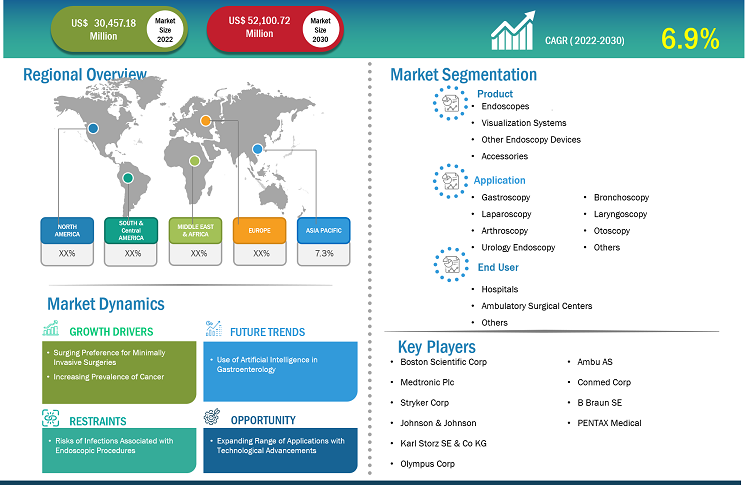

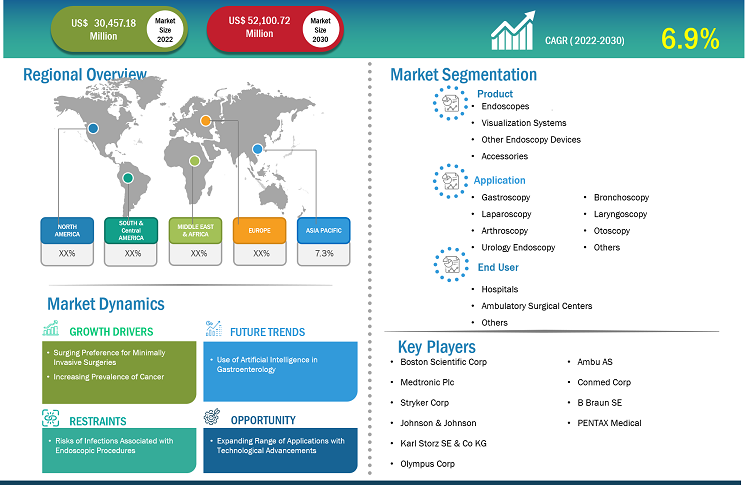

[Research Report] The Endoscopy Device market size is projected to grow from US$ 30,457.18 million in 2022 to US$ 52,100.72 million by 2030; it is estimated to record a CAGR of 6.9% during 2022–2030.

Market Insights and Analyst View:

Endoscopy is a minimally invasive surgical procedure employed to visualize internal organs of the human body; it is also used in surgeries performed on various organs. The procedure is performed with the help of a small flexible tube known as an endoscope. This tube is attached to a camera, enabling a clear view of the organ to be observed. Based on the area to be examined, various types of scopes are available; a few of these are arthroscopes, bronchoscopes, laparoscopes, and hysteroscopes. Various other devices and instruments are used in an endoscopy procedure for better visualization, sterilization, and enhanced-quality imaging.

Growth Drivers:

Increasing Demand for Minimally Invasive Techniques

The growing demand for minimally invasive techniques in surgical procedures reflects a significant shift in medical practice and patient preferences. This trend is driven by the desire to minimize the invasiveness of procedures, reduce the associated risks, and promote faster recovery times. Endoscopy is a minimally invasive surgery procedure that involves a minimal incision size, shortened recovery time, and better visibility into the internal body cavity. A surgeon can visualize and work within the body cavity using an endoscope without making a large incision. Minimally invasive approaches typically involve smaller incisions, and the use of specialized instruments and technologies to access different organs, which can lead to shorter hospital stays and less scarring. Moreover, patients often experience less pain and a quicker return to their daily activities. Surgeons have embraced these techniques due to their potential benefits, and advancements in medical devices and surgical skills. As a result, healthcare institutions are investing in training their medical teams and acquiring the necessary equipment to meet the increasing demand for minimally invasive endoscopy surgeries, thereby providing patients with improved treatment options and enhanced overall healthcare experiences.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Endoscopy Device Market: Strategic Insights

Market Size Value in US$ 30,457.18 million in 2022 Market Size Value by US$ 52,100.72 million by 2030 Growth rate CAGR of 6.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Endoscopy Device Market: Strategic Insights

| Market Size Value in | US$ 30,457.18 million in 2022 |

| Market Size Value by | US$ 52,100.72 million by 2030 |

| Growth rate | CAGR of 6.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “endoscopy device market” is segmented on the basis of product, application, and end user. Based on product, the market is segmented into endoscopes, visualization systems, accessories, and other endoscopy devices. The market for the endoscopes segment is further subsegmented into flexible endoscopes, rigid endoscopes, robot-assisted endoscopes, and capsule endoscopes. The endoscopy device market for the visualization systems segment is further segregated into wireless displays and monitors, light sources, video processors, endoscopic cameras, video recorders, video converters, carts, transmitters and receivers, camera heads, and other instruments. The market for the other endoscopy devices segment is further segmented as electronic instruments and mechanical instruments. The market for the accessories segment is subsegmented into cleaning brushes, overtubes, surgical dissectors, light cables, fluid flushing devices, needle holders/needle forceps, mouthpieces, biopsy valves, and others. By application, the endoscopy device market is segmented into gastroscopy, laparoscopy, arthroscopy, otoscopy, urology endoscopy, bronchoscopy, laryngoscopy, and other applications. The market, based on end user, is segmented into hospitals, ambulatory surgical centers, and others.

Segmental Analysis:

By product, the endoscopes segment held the largest share of the endoscopy device market in 2022. The visualization systems segment is estimated to register the highest CAGR during 2022–2030. Visualization systems used in endoscopy procedures help in obtaining images and videos of enhanced quality. The visualization system in endoscopy procedures consists of components such as wireless displays and monitors, light sources, video processors, endoscopic cameras, video recorders, video converters, carts, transmitters and receivers, camera heads, and other instruments. Boston Scientific Corporation and KARL STORZ SE & Co. KG provide visualization systems in the endoscope devices market.

In terms of application, the gastroscopy segment held the largest share of the endoscopy device market in 2022. Further, the laparoscopy segment is expected to record the highest CAGR during 2022–2030. Gastroscopy (also known as upper endoscopy) involves examining the upper gastrointestinal tract, which includes the esophagus, stomach, and duodenum (the beginning part of the small intestine). It is used to diagnose conditions such as ulcers, tumors, inflammation, and gastroesophageal reflux disease (GERD). Endoscopy devices designed for gastroscopy include flexible endoscopes with advanced imaging capabilities provided by high-definition cameras and optical enhancements.

Based on end user, the hospitals segment held the largest share of the endoscopy device market in 2022. It is further expected to register the highest CAGR in the market during 2022–2030. Hospitals encompass a wide spectrum of medical facilities, ranging from community hospitals to large academic medical centers. They serve as major end users of endoscopy devices. The demand for endoscopy devices within hospital settings is mainly driven by a high footfall of patients into these facilities, which can be attributed to factors such as comprehensive care delivery, inpatient and outpatient services, and advanced procedures and interventions. Hospitals are equipped to perform complex endoscopic procedures, including surgeries, advanced imaging, and specialized therapeutic endoscopy. Endoscopes are also used to examine the interior of hollow organs or cavities inside the body. A few endoscopic examinations are particularly performed in hospital settings. For instance, cystoscopies are typically performed in hospital outpatient settings. Ureteroscopy procedures for managing or removing kidney stones are performed in operating rooms. Similarly, most ENT endoscopies, such as examining a patient’s nose or throat to assess breathing problems or swallowing difficulties, are performed in inpatient and outpatient hospital settings.

Regional Analysis:

Based on geography, the endoscopy device market is segmented into Asia Pacific, Europe, the Middle East & Africa, North America, and South & Central America. In 2022, North America held the largest share of the global market. Asia Pacific is anticipated to register the highest CAGR in the endoscopy device market during 2022–2030.

The endoscopy device market in North America is split into the US, Canada, and Mexico. The US is the largest market for endoscopy device in this region. The market is majorly driven by the surging preference for minimally invasive surgeries and increasing prevalence of cancer. Other factors such as the introduction of advanced equipment in healthcare, a higher number of hospitals, and the implementation of strategic government policies also aid in promoting the expansion of the endoscopy device market. Additionally, the need for automated systems due to the increasing patient population and crunch of healthcare resources are expected to fuel the adoption of endoscopy systems in the US. Emphasis on using technologically advanced endoscopy devices equipped with high-definition cameras and light sources is also prominently expected to fuel the market growth during the estimated period.

Endoscopy Device Market Report Scope

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the endoscopy device market are listed below:

- In February 2023, Boston Scientific Corp announced that the FDA has approved its LithoVue Elite Single-Use Digital Flexible Ureteroscope System. It is the first ureteroscope system can monitor intrarenal pressure in real-time during ureteroscopy procedures. The LithoVue Elite Single-Use Digital Flexible Ureteroscope System comprises of StoneSmart Connect Console that has upgraded the device to offer upgraded image quality, control features, and streamlined integration.

- In September 2023, Ambu expanded its gastroenterology portfolio with the announcement of the Ambu aScope Gastro Large and Ambu aBox 2, two new larger-sized gastroscopy solutions that will be available in Europe. In addition to being the first gastroscope in the world with a 4.2 mm operating channel, which enables gastroenterologists to achieve strong suction performance during procedures in the ICU and endoscopy unit, the Ambu aScope Gastro Large is also the first endoscope ever manufactured of bioplastic materials.

- In September 2022, Medtronic plc announced that the US Food and Drug Administration has approved the Nexpowder endoscopic hemostasis system. The hemostasis system is supplied worldwide by Medtronic and is separately developed by NEXTBIOMEDICAL CO., LTD (Korea). Using a catheter with patented powder-coating technology, a noncontact, nonthermal, and nontraumatic hemostatic powder is sprayed to operate the Nexpowder system

- In September 2023, Stryker Corp announced the launch of the 1788 platform, which is the next generation of minimally invasive surgical cameras. The camera platform is enhanced with upgraded technology to be used in advanced surgery across multiple specialties. The camera provides a vibrant image with balanced lighting that improves visualization of blood flow and critical anatomy and can visualize multiple optical imaging agents.

Competitive Landscape and Key Companies:

Boston Scientific Corp, Medtronic Plc, Stryker Corp, Johnson & Johnson, Karl Storz SE & Co KG, Olympus Corp, Ambu AS, Conmed Corp, B Braun SE, and PENTAX Medical are among the prominent companies operating in the endoscopy device market. These companies focus on new technologies, existing products advancements, and geographic expansions to meet the globally growing consumer demand.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The endoscopy devices market by user was metameric into hospitals and ambulant surgical centers and alternative end users. The hospitals section command the most important share of the market, by application. The section is additionally anticipated to grow at a gradual rate throughout the forecast amount, thanks to availableness of compensation for endoscopy procedures.

The marketplace for endoscopy devices is anticipated to grow within the returning years, due to the technological advancements created by the players in operation within the market. These technological advancements have created the procedure of endoscopy easier also because the results obtained are a lot of correct and accurate.

The outstanding players in operation in endoscopy devices market are STRYKER, Medtronic, KARL STORZ SE & Co. KG, Ethicon US, LLC., Olympus Corporation, Richard Wolf GmbH, Boston Scientific Corporation, Smith & Nephew, Cook, and FUJIFILM Holdings Corporation.

The market is calculable to grow with a CAGR of 7.5% from 2018-2025.

North America is that the largest geographic market and it's expected to be the most important revenue generator throughout the forecast amount. North America's market is driven by the factors like, bureau approvals (FDA) obtained by the Endoscopy Devices market players also as rising prevalence of cancer cases.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

4. Endoscopy Device Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Endoscopy Device Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Endoscopy Device Market - Saudi Arabia Market Analysis

6.1 Endoscopy Device - Saudi Arabia Market Overview

6.2 Endoscopy Device - Saudi Arabia Market and Forecast to 2030

7. Endoscopy Device Market – Revenue Analysis (USD Million) – By Product, 2020-2030

7.1 Overview

7.2 Endoscopes

7.2.1 Rigid Endoscopes

7.2.2 Flexible Endoscopes

7.2.3 Capsule Endoscopes

7.2.4 Robot-Assisted Endoscope

7.3 Visualization Systems

7.3.1 Wireless Displays and Monitors

7.3.2 Light Sources

7.3.3 Video Processors

7.3.4 Endoscopic Cameras

7.3.5 Video Recorders

7.3.6 Video Converters

7.3.7 Carts

7.3.8 Transmitters and Receivers

7.3.9 Camera Heads

7.4 Accessories

7.4.1 Cleaning Brushes

7.4.2 Overtubes

7.4.3 Surgical Dissectors

7.4.4 Light Cables

7.4.5 Fluid Flushing Devices

7.4.6 Needle Holders/ Needle Forceps

7.4.7 Mouth Pieces

7.4.8 Biopsy Valves

7.4.9 Others

7.5 Other Endoscopy Devices

7.5.1 Electronic Instruments

7.5.2 Mechanical Instruments

8. Endoscopy Device Market – Revenue Analysis (USD Million) – By Application, 2020-2030

8.1 Overview

8.2 Gastroscopy

8.3 Laparoscopy

8.4 Arthroscopy

8.5 Otoscopy

8.6 Urology Endoscopy

8.7 Bronchoscopy

8.8 Laryngoscopy

8.9 Other Applications

9. Endoscopy Device Market – Revenue Analysis (USD Million) – By End User, 2020-2030

9.1 Overview

9.2 Hospitals

9.3 Ambulatory Surgical Centres

9.4 Others

10. Industry Landscape

10.1 Mergers and Acquisitions

10.2 Agreements, Collaborations, Joint Ventures

10.3 New Product Launches

10.4 Expansions and Other Strategic Developments

11. Competitive Landscape

11.1 Heat Map Analysis by Key Players

11.2 Company Positioning and Concentration

12. Endoscopy Device Market - Key Company Profiles

12.1 Boston Scientific Corporation

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

Note - Similar information would be provided for below list of companies

12.2 Medtronic

12.3 STRYKER

12.4 Johnson and Johnson

12.5 KARL STORZ

12.6 Olympus Corporation

12.7 Ambu AS

12.8 Conmed Corp

12.9 B Braun SE

12.10 PENTAX Medical

13. Appendix

13.1 Glossary

13.2 About The Insight Partners

13.3 Market Intelligence Cloud

The List of Companies - Endoscopy Device Market

- Boston Scientific Corp

- Medtronic Plc

- Stryker Corp

- Johnson & Johnson

- Karl Storz SE & Co KG

- Olympus Corp

- Ambu AS

- Conmed Corp

- B Braun SE

- PENTAX Medical

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Sep 2025

Infectious Disease In vitro Diagnostics Market

Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Application (HIV or AIDS, Tuberculosis, Hepatitis B and C, Malaria, and Others), End User (Hospitals and Clinics, Diagnostic Laboratories, Blood Bank, and Others), and Geography

Sep 2025

Donor Blood Components Market

Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Blood Component (Red Blood Cells, White Blood Cells, Platelets, Plasma, and Others), Indication (Immunosuppression and Oncology), Application (Anemia Management, Thrombocytopenia Treatment, Coagulopathy Correction, Supportive Care During Chemotherapy, Surgery, and Others), Age Group (Adult and Child), End User (Hospitals, Oncology Centers, Transplant Centers, Ambulatory Surgical Centers, and Others), and Geography

Sep 2025

Aesthetic Injectable Devices Market

Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Product (Dermal Filler, Botulinum Toxin and Others), Dermal Fillers (Calcium Hydroxylapatite, Hyaluronic Acid, Collagen, Poly-L-Lactic Acid, Polymethylmethacrylate, Fat Fillers, and Others), Device Type (Microcannulas, Pre-Filled Syringes, Mesotherapy Guns, and Others), Application (Facial Line Correction, Face Lift, Lip Treatment, Anti-Ageing and Wrinkle Treatment, Acne and Scar Treatment, Stretch Marks, and Others), Age Group (Up to 30, 31-40, 41-50, 51-60, and More Than 60), Gender (Female and Male), End User (Medical Spas, Dermatology Clinics, Hospitals, and Others), and Geography

Sep 2025

ECG Monitoring Equipment Market

Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG, Stress ECG, Holter Monitors, and Cardiopulmonary Stress Testing Monitors), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Sep 2025

Prescription Drugs Market

Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Product Type (Branded and Generics), Drug Type (Small Molecule and Biologics and Biosimilar), Therapeutic Area (Oncology, Cardiovascular Diseases, Neurological Diseases, Metabolic Diseases, Respiratory Diseases, Immunology, and Others), Route Of Administration (Oral, Injectable, Topical, and Others), Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Sep 2025

Regenerative Dentistry Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Natural and Synthetic), Technology (Tissue Engineering, Stem Cell Therapy, and Others), Application (Periodontal Regeneration, Endodontic Regeneration, Tooth Reconstruction, Bone Regeneration, and Others), Age Group (Adult and Pediatric), End User (Dental Clinics, Hospital, and Others), and Geography

Sep 2025

Wound Closure Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Sutures, Adhesives, Staplers, Strips, and Others), Wound Type (Chronic Wound and Acute Wound), End User (Hospitals, Clinics, Ambulatory Surgery Centers, and Others), and Geography

Sep 2025

Cell and Gene Therapy Contract Development and Manufacturing Organization Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Drug Development and Manufacturing, Testing and Regulatory Services, and Others), Product Type (Gene Therapy and Cell Therapy), End User (Pharmaceutical Companies, Biopharmaceutical Companies, and Others), and Geography

Get Free Sample For

Get Free Sample For