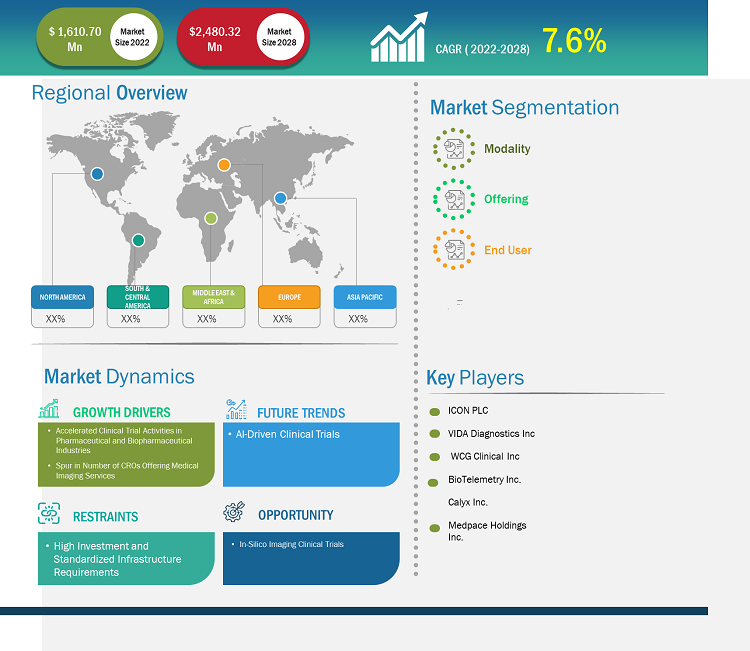

[Research Report] The clinical trial imaging market size is expected to reach US$ 2,480.32 million by 2028 from US$ 1,610.70 million in 2022; it is estimated to record a CAGR of 7.6% from 2023 to 2028.

Market Insights and Analyst View:

Clinical trial imaging is a research study conducted with people who volunteer to take part. The study mainly aims to determine the value of imaging procedures for detecting, diagnosing, guiding, or monitoring the treatment of disease. Some image interpretation processes may include the use of test images intermixed among the clinical trial images such that readers are intermittently tested as to the proficiency and/or consistency in their reads. Failure to sustain proficiency may result in replacement of a reader with another trained and qualified reader. Rapid increase in utilization of imaging endpoints in multicenter clinical trials, the amount of data and workflow complexity have also increased. A Clinical Trial Imaging Management System (CTIMS) is required to comprehensively support imaging processes in clinical trials as to follow a seamless workflow and also improve patient outcomes. Key regulatory requirements of CTIMS were extracted through a thorough review of many related regulations and guidelines including International Conference on Harmonization-GCP E6, FDA 21 Code of Federal Regulations parts 11 and 820, Good Automated Manufacturing Practice, and Clinical Data Interchange Standards Consortium.

Growth Drivers and Challenges:

Clinical research organizations (CROs) assist in the successful implementation of clinical trials through the services offered using high-quality facilities and deep subject matter expertise. CROs have begun acting as a backbone of the clinical trial industry through their efficient and cost-effective operations that benefit trial sponsors. For example, on an average, CROs take 30% lesser time than in-house activity to conduct and complete clinical trials.

With the rising number of CROs leading to high competition, some of these businesses offer specialized imaging services, thus emerging as imaging CROs (iCROs). Keosys Medical Imaging and Medica Group PLC are the iCROs examples. The total number of clinical trials has doubled since 2010, and the use of imaging modalities in these trials has increased by almost 500%. Per a report by KEOSYS MEDICAL IMAGING company, iCROs allocate 7.5–10% of their budgets for imaging, which helps them optimize their workflow to manage every step of the process from image acquisition to interpretation. These CROs offer key knowledge insights in areas such as site qualification for imaging, acquisition of standardized images, and determination of read designs and criteria, thereby contributing to the growth of the global clinical trial imaging market

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Clinical Trial Imaging Market: Strategic Insights

Market Size Value in US$ 1,610.70 million in 2022 Market Size Value by US$ 2,480.32 million by 2028 Growth rate CAGR of 7.6% from 2023 to 2028 Forecast Period 2023-2028 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Clinical Trial Imaging Market: Strategic Insights

| Market Size Value in | US$ 1,610.70 million in 2022 |

| Market Size Value by | US$ 2,480.32 million by 2028 |

| Growth rate | CAGR of 7.6% from 2023 to 2028 |

| Forecast Period | 2023-2028 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Clinical trials help determine if a new form of treatment or prevention, such as a new drug, diet, or medical device, is safe and effective. The trials are mainly carried out during drug development. According to the data provided by the National Library of Medicine (NLM), ~52,000 new studies were registered with NLM (ClinicalTrials.gov) in 2020, which increased to ~58,000 in 2023. In January 2023, the NLM reported 38,837 active clinical trials in the US and 105,172 active trials worldwide. According to European Medicine Agency, in the European Union (EU), ~4,000 clinical trials are authorized annually, of which about 60% of clinical trials are associated with the pharmaceutical industry. An increasing number of clinical trials for developing different effective treatments due to the rising prevalence of chronic diseases globally is fuelling the growth of the clinical trial imaging market.

Further, clinical trials are increasingly becoming complex procedures, owing to which proper execution and overseeing of the operation occurring in research-based organizations has become crucial. To avoid errors due to improper execution, research-based organizations are outsourcing clinical trials to develop their products. Clinical research organizations (CROs) assist in successfully implementing clinical trials through the services offered using high-quality facilities and deep subject matter expertise. CROs have begun acting as a backbone of the clinical trial industry through their efficient and cost-effective operations benefitting trial sponsors. According to the blog published on Thermo Fisher Scientific, in 2022, ~3 out of 4 clinical trials were carried out by CROs to reassure the clinical programs of drug developers, provide a wealth of expertise, drive time and cost efficiencies, and deliver customized, high-quality data. Thus, the development of cost-effective solutions and decreasing errors in CROs during the drug development process are driving the clinical trial market growth, which in turn is increasing the clinical trials imaging market.

The pharmaceutical industry is one of the most R&D-intensive industries globally. The value of medicines is becoming increasingly important as pharmaceutical companies are keen to ensure that R&D achieves their intended goal. Over the last decade, the number of new drugs approved yearly has also increased. Per the Food and Drug Administration (FDA) approved 37 new drugs annually in 2022. Efforts are being made to achieve greater effectiveness and efficiency in fulfilling patients' needs. The research-based industry allocates ~15–20% of revenues to R&D activities and invests more than US$ 50 billion in R&D annually. Globally, the US is a leading country in R&D investments, producing over half of the world’s new molecules in the past decade. As per the European Federation of Pharmaceutical Industries and Associations (EFPIA), in 2019, North America accounted for 48.7% of global pharmaceutical sales. The US accounted for 62.3% of sales of new medicines launched during 2014–2019. R&D is a significant and essential part of the business of pharmaceutical companies as it enables them to come up with new molecules for various therapeutic applications with significant medical and commercial potential.

R&D Investments by Major Pharmaceuticals Companies

Company | R&D Investment in 2021 (US$ Billion) | R&D Investment in 2022 (US$ Billion) |

Takeda Pharmaceutical Co Ltd | 4.2 | 4.6 |

Pfizer Inc | 10.3 | 11.4 |

Grifols SA | 404.57 | 427.05 |

Note: Current conversion rate is considered for presenting the currencies.

Source: Annual Reports and The Insight Partners Analysis

R&D expenditure is done to discover, examine, and produce new products; upfront payments; ; improve existing outcomes; and demonstrate product efficacy and regulatory compliance before launch. The R&D investments differ as per the need and demand for clinical trials. The cost includes materials, supplies used, and salaries, along with the cost of developing quality control.

The companies mentioned above and hospitals are investing in developing products to treat various diseases and disorders, such as immunological disorders. In June 2021, Takeda announced ADVANCE-1, a randomized, placebo-controlled, double-blind Phase 3 clinical trial that evaluate HYQVIA [Immune Globulin Infusion 10% (Human) with Recombinant Human Hyaluronidase] to maintain treatment of chronic inflammatory demyelinating polyradiculoneuropathy (CIDP), that will meet its primary endpoint. Thus, increasing R&D investments by companies coupled with the advanced pharmaceutical industry are fueling the clinical trials imaging market growth.

For pharmaceutical and biopharmaceutical companies, active participation in clinical research is rewarding but demanding, and medical imaging is becoming an integral part of the research. However, the unique technical specifications and administrative aspects of clinical trial and imaging modalities vary substantially from standard-of-care imaging, thus burdening an established clinical infrastructure at investigational sites. Failure to comply with such clinical requirements results in the generation of noncredible data, need for repetitive imaging, and removal of patient enrollment for the trial. Further, the lack of appropriate infrastructure at investigational sites may hinder the efforts made by CROs to address such challenges. Clinical trial imaging equipment seeks hefty investments of resources from stakeholders. For example, drug or device investigational sites must meet clinical trial requirements and infrastructure, maintain superiority in patient care, and guarantee trial integrity. Moreover, clinical trial sponsors must acknowledge the burden of clinical trial imaging by providing support for the development of necessary local infrastructure for meeting the abovementioned requirements. The Quantitative Imaging Biomarkers Alliance by the Radiologic Society of North America seeks to define standard imaging protocols and workflows, ensuring consistency in the examination of images for producing quantifiable clinical trial results. Thus, high investments and standardized infrastructure requirements impede the growth of the global clinical trial imaging market.

Report Segmentation and Scope:

The “Global Clinical Trial Imaging Market” is segmented based on modality, offering, end user, and geography. Based on modality, the clinical trial imaging market is segmented into tomography, ultrasound, positron emission tomography, X-ray, echocardiography, magnetic resonance imaging, and others. Based on offering, the clinical trial imaging market is segmented into trial design consulting services, read analysis services, operational imaging services, imaging software, and others. Based on end user, the clinical trial imaging market is segmented into pharmaceutical & biopharmaceutical companies, contract research organizations, and academic & government research institutes, and others. The clinical trial imaging market based on geography is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

The global clinical trial imaging market, offering, has been segmented into trial design consulting services, read analysis services, operational imaging services, imaging software, and others. Operational imaging services segment held the largest share in 2021 and is expected to continue a similar trend during the forecast period. Operational imaging services include imaging modalities such as MRI, CT, ultrasound, PET, and SPECT for therapeutic applications such as neurology, oncology, cardiovascular diseases, gastroenterology, musculoskeletal disorders, and medical devices used to conduct clinical trials. Clinical imaging, a non-invasive method of research, has a number of advantages for the advancement of medical science in general, as well as clinical studies in particular. As a consequence, there is a strong and growing trend to incorporate novel imaging technologies deeply into clinical trials, making them a fundamental element of biotech, pharmaceuticals, and medical devices.

Also, choosing the right read design is crucial when executing imaging in a trial. The read design refers to the number and type of readers used to capture and interpret the images. Reducing variability leads to crucial challenges in image capture and analysis since trials can include imageries obtained from various imaging modalities, requiring a review by experts such as radiologists, pathologists, and cardiologists. The type of read design used is paramount to reduce bias when interpreting medical images in clinical trials. Single reads, double reads, and double reads with adjudicators are the three primary types of read designs. The image is interpreted only by one reader in a single read. In a double read, two or more readers interpret it. Large trials may require multiple readers due to a heavy workload. Ideally, one (or two in the case of a double-read design) reader(s) will review all the images of the same patient throughout the study. Multiple readers reviewing different imaging time points of the same patient may result in additional variations. An oncology trial, for instance, usually involves the following stages: initial screening for lesion selection and measurement before treatment, the sequential selection and measurement of a lesion at each follow-up imaging visit, and the assessment of incremental radiological response at each time point.

Keosys Medical Imaging offers web-based imaging and reading software for applications in clinical trials to limit reader subjectivity; increase measurement and quantification accuracy; and improve overall operational efficiency, data quality, and traceability. An advanced lesion management system and specialized applications for different therapeutic areas are included in the reading software offered by Keosys. The reading software is FDA 510 (k) cleared and ISO 13485 (Medical Devices) compliant.

Based on modality, the clinical trial imaging market is into tomography, ultrasound, positron emission tomography, X-ray, echocardiography, magnetic resonance imaging, and others. Tomography segment held the largest share in 2021 and is expected to continue a similar trend during the forecast period. In tomography, shadows of superimposed structures are blurred by a moving X-ray tube that is used for X-ray imaging. Computed tomography (CT) scan imaging used in research and clinical trials combines X-ray images taken from different angles, followed by computer processing to provide cross-sectional images of bones, blood vessels, and soft tissues. Linear and nonlinear tomography systems operate in a similar way—a tube moves in one direction, while a film cassette moves in the opposite direction, centered around a fulcrum in both techniques.

The introduction of new imaging methods or the refinement of existing methods requires accurate timing in relation to specific disease treatment. Scheduling imaging at an apt time is essential for correctly interpreting the subject’s anatomy. In hospitals, it helps effectively administer treatments such as surgery, radiation therapy, or chemotherapy while monitoring the patient's toxicity and morbidity. Clinical research in the field of oncology relies heavily on imaging, and scanning procedures performed at certain durations, intensities, and frequencies are fundamental to the trial protocols.

Advanced imaging metrics with CT scans are used extensively in new drug development and cancer research. It is the most used imaging modality for research related to advanced cancer types, affecting the neck, chest, abdomen, or pelvis.

Regional Analysis:

Based on geography, the clinical trial imaging market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2021, North America held the largest share of the clinical trial imaging market followed by Europe. The US has emerged as a leading clinical research destination. Nearly half of the total clinical trials conducted globally are conducted in the US. Additionally, most pharma research companies prefer to perform clinical trials in the US owing to established medical infrastructure, fast approval timelines, a favorable regulatory framework, and accepted clinical trial generated data globally. A World Health Organisation (WHO) report states that the US registered the highest number of clinical trials (157,618) in 2021.

The following table illustrates the number of clinical trials registered in the US with the number of total patients recruited in them, along with the percentage share of the US for the said parameters in the world.

2023 | Registered Clinical Trial Studies | Patient Recruited in Studies |

US | 139,632 (31% of the global studies) | 20,680 (32% of the worldwide headcount) |

Source: ClinicalTrial.gov report

Innovative products launched by companies for applications in clinical trials further boost the growth of the clinical trial imaging market in the US. Medical Metrics, a CRO providing imaging services for clinical trials, offers "Assessa." This product assists in the improvement of decision-making in drug discovery and related clinical studies, particularly in the discovery of drugs for neurological disorders, such as dementia; cognitive impairment; and Alzheimer's, Schizophrenia, Parkinson's Disease, and other memory-related diseases. The rising number of clinical trials in the US favors the growth of the clinical trial imaging market in the country.

Clinical Trial Imaging Market Report Scope

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global clinical trial imaging market are listed below:

- In December 2022, Tata Consultancy Services (TCS) (BSE: 532540, NSE: TCS) announced that the TCS ADD Connected Clinical Trials platform for decentralized trials, has won the India Pharma Award 2022 in the category, Excellence in Ancillary Pharma Services.

- In October 2021, Medidata, a Dassault Systèmes company, announced that Rave Imaging, the company’s cloud-based, secure clinical trial imaging management platform, has reached a significant milestone, having supported more than 1,000 imaging studies. Rave Imaging, built on the Medidata Unified Platform, processes more than 100 million images per year. The technology provides real-time visibility into all imaging-related trial activities across all Rave Imaging trials to enhance study efficiency.

Competitive Landscape and Key Companies:

The clinical trial imaging market majorly consists of players such as eResearch Technology Inc, Calyx Inc, ICON PLC, VIDA Diagnostics Inc, WCG Clinical Inc, BioTelemetry Inc, Medical Metrics Inc, Medpace Holdings Inc, Radiant Sage LLC, and IXICO plc. The companies have been implementing various strategies that have helped their growth and, in turn, have brought about various changes in the market. The companies have utilized organic strategies (such as launches, expansion, and product approvals) and inorganic strategies (such as product launches, partnerships, and collaborations).

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Modality, Offering, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Clinical trial imaging is a key asset in the drug development process as it offers efficacy evaluation and safety monitoring data required in clinical trials for regulatory submission. Additionally, imaging offers insights into the drug mechanism of action (MOA) and drug effects that assist researchers in making scientific decisions. For example, in late-phase trials, medical imaging can be utilized as an imaging biomarker to improve clinical trial efficacy and reduce the time to complete a given trial.

The CAGR value of the clinical trial imaging market during the forecasted period of 2023-2028 is 7.6%.

The operational imaging services segment dominated the clinical trial imaging market and held the largest market share in 2022.

Key factors that are driving the growth of this market are accelerated clinical trial activities in pharmaceutical and biotechnology industry and spur in number of CROs offering medical imaging services to boost the market growth for the clinical trial imaging over the years.

Tomography segment held the largest share of the market in the clinical trial imaging market and held the largest market share in 2022.

ICON plc and Calyx Inc are the top two companies that hold huge market shares in the clinical trial imaging market.

The clinical trial imaging market majorly consists of the players such eResearch Technology Inc, Calyx Inc, ICON PLC, VIDA Diagnostics Inc, WCG Clinical Inc, BioTelemetry Inc, Medical Metrics Inc, Medpace Holdings Inc, Radiant Sage LLC, and IXICO plc. .

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Global Clinical Trial Imaging Market – by Modality

1.3.2 Global Clinical Trial Imaging Market – by Offering

1.3.3 Global Clinical Trial Imaging Market – by End User

1.3.4 Global Clinical Trial Imaging Market – by Geography

2. Clinical Trial Imaging Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Clinical Trial Imaging Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America PEST Analysis

4.2.2 Europe PEST Analysis

4.2.3 Asia Pacific PEST Analysis

4.2.4 Middle East and Africa PEST Analysis

4.2.5 South and Central America PEST Analysis

4.3 Expert Opinion

5. Clinical Trial Imaging Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Accelerated Clinical Trial Activities in Pharmaceutical and Biotechnology Industry

5.1.2 Spur in Number of CROs Offering Medical Imaging Services

5.2 Market Restraints

5.2.1 High Investment and Standardized Infrastructure Requirements

5.3 Market Opportunities

5.3.1 In-Silico Imaging Clinical Trials

5.4 Future Trends

5.4.1 AI-Driven Clinical Trials

5.5 Impact Analysis

6. Clinical Trial Imaging Market – Global Analysis

6.1 Global Clinical Trial Imaging Market Revenue Forecast and Analysis

6.2 Global Clinical Trial Imaging Market, by Geography – Forecast and Analysis

6.3 Market Positioning of Key Players

7. Clinical Trial Imaging Market Revenue and Forecast To 2028 – by Modality

7.1 Overview

7.2 Clinical Trial Imaging Market Revenue Share, by Modality (2022 and 2028)

7.3 Tomography

7.3.1 Overview

7.3.2 Tomography: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Ultrasound

7.4.1 Overview

7.4.2 Ultrasound: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Positron Emission Tomography

7.5.1 Overview

7.5.2 PET: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

7.6 X-Ray

7.6.1 Overview

7.6.2 X-Ray: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

7.7 Echocardiography

7.7.1 Overview

7.7.2 Echocardiography: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

7.8 Magnetic Resonance Imaging

7.8.1 Overview

7.8.2 Magnetic Resonance Imaging: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

7.9 Others

7.9.1 Overview

7.9.2 Others: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

8. Clinical Trial Imaging Market Revenue and Forecast To 2028 – Offering

8.1 Overview

8.2 Clinical Trial Imaging Market Revenue Share, by Offering (2022 and 2028)

8.3 Trial Design Consulting Services

8.3.1 Overview

8.3.2 Trial Design Consulting Services: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Read Analysis Services

8.4.1 Overview

8.4.2 Read Analysis Services: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Operational Imaging Services

8.5.1 Overview

8.5.2 Operational Imaging Services: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

8.6 Imaging Software

8.6.1 Overview

8.6.2 Imaging Software: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

9. Clinical Trial Imaging Market Revenue and Forecasts To 2028– by End User

9.1 Overview

9.2 Clinical Trial Imaging Market Revenue Share, by End User (2022 and 2028)

9.3 Pharmaceutical and Biopharmaceutical Companies

9.3.1 Overview

9.3.2 Pharmaceutical and Biopharmaceutical Companies: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Contract Research Organizations

9.4.1 Overview

9.4.2 Contract Research Organizations: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

9.5 Academic and Research Institutes

9.5.1 Overview

9.5.2 Academic and Research Institutes: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

9.6 Others

9.6.1 Overview

9.6.2 Others: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10. Clinical Trial Imaging Market – Revenue and Forecast to 2028 – Geographic Analysis

10.1 North America: Clinical Trial Imaging Market

10.1.1 Overview

10.1.2 North America: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3 North America: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.1.4 North America: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.1.5 North America: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.1.6 North America: Clinical Trial Imaging Market, by Country, 2022& 2028 (%)

10.1.6.1 US: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.1.1 Overview

10.1.6.1.2 US: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.1.3 US: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.1.6.1.4 US: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.1.6.1.5 US: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.1.6.2 Canada: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.2.1 Overview

10.1.6.2.2 Canada: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.2.3 Canada: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.1.6.2.4 Canada: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.1.6.2.5 Canada: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.1.6.3 Mexico: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.3.1 Overview

10.1.6.3.2 Mexico: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.3.3 Mexico: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.1.6.3.4 Mexico: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.1.6.3.5 Mexico: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.2 Europe: Clinical Trial Imaging Market

10.2.1 Overview

10.2.2 Europe: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.3 Europe: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.2.4 Europe: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.2.5 Europe: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.2.6 Europe: Clinical Trial Imaging Market, by Country, 2022 & 2028 (%)

10.2.6.1 Germany: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.1.1 Overview

10.2.6.1.2 Germany: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.1.3 Germany: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.2.6.1.4 Germany: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.2.6.1.5 Germany: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.2.6.2 UK: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.2.1 Overview

10.2.6.2.2 UK: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.2.3 UK: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.2.6.2.4 UK: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.2.6.2.5 UK: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.2.6.3 France: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.3.1 Overview

10.2.6.3.2 France: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.3.3 France: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.2.6.3.4 France: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.2.6.3.5 France: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.2.6.4 Italy: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.4.1 Overview

10.2.6.4.2 Italy: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.4.3 Italy: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.2.6.4.4 Italy: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.2.6.4.5 Italy: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.2.6.5 Spain: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.5.1 Overview

10.2.6.5.2 Spain: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.5.3 Spain: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.2.6.5.4 Spain: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.2.6.5.5 Spain: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.2.6.6 Rest of Europe: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.6.1 Overview

10.2.6.6.2 Rest of Europe: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.6.3 Rest of Europe: Clinical Trial Imaging Market, by Modality, 2020-2028 (US$ Million)

10.2.6.6.4 Rest of Europe: Clinical Trial Imaging Market, by Offering, 2020-2028 (US$ Million)

10.2.6.6.5 Rest of Europe: Clinical Trial Imaging Market, by End User, 2020-2028 (US$ Million)

10.3 Asia Pacific: Clinical Trial Imaging Market

10.3.1 Overview

10.3.2 Asia Pacific: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.3.3 Asia Pacific: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.3.4 Asia Pacific: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.3.5 Asia Pacific: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.3.6 Asia Pacific: Clinical Trial Imaging Market, by Country, 2022 & 2028 (%)

10.3.6.1 China: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.1.1 China: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.3.6.1.2 China: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.3.6.1.3 China: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.3.6.1.4 China: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.3.6.2 Japan: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.2.1 Japan: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.3.6.2.2 Japan: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.3.6.2.3 Japan: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.3.6.2.4 Japan: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.3.6.3 India: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.3.1 India: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.3.6.3.2 India: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.3.6.3.3 India: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.3.6.3.4 India: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.3.6.4 South Korea: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.4.1 South Korea: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.3.6.4.2 South Korea: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.3.6.4.3 South Korea: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.3.6.4.4 South Korea: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.3.6.5 Australia: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.5.1 Australia: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.3.6.5.2 Australia: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.3.6.5.3 Australia: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.3.6.5.4 Australia: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.3.6.6 Rest of Asia Pacific: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.6.1 Rest of Asia Pacific: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.3.6.6.2 Rest of Asia Pacific: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.3.6.6.3 Rest of Asia Pacific: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.3.6.6.4 Rest of Asia Pacific: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.4 South and Central America: Clinical Trial Imaging Market

10.4.1 Overview

10.4.2 South and Central America: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.4.3 South and Central America: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.4.4 South and Central America: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.4.5 South and Central America: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.4.5.1 Brazil: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.4.5.1.1 Brazil: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.4.5.1.2 Brazil: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.4.5.1.3 Brazil: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.4.5.1.4 Brazil: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.4.5.2 Argentina: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.4.5.2.1 Argentina: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.4.5.2.2 Argentina: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.4.5.2.3 Argentina: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.4.5.2.4 Argentina: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.4.5.3 Rest of South and Central America: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.4.5.3.1 Rest of South and Central America: Clinical Trial Imaging Market - Revenue and Forecast to 2028 (US$ Million)

10.4.5.3.2 Rest of South and Central America: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.4.5.3.3 Rest of South and Central America: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.4.5.3.4 Rest of South and Central America: Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.5 Middle East & Africa Clinical Trial Imaging Market

10.5.1 Overview

10.5.2 Middle East & Africa: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.5.3 Middle East & Africa: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.5.4 Middle East & Africa: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.5.5 Middle East & Africa Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.5.6 Middle East & Africa: Clinical Trial Imaging Market, by Country, 2022 & 2028 (%)

10.5.6.1 South Africa: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.1.1 Overview

10.5.6.1.2 South Africa: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.1.3 South Africa: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.5.6.1.4 South Africa: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.5.6.1.5 South Africa Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.5.6.2 Saudi Arabia: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.2.1 Overview

10.5.6.2.2 Saudi Arabia: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.2.3 Saudi Arabia: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.5.6.2.4 Saudi Arabia: Clinical Trial Imaging Market, by Product and Services, 2020–2028 (US$ Million)

10.5.6.2.5 Saudi Arabia Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.5.6.3 UAE: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.3.1 Overview

10.5.6.3.2 UAE: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.3.3 UAE: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.5.6.3.4 UAE: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.5.6.3.5 UAE Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

10.5.6.4 Rest of Middle East & Africa: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.4.1 Overview

10.5.6.4.2 Rest of Middle East & Africa: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.4.3 Rest of Middle East & Africa: Clinical Trial Imaging Market, by Modality, 2020–2028 (US$ Million)

10.5.6.4.4 Rest of Middle East & Africa: Clinical Trial Imaging Market, by Offering, 2020–2028 (US$ Million)

10.5.6.4.5 Rest of Middle East & Africa Clinical Trial Imaging Market, by End User, 2020–2028 (US$ Million)

11. Impact Of COVID-19 Pandemic on Clinical Trial Imaging Market

11.1 North America: Assessment of COVID-19 Pandemic

11.2 Europe: Impact Assessment of COVID-19 Pandemic

11.3 Asia-Pacific: Impact Assessment of COVID-19 Pandemic

11.4 South and Central America: Impact Assessment of COVID-19 Pandemic

11.5 Middle East and Africa: Impact Assessment of COVID-19 Pandemic

12. Clinical Trial Imaging Market – Industry Landscape

12.1 Overview

12.2 Growth Strategies in Clinical Trial Imaging Market

12.3 Inorganic Growth Strategies

12.3.1 Overview

12.4 Organic Growth Strategies

12.4.1 Overview

13. Company Profiles

13.1 eResearch Technology Inc

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Calyx Inc

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 ICON PLC

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 VIDA Diagnostics Inc

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 WCG Clinical Inc

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 BioTelemetry Inc

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Medical Metrics Inc

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Medpace Holdings Inc

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Radiant Sage LLC

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 IXICO plc

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 2. North America Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 3. North America Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 4. US Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 5. US Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 6. US Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada: Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 8. Canada: Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 9. Canada: Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 10. Mexico: Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 11. Mexico: Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 12. Mexico: Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 13. Europe Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 14. Europe Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 15. Europe Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 16. Germany: Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 17. Germany: Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 18. Germany: Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 19. UK Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 20. UK Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 21. UK Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 22. France: Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 23. France: Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 24. France: Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 25. Italy: Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 26. Italy: Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 27. Italy: Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 28. Spain: Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 29. Spain: Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 30. Spain: Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 31. Rest of Europe: Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 32. Rest of Europe: Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 33. Rest of Europe: Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 34. Asia Pacific Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 35. Asia Pacific Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 36. Asia Pacific Clinical Trial Imaging Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 37. China Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 38. China Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 39. China Clinical Trial Imaging Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 40. Japan Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 41. Japan Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 42. Japan Clinical Trial Imaging Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 43. India Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 44. India Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 45. India Clinical Trial Imaging Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 46. South Korea Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 47. South Korea Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 48. South Korea Clinical Trial Imaging Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 49. Australia Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 50. Australia Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 51. Australia Clinical Trial Imaging Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 52. Rest of Asia Pacific Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 53. Rest of Asia Pacific Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 54. Rest of Asia Pacific Clinical Trial Imaging Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 55. South and Central America Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 56. South and Central America Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 57. South and Central America Clinical Trial Imaging Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 58. Brazil Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 59. Brazil Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 60. Brazil Clinical Trial Imaging Market, by End Use– Revenue and Forecast to 2028 (US$ Million)

Table 61. Argentina Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 62. Argentina Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 63. Argentina Clinical Trial Imaging Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 64. Rest of South and Central America Clinical Trial Imaging Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 65. Rest of South and Central America Clinical Trial Imaging Market, by Offering– Revenue and Forecast to 2028 (US$ Million)

Table 66. Rest of South and Central America Clinical Trial Imaging Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 67. Middle East & Africa Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 68. Middle East & Africa Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 69. Middle East & Africa Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 70. South Africa Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 71. South Africa Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 72. South Africa Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 73. Saudi Arabia Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 74. Saudi Arabia Clinical Trial Imaging Market, by Product and Services – Revenue and Forecast to 2028 (US$ Million)

Table 75. Saudi Arabia Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 76. UAE Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 77. UAE Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 78. UAE Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 79. Rest of Middle East & Africa Clinical Trial Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 80. Rest of Middle East & Africa Clinical Trial Imaging Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 81. Rest of Middle East & Africa Clinical Trial Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 82. Recent Inorganic Growth Strategies in the Clinical Trial Imaging Market

Table 83. Recent Organic Growth Strategies in Clinical Trial Imaging Market

Table 84. Glossary of Terms

LIST OF FIGURES

Figure 1. Clinical Trial Imaging Market Segmentation

Figure 2. Clinical Trial Imaging Market by Region

Figure 3. Global Clinical Trial Imaging Market Overview

Figure 4. Tomography Largest Share of Modality Segment in Clinical Trial Imaging Market

Figure 5. Asia Pacific Expected to Show Remarkable Growth During Forecast Period

Figure 6. Clinical Trial Imaging Market, by Geography (US$ Million)

Figure 7. Global Clinical Trial Imaging Market – Leading Country Markets (US$ Million)

Figure 8. Global Clinical Trial Imaging Market – Industry Landscape

Figure 9. North America: PEST Analysis

Figure 10. Europe: PEST Analysis

Figure 11. Asia Pacific: PEST Analysis

Figure 12. Middle East and Africa: PEST Analysis

Figure 13. South and Central America: PEST Analysis

Figure 14. Clinical Trial Imaging Market: Impact Analysis of Drivers and Restraints

Figure 15. Global Clinical Trial Imaging Market – Revenue Forecast and Analysis – 2021–2028

Figure 16. Global Clinical Trial Imaging Market, by Geography – Forecast and Analysis (2022–2028)

Figure 17. Market Positioning of Key Players in the Clinical Trial Imaging Market

Figure 18. Clinical Trial Imaging Market Revenue Share, by Modality (2022 and 2028)

Figure 19. Tomography: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Ultrasound: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. PET: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. X-Ray: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Echocardiography: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Magnetic Resonance Imaging: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Others: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Clinical Trial Imaging Market Revenue Share, by Offering (2022 and 2028)

Figure 27. Trial Design Consulting Services: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Read Analysis Services: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. Operational Imaging Services: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. Imaging Software: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. Others: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. Clinical Trial Imaging Market Revenue Share, by End User (2022 and 2028)

Figure 33. Pharmaceutical and Biopharmaceutical Companies: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. Contract Research Organizations: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Academic and Research Institutes: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Others: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. North America: Clinical Trial Imaging Market, by Key Country – Revenue (2022) (US$ Million)

Figure 38. North America Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 39. North America: Clinical Trial Imaging Market, by Country, 2022 & 2028 (%)

Figure 40. US: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 41. Canada: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 42. Mexico: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 43. Europe: Clinical Trial Imaging Market, by Key Country – Revenue (2022) (US$ Million)

Figure 44. Europe Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 45. Europe: Clinical Trial Imaging Market, by Country, 2022 & 2028 (%)

Figure 46. Germany: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 47. UK: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 48. France: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 49. Italy: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 50. Spain: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 51. Rest of Europe: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 52. Asia Pacific: Clinical Trial Imaging Market, by Key Country – Revenue (2022) (US$ Million)

Figure 53. Asia Pacific Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 54. China Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 55. Japan Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 56. India Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 57. South Korea Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 58. Australia Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 59. Rest of Asia Pacific Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 60. South and Central America: Clinical Trial Imaging Market, by Key Country – Revenue (2022) (US$ Million)

Figure 61. South and Central America Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 62. Brazil Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 63. Argentina Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 64. Rest of South and Central America Clinical Trial Imaging Market Revenue and Forecast to 2028 (US$ Million)

Figure 65. Middle East & Africa: Clinical Trial Imaging Market, by Key Country – Revenue (2022) (US$ Million)

Figure 66. Middle East & Africa Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 67. South Africa: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 68. Saudi Arabia: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 69. UAE: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 70. Rest of Middle East & Africa: Clinical Trial Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 71. Impact of COVID-19 Pandemic on North American Country Markets

Figure 72. Impact of COVID-19 Pandemic on European Country Markets

Figure 73. Impact of COVID-19 Pandemic In Asia Pacific Country Markets

Figure 74. Impact of COVID-19 Pandemic on South and Central America Country Markets

Figure 75. Impact of COVID-19 Pandemic on Middle East and Africa Country Markets

Figure 76. Growth Strategies in Clinical Trial Imaging Market

The List of Companies - Clinical Trial Imaging Market

- eResearch Technology Inc

- Calyx Inc

- ICON PLC

- VIDA Diagnostics Inc

- WCG Clinical Inc

- BioTelemetry Inc

- Medical Metrics Inc

- Medpace Holdings Inc

- Radiant Sage LLC

- IXICO plc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Clinical Trial Imaging Market

May 2023

Pediatric Cardiology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Transcatheter Heart Valves, Occlusion Devices, Catheters, Stents, Introducer Sheaths, and Others), Disease Indication (Congenital Heart Disease, Acquired Heart Disease, Arrhythmias, Cardiomyopathies, and Others), Surgical Procedure (Interventional Procedures, Heart Rhythm Management Procedures, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

May 2023

Pharmaceutical Membrane Filters Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Microfiltration, Ultrafiltration, Reverse Osmosis and Nanofiltration), Design (Hollow Fiber, Spiral Wound, Tubular System and Plate and Frame), Material (Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based Membranes, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN) and Others), End User (Pharmaceutical and Biotech Industries and CROs and CDMOs), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

May 2023

ECG Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

May 2023

Surgical Laser Fiber Units Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (CO2 Laser, Diode Laser, Erbium Laser, Nd:YAG Laser, Holmium Laser, Alexandrite Laser, and Others), Material (Silica-Based Fibers, Quartz Fibers, Polymer-Based Fibers, Multimode Fibers, and Others), Power (Low-Power Lasers, Medium-Power Lasers, and High-Power Lasers), Application (Urology, Dermatology, Gynecology, Cardiology, Neurology, Ophthalmology, Respiratory, Dentistry and Others), Wavelength (9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm), End User (Hospitals, Specialty Clinics, Physician Office, and Others), and Geography

May 2023

Therapeutic Vaccines Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Cancer Vaccines, Infectious Disease Vaccines, and Others), Technology (Allogenic Vaccines and Autologous Vaccines), End User (Hospitals, Clinics, and Others), and Geography

May 2023

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

May 2023

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

May 2023

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography

Get Free Sample For

Get Free Sample For