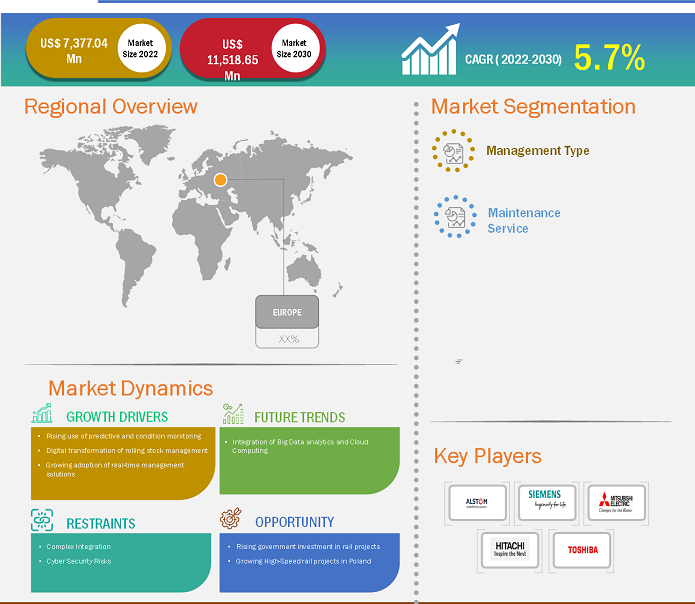

Europe rolling stock management market accounted for US$ 7,377.04 million in the year 2022 and is expected to account for US$ 11,518.65 million in the year 2030; it is expected to grow at a CAGR of 5.7% during the period 2022–2030.

Analyst Perspective:

Europe has one of the world's largest train networks. The European Union has been planning to double freight rail's model share by 2030 to ease the congestion of major road connections and reduce the transport sector's CO2 emissions. Countries in the region are signing contracts with various companies for rail or infrastructure expansion. Rail transportation plays a key part in Europe's development. As per the International Energy Agency (IEA) report, in 2020, passengers traveled ~378 billion passenger kilometers on European railways, making this region the massive market for rail passenger traffic. This, in turn, will result in a rise in demand for rolling stock management market in Europe.

Market Overview:

Rolling stock refers to railway vehicles that include both powered and unpowered vehicles. It is referred to any railway vehicle that can move on the rail tracks. The rolling stock's maintenance, information tracking, and management are the key features of the rolling stock management system. It maintains the information regarding the running as well as breakdown and inspection records of the rolling stocks. It also stores the records of the rolling stock from its manufacturing to the information regarding its main fittings. The management of the history log of the rolling stock helps the workers, during its inspection and breakdown, to efficiently manage their work.

For instance, in January 2023, UK-based Transport for Wales (TfW) announced the start of its construction of a new Butetown railway station and overhaul of Cardiff Bay station. Therefore, with the expansion of the railway network and infrastructure, the rolling stock management market is expected to grow significantly in the coming years. Similarly, Sinara Transport Machines Holding (STM) established a new railway infrastructure division to offer infrastructure maintenance services in Russia starting in 2022.

The rise in the rail industry is also one of the significant contributors to the rolling stock management market. The rise in the launch of new rail stations and expansion of the rail network generates the need for an efficient rolling stock management system to manage the rolling stock, its route, and maintenance. New station and rail expansion projects are key factors accelerating the rolling stock management market growth.

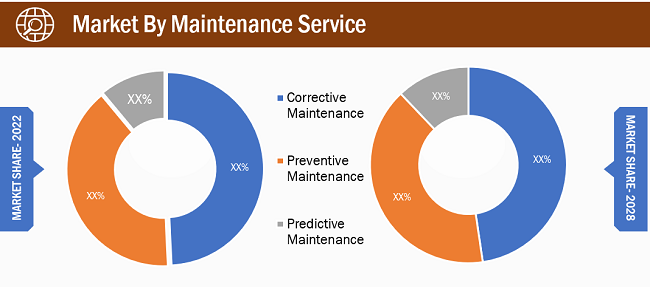

Based on management type, the rolling stock management market is bifurcated into rail management and infrastructure management. Based on maintenance service, the rolling stock management market is categorized into corrective maintenance, preventive maintenance, and predictive maintenance. The rolling stock management market share, based on region, is categorized into the UK, Russia, and Poland.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe Rolling Stock Management Market: Strategic Insights

Market Size Value in US$ 7,377.04 million in 2022 Market Size Value by US$ 11,518.65 million by 2030 Growth rate CAGR of 5.7% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe Rolling Stock Management Market: Strategic Insights

| Market Size Value in | US$ 7,377.04 million in 2022 |

| Market Size Value by | US$ 11,518.65 million by 2030 |

| Growth rate | CAGR of 5.7% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Digital transformation of rolling stock management Boosting The rolling Stock Management Market Growth

Digital technologies enable rail operators to streamline operations, improving efficiency. This includes digital scheduling, route optimization, and real-time tracking of rolling stock. As efficiency increases, operators can get more out of their existing rolling stock, reducing the need for additional investments in new trains. Digital technologies enhance the passenger experience. Real-time updates, Wi-Fi connectivity, and digital ticketing systems make rail travel more convenient and attractive to passengers. Satisfied passengers are more likely to use rail services, driving demand for rolling stock. Digital systems also help manage rail infrastructure more effectively as it helps to monitor track conditions, switches, and signals. Improved infrastructure management ensures that rolling stock can operate on well-maintained tracks, reducing wear and tear. Digitalization promotes interoperability between different rail networks and systems. This is crucial in Europe, where cross-border rail travel is common. Interoperable systems facilitate seamless travel and trade, increasing the importance of well-managed rolling stock. The digital transformation of rail transportation in Europe offers numerous benefits, including operational efficiency, safety improvements, enhanced passenger experience, and environmental sustainability. These advantages drive the demand for advanced rolling stock management solutions that leverage digital technologies to optimize operations and asset management. Thus, the increasing awareness regarding the benefits of digital transformation drives the rolling stock management market in Europe.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

Based on management type, the Europe rolling stock management market share is segmented into rail management and infrastructure management.

Efficient rail management is crucial in optimizing the performance of the rolling stock. The implementation of rail management provides conditioning-based monitoring and predictive analytics that help rail operators reduce downtime, improve reliability, and extend the rolling stock's lifespan. These management systems are focused on enhancing operational efficiency by optimizing train schedules and minimizing delays. Therefore, rolling stock management market players are deploying solutions for better rail management. For instance, in May 2021, MV Technology Solutions Pty Ltd, in partnership with HaslerRail AG, provided a real-time remote diagnostics system to Adelaide train fleets. The HaslerRails EVAplus software for rail data management provides real-time remote monitoring of maintainers and operators. The demand for such solutions is increasing with the rise in fleet size. For instance, according to Indian Railways, the locomotive fleet size was 12,734 units as of March 2021 and increased to 13,215 units as of March 2022. Such an increase in the rolling stock fleet leads to an increase in operation and movements, further rolling stock management market growth.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Regional Analysis:

The rolling stock management market in the UK is primarily focused on ensuring the safe, reliable, and efficient operation of trains and rail vehicles. It includes maintenance, servicing, repair, refurbishment, and rolling stock upgrades. Several companies and organizations are involved in rolling stock management in the UK. These include train operating companies (TOCs), rolling stock leasing companies (ROSCOs), maintenance and repair providers, and government agencies such as Network Rail. Further, the UK government is also focusing on improving the railway infrastructure of the UK, which is one of the significant drivers of the Europe rolling stock management market share. For instance, in May 2023, the UK government unveiled a US$ 77.17 million funding initiative to enhance train reliability in Manchester. This financial package will be directed toward constructing a third platform at Salford Crescent Station and the comprehensive improvement of rail tracks in Northern Manchester. The funding will be used to construct a third platform at Salford Crescent station and complete track improvement work across North Manchester. These initiatives are part of ongoing maintenance, upgrades, and modernization efforts for rail infrastructure, which are essential for rolling stock management. Thus, the government's funding package for rail infrastructure in Manchester significantly contributes to the UK rolling stock management market.

Key Player Analysis:

Alstom SA, Hitachi Rail Ltd, ABB Ltd, Mitsubishi Electric Corp, Siemens Mobility GmbH, Talgo SA, Thales SA, Toshiba Infrastructure Systems and Solutions Corp, Trimble Inc, and LocoTech LLC are the prominent market participants in the rolling stock management market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the rolling stock management market. The market initiative is a strategy adopted by businesses to expand their footprint and to meet the growing customer demand. The key rolling stock management market players present in the market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by key rolling stock management market players are listed below:

Year | News |

Mar-2023 | Alstom has inked a contract with the Port Authority of New York and New Jersey and Newark Liberty International Airport to provide operations and maintenance services for its Innovia monorail system, known as AirTrain Newark, for the next seven years, until January 2030. The contract is valued at ~ US$ 263.15 million and includes an option for one additional year. |

Jan 2022 | Alstom was awarded a renewed contract with VR Sweden to maintain 30 regional trains in Sweden. Alstom will provide fleet maintenance to VR Sweden, the new operator of the trains, for Tåg I Bergslagen's fleet, which links the four Bergslag counties. |

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Management Type, and Maintenance Service

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Alstom SA, Hitachi Rail Ltd, Mitsubishi Electric Corp, Siemens Mobility GmbH, and Talgo SA are the top key market players operating in the Europe rolling stock management market.

The integration of big data analytics and cloud computing represents a significant opportunity for the rolling stock management market in Europe. It enhances operational efficiency, safety, and passenger experience while providing data-driven insights for better decision-making. As the adoption of these technologies grows, the rolling stock management market is likely to experience continued expansion and innovation, ultimately delivering more efficient and reliable rail transportation systems.

The increasing investment in rail projects across Europe is driving the need for advanced rolling stock management solutions. As rail networks expand and modernize, the rolling stock management market in Europe is poised for significant growth, presenting opportunities for technology providers and service companies to meet the evolving needs of the rail industry.

The adoption of predictive and condition monitoring technologies in rolling stock management improves operational efficiency and safety and aligns with Europe's commitment to sustainable and efficient transportation systems. Thus, constant technological advancements positively influence the Europe rolling stock management market.

The rolling stock management market in the UK is primarily focused on ensuring the safe, reliable, and efficient operation of trains and rail vehicles. It includes maintenance, servicing, repair, refurbishment, and rolling stock upgrades. Several companies and organizations are involved in rolling stock management in the UK.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Rolling Stock Management Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 Rolling Stock Maintenance Service Providers

5. Rolling Stock Management Market - Key Industry Dynamics

5.1 Key Market Drivers:

5.1.1 Rising use of predictive and condition monitoring

5.1.2 Digital transformation of rolling stock management

5.1.3 Growing adoption of real-time management solutions

5.2 Key Market Challenges

5.2.1 Complex Integration

5.2.2 Cyber Security Risks

5.3 Key Market Opportunities

5.3.1 Rising government investment in rail projects

5.3.2 Growing High-Speed rail projects in Poland

5.4 Key Market Trend

5.4.1 Integration of Big Data analytics and Cloud Computing

5.5 Impact of Drivers And Restraints:

6. Rolling Stock Management Market – Regional Market Analysis

6.1 Rolling Stock Management Market Revenue (US$ Mn), 2020 – 2030

6.2 Rolling Stock Management Market Forecast And Analysis

7. Europe Rolling Stock Management Market Revenue Analysis - by Management Type

7.1 Overview

7.2 Europe Rolling Stock Management Market, by Management type (2022 and 2030)

7.3 Rail management

7.3.1 Remote Diagnostic Management

7.3.1.1 Overview

7.3.1.2 Remote Diagnostic Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

7.3.2 Wayside Management

7.3.2.1 Overview

7.3.2.2 Wayside Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

7.3.3 Train Management

7.3.3.1 Overview

7.3.3.2 Train Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

7.3.4 Asset Management

7.3.4.1 Overview

7.3.4.2 Asset Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

7.3.5 Cab Advisory

7.3.5.1 Overview

7.3.5.2 Cab Advisory: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

7.3.6 Others

7.3.6.1 Overview

7.3.6.2 Others: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

7.4 Infrastructure Management

7.4.1 Control Room Management

7.4.1.1 Overview

7.4.1.2 Control Room Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

7.4.2 Station Management

7.4.2.1 Overview

7.4.2.2 Station Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

7.4.3 Automatic Fare Collection Management

7.4.3.1 Overview

7.4.3.2 Automatic Fare Collection Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

7.4.4 Others

7.4.4.1 Overview

7.4.4.2 Others: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

8. Rolling Stock Management Market Analysis – Maintenance Service

8.1 Overview

8.2 Europe Rolling Stock Management Market, by Maintenance Service (2022 and 2030)

8.3 Corrective Maintenance

8.3.1 Overview

8.3.2 Corrective Maintenance Market Volume, Revenue and Forecast to 2030 (US$ Mn)

8.4 Preventive Maintenance

8.4.1 Overview

8.4.2 Preventive Maintenance: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

8.5 Predictive Maintenance

8.5.1 Overview

8.5.2 Predictive Maintenance: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

9. Europe Rolling stock management Market – Regional Analysis

9.1 Overview

9.1.1 Europe Rolling Stock Management Market Breakdown by Country

9.1.2 United Kingdom Rolling Stock Management Market Revenue and Forecasts To 2030 (US$ Mn)

9.1.2.1 United Kingdom Rolling Stock Management Market Breakdown by Management Type

9.1.2.1.1 United Kingdom Rolling Stock Management Market Breakdown by Rail Management

9.1.2.1.2 United Kingdom Rolling Stock Management Market Breakdown by Infrastructure Management

9.1.2.2 United Kingdom Rolling Stock Management Market Breakdown by Maintenance Services

9.1.3 Russia Rolling Stock Management Market Revenue and Forecasts To 2030 (US$ Mn)

9.1.3.1 Russia Rolling Stock Management Market Breakdown by Management Type

9.1.3.1.1 Russia Rolling Stock Management Market Breakdown by Rail Management

9.1.3.1.2 Russia Rolling Stock Management Market Breakdown by Infrastructure Management

9.1.3.2 Russia Rolling Stock Management Market Breakdown by Maintenance Services

9.1.4 Poland Rolling Stock Management Market Revenue and Forecasts To 2030 (US$ Mn)

9.1.4.1 Poland Rolling Stock Management Market Breakdown by Management Type

9.1.4.1.1 Poland Rolling Stock Management Market Breakdown by Rail Management

9.1.4.1.2 Poland Rolling Stock Management Market Breakdown by Infrastructure Management

9.1.4.2 Poland Rolling Stock Management Market Breakdown by Maintenance Services

10. Covid-19 Impact Analysis

11. Competitive Landscape

11.1 Company Positioning & Concentration

12. Rolling Stock Management Market Industry Landscape

12.1 Overview

12.2 Market Initiative

13. Company Profiles

13.1 Alstom SA

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 ABB Ltd

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Hitachi Rail Ltd

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Mitsubishi Electric Corp

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Siemens Mobility GmbH

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Talgo SA

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Thales SA

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Stadler Rail AG

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Trimble Inc

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Loram UK Ltd

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About US

14.2 Glossary of Terms

List of Tables

Table 1. Rolling Stock Management Market Segmentation

Table 2. Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn)

Table 3. Europe Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Country

Table 4. United Kingdom Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Management Type

Table 5. United Kingdom Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Rail Management

Table 6. United Kingdom Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Infrastructure Management

Table 7. United Kingdom Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Maintenance Services

Table 8. Russia Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Management Type

Table 9. Russia Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Rail Management

Table 10. Russia Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Infrastructure Management

Table 11. Russia Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Maintenance Services

Table 12. Poland Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Management Type

Table 13. Poland Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Rail Management

Table 14. Poland Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Infrastructure Management

Table 15. Poland Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn) – Maintenance Services

Table 16. Glossary of Terms, Rolling Stock Management Market

List of Figures

Figure 1. Rolling Stock Management Market Segmentation, by Region

Figure 2. Rolling Stock Management Market - PEST Analysis

Figure 3. Rolling stock management Market - Key Industry Dynamics

Figure 4. Impact Analysis of Drivers And Restraints

Figure 5. Rolling Stock Management Market Revenue (US$ Mn), 2020 – 2030

Figure 6. Europe Rolling Stock Management Market Revenue Share, by Management type (2022 and 2030)

Figure 7. Europe Rolling Stock Management Market Revenue Share, by Rail management (2022 and 2030)

Figure 8. Remote Diagnostic Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 9. Wayside Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 10. Train Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 11. Asset Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 12. Cab Advisory: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 13. Others: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 14. Europe Rolling Stock Management Market Revenue Share, by Infrastructure Management (2022 and 2030)

Figure 15. Control Room Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 16. Station Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 17. Automatic Fare Collection Management: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 18. Others: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 19. Rolling Stock Management Market Share (%) – Maintenance Service, (2022 and 2030)

Figure 20. Corrective Maintenance Market Revenue And Forecasts To 2030 (US$ Mn)

Figure 21. Preventive Maintenance: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 22. Predictive Maintenance: Europe Rolling Stock Management Market Revenue and Forecast to 2030 (US$ Million)

Figure 23. Rolling Stock Management Market Breakdown by Regional Analysis, 2022 And 2030 (%)

Figure 24. Europe Rolling Stock Management Market Breakdown by Key Countries, 2022 And 2030 (%)

Figure 25. United Kingdom Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn)

Figure 26. Russia Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn)

Figure 27. Poland Rolling Stock Management Market Revenue And Forecasts To 2030 (US$ Mn)

Figure 28. Company Positioning & Concentration

The List of Companies - Europe Rolling Stock Management Market

- Alstom SA

- Hitachi Rail Ltd

- ABB Ltd

- Mitsubishi Electric Corp

- Siemens Mobility GmbH

- Talgo SA

- Thales SA

- Toshiba Infrastructure Systems and Solutions Corp

- Trimble Inc

- LocoTech LLC

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Europe Rolling Stock Management Market

Oct 2023

Heavy Commercial Vehicle Air Brake Systems Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Compressor, Reservoir, Foot Valve, Brake Lining and Drum or Rotors, Brake Shoes, and Others), Type (Air Disc Brake and Air Drum Brake), Technology (Conventional Air Brake System, Electronically Controlled Air Braking System, and Antilock Braking System), Distribution Channel (OEMs and Aftermarket), Vehicle Type (Bus, Truck, Construction Equipment, and Tractor), and Geography

Oct 2023

Heavy Commercial Vehicle Clutch Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Distribution Channel (OEM and Aftermarket), Product (Single Plate Clutches, Multi-Plate Clutches, Diaphragm Spring Clutches, Centrifugal Clutches, and Hydraulic Clutches), Vehicle Type (Bus, Truck, Construction Equipment, and Tractors), and Geography

Oct 2023

Electric Vehicle Heat Pump Systems Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Propulsion Type (BEV, HEV, PHEV), Component (Evaporator, Condenser, Compressors, Others), Vehicle Type (Passenger Vehicle, Commercial Vehicle), and Geography

Oct 2023

Hydrogen Fuel Cell Train Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Proton Exchange Membrane Fuel Cell, Phosphoric Acid Fuel Cell, and Others), Component (Hydrogen Fuel Cell Pack, Batteries, Electric Traction Motors, and Others), Rail Type (Passenger Rail, Commuter Rail, Light Rail, Trams, Freight, and Others) and Geography

Oct 2023

Automotive Seat Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Heated, Heated-Ventilated, Ventilated, With Massage Functions, and Others), Adjustment Type (Electrically Adjusted and Manual), Vehicle Type (Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial Vehicle), and Seat Type (Front Row, Second Row, and Third Row) and Geography

Oct 2023

Connected Vehicle Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Technology (5G, 4G/LTE, 3G & 2G), Connectivity (Integrated, Tethered, Embedded), Application (Telematics, Infotainment, Driving assistance, Others) and Geography

Oct 2023

Automotive High Voltage Cable Market

Forecast to 2030 - Global Analysis by Vehicle Type [Battery Electric Vehicles (BEV), Plugin Hybrid Electric Vehicles (PHEV), and Plugin Hybrid Vehicles (PHV)], Conductor Type (Copper and Aluminum), and Core Type (Multi Core and Single Core)

Get Free Sample For

Get Free Sample For