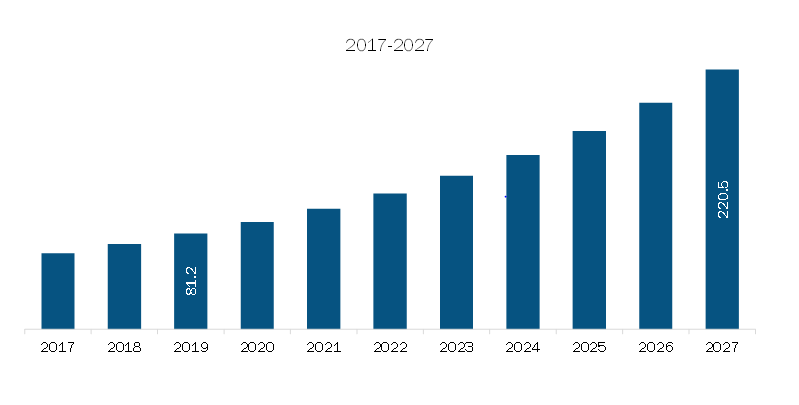

Indonesia Subsea Cable Market to Grow at a CAGR of 13.5% to reach US$ 220.5 million from 2020 to 2027

In terms of revenue, the Indonesia Subsea cable market was valued at US$ 81.2 million in 2019, and it is expected to grow at a CAGR of 13.5% during the forecast period, to reach US$ 220.5 million by 2027.

Indonesia is the fourth most populous country in the world and is the fourth-highest number of internet user in the world. As of January 2020, there were 175.4 million internet users in the country. This depicts an increase of 17% compared to that in 2019. Further, the internet penetration in the country is 64%. The country has observed increasing demands for internet bandwidths. Supportive government policies in the country for enabling a complete digitalized economy has further fuelled the needs for establishing a seamless internet infrastructure, thereby leading to the growth of the Indonesian subsea fiber optical cables network.

In 2019, the Indonesian government announced the completion of the Palapa Ring project. It is a crucial infrastructure project that is intended to deliver access to 4G internet services to over 500 localities across the country. The project was worth ~US$ 1.5 billion, and it included 35,000 km of undersea fiber-optic cables. Through this project, the government intends to attain speeds of up to 100 Gbps anywhere the country. Currently, the country’s dependency on uninterrupted data connectivity is increasing rapidly. With the rapid urge for bandwidth availability, there is a steadily rising need for fiber-optic-based interconnectivity. Most of the present intercontinental internet traffic is transmitted via subsea cables, which is mainly attributed to the high level of efficiency in transmission via subsea cables, compared to satellites. Subsea optical cables are capable of transmitting ~100% of the total international internet traffic, along with ~95% of the global combined data as well as voice traffic. The transmission of data traffic via subsea optical fiber cables features high reliability, capacity, and security; moreover, it is a cost-effective transmission method. Further, advancements in optical transmission technology help enhance data rate, channel count, and capacity; rising demand for video and data transmissions are anticipated to propel the growth of the Indonesia subsea cable market in the coming years.

Impact of COVID-19 Pandemic on Subsea CableMarket

On 15 March 2020, the Indonesian Government urged people to work from home as well as practice social distancing. Since then, several day-to-day activities from working to schooling have shifted online. This shift has resulted in a surge in digital communications services across the country.

The telecom network providers in Indonesia recorded growth in internet traffic as well as data communication after the Government’s instruction to stay at home. As per Telkomsel, a wireless network provider in Indonesia, the company recorded a 5% surge in data services post-March 15. Also, from studying several data communication services consumers accessed, the company saw a rapid increase in the demand for e-learning platforms by 236% with a 13% rise in online gaming services. Moreover, the company also recorded a 10.4% surge in traffic for cloud-computing services. Other services, which recorded increased traffic includes digital advertising, streaming services, and browser services. The rising demand for internet is expected to boost the growth of Indonesia subsea cable market.

Indonesia Subsea Cable Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Market Insights

Increasing Initiatives toward Development of Energy Sector is supporting the growth of Indonesia subsea cable market

The government implemented several measures in 2018 to foster investor appeal. One of these measures involved the relaxation of taxes by granting 100% corporate income tax reduction to new FDI projects in every business sector, given that they fulfill certain requirements. Apart from this, several foreign ownership restrictions were lifted in an effort to boost FDI inflows. The government withdrew 22 of 51 restrictions for business licenses in the energy sector, comprising those for oil & gas, electricity, and mineral resources. Additionally, it also announced its plan of rolling out the tax deductions of up to 200% for companies conducting R&D activities. However, downstream investment is anticipated to be boosted by a number of pipeline initiatives. In January 2018, BPH Migas announced that the government was preparing to auction three gas pipeline projects. Moreover, in 2018, an upstream project named the Indonesia Deepwater Development (IDD) projectalso made progress. More such developments in the energy sector are expected to continue to boost the growth of Indonesia subsea cable market during the forecast period.

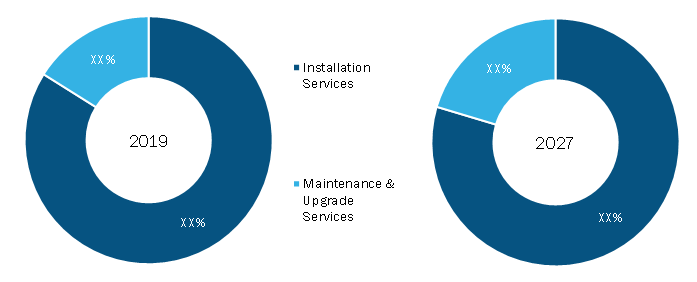

Service-BasedInsights

In terms of service, installation service captured a larger share of the Indonesiasubsea cable market in 2019. Submarine cable system owners face the issues related to cable maintenance. For instance, during an unexpected network outage, clear channels of accountability, troubleshooting measures, problem escalation as well as awareness of spares availability are among the critical points that might be necessary to accelerate a network’s return to service as well as revenue generation. Also, the information and measures have to be up-to-date, accessible by decision-makers’ moreover, it should be backed up by the well-trained and expert teams. This highlights the vitality of cable maintenance and repair services; however, the know-how required is often not obtainable in-house. Several players in the subsea cable ecosystem offer maintenance and repair services, usually on a contract basis.

Indonesia Subsea Cable Market, by Service– 2019and 2027

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Application-BasedInsights

The Indonesia subsea cable market, by application, is segmented into communications and energy & power. The communication segment captured a dominating share in the Indonesiasubsea cable market in 2019. Subsea communications cablesare placed on the sea bed between land-based stations for transmitting telecommunication signals through stretches of sea and ocean. The Indonesian government commits to ensure telecommunications and broadband access for the country’s fast-growing population of ~264 million people. In line with this, several communication providers are deploying subsea cables to offer high-speed internet. For instance, in November 2018, Moratelindo, a broadband operator, announced its plans to deploy the countrywide fiber optic network by constructing the Jayabaya high-speed subsea cable system for Java Island. For this project, Nexans supplied 915-km fiber optic cables.The increasing demand for the internet in the country is expected to further boost the deployment of subsea cables for communication purposes. Several hyper-scale data center players are also investing in subsea cable across Indonesia.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Indonesia Subsea Cable Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Indonesia Subsea Cable Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

PGASCOM,PT Telekomunikasi Indonesia Tbk (Telkom Indonesia), PT XL AxiataTbk, PT Nap Info Lintas Nusa, PT Mora Telematika Indonesia (Moratelindo), PT Len Telekomunikasi Indonesia, Trident Subsea Cable, PT IndosatTbk (INDOSAT Ooredoo), PT. KetrosdenTriasmitra, PT. Bina Nusantara Perkasa, Optic Marine Group, PT. Sarana Global Indonesia (SGI), PT. Limin Marine & Offshore, and PT Telkom Infra are among the key players that were profiled during Indonesia subsea cable market study. In addition to these players, several other important Indonesia subsea cablemarket players were studied and analyzed to get a holistic view of the ecosystem. A few of the recent developments in the Indonesia subsea cable market are listed below:

2020:

PT XL AxiataTbk (XL Axiata) with Vocus Group and Alcatel Submarine Networks have successfully completed the Australia-Indonesia-Singapore Sea Cable Communication System (SKKL) development project; the construction of this projected began in December 2017.2019:

PT KetrosdenTriasmitra (Triasmitra) collaborated with PT Telekomunikasi Indonesia (Telkominfra), which is a subsidiary of PT Telekomunikasi Indonesia (Telkom), has conducted a Kick-Off of the Medan – Dumai Submarine Communication Cable (SKKL) named the project PEACE.Market Segmentation

Indonesia Subsea cable Market – By Service

- Installation Services

- Maintenance & Upgrade Services

Indonesia Subsea Cable Market – By Application

- Communication

- Energy & Power

Companies Profiled in Indonesia Subsea CableMarket are as Follows:

- Optic Marine Group

- PGASCOM

- PT IndosatTbk

- PT Infrastruktur Telekomunikasi Indonesia (Telkominfra)

- PT LEN TELEKOMUNIKASI INDONESIA

- PT Limin Marine & Offshore

- PT MORA TELEMATIKA INDONESIA (MORATELINDO)

- PT NAP Info Lintas Nusa

- PT Telkom Indonesia (Persero) Tbk

- PT XL AxiataTbk

- PT. Bina Nusantara Perkasa

- Pt. KetrosdenTriasmitra

- PT. Sarana Global Indonesia

- Trident Subsea Cable

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

With the rapid urge for bandwidth availability, there is a steadily rising need for fiber-optic-based interconnectivity. Most of the present intercontinental internet traffic is transmitted via subsea cables, which is mainly attributed to the high level of efficiency in transmission via subsea cables, compared to satellites. Subsea optical cables are capable of transmitting ~100% of the total international internet traffic, along with ~95% of the global combined data as well as voice traffic. The transmission of data traffic via subsea optical fiber cables features high reliability, capacity, and security; moreover, it is a cost-effective transmission method. Further, advancements in optical transmission technology that help enhance data rate, channel count, and capacity; and rising demand for video and data transmissions are anticipated to propel the demand for submarine cables in the coming years.

The communication segment led the Indonesia subsea cable market during the forecast period from 2020 to 2027.A subsea communications cable is placed on the sea bed between land-based stations for transmitting telecommunication signals through stretches of sea and ocean. The Indonesian government has made a commitment to ensure telecommunications and broadband access for the country’s fast-growing population of ~264 million people. In line with this, several communication providers are deploying subsea cables to offer high-speed internet. For instance, in November 2018, Moratelindo, a broadband operator, announced to deploy the countrywide fiber optic network by constructing the Jayabaya high-speed subsea cable system for Java Island. For this project, Nexans supplied a 915 kilometers of fiber optic cables.

The growth in the number of data centers in Indonesia is mainly attributed to the government regulations that mandated the confinement of all country-related data in data centers within its borders by 2017, which boosted the IT industry growth as well. On a global level, Indonesia, particularly Jakarta, is a small data center market, and considering the size of the economy and city along with the location of the country, the opportunities in that market are noteworthy. The increasing digitalization of the Indonesian economy has resulted in the emergence of the market for data centers in it. With the high use of mobile devices, increasing penetration of internet, and expanding community of start-up, the data center market is becoming far more dynamic. Thus growth in data center market is likely to boost the demand for deployment of subsea cable market in Indonesia region.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Subsea Cable Market Landscape

4.1 Market Overview

4.1.1 Indonesia PEST Analysis

4.2 Ecosystem Analysis

4.2.1 Cable Owners

4.2.2 Installers

4.2.3 Carriers

4.2.4 Cable Suppliers

4.2.5 Repair & Maintenance

4.3 Expert Opinion

4.4 Premium Insights

4.4.1 Vessels flagged Indonesia for installing Array Cables and Repairs & Maintenance

5. Indonesia Subsea Cable Market –Market Dynamics

5.1 Market Drivers

5.1.1 Rising Demand for Bandwidth Availability

5.1.2 Increasing Initiatives toward Development of Energy Sector

5.2 Market Restraints

5.2.1 Less Number of Fixed Broadband Connections Compared to Other Asian Countries

5.3 Market Opportunities

5.3.1 Growth in Number of Data Centers

5.4 Future Trends

5.4.1 Deployment of Super Cables

5.5 Impact Analysis of Drivers and Restraints

6. Indonesia Market Analysis

6.1 Subsea Cables - Indonesia Market Overview

6.2 Subsea Cables - Indonesia Market and Forecast to 2027

6.3 Market Positioning – Five Key Players

7. Indonesia Subsea Cable Market Analysis – By Service

7.1 Overview

7.2 Indonesia Subsea Cable Market Breakdown, by Type, 2019 & 2027

7.3 Installation Service

7.3.1 Installation Service Market Revenue and Forecast to 2027 (US$ Million)

7.4 Maintenance & Upgrade

7.4.1 Overview

7.4.2 Maintenance & Upgrade Market Revenue and Forecast to 2027 (US$ Million)

8. Indonesia Subsea Cable Market Analysis – By Application

8.1 Overview

8.2 Indonesia Subsea Cable Market Breakdown, by Application, 2019 & 2027

8.3 Communication

8.3.1 Overview

8.3.2 Communication Market Revenue and Forecast to 2027 (US$ Million)

8.3.3 Subsea Cable Market Volume- Number of Existing Projects

8.3.4 Key Upcoming Projects:

8.4 Energy & Power

8.4.1 Overview

8.4.2 Energy & Power Market Revenue and Forecast to 2027 (US$ Million)

9. Indonesia Subsea Cable Market- COVID-19 Impact Analysis

9.1 Overview

10. Industry Landscape

10.1 Overview

10.2 Market Initiative

10.3 Merger and Acquisition

11. Company Profiles

11.1 Optic Marine Group

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.1.7 Optic Marine Services

11.1.8 Optic Marine Indonesia

11.2 PGASCOM

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 PT Indosat Tbk

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 PT Infrastruktur Telekomunikasi Indonesia (Telkominfra)

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Financial Overview

11.4.4 SWOT Analysis

11.4.5 Key Developments

11.5 PT LEN TELEKOMUNIKASI INDONESIA

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 PT Limin Marine & Offshore

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 PT MORA TELEMATIKA INDONESIA (MORATELINDO)

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 PT NAP Info Lintas Nusa

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 PT Telkom Indonesia (Persero) Tbk

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 PT XL Axiata Tbk.

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

11.11 PT. Bina Nusantara Perkasa

11.11.1 Key Facts

11.11.2 Business Description

11.11.3 Products and Services

11.11.4 Financial Overview

11.11.5 SWOT Analysis

11.11.6 Key Developments

11.12 Pt. Ketrosden Triasmitra

11.12.1 Key Facts

11.12.2 Business Description

11.12.3 Products and Services

11.12.4 Financial Overview

11.12.5 SWOT Analysis

11.12.6 Key Developments

11.13 PT. Sarana Global Indonesia

11.13.1 Key Facts

11.13.2 Business Description

11.13.3 Products and Services

11.13.4 Financial Overview

11.13.5 SWOT Analysis

11.13.6 Key Developments

11.14 Trident Subsea Cable

11.14.1 Key Facts

11.14.2 Business Description

11.14.3 Products and Services

11.14.4 Financial Overview

11.14.5 SWOT Analysis

11.14.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Glossary

LIST OF TABLES

Table 1. Indonesia Subsea Cable Market – Revenue and Forecast to 2027 (US$ Million)

Table 2. Glossary of Terms, Indonesia Subsea Cable Market

LIST OF FIGURES

Figure 1. Indonesia Subsea Cable Market Segmentation

Figure 2. Indonesia Subsea Cable Market Overview

Figure 3. Indonesia Subsea Cable, By Service

Figure 4. Indonesia Subsea Cable, By Application

Figure 5. Indonesia– PEST Analysis

Figure 6. Ecosystem Analysis

Figure 7. Expert Opinion

Figure 8. Subsea Cable Market Impact Analysis of Drivers and Restraints

Figure 9. Indonesia Subsea Cable Market – Revenue and Forecast to 2027 (US$ Million)

Figure 10. Indonesia Subsea Cable Market Breakdown, By Type (2019 and 2027)

Figure 11. Installation Service Market Revenue and Forecast to 2027(US$ Million)

Figure 12. Maintenance & Upgrade Market Revenue and Forecast to 2027(US$ Million)

Figure 13. Indonesia Subsea Cable Market Breakdown, by Application (2019 and 2027)

Figure 14. Communication Market Revenue and Forecast to 2027(US$ Million)

Figure 15. Energy & Power Market Revenue and Forecast to 2027(US$ Million)

Figure 16. Impact of COVID-19 Pandemic on Indonesia Subsea Cable Market

The List of Companies - Indonesia Subsea Cable Market

- PGASCOM

- PT Telekomunikasi Indonesia Tbk (Telkom Indonesia)

- PT XL AxiataTbk

- PT Nap Info Lintas Nusa

- PT Mora Telematika Indonesia (Moratelindo)

- PT Len Telekomunikasi Indonesia

- Trident Subsea Cable

- PT Indosat Tbk (INDOSAT Ooredoo)

- PT. Ketrosden Triasmitra

- PT. Bina Nusantara Perkasa

- Optic Marine Group

- PT. Sarana Global Indonesia (SGI)

- PT. Limin Marine & Offshore

- PT Telkom Infra

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Indonesia Subsea Cable Market

Jun 2020

Pluggable Optics for Data Center Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Switches, Routers, and Servers), Data Rate (100–400 Gb/s, 400–800 Gb/s, and 800 Gb/s and above), and Geography

Jun 2020

Collaborative Robots Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Payload (Up to 5 Kgs, 5-10 Kgs, and Above 10 Kgs), Application (Assembly, Material Handling, Pick & Place, Quality Testing, Packaging, Machine Tending, Welding, and Others), Type (Robotic Arm, Grippers, Welding Guns, and Others), End-User Industry (Automotive, Metal & Machinery, Electronics, Pharmaceuticals, Food & beverages, Logistics, and Others), and Geography

Jun 2020

Analog to Digital Converter Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others), and Geography

Jun 2020

Adaptive Traffic Control System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Hardware, Software, and Services), Component (OPAC, SCOOT, RHODES, and SCATS), and Application [Highways and Urban (Cities)] and Geography

Jun 2020

3D Audio Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Hardware, Software, and Services) and End Use Industries (Consumer Electronics, Automotive, Media and Entertainment, Gaming, and Others)

Jun 2020

Data Center Cooling Fans Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Axial Fans, Centrifugal Fans, Mixed Flow Fans, and Others), Data Center Type (Hyperscale Data Center, Colocation Data Center, Wholesale Data Center, Enterprise Data Center, and Edge Data Center), and Geography

Jun 2020

Chillers Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Chiller Technology (Air-Cooled, Water-Cooled, and Steam-Fired), Technology (Process Chillers, Scroll Chillers, Screw Chillers, Centrifugal Chillers, Absorption Chillers, Modular Chillers, and Reverse Cycle Chillers), and Application (Commercial, Industrial, and Residential) and Geography

Jun 2020

Valve Actuator Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By End-user (Mining, LNG, Chemical, Oil and Gas, Water and Wastewater, Others), Product Type (Electrical, Manual, Hydraulic, Pneumatic), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

Get Free Sample For

Get Free Sample For