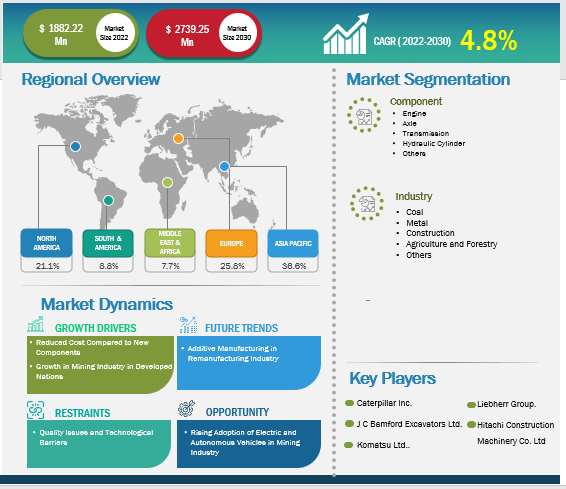

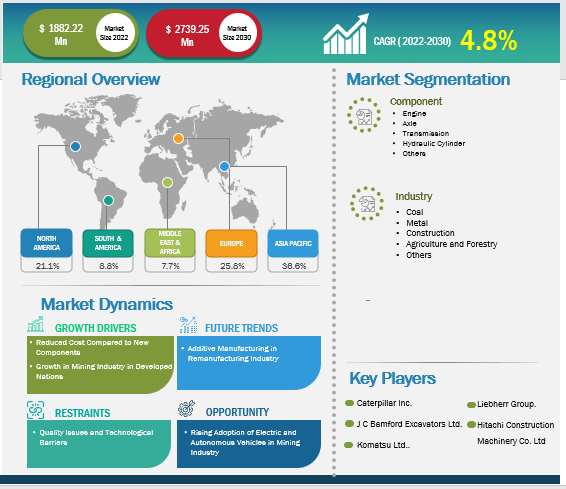

[Research Report] The excavator remanufactured components market size was valued at US$ 1,882.22 million in 2022 and is projected to reach US$ 2,739.25 million by 2030; it is expected to register a CAGR of 4.80% from 2022 to 2030. The report includes growth prospects in light of current excavator remanufactured components market trends and driving factors influencing the market growth.

Analyst Perspective:

The expansion of construction and mining industries is significantly transforming the global excavator remanufactured components market. THe mining sector in the Asia Pacific countries such as India, Japan, and China is growing at rapid pace. The globally Chinese mining operations of the copper extraction contributed around7% of the global copper supply. China is handling 38% of the global copper supply across the overall mining sector. Excavators are widely used for material handling across the mining sector. In the construction sector, the demand for excavators for landscaping, digging, trenching, and the construction of public infrastructures such as roadways, highways, utilities, and railways is rapidly growing. In November 2023, the US government announced an investment of ~US$ 1.2 trillion as the federal fund for the public infrastructure toward energy, transportation, and climate-related infrastructure projects across the country. Thus, the growth of mining and construction industries is propelling the global excavator remanufactured components market growth.

Market Overview:

The process for remanufacturing excavator components involves several steps, including the needs of customers, the types of components to be remanufactured, and different models and their components. Excavator remanufacturing involves the production and finishing of the used excavator components to perform efficiently. Remanufacturing, the process of restoring discarded products to a like new condition with a matching warranty, is seen as a more sustainable way of manufacturing because it can be more profitable and less destructive to the environment than traditional production.

The rise in construction work across residential and commercial sectors, owing to the increase in urbanization, contributes to the growing excavator remanufactured components market size. According to the Ceramics Organization Report, the global market for residential buildings, including new construction, renovation buildings, and remodeling, was valued at US$ 6.80 trillion in 2022. Government bodies are putting additional emphasis on strengthening construction and infrastructural development, further enduring the demand for excavators' remanufactured components. As per Global Construction 2030, the volume of construction output worldwide is expected to increase by 85% to US$ 15.5 trillion by 2030. The US, China, and India contributes largest share in the excavator remanufactured components market and India is growing with the highest CAGR during the forecast period. Moreover, investment to renovate old buildings and structures and increased inclination toward a greener future are boosting the requirement for green buildings, further nurturing the excavator remanufactured components market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Excavator Remanufactured Components Market: Strategic Insights

Market Size Value in US$ 1,882.22 million in 2022 Market Size Value by US$ 2,739.25 million by 2030 Growth rate CAGR of 4.80% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Excavator Remanufactured Components Market: Strategic Insights

| Market Size Value in | US$ 1,882.22 million in 2022 |

| Market Size Value by | US$ 2,739.25 million by 2030 |

| Growth rate | CAGR of 4.80% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Reduced Cost Compared to New Components Driving Excavator Remanufactured Components Market

The costs involved with manufacturing of the new excavator components is high as compared to remanufactured components. Hence, the key players are launching programs to remanufacture the old components of the excavators. Increasing infrastructure development projects such as roads, public infrastructure, and commercial offices is also driving the demand for the excavators remanufactured components market during the forecast period. Other company-built infrastructure, such as roads, railways, bridges, power plants, and seaports, are frequently uses excavators to assist in extraction and shipping. Also, there are increase in day-to-day expenses in the actual mining process is major driving factor for the remanufactured excavators components. In all the phases mentioned above, equipment such as wheel dozers, wheel loaders, crawler dozers, and haul trucks play an important role and account for a notable share of the mining industry costs. These vehicles cost ~10–15% of the total mining operating expenditure. Continuous wear and tear of such equipment leads to the requirement for component replacement, which results in capital investment. Thus, many mining and equipment OEM companies have turned toward remanufacturing components to reduce overall mining operating costs. Caterpillar, one of the leading mining equipment manufacturers, claims that its remanufacturing and rebuilding program for wheel dozers reduces 40–70% costs compared to new manufacturing.

Segmental Analysis:

The excavator remanufactured components market analysis has been carried out by considering the following segments: component and industry. Based on component, the global excavator remanufactured components market is segmented into engine, axle, transmission, hydraulic cylinder, and others. The engine, transmission, and hydraulic cylinder segments are likely to account for significant shares of the excavator remanufactured components market share. The state of a mining vehicle is highly affected by the way it is handled and the environment around it, necessitating continuous replacements. If any equipment breaks down in case of engine, axle, transmission, or hydraulic cylinder failure, the profitability of mining companies is affected. Thus, most mining companies prefer replacing equipment with remanufactured components due to their cost-effectiveness and reliability. This factor is driving the excavator remanufactured components market.

Regional Analysis:

North America is growing at moderate CAGR during the forecast period. The North America excavator remanufactured components market is segmented into the US, Canada, and Mexico. The mining sector in North America, particularly in countries such as the US, Canada, and Mexico, majorly drives the demand for excavators' remanufactured components market. The excavator remanufactured components market in North America is expected to continue its growth trajectory due to the steady expansion of various end-use industries and continuous investments in infrastructure development. For instance, according to the data published by the Canadian government, with US$ 89 billion in capital expenditures spread across 119 major mining-related projects, the industry demonstrated continued interest in mine constructions, redevelopments, expansions, and processing facilities. The country witnessed an increase in capital expenditures from US$ 82 billion and 120 projects in 2020 to US$ 89 billion and 119 projects in 2021, which signifies continued interest in mining-related projects despite the challenges posed by the onset of the COVID-19 outbreak. The continued focus on infrastructure development, including construction projects, ports, and terminals, also contributes to the demand for excavator-remanufactured components in the region. Thus, the increased demand for minerals and metals is propelling the growth of mining activities in the region, creating a growth opportunity for the excavator remanufactured components market in North America.

Key Player Analysis:

Atlas Copco, AB Volvo, Caterpillar Inc., Hitachi Construction Machinery Co. Ltd., Epiroc AB, Komatsu Ltd., Liebherr Group, SRC Holding Corporation, J C Bamford Excavators Ltd., and Swanson Industries are among the key players covered in the excavator remanufactured components market report.

Excavator Remanufactured Components Market Report Scope

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the excavator remanufactured components market. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The market players mentioned in the excavator remanufactured components market report are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by key market players are listed below:

|

|

|

April 2023 | Tata Hitachi, the construction machinery manufacturing company, made a joint venture between Hitachi Construction Machinery (HCM) and Tata Motors. The partnership with Hitachi Construction Machinery (HCM) is the largest joint venture in the industry. The Tata Hitachi manufactures excavators and construction components in Dharwad and Kharagpur, India. | APAC |

April 2023 | Komatsu and Honda have developed the PC05E-1 electric micro excavator, an expanded version of the PC01E-1, for early introduction to the Japanese market in FY2023. The machine, powered by Honda Mobile Power Pack e and Honda eGX electrified power unit, is used for small-scale civil engineering and construction work. | APAC |

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

As one of the major technologies of remanufacturing engineering, rising adoption of the additive remanufacturing technology can repair the structure and function of high-value-added key metal parts of large and complex equipment, significantly reducing use and maintenance costs and saving labor and time costs. Additive remanufacturing is a subset of additive manufacturing technology that might restore the size accuracy of damaged parts, increase surface performance, and introduce new surface functions as needed.

Rapid industrialization in emerging countries in Asia Pacific is accompanied by high growth in industrial output in construction and mining sectors and increased investments in energy and transport infrastructure. These countries rely on imports to acquire high-tech and productive machine tools. Cheap labor costs, easy availability, and wide scope for development within the mining industry aid in this region's excavator remanufactured components market growth.

The mining sector is beginning to profit from a next generation of low-emission "driverless" mine vehicles that are changing the industry's image and moving it toward decarbonization. Key players are launching hybrid excavators’ components in order to improve the vehicles efficiency.

High cost of the excavators and increasing remanufacturing programs approved by Remanufacturing Industries Council (RIC) and several key players in the market drives the market growth. Remanufacturing of the excavators is primarily driven by rapid growth in the construction industry across the emerging countries such as India, Japan, Mexico, and UK.

AB Volvo, Caterpiller Inc., Hitachi Construction Machinery Co. Ltd., Epiroc AB, Atlas Copco, Liebherr Group, Komatsu Ltd., SRC Holding Corporation, J C Bamford Excavators Ltd., and Swanson Industries key market players operating in the global excavator remanufactured components market.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Excavators Remanufactured Components Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Excavators Remanufactured Components Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Excavators Remanufactured Components Market - Global Market Analysis

6.1 Excavators Remanufactured Components - Global Market Overview

6.2 Excavators Remanufactured Components - Global Market and Forecast to 2031

7. Excavators Remanufactured Components Market – Revenue Analysis (USD Million) – By Component, 2020-2030

7.1 Overview

7.2 Engine

7.3 Axle

7.4 Transmission

7.5 Hydraulic Cylinder

7.6 Others

8. Excavators Remanufactured Components Market – Revenue Analysis (USD Million) – By Industry, 2020-2030

8.1 Overview

8.2 Coal

8.3 Metal

8.4 Construction

8.5 Agriculture and Forestry

8.6 Others

9. Excavators Remanufactured Components Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

9.1 North America

9.1.1 North America Excavators Remanufactured Components Market Overview

9.1.2 North America Excavators Remanufactured Components Market Revenue and Forecasts to 2031

9.1.3 North America Excavators Remanufactured Components Market Revenue and Forecasts and Analysis - By Component

9.1.4 North America Excavators Remanufactured Components Market Revenue and Forecasts and Analysis - By Industry

9.1.5 North America Excavators Remanufactured Components Market Revenue and Forecasts and Analysis - By Countries

9.1.5.1 United States Excavators Remanufactured Components Market

9.1.5.1.1 United States Excavators Remanufactured Components Market, by Component

9.1.5.1.2 United States Excavators Remanufactured Components Market, by Industry

9.1.5.2 Canada Excavators Remanufactured Components Market

9.1.5.2.1 Canada Excavators Remanufactured Components Market, by Component

9.1.5.2.2 Canada Excavators Remanufactured Components Market, by Industry

9.1.5.3 Mexico Excavators Remanufactured Components Market

9.1.5.3.1 Mexico Excavators Remanufactured Components Market, by Component

9.1.5.3.2 Mexico Excavators Remanufactured Components Market, by Industry

Note - Similar analysis would be provided for below mentioned regions/countries

9.2 Europe

9.2.1 Germany

9.2.2 France

9.2.3 Italy

9.2.4 United Kingdom

9.2.5 Rest of Europe

9.3 Asia-Pacific

9.3.1 Australia

9.3.2 China

9.3.3 India

9.3.4 Japan

9.3.5 South Korea

9.3.6 Rest of Asia-Pacific

9.4 Middle East and Africa

9.4.1 South Africa

9.4.2 Saudi Arabia

9.4.3 U.A.E

9.4.4 Rest of Middle East and Africa

9.5 South and Central America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South and Central America

10. Industry Landscape

10.1 Mergers and Acquisitions

10.2 Agreements, Collaborations, Joint Ventures

10.3 New Product Launches

10.4 Expansions and Other Strategic Developments

11. Competitive Landscape

11.1 Heat Map Analysis by Key Players

11.2 Company Positioning and Concentration

12. Excavators Remanufactured Components Market - Key Company Profiles

12.1 AB Volvo

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

Note - Similar information would be provided for below list of companies

12.2 Atlas Copco

12.3 Caterpiller Inc

12.4 Epiroc AB

12.5 Hitachi Construction Machinery Co. Ltd.

12.6 J C Komatsu Ltd.

12.7 Liebherr Group

12.8 Bamford Excavators Ltd.

12.9 SRC Holding Corporation

12.10 Swanson Industries

13. Appendix

13.1 Glossary

13.2 About The Insight Partners

13.3 Market Intelligence Cloud

The List of Companies - Excavator Remanufactured Components Market

- AB Volvo

- Atlas Copco

- Caterpiller Inc

- Epiroc AB

- Hitachi Construction Machinery Co. Ltd.

- J C Komatsu Ltd.

- Liebherr Group

- Bamford Excavators Ltd.

- SRC Holding Corporation

- Swanson Industries

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Excavator Remanufactured Components Market

Feb 2024

Welded Steel Tubes Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Steel Grades (Carbon Base Grades, Boron Grades, Alloy Grades, HSLA, AHSS, and Others), Application (Exhaust, Automotive, Appliances, Medical Devices, HVAC, Burner, Conveyor Belts, and Others), Type (ERW, LSAW, and SSAW), Coating Type (Clear Coat and Non-Coated), and Geography

Feb 2024

High Heat Bearing Market

Size and Forecast (2021–2031), Country Share, Trend, and Growth Opportunity Analysis Report Coverage: by Type [Plain Bearings (Spherical Plain Bearings, Rod Ends, and Bushings), Roller Bearings, and Deep Groove Ball Bearings], Industry (Metal Processing, Aerospace, Defense, Food and Beverages, Energy and Power, Manufacturing, Automotive, and Others), and Geography

Feb 2024

Electromechanical Joining Servo Press Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Stroke (Upto 100 mm, 101-200 mm, 201-400 mm, 401-600 mm and Above 601 mm), Application (Automotive Industry, Electric and Electronic Industry, Medical Device Manufacturing and Others), and Geography

Feb 2024

Indexable Inserts Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Insert Shape (Round, Square, Triangle, Rhombic, and Others), Application (Milling, Drilling, Turning, Threading, and Others), Size (Up to 10 mm, 10-20 mm, and Above 20 mm), Insert Material (Carbide, Ceramic and Composites, PCD Inserts, and Others), Industry (Aerospace and Defense, General Industry, Oil and Gas, Power Generation, Automotive, Electric and Electronics, Medical, and Others), and Geography

Feb 2024

End Mills Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material (Carbide, Steel, and Others), Type (Square Nose, Ball Nose, and Others), Diameter Size (Upto 4 mm, 4–6 mm, 6–8 mm, 8–12 mm, and Above 12 mm), End-Use Industry (Automotive, Heavy Machinery, Semiconductor and Electronics, Medical and Healthcare, Energy, Aerospace and Others), and Geography

Feb 2024

Plain Bearings Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Spherical Bearings (Radial, Angular, and Thrust), Rod Ends (Female Thread, Male Thread, and Welding Shank), and Bushings], Application (Agriculture, Construction, Industrial Vehicles, Automotive and Transportation, Aerospace and Defense, Energy and Power, and Others), and Geography

Feb 2024

Thermostatic Mixers Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Mounting Type (Deck Mount and Wall Mount), Application (Residential and Commercial), Design Type (Concealed and Exposed), and Geography

Feb 2024

Get Free Sample For

Get Free Sample For