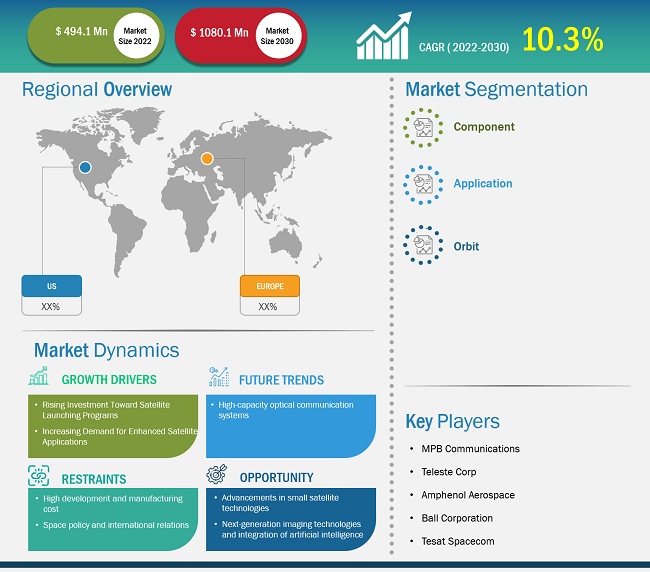

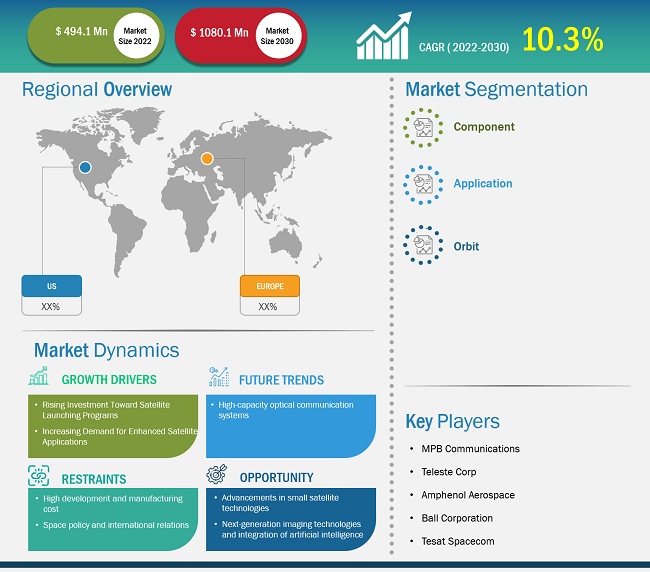

The Europe and US satellite optical components market was valued at US$ 494.10 million in 2022 and is projected to reach US$ 1,080.10 million by 2030; it is expected to register a CAGR of 10.3% from 2022 to 2030.

Analyst Perspective:

The Europe and US satellite optical components market is a dynamic and pivotal sector within the broader satellite technology landscape. Many companies in European countries and the US are significantly focused on the development of advanced satellite optical components and contributing to enhancing cutting-edge satellite communication systems and earth observation capabilities. In recent years, there has been a surge in demand for high-performance optical components, driven by the increasing need for data-intensive applications, including high-resolution imaging, navigation, and broadband communication. European countries and the US have well-established, robust infrastructure for research and development, which aims to innovate and develop satellite optical components. The industry's focus includes developing lightweight, durable, and high-precision optical components that can withstand the harsh conditions of space. Ongoing advancements in materials and manufacturing processes contribute to improved performance and reliability. As global demand for satellite services continues to grow, the Europe and US satellite optical components market is anticipated to play a key role in driving the future of space-based technologies, impacting communication, earth observation, and scientific research on a global scale.

Market Overview:

The Europe and US satellite optical components market in Europe and the US is characterized by dynamic growth, technological innovation, and strategic collaborations. Key players such as Spectrum Control Inc, Skyworks Solutions Inc, Lumibird SA, CACI International Inc, and BridgeComm Systems contribute significantly to developing cutting-edge optical components for satellites. These optical components are integral to diverse satellite applications, including Earth observation, telecommunications, navigation, broadcasting, and scientific research. The European Space Agency (ESA) and the National Aeronautics and Space Administration (NASA) play pivotal roles, fostering collaborative initiatives and supporting research and development efforts.

The Europe and US satellite optical components market growth in Europe and the US is driven by the growing demand for high-resolution imaging, rising data-intensive applications, and expanding satellite-based services. Materials, manufacturing processes, and precision engineering advancements contribute to improved satellite performance and reliability. Europe and the US leverage their robust aerospace industries and engineering capabilities to stay at the forefront of satellite technology. In addition, the rise in investment in the space industry in Europe and the US is expected to boost the growth of the Europe and US satellite optical components market size in the coming years. For example, the European Union Space Program 2021–2027, launched in January 2021, aimed to provide high-quality and secure space-related data and services, secure satellite communications, and better navigation results.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe and US Satellite Optical Components Market: Strategic Insights

Market Size Value in US$ 494.10 million in 2022 Market Size Value by US$ 1,080.10 million by 2030 Growth rate CAGR of 10.3% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe and US Satellite Optical Components Market: Strategic Insights

| Market Size Value in | US$ 494.10 million in 2022 |

| Market Size Value by | US$ 1,080.10 million by 2030 |

| Growth rate | CAGR of 10.3% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Rise in Investment Toward Satellite Launching Programs are Driving the Europe and US Satellite Optical Components Market

Increased funding in satellite launching programs reflects a growing emphasis on space exploration, satellite deployment, and space-based services. As more satellites are launched into orbit for applications such as communication, Earth observation, and navigation, there is a parallel surge in demand for advanced optical components. For instance, according to the United Nations Office for Outer Space Affairs (UNOOSA), 2,474 satellites were launched in 2022—compared to 1,810 in 2021 across the globe. These components play a key role in enhancing the capabilities of satellites, including improved imaging systems, high-speed data communication, and precise sensing. High investment in launching programs indicates a broader commitment to space technology, creating opportunities for optical component manufacturers to contribute to developing sophisticated satellite systems. Thus, the rising investment toward satellite launching programs drives the Europe and US satellite optical components market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

The optical amplifier segment held the largest share in the Europe and US satellite optical components market in 2022. Optical components are essential in astronomy and space exploration, allowing scientists to observe celestial objects and explore the universe. Optical components are also used in space-based telescopes and satellites, providing valuable data for scientific research and space exploration missions. For example, optical components such as amplifiers, sensors, transceivers/receivers, and amplifiers are used to generate, manipulate, and detect light signals in optical communication systems in satellite applications. These optical components enable efficient data transfer and high-speed Internet, fiber optic networks, and long-distance communications.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

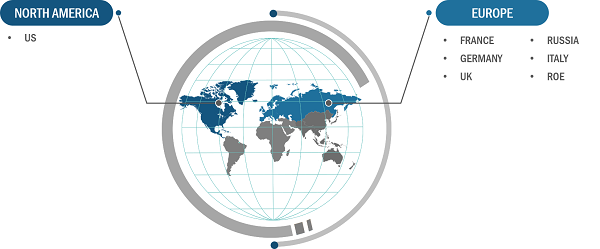

Regional Analysis:

The Europe and US satellite optical components market size is segmented into key regions, including Europe and the US. Europe registered the highest market share. The Europe and US satellite optical components market is dynamic and is experiencing strong growth characterized by technological innovation and strategic collaborations. With a strong emphasis on satellite communication and Earth observation, European countries have emerged as key players in advancing satellite optical technologies. Major industry contributors include leading aerospace companies such as Airbus and Thales Alenia Space, renowned for their expertise in developing cutting-edge optical components. These components are integral for the success of satellites for applications ranging from telecommunications to environmental monitoring. Thus, the presence of major industry contributors is driving the Europe and US satellite optical components market growth.

The Europe and US satellite optical components market benefits from collaborative initiatives facilitated by organizations such as the European Space Agency (ESA). These partnerships foster research and development, encouraging the exchange of knowledge and expertise among member states. The region's commitment to space exploration is evident in projects such as the Copernicus program, which emphasizes Earth observation and environmental monitoring. As demand for high-resolution imaging and data-intensive applications continues to rise, the Europe and US satellite optical components market in Europe is positioned to proliferate, contributing significantly to advancements in space technology and reinforcing Europe as a key region in the global space sector.

Several satellite constellation operators have been focusing on the development of different types of satellite ecosystems for various applications including communications, broadcasting, navigation, space exploration, and scientific research as well. Further, the growing number of satellite production and launches is also pushing the growth of Europe and US satellite optical components market.

Key Player Analysis:

Spectrum Control Inc, Skyworks Solutions Inc, Lumibird SA, CACI International Inc, Satellite Imaging Corp, Amphenol Corp, Exail SAS, Alter Technology TUV Nord SA, Bridgecom Systems Inc, and MACOM Technology Solutions Holdings Inc are among the key Europe and US satellite optical components market players with significant market share that are profiled in this Europe and US satellite optical components market study.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies operating in the Europe and US satellite optical components market. A few recent developments by key Europe and US satellite optical components market players in the market are listed below:

|

|

|

September, 2023 | CACI International completed Optical Communication Terminal (OCT) Interoperability Testing (OIT) for its CrossBeam OCT for the Space Development Agency's Tranche 1 data relay and tracking network. CACI was the first SDA-compliant terminal to set up a consistent data communication link with the reference modem. The testing was part of a team led by Lockheed Martin to build 42 satellites for SDA's Tranche 1 Transport Layer (T1TL), a mesh network of 126 optically interconnected space vehicles. | North America |

December, 2023 | Thales Alenia Space, the joint venture between Thales (67%) and Leonardo (33%), has signed a multi-mission contract with PT Len Industri to provide a state-of-the-art Earth observation constellation combining both radar and optical sensors, which is dedicated to the Indonesian Ministry of Defense (MoD). | North America |

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Optical Amplifier, Application, Orbit, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Increased funding in satellite launching programs reflects a growing emphasis on space exploration, satellite deployment, and space-based services. As more satellites are launched into orbit for applications such as communication, Earth observation, and navigation, there is a parallel surge in demand for advanced optical components. For instance, according to the United Nations Office for Outer Space Affairs (UNOOSA), 2,474 satellites were launched in 2022, compared to 1,810 in 2021 across the globe.

Advancements in small satellite technologies present a compelling opportunity for optical components within the satellite optical components market. The trend toward miniaturization, as seen in CubeSats and other small satellite platforms, opens new frontiers for optical innovation. Key players operating in satellite development are adopting strategies such as business expansion, product launches, and collaborations to stay competitive and enhance the product portfolio in the small satellite technologies.

BAE Systems Plc; Nexter Groupe KNDS; Denel Land Systems; Elbit Systems Ltd; General Dynamics; and Lockheed Martin Corporation are the key market players operating in the Europe and US satellite optical components market.

The US, Canada, and Mexico are the major economies in North America that have witnessed growth in the artillery systems market. The Ukraine-Russia conflict has contributed to the growth of the artillery systems market in North America. While North America, primarily the US and Canada, is not directly involved in the conflict, several factors influence the regional military equipment market landscape. North American nations, particularly the United States, have provided military support to Ukraine in response to the conflict.

High-capacity optical communication systems revolutionize satellite communication by employing advanced laser technology to transmit data optically. These systems utilize optical transceivers, modulation techniques, and free-space optical communication to achieve significantly higher bandwidth and data rates than traditional radio-frequency methods. Larger missions such as the Geosynchronous Lightweight Technology Experiment (GeoLITE), the Near Field Infrared Experiment (NFIRE), and the Lunar Laser Communication Demonstration (LLCD) have demonstrated laser communication downlinks and crosslinks for over a decade.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Europe and US Satellite Optical Components Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers

4.3.2 Optical Components Manufacturers

4.3.3 End Users

4.4 Premium Insights

4.4.1 Satellite Launch Forecasts

4.4.2 Top Satellite Constellations Overview

4.4.2.1 Starlink

4.4.2.2 G60 Starlink

4.4.2.3 Iridium

4.4.2.4 Globalstar

4.4.2.5 BeiDou

4.4.2.6 GPS

4.4.2.7 GLONASS

4.4.2.8 Galileo

4.4.2.9 Eutelsat OneWeb

4.4.2.10 O3b

5. Europe and US Satellite Optical Components Market – Key Market Dynamics

5.1 Europe and US Satellite Optical Components Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 The rise in investment toward satellite launching programs in Europe and the US:

5.2.2 Increased demand for high-resolution imaging, earth observation, and environmental monitoring:

5.3 Market Restraints

5.3.1 High development and manufacturing cost:

5.3.2 Space policy and international relations:

5.4 Market Opportunities

5.4.1 Advancements in small satellite technologies:

5.4.2 Next-generation imaging technologies and integration of artificial intelligence:

5.5 Future Trends

5.5.1 High-capacity optical communication systems:

5.6 Impact of Drivers and Restraints:

6. Europe and US Satellite Optical Components Market – Global Market Analysis

6.1 Europe and US Satellite Optical Components Market Revenue (US$ Million), 2022–2030

6.2 Europe and US Satellite Optical Components Market Forecast Analysis

7. Europe and US Satellite Optical Components Market Analysis – by Component

7.1 Optical Amplifier

7.1.1 Overview

7.1.2 Low Noise Optical Amplifier

7.1.3 High-Power Optical Amplifier

7.1.4 Optical Amplifier: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

7.1.5 Optical Amplifier: Europe and US Satellite Optical Components Market – Volume and Forecast to 2030 (Units)

7.2 Optical Transceivers/Receivers

7.2.1 Overview

7.2.2 Optical Transceivers/Receivers: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

7.2.3 Optical Transceivers/Receivers: Europe and US Satellite Optical Components Market – Volume and Forecast to 2030 (Units)

7.3 Optical Sensors

7.3.1 Overview

7.3.2 Optical Sensors: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

7.3.3 Optical Sensors: Europe and US Satellite Optical Components Market – Volume and Forecast to 2030 (Units)

7.4 Others

7.4.1 Overview

7.4.2 Others: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

7.4.3 Others: Europe and US Satellite Optical Components Market – Volume and Forecast to 2030 (Units)

8. Europe and US Satellite Optical Components Market Analysis – by Application

8.1 Communication

8.1.1 Overview

8.1.2 Communication: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

8.2 Broadcasting

8.2.1 Overview

8.2.2 Broadcasting: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

8.3 Navigation

8.3.1 Overview

8.3.2 Navigation: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Others

8.4.1 Overview

8.4.2 Others: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

9. Europe and US Satellite Optical Components Market Analysis – by Orbit

9.1 LEO

9.1.1 Overview

9.1.2 LEO: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

9.2 MEO

9.2.1 Overview

9.2.2 MEO: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

9.3 GEO

9.3.1 Overview

9.3.2 GEO: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

10. Europe and US Satellite Optical Components Market – Geographical Analysis

10.1 Overview

10.1.1 Europe and US: Satellite Optical Components Market – Revenue and Forecast Analysis – by Country

10.1.1.1 Europe: Europe and US Satellite Optical Components Market – Revenue and Forecast Analysis – by Country

10.1.1.2 Germany: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

10.1.1.2.1 Germany: Europe and US Satellite Optical Components Market Breakdown, by Component

10.1.1.2.2 Germany: Europe and US Satellite Optical Components Market Breakdown, by Optical Amplifier

10.1.1.2.3 Germany: Europe and US Satellite Optical Components Market Breakdown, by Application

10.1.1.2.4 Germany: Europe and US Satellite Optical Components Market Breakdown, by Orbit

10.1.1.3 France: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

10.1.1.3.1 France: Europe and US Satellite Optical Components Market Breakdown, by Component

10.1.1.3.2 France: Europe and US Satellite Optical Components Market Breakdown, by Optical Amplifier

10.1.1.3.3 France: Europe and US Satellite Optical Components Market Breakdown, by Application

10.1.1.3.4 France: Europe and US Satellite Optical Components Market Breakdown, by Orbit

10.1.1.4 Italy: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

10.1.1.4.1 Italy: Europe and US Satellite Optical Components Market Breakdown, by Component

10.1.1.4.2 Italy: Europe and US Satellite Optical Components Market Breakdown, by Optical Amplifier

10.1.1.4.3 Italy: Europe and US Satellite Optical Components Market Breakdown, by Application

10.1.1.4.4 Italy: Europe and US Satellite Optical Components Market Breakdown, by Orbit

10.1.1.5 United Kingdom: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

10.1.1.5.1 United Kingdom: Europe and US Satellite Optical Components Market Breakdown, by Component

10.1.1.5.2 United Kingdom: Europe and US Satellite Optical Components Market Breakdown, by Optical Amplifier

10.1.1.5.3 United Kingdom: Europe and US Satellite Optical Components Market Breakdown, by Application

10.1.1.5.4 United Kingdom: Europe and US Satellite Optical Components Market Breakdown, by Orbit

10.1.1.6 Russia: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

10.1.1.6.1 Russia: Europe and US Satellite Optical Components Market Breakdown, by Component

10.1.1.6.2 Russia: Europe and US Satellite Optical Components Market Breakdown, by Optical Amplifier

10.1.1.6.3 Russia: Europe and US Satellite Optical Components Market Breakdown, by Application

10.1.1.6.4 Russia: Europe and US Satellite Optical Components Market Breakdown, by Orbit

10.1.1.7 Rest of Europe: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

10.1.1.7.1 Rest of Europe: Europe and US Satellite Optical Components Market Breakdown, by Component

10.1.1.7.2 Rest of Europe: Europe and US Satellite Optical Components Market Breakdown, by Optical Amplifier

10.1.1.7.3 Rest of Europe: Europe and US Satellite Optical Components Market Breakdown, by Application

10.1.1.7.4 Rest of Europe: Europe and US Satellite Optical Components Market Breakdown, by Orbit

10.1.1.8 US: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

10.1.1.8.1 US: Europe and US Satellite Optical Components Market Breakdown, by Component

10.1.1.8.2 US: Europe and US Satellite Optical Components Market Breakdown, by Optical Amplifier

10.1.1.8.3 US: Europe and US Satellite Optical Components Market Breakdown, by Application

10.1.1.8.4 US: Europe and US Satellite Optical Components Market Breakdown, by Orbit

11. Europe and US Satellite Optical Components Market – Impact of COVID-19 Pandemic

11.1 Pre & Post COVID-19 Impact

12. Competitive Landscape

12.1 Company Positioning & Concentration

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

13.3 Product Development

13.4 Mergers & Acquisitions

14. Company Profiles

14.1 Spectrum Control Inc

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Skyworks Solutions Inc

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Lumibird SA

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 CACI International Inc

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Satellite Imaging Corp

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Amphenol Corp

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Exail SAS

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Alter Technology Tuv Nord SA

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 BridgeCom Systems Inc

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 MACOM Technology Solutions Holdings Inc

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

14.11 Honeywell International Inc

14.11.1 Key Facts

14.11.2 Business Description

14.11.3 Products and Services

14.11.4 Financial Overview

14.11.5 SWOT Analysis

14.11.6 Key Developments

14.12 MPB Communications Inc

14.12.1 Key Facts

14.12.2 Business Description

14.12.3 Products and Services

14.12.4 Financial Overview

14.12.5 SWOT Analysis

14.12.6 Key Developments

14.13 Thales SA

14.13.1 Key Facts

14.13.2 Business Description

14.13.3 Products and Services

14.13.4 Financial Overview

14.13.5 SWOT Analysis

14.13.6 Key Developments

14.14 Alnair Labs Corp

14.14.1 Key Facts

14.14.2 Business Description

14.14.3 Products and Services

14.14.4 Financial Overview

14.14.5 SWOT Analysis

14.14.6 Key Developments

14.15 Qorvo Inc

14.15.1 Key Facts

14.15.2 Business Description

14.15.3 Products and Services

14.15.4 Financial Overview

14.15.5 SWOT Analysis

14.15.6 Key Developments

14.16 Castle Microwave Ltd

14.16.1 Key Facts

14.16.2 Business Description

14.16.3 Products and Services

14.16.4 Financial Overview

14.16.5 SWOT Analysis

14.16.6 Key Developments

14.17 SAGE Millimeter Inc

14.17.1 Key Facts

14.17.2 Business Description

14.17.3 Products and Services

14.17.4 Financial Overview

14.17.5 SWOT Analysis

14.17.6 Key Developments

14.18 Infineon Technologies AG

14.18.1 Key Facts

14.18.2 Business Description

14.18.3 Products and Services

14.18.4 Financial Overview

14.18.5 SWOT Analysis

14.18.6 Key Developments

14.19 Narda-MITEQ

14.19.1 Key Facts

14.19.2 Business Description

14.19.3 Products and Services

14.19.4 Financial Overview

14.19.5 SWOT Analysis

14.19.6 Key Developments

14.20 Teleste Corp

14.20.1 Key Facts

14.20.2 Business Description

14.20.3 Products and Services

14.20.4 Financial Overview

14.20.5 SWOT Analysis

14.20.6 Key Developments

14.21 Tesat-Spacecom GmbH & Co KG

14.21.1 Key Facts

14.21.2 Business Description

14.21.3 Products and Services

14.21.4 Financial Overview

14.21.5 SWOT Analysis

14.21.6 Key Developments

14.22 Space Micro Inc

14.22.1 Key Facts

14.22.2 Business Description

14.22.3 Products and Services

14.22.4 Financial Overview

14.22.5 SWOT Analysis

14.22.6 Key Developments

14.23 Ball Corp

14.23.1 Key Facts

14.23.2 Business Description

14.23.3 Products and Services

14.23.4 Financial Overview

14.23.5 SWOT Analysis

14.23.6 Key Developments

14.24 Accelink Technology Co Ltd

14.24.1 Key Facts

14.24.2 Business Description

14.24.3 Products and Services

14.24.4 Financial Overview

14.24.5 SWOT Analysis

14.24.6 Key Developments

14.25 Broadcom Inc

14.25.1 Key Facts

14.25.2 Business Description

14.25.3 Products and Services

14.25.4 Financial Overview

14.25.5 SWOT Analysis

14.25.6 Key Developments

15. Appendix

15.1 About The Insight Partners

List of Tables

Table 1. Europe and US Satellite Optical Components Market Segmentation

Table 2. Global New Satellite Launches & Forecasts to 2030 (Units)

Table 3. Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Table 4. Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million) – by Component

Table 5. Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million) – by Optical Amplifier

Table 6. Europe and US Satellite Optical Components Market – Volume and Forecast to 2030 (Units) – by Component

Table 7. Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million) – by Application

Table 8. Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million) – by Orbit

Table 9. Europe: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 10. Germany: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 11. Germany: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Optical Amplifier

Table 12. Germany: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 13. Germany: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Orbit

Table 14. France: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 15. France: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Optical Amplifier

Table 16. France: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 17. France: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Orbit

Table 18. Italy: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 19. Italy: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Optical Amplifier

Table 20. Italy: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 21. Italy: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Orbit

Table 22. United Kingdom: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 23. United Kingdom: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Optical Amplifier

Table 24. United Kingdom: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 25. United Kingdom: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Orbit

Table 26. Russia: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 27. Russia: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Optical Amplifier

Table 28. Russia: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 29. Russia: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Orbit

Table 30. Rest of Europe: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 31. Rest of Europe: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Optical Amplifier

Table 32. Rest of Europe: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 33. Rest of Europe: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Orbit

Table 34. US: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 35. US: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Optical Amplifier

Table 36. US: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 37. US: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million) – by Orbit

List of Figures

Figure 1. Europe and US Satellite Optical Components Market Segmentation, by Geography

Figure 2. PEST Analysis

Figure 3. Ecosystem Analysis

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. Europe and US Satellite Optical Components Market Revenue (US$ Million), 2022–2030

Figure 6. Europe and US Satellite Optical Components Market Share (%) – by Component (2022 and 2030)

Figure 7. Optical Amplifier: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. Optical Amplifier: Europe and US Satellite Optical Components Market – Volume and Forecast to 2030 (Units)

Figure 9. Optical Transceivers/Receivers: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Optical Transceivers/Receivers: Europe and US Satellite Optical Components Market – Volume and Forecast to 2030 (Units)

Figure 11. Optical Sensors: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Optical Sensors: Europe and US Satellite Optical Components Market – Volume and Forecast to 2030 (Units)

Figure 13. Others: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Others: Europe and US Satellite Optical Components Market – Volume and Forecast to 2030 (Units)

Figure 15. Europe and US Satellite Optical Components Market Share (%) – by Application (2022 and 2030)

Figure 16. Communication: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Broadcasting: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Navigation: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Others: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Europe and US Satellite Optical Components Market Share (%) – by Orbit (2022 and 2030)

Figure 21. LEO: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. MEO: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. GEO: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Europe: Europe and US Satellite Optical Components Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 25. Germany: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 26. France: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 27. Italy: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 28. United Kingdom: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 29. Russia: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 30. Rest of Europe: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 31. US: Europe and US Satellite Optical Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 32. Company Positioning & Concentration

The List of Companies - Europe and US Satellite Optical Components Market

- Spectrum Control Inc

- Skyworks Solutions Inc

- Lumibird SA

- CACI International Inc

- Satellite Imaging Corp

- Amphenol Corp,

- Exail SAS

- Alter Technology TUV Nord SA

- Bridgecom Systems Inc

- MACOM Technology Solutions Holdings Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Europe and US Satellite Optical Components Market

Jan 2024

Aerospace Stainless Steel And Superalloy Fasteners Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material Type [Stainless Steel, Superalloy (A286, Inconel 718, Waspaloy, and Others)], Application (Airframe, Engine, Interior, and Others), Aircraft Type (Fixed Wing and Rotary Wing), Product Type (Screws, Rivets, Nut/Bolts, and Others), and Geography

Jan 2024

Military Antenna Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Aperture Antennas, Dipole Antennas, Travelling Wave Antennas, Monopole Antennas, Loop Antennas, Array Antennas, Others); Frequency (High Frequency, Very High Frequency, Ultra-High Frequency); Platform (Marine, Ground, Airborne); Application (Communication, Telemetry, Electronic Warfare, Surveillance, Navigation); and Geography

Jan 2024

Helicopter MRO Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Airframe Maintenance, Engine Maintenance, Component Maintenance, Line Maintenance); Helicopter Type (Light Helicopter, Medium Helicopter, Heavy Helicopter); End User (Commercial, Military); and Geography

Jan 2024

Airport Infrastructure Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Airport Type (Commercial Airport, Military Airport, General Aviation Airport); Infrastructure Type (Terminal, Control Tower, Taxiway & Runway, Hangar, Others); and Geography

Jan 2024

Airport Fueling Equipment Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Tanker Capacity (Below 5000 litres, 5000-20000 litres, Above 20000 litres); Aircraft Type (Civil Aircraft, Military Aircraft); Power Source (Electric, Non-Electric); and Geography

Jan 2024

Jan 2024

Airborne Pods Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Aircraft Type (Combat Aircraft, Helicopters, UAVs and Others); Pod Type (ISR, Targeting, and Countermeasure); Sensor Technology (EO/IR, EW/EA, and IRCM); Range (Short, Long, and Intermediate); and Geography

Jan 2024

Air Defense Radar Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Range (Long Range, Medium Range, Short Range); Product Type (Synthetic Aperture and Moving Target Indicator Radar, Surveillance Radar, Airborne Early Warning Radar, Multi-functional Radar, Weather Radar, Others); System Type (Fixed, Portable); Platform (Ground-based, Aircraft-mounted, Naval-based); Application (Ballistic Missile Defense, Identification Friend or Foe, Weather Forecasting, Others); and Geography

Get Free Sample For

Get Free Sample For