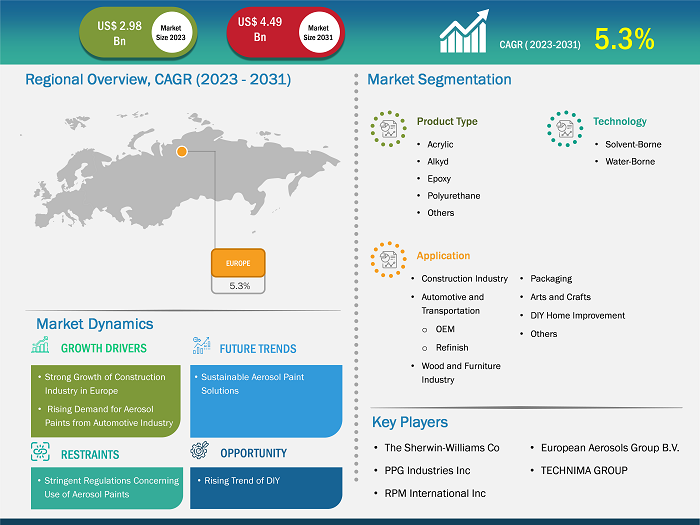

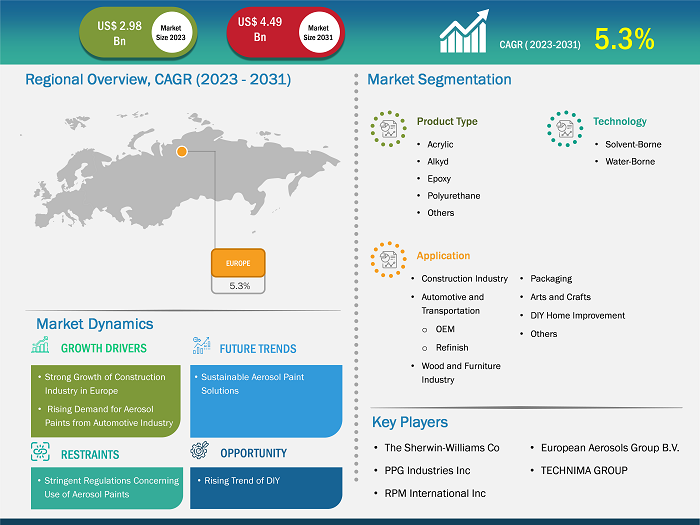

The Europe aerosol paints market was valued at US$ 2.98 billion in 2023 and is projected to reach US$ 4.49 billion by 2031; it is anticipated to record a CAGR of 5.3% from 2023 to 2031.

Market Insights and Analyst View:

Aerosol paints, also known as spray paints, are widely used to increase the shelf life of wood, metal, and plastic components in various industries. Pigments, solvents, and propellants are the major raw materials used for manufacturing aerosol paints. The manufacturing process of aerosol paints varies according to the technology, such as solvent-borne and water-borne. Water-borne aerosol paints are formulated with a water-based solution, and solvent-borne aerosol paints are formulated with a solvent or oil-based solution. Aerosol paints are used in applications such as construction, automotive & transportation, wood & furniture, packaging, arts & crafts, and DIY home improvement. Aerosol paint is useful for quick, semi-permanent marking on construction and surveying sites. It offers good resistance to abrasion, corrosion, and solvents and a lustrous protective coating on the surface to which they are applied.

Growth Drivers and Challenges:

The key factor bolstering the Europe aerosol paints market size is the strong growth of the construction industry in Europe. Aerosol paints offer desired heavy-duty finishes and rust prevention to building and construction sites. According to the European Construction Industry Federation, in the European Union, Germany, France, the UK, Italy, and Spain accounted for more than 70% of total investments in the construction of buildings and other structures. Thus, the significantly growing construction sector in the region is expected to boost the demand for aerosol paints. Moreover, the infrastructure sector is more resilient to the economic cycle as investment mainly comes from local or central governments. The EU infrastructure volumes have shown growth in 2022 (2.4%) and 2023 (3.2%), according to Eurostat. This growth in infrastructure supports total construction volumes in Europe. The Europe aerosol paints market is further fueled by increasing government spending on construction, infrastructures, and rising demand for new homes and building improvements. According to the European Commission, the construction industry is one of the major industries in Europe, contributing ~9% to the region's GDP. The Europe aerosol paints market trends include the development of sustainable aerosol paint solutions.

The stringent regulations concerning the use of aerosol paints are expected to restrain the Europe aerosol paints market growth. The solvent-based aerosol paints emit volatile organic compounds (VOCs)—toxic chemicals that easily evaporate into the air and accumulate in the environment. VOCs can be a risk to human health and the local environment. With rising environmental concerns, government agencies regulated the paints and coating industries in Europe. The region has been at the forefront of regulating VOCs in the paint and coating industry. The European Union (EU) has implemented the VOC Solvents Emissions Directive (SED) to reduce VOC emissions from industrial activities, including the paint and coating industry. The SED sets emission limits for VOCs and mandates industries to use low-VOC or zero-VOC solvents wherever possible.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe Aerosol Paints Market: Strategic Insights

Market Size Value in US$ 2.98 billion in 2023 Market Size Value by US$ 4.49 billion by 2031 Growth rate CAGR of 5.3% from 2023 to 2031 Forecast Period 2023-2031 Base Year 2023

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe Aerosol Paints Market: Strategic Insights

| Market Size Value in | US$ 2.98 billion in 2023 |

| Market Size Value by | US$ 4.49 billion by 2031 |

| Growth rate | CAGR of 5.3% from 2023 to 2031 |

| Forecast Period | 2023-2031 |

| Base Year | 2023 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The "Europe Aerosol Paints Market Analysis" has been performed by considering the following segments: raw material, technology, application, and country. Based on raw material, the market is segmented into acrylic, alkyd, epoxy, polyurethane, and others. By technology, the market is segmented into solvent-borne and water-borne. By application, the market is segmented into the construction industry, automotive & transportation, wood & furniture industry, packaging, arts and crafts, DIY home improvement, and others. The automotive and transportation segment is further segmented into OEM and Refinish. The geographic scope of the Europe aerosol paints market report focuses on countries such as Germany, France, Italy, the UK, Russia, Spain, and the Rest of Europe.

Segmental Analysis:

Based on raw material, the Europe aerosol paints market is segmented into acrylic, alkyd, epoxy, polyurethane, and others. Based on raw material, the alkyd segment is anticipated to hold a significant Europe aerosol paints market share by 2031. Alkyd aerosol paints are ester-based polymers that contain fatty acids. They are effective binders in commercial and industrial oil-based coatings. Alkyd aerosol paints are durable, glossy, and flexible and also provide an enamel finish similar to oil paints. They are used for architectural, machinery, and other metal and wood applications. The use of alkyd aerosol paint is increasing, which can be attributed to its ease of application and high gloss finish. Thus, all these factors are expected to boost the demand for alkyd aerosol paints. Acrylic is also one of the major raw materials in the Europe aerosol paints market. Acrylic aerosol paints are made from acrylic resins and are known for their water-resistant and fast-drying properties. Acrylic aerosol paint consists of color pigments suspended in an acrylic polymer blend. These paints are easy to clean and need little maintenance. Acrylic aerosol paints are common in arts and crafts, but it is also a suitable coating for industrial applications.

Regional Analysis:

Based on country, the market is segmented into Germany, France, Italy, the UK, Russia, Spain, and Rest of Europe. In terms of revenue, Germany dominated the Europe aerosol paints market share. The market in Germany accounted for over US$ 500 million in 2023. The demand for aerosol paints is high in Germany as it has the largest construction industry in Europe. Various government projects in the country are fueling the aerosol paints market growth. For instance, the new German Social Democrat government is heavily focusing on the housing crisis in the country. The government is creating an entirely new ministry to supervise its housing plans. It has also pledged to construct over 400,000 new housing units yearly since 2022. Of which 100,000 will be publicly subsidized. Also, the growing demand from the automotive industry, surging demand from domestic applications, increasing use of corrosion spray coatings, and rising environmental awareness further fuel the demand for aerosol paints in the country.

The UK is another major contributor, holding more than 10% of the Europe market share. The aerosol paints market in the UK is significantly growing with increasing demand for automobiles, construction, and packaging. Over the last few years, the packaging industry has developed in the country, owing to the growth of outsourcing packaging services by companies in the downstream industries to generate cost efficiencies. The rising efforts to enhance the appearance of products and the introduction of innovative packaging solutions by a few players reinforced the packaging industry expansion in recent years. Thus, the increasing use of aerosol paints in packaging bolsters the growth of the aerosol paints market in the UK. Manufacturers are enhancing aerosol paints to cater to the changing demands of consumers and end-use industries. For instance, in November 2023, ROCOL—the aerosol paint leader in the UK—improved its market-leading Easyline Edge product by reformulating it to give twice the solids content while reducing its touch-drying time to eight minutes. Easyline Edge is used in the traffic marking paint sector, and its epoxy base confers exceptional resistance to cleaning products and chemicals.

Industry Developments and Future Opportunities:

The Europe aerosol paints market forecast can help stakeholders plan their growth strategies. The following are initiatives taken by the key players operating in the Europe aerosol paints market:

- In April 2023, Rust-Oleum announced the launch of Custom Spray 5-in-1, its latest evolution in spray paint technology. This unique spray paint innovation allows painters to easily switch spray patterns with just a click of a dial, making it easier to use. The Custom Spray 5-in-1 dial offers five spray patterns such as high output, standard, low output, vertical fan, and horizontal fan.

- In April 2022, PPG introduced PPG INNOVEL PRO technology, an upgraded version of its non-bisphenol beverage can coatings. PPG INNOVEL PRO is a next-generation, high-performance internal spray acrylic coating for the infinitely recyclable aluminum beverage can that provides more robust application properties and uses no bisphenol-A (BPA) or bisphenol starting substances.

- In April 2022, The GLIDDEN paint brand by PPG introduced GLIDDEN MAX FLEX spray paint to cater to DIY projects of varying sizes and surfaces. The spray paint is an interior/exterior paint + primer that utilizes a lacquer-based formula to provide a high-coverage, ultra-durable coating on a wide range of surfaces.

- In June 2022, the Sherwin-Williams Company announced an agreement to acquire Gross & Perthun GmbH. This German company develops, manufactures, and distributes coatings mainly for the heavy equipment and transportation industries. The purchase will add ~100 employees to the Sherwin-Williams workforce and is expected to generate annual sales of around US$ 50 million. The acquisition is aimed to add waterborne and solvent liquid coatings technology to the company's product portfolio. The combination of these businesses offers several opportunities to generate profit and foster growth throughout Europe and beyond.

Competitive Landscape and Key Companies:

The Sherwin-Williams Co, PPG Industries Inc, RPM International Inc, Kobra Paint–Spray Art Technologies, European Aerosols Group B.V., TECHNIMA GROUP, WRX Trade Brands, Black Country Paints Ltd, Peter Kwasny GmbH, and TA Paints Ltd are among the prominent players profiled in the Europe aerosol paints market report. Players operating in the market focus on providing high-quality products to fulfill customer demand. Also, they focus on adopting various strategies such as new product launches, capacity expansions, partnerships, and collaborations in order to stay competitive in the market.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Raw Material, Technology, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Secondary Research

3.2 Primary Research

3.2.1 Hypothesis formulation:

3.2.2 Macro-economic factor analysis:

3.2.3 Developing base number:

3.2.4 Data Triangulation:

3.2.5 Country level data:

4. Europe Aerosol Paints Market Landscape

4.1 Overview

4.2 Porter’s Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Intensity of Competitive Rivalry

4.2.5 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers

4.3.2 Manufacturers

4.3.3 Distributors/Suppliers

4.3.4 End Use

4.3.5 List of Vendors in the Value Chain

5. Europe Aerosol Paints Market – Key Market Dynamics

5.1 Europe Aerosol Paints Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Strong Growth of Construction Industry in Europe

5.2.2 Rising Demand for Aerosol Paints from Automotive Industry

5.3 Market Restraints

5.3.1 Stringent Regulations Concerning Use of Aerosol Paints

5.4 Market Opportunities

5.4.1 Rising Trend of DIY

5.5 Future Trends

5.5.1 Sustainable Aerosol Paint Solutions

5.6 Impact of Drivers and Restraints:

6. Europe Aerosol Paints Market Analysis

6.1 Europe Aerosol Paints Market Revenue (US$ Million), 2021–2031

6.2 Europe Aerosol Paints Market Forecast and Analysis

7. Europe Aerosol Paints Market Analysis – by Raw Material

7.1 Acrylic

7.1.1 Overview

7.1.2 Acrylic: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

7.2 Alkyd

7.2.1 Overview

7.2.2 Alkyd: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

7.3 Epoxy

7.3.1 Overview

7.3.2 Epoxy: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

7.4 Polyurethane

7.4.1 Overview

7.4.2 Polyurethane: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

8. Europe Aerosol Paints Market Analysis – by Technology

8.1 Solvent-Borne

8.1.1 Overview

8.1.2 Solvent-Borne: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

8.2 Water-Borne

8.2.1 Overview

8.2.2 Water-Borne: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

9. Europe Aerosol Paints Market Analysis – by Application

9.1 Construction Industry

9.1.1 Overview

9.1.2 Construction Industry: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

9.2 Automotive and Transportation

9.2.1 Overview

9.2.2 Automotive and Transportation: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

9.2.2.1 OEM

9.2.2.1.1 Overview

9.2.2.1.2 OEM: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

9.2.2.2 Refinish

9.2.2.2.1 Overview

9.2.2.2.2 Refinish: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

9.3 Wood and Furniture Industry

9.3.1 Overview

9.3.2 Wood and Furniture Industry: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

9.4 Packaging

9.4.1 Overview

9.4.2 Packaging: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

9.5 Arts and Crafts

9.5.1 Overview

9.5.2 Arts and Crafts: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

9.6 DIY Home Improvement

9.6.1 Overview

9.6.2 DIY Home Improvement: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

9.7 Others

9.7.1 Overview

9.7.2 Others: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

10. Europe Aerosol Paints Market – Country Analysis

10.1 Europe

10.1.1 Europe Aerosol Paints Market Breakdown by Countries

10.1.2 Europe Aerosol Paints Market Revenue and Forecast and Analysis – by Country

10.1.2.1 Europe Aerosol Paints Market Revenue and Forecast and Analysis – by Country

10.1.2.2 Germany: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

10.1.2.2.1 Germany: Europe Aerosol Paints Market Breakdown by Raw Material

10.1.2.2.2 Germany: Europe Aerosol Paints Market Breakdown by Technology

10.1.2.2.3 Germany: Europe Aerosol Paints Market Breakdown by Application

10.1.2.3 France: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

10.1.2.3.1 France: Europe Aerosol Paints Market Breakdown by Raw Material

10.1.2.3.2 France: Europe Aerosol Paints Market Breakdown by Technology

10.1.2.3.3 France: Europe Aerosol Paints Market Breakdown by Application

10.1.2.4 Italy: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

10.1.2.4.1 Italy: Europe Aerosol Paints Market Breakdown by Raw Material

10.1.2.4.2 Italy: Europe Aerosol Paints Market Breakdown by Technology

10.1.2.4.3 Italy: Europe Aerosol Paints Market Breakdown by Application

10.1.2.5 United Kingdom: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

10.1.2.5.1 United Kingdom: Europe Aerosol Paints Market Breakdown by Raw Material

10.1.2.5.2 United Kingdom: Europe Aerosol Paints Market Breakdown by Technology

10.1.2.5.3 United Kingdom: Europe Aerosol Paints Market Breakdown by Application

10.1.2.6 Russia: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

10.1.2.6.1 Russia: Europe Aerosol Paints Market Breakdown by Raw Material

10.1.2.6.2 Russia: Europe Aerosol Paints Market Breakdown by Technology

10.1.2.6.3 Russia: Europe Aerosol Paints Market Breakdown by Application

10.1.2.7 Spain: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

10.1.2.7.1 Spain: Europe Aerosol Paints Market Breakdown by Raw Material

10.1.2.7.2 Spain: Europe Aerosol Paints Market Breakdown by Technology

10.1.2.7.3 Spain: Europe Aerosol Paints Market Breakdown by Application

10.1.2.8 Rest of Europe: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

10.1.2.8.1 Rest of Europe: Europe Aerosol Paints Market Breakdown by Raw Material

10.1.2.8.2 Rest of Europe: Europe Aerosol Paints Market Breakdown by Technology

10.1.2.8.3 Rest of Europe: Europe Aerosol Paints Market Breakdown by Application

11. Competitive Landscape

11.1 Heat Map Analysis

11.2 Company Positioning and Concentration

12. Industry Landscape

12.1 Overview

13. Company Profiles

13.1 The Sherwin-Williams Co

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 PPG Industries Inc

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 RPM International Inc

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Kobra Paint - Spray Art Technologies

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 European Aerosols Group BV.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 TECHNIMA GROUP

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 WRX Trade Brands

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Black Country Paints Ltd.

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Peter Kwasny GmbH

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 TA Paints Ltd

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

List of Tables

Table 1. Europe Aerosol Paints Market Segmentation

Table 2. List of Vendors

Table 3. Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

Table 4. Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Raw Material

Table 5. Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 6. Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Application

Table 7. Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Country

Table 8. Germany: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Raw Material

Table 9. Germany: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 10. Germany: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Application

Table 11. France: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Raw Material

Table 12. France: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 13. France: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Application

Table 14. Italy: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Raw Material

Table 15. Italy: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 16. Italy: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Application

Table 17. United Kingdom: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Raw Material

Table 18. United Kingdom: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 19. United Kingdom: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Application

Table 20. Russia: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Raw Material

Table 21. Russia: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 22. Russia: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Application

Table 23. Spain: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Raw Material

Table 24. Spain: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 25. Spain: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Application

Table 26. Rest of Europe: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Raw Material

Table 27. Rest of Europe: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 28. Rest of Europe: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million) – by Application

List of Figures

Figure 1. Europe Aerosol Paints Market Segmentation, by Country

Figure 2. Porter’s Analysis

Figure 3. Ecosystem: Europe Aerosol Paints Market

Figure 4. Infrastructure Sector Growth In European Countries

Figure 5. New Passenger Car Registration in Europe

Figure 6. Impact Analysis of Drivers and Restraints

Figure 7. Europe Aerosol Paints Market Revenue (US$ Million), 2021–2031

Figure 8. Europe Aerosol Paints Market Share (%) – by Raw Material, 2023 and 2031

Figure 9. Acrylic: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 10. Alkyd: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 11. Epoxy: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 12. Polyurethane: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 13. Others: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 14. Europe Aerosol Paints Market Share (%) – by Technology, 2023 and 2031

Figure 15. Solvent-Borne: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 16. Water-Borne: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 17. Europe Aerosol Paints Market Share (%) – by Application, 2023 and 2031

Figure 18. Construction Industry: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 19. Automotive and Transportation: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 20. OEM: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 21. Refinish: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 22. Wood and Furniture Industry: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 23. Packaging: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 24. Arts and Crafts: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 25. DIY Home Improvement: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 26. Others: Europe Aerosol Paints Market– Revenue and Forecast to 2031 (US$ Million)

Figure 27. Europe Aerosol Paints Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 28. Germany: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

Figure 29. France: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

Figure 30. Italy: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

Figure 31. United Kingdom: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

Figure 32. Russia: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

Figure 33. Spain: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

Figure 34. Rest of Europe: Europe Aerosol Paints Market – Revenue and Forecast to 2031 (US$ Million)

Figure 35. Heat Map Analysis

Figure 36. Company Positioning and Concentration

The List of Companies - Europe Aerosol Paints Market

- The Sherwin-Williams Co

- PPG Industries Inc

- RPM International Inc

- Kobra Paint - Spray Art Technologies

- European Aerosols Group B.V.

- TECHNIMA GROUP

- WRX Trade Brands

- Black Country Paints Ltd

- Peter Kwasny GmbH

- TA Paints Ltd

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Europe Aerosol Paints Market

Apr 2024

Re-Refined Paraffinic Base Oil Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Process (Acid Treatment, Clay Treatment, Solvent Extraction, and Hydrotreating), Application (Engine Oil, Hydraulic Oil, Metalworking Fluid, Compressor Oil, Grease, Turbine Oil, and Others), End Use (Automotive, Construction, Mining and Metallurgy, Marine, Energy and Power, Oil and Gas, and Others), and Geography

Apr 2024

Cosmetic Polymer Ingredients Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Polyethylene Glycol, Acrylic Acid-Based, Vinyl Acetate, Silicone, Cellulose, Collagen, Pectin, Xanthan Gum, Chitosan, and Others), Category (Natural, Synthetic, and Semi-Synthetic), Function (Rheology Modifier, Stabilizers, Emulsifiers, Film Formers, Conditioning, and Others), Application (Skincare, Hair Care, Makeup, and Others), and Geography

Apr 2024

Plastic Pipes Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Corrugated (Single-Wall and Multi-Wall) and Smoothwall], Material Type (Polyvinyl Chloride, High-Density Polyethylene, Polypropylene, and Others), Application (Water Supply, Sewage and Drainage, Irrigation, Gas Distribution, and Others), End-Use Industry (Construction and Infrastructure, Water and Wastewater Management, Oil and Gas, and Others), and Geography

Apr 2024

Nonwovens for Energy Applications Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Carbon Fiber, Titanium Fiber, and Others), Application [Battery, Fuel Cell Gas Diffusion Layer (GDL), PTL, and Wind Energy], and Geography

Apr 2024

Antimicrobial Coating Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material (Silver, Copper, Titanium Dioxide, and Others), Application (Healthcare, HVAC, Mold Remediation, Building and Construction, Food and Beverages, and Others), and Geography

Apr 2024

Hot Melt Adhesives Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Glue Sticks, Glue Slugs, and Others), Type (Ethylene Vinyl Acetate, Polyolefins, Polyamides, Polyurethanes, Styrene Block Copolymers, and Others), Application (Packaging, Construction, Automotive, Furniture, Footwear, Electronics, and Others), and Geography

Apr 2024

Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Base Oil (Mineral Oil, Synthetic Oil, and Bio-based Oil), Type (Hydraulic Fluid, Engine Oil, Driveline Lubricants, Metalworking Fluids, Grease, Process Oils, Coolants, and Others), End-Use Industry [Automotive (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Others), Building and Construction, Power Generation, Mining and Metallurgy, Food Processing, Oil and Gas, Marine, Aviation, and Others], and Geography

Apr 2024

Cosmetic Preservatives Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Natural and Synthetic), Product Type (Parabens, Formaldehyde Releasers, Organic Acids, Quaternary Compounds, Phenol Derivatives, Alcohols, and Others), Application (Hair Care, Skin Care, Makeup Products, Toiletries, Perfumes and Deodorants, and Others), and Geography

Get Free Sample For

Get Free Sample For