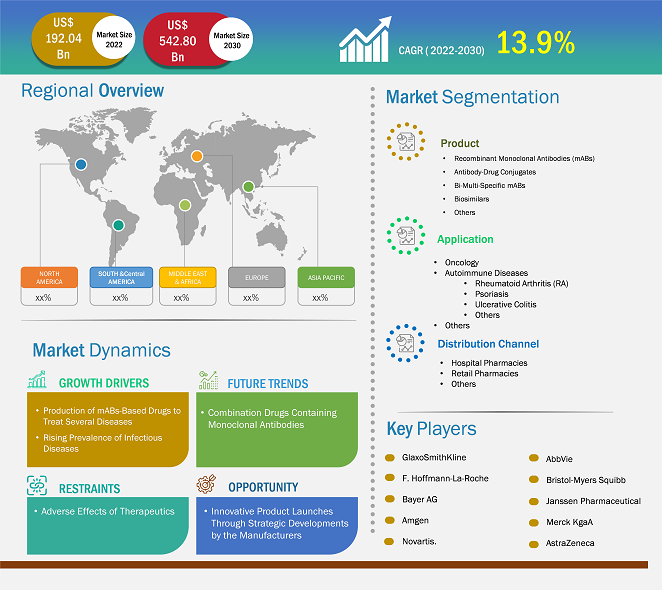

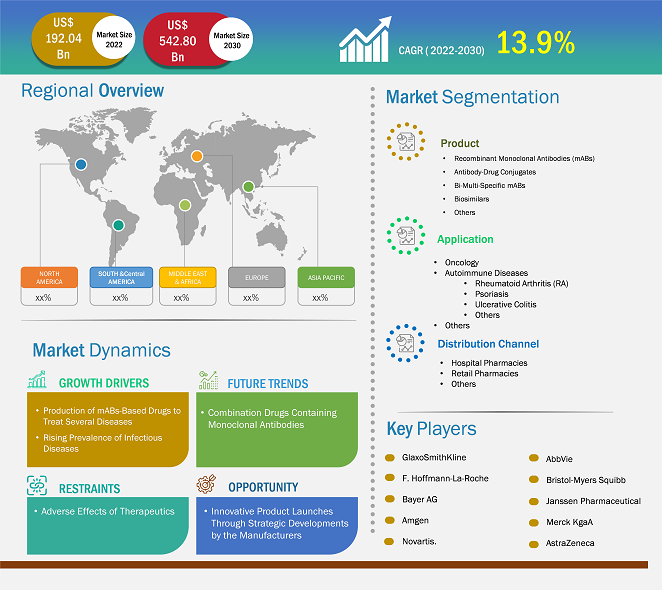

[Research Report] The monoclonal antibody therapeutics (mABs) market size is projected to grow from US$ 192.04 billion in 2022 to US$ 542.80 billion by 2030; the market is estimated to record a CAGR of 13.9% during 2022–2030.

Market Insights and Analyst View:

Robust research and development and the increasing in prevalence of chronic diseases are likely to have a significant impact on the monoclonal antibody therapeutics (mABs) market forecast in the next few years

A monoclonal antibody (mAbs) drug is a homogenous collection of antibodies having specificity toward selected target antigens. The production process of therapeutic mAbs requires a mammalian expression system offering the cell machinery essential to glycosylate, fold, orient, and covalently bind antibody peptide chains to produce complete and biologically functional molecules. New modality antibodies such as bispecific and trispecific antibodies recognize multiple epitopes on a single antigen, while single-domain antibodies can penetrate tissues with greater ease. Such advanced antibody types can enhance the efficiency of the antibody therapeutics, thereby expanding their application areas. These antibodies can also form antibody–drug conjugates to improve the efficiency of chemotherapy agents in targeting specific cell types. Production of mAB-based drugs to treat several diseases propel the market development. Innovative product launches through strategic developments by the manufacturers act as lucrative market opportunities. Furthermore, combination drugs containing mABs acts as a market trend for mAbs therapeutic market.

Market Driver

Production of mAB-Based Drugs to Treat Several Diseases Drives Market Growth

Monoclonal antibody therapeutics (mABs) are employed to treat a wide range of diseases, including cancer, autoimmune diseases, and metabolic diseases. Such drugs produced by biopharmaceutical companies and scientific research institutes have gained significant attention in the global market due to their high specificity, strong targeting ability, and low toxicity and side effects. Thus, an increase in the production capabilities of mAB therapeutics is anticipated to drive the monoclonal antibody therapeutics (mABs) market growth

Therapeutic mABs Approved in European Union (EU) and US

|

|

|

|

|

Pozelimab | VEOPOZ | CHAPLE disease | NA | 2023 |

Elranatamab | Elrexfio | Multiple myeloma | 2023 | 2023 |

Rozanolixizumab | RYSTIGGO | Generalized myasthenia gravis | 2024 | 2023 |

Talquetamab | TALVEY | Multiple myeloma | 2023 | 2023 |

Epcoritamab | EPKINLY | Diffuse large B-cell lymphoma | 2023 | 2023 |

Mirikizumab | Omvoh | Ulcerative colitis | 2023 | 2023 |

Source: Antibody Society

Market Opportunity

Innovative Product Launches Through Strategic Developments by Manufacturers

Organic developments such as product launches by the manufacturers of therapeutic mABs are likely to bolster the monoclonal antibody therapeutics (mABs) market in the coming years. In March 2022, Adagio Therapeutics, Inc. announced the launch of ADG20 (ADINTREVIMAB). The newly launched product is the first monoclonal antibody to meet primary endpoints with statistical significance across pre-and post-exposure prophylaxis and treatment for COVID-19 by seeking US Emergency Use Authorization (EUA).

Further, inorganic developments such as mergers and acquisitions would result in the introduction of new therapeutic mABs. For instance, in July 2023, Elli Lilly announced the acquisition of Versanis, a private clinical-stage biopharmaceutical company intended to treat cardiometabolic diseases. Elli Lilly acquired Versanis to access its core product portfolio, including a monoclonal antibody product named bimagrumab. This product is currently being assessed in the "BELIEVE Phase 2b study" as a standalone molecule. It is also being studied in combination with semaglutide for its combined potential to reduce fat mass, preserve muscle mass, and deliver better patient outcomes in people living with obesity and obesity-related complications. The aforementioned factors are responsible for influential monoclonal antibody therapeutics (mABs) market growth in the coming years.

Monoclonal Antibody Therapeutics (mABs) Market Trends

Combination Drugs Containing Monoclonal Antibodies (mABs)

According to the National Institute of Health (NIH) 2021 report, Roche and Regeneron (pharmaceutical companies) initiated the clinical trial phase 2/3 to evaluate combinational monoclonal antibodies for patients suffering from mild to moderate COVID-19. They are investigating "REGN-COV2," a cocktail drug produced by combining two monoclonal antibodies—casirivimab and imdevimab—for the treatment of COVID-19. These companies expect that the combination of this mAB drug would reduce hospitalization by 70%, and it would be more effective on children above 12 years (having a body weight of more than 40 kg). Researchers are strongly looking for more such therapeutic combinations of monoclonal antibodies. For example, bamlanivimab and etesivimab developed by Elli Lilly have shown positive clinical results for COVID-19 in 2022. Therefore, combination drugs of monoclonal antibodies to treat several diseases would gain significant attention in the coming years, thus emerging as a prominent trend in the monoclonal antibody therapeutics (mABs) market.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Monoclonal Antibody Therapeutics (mABs) Market: Strategic Insights

Market Size Value in US$ 192.04 billion in 2022 Market Size Value by US$ 542.80 billion by 2030 Growth rate CAGR of 13.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Monoclonal Antibody Therapeutics (mABs) Market: Strategic Insights

| Market Size Value in | US$ 192.04 billion in 2022 |

| Market Size Value by | US$ 542.80 billion by 2030 |

| Growth rate | CAGR of 13.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The monoclonal antibody therapeutics (mABs) market analysis has been carried out by considering the following segments: product, application, and distribution channel

The market, based on product, is segregated as recombinant mABs, antibody–drug conjugates, bispecific and multispecific mABs, biosimilars, and others. The monoclonal antibody therapeutics (mABs) market, by application, is segmented into oncology, autoimmune diseases, and others. The market for autoimmune diseases is further segmented as rheumatoid arthritis, psoriasis, ulcerative colitis, and others. The monoclonal antibody therapeutics (mABs) market, based on distribution channel, is segmented into hospital pharmacies, retail pharmacies, and others.

In terms of product, the recombinant mABs segment held the largest monoclonal antibody therapeutics (mABs) market share in 2022. The antibody–drug conjugates segment is anticipated to record the fastest CAGR of 18.5% during the forecast period. According to the ACS Publications report, therapeutic recombinant monoclonal antibodies reflect state-of-the-art biomedical research conducted by planning effective strategies to treat a wide range of diseases for which no effective treatment is available. Tocilizumab is an example of a recombinant mAB drug administered to treat arthritis, idiopathic arthritis, and rheumatoid arthritis (RA). Additionally, recombinant mABs can also be used to treat diseases such as autoimmune diseases and cancer. Bevacizumab is an example of a recombinant mAB currently used to treat breast, lung, and colorectal cancer; HIV-1; bacterial toxins infections/reactions, and SARS-CoV-2 and ebola virus infections.

Antibody-drug conjugates (ADC) are a rapidly emerging class of therapeutic agents and a new emerging class of highly potent pharmaceutical drugs exploiting a combination of chemotherapy and immunotherapy. According to a report by the NIH, currently, ADCs are predominantly based on immunoglobulin G (IgG), and till now, 13 ADCs have been approved by the US Food and Drug Administration (FDA). Further, more than 90 ADCs are under clinical development/trials.

|

|

|

1 | Mylotarg | Relapsed acute myelogenous leukemia |

2 | Adcetris | Relapsed Hodgkin lymphoma and relapsed systemic anaplastic large cell lymphomas |

3 | Kadcyla | HER2-positive metastatic breast cancer |

4 | Besponsa | Relapsed or refractory CD22-positive B-cell precursor acute lymphoblastic leukemia |

5 | Lumoxiti | Relapsed or refractory hairy cell leukemia or HCL |

6 | Polivy | Relapsed or refractory (R/R) diffuse large B-cell lymphoma or DLBCL |

7 | Padcev | Metastatic urothelial cancer |

8 | Enhertu | Metastatic HER2-positive breast cancer |

9 | Trodelvy | Metastatic triple-negative breast cancer |

10 | Blenrep | Relapsed or refractory multiple myeloma |

11 | Zynlota | Large B-cell lymphoma |

12 | Tivdak | Recurrent or metastatic cervical cancer therapy |

13 | Elahere | Platinum-resistant ovarian cancer |

Source: Single Use Support Article

Therefore, regulatory approvals of ADCs and ongoing clinical trials for treatment approaches for rare diseases boost the growth of the monoclonal antibody therapeutics (mABs) market for the antibody–drug conjugates segment during the forecast period.

Regional Analysis:

Based on geography, the Monoclonal Antibody Therapeutics (mABs) market report covers North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In 2022, North America accounted for the largest global monoclonal antibody therapeutics (mABs) market share. Asia Pacific is expected to register the highest CAGR during 2022–2030. In North America, the US accounts for the largest market share. Accelerated product approval procedures for mABs therapeutics benefit the market in this country. Until December 2019, 79 therapeutic mABs were approved by the US FDA according to the statistics revealed by a study published in the BioMed Central journal. Among 79 therapeutic mABs, 30 are intended for cancer treatment. In May 2021, the FDA announced authorized EUA for the use of a new therapeutic mAB—Sotrovimab—intended for outpatient applications to treat people suffering from severe COVID-19 condition. In February 2022, the FDA announced the issuing of EUA for bebtelovimab produced by Elli Lilly and Company, an example of mAB intended against the Omicron variant. Further, etesevimab is also an example of therapeutic mABs approved by the US FDA.

Monoclonal Antibody Therapeutics (mABs) Market Report Scope

Monoclonal antibody therapeutics (mABs) Industry Developments and Future Opportunities:

Various strategic developments by leading players operating in the monoclonal antibody therapeutics (mABs) market are listed below:

- In January 2023, AstraZeneca received approval for Evusheld in the European Union (EU). Evusheld is a combination of two long-acting antibodies—tixagevimab (AZD8895) and cilgavimab (AZD1061). The US government extended support for the development of this product through federal funds from the Department of Health and Human Services, the Administration for Strategic Preparedness and Response, and the Biomedical Advanced Research and Development Authority.

- In August 2023, Regeneron Pharmaceuticals, Inc. entered into an agreement with the Biomedical Advanced Research and Development Authority (BARDA) to support clinical development, clinical manufacturing, and the regulatory licensure process for next-generation monoclonal antibody therapy against COVID-19. Under this agreement, Regeneron plans to work collaboratively with BARDA to evaluate and further develop and manufacture this therapy, and conduct regulatory activities.

Competitive Landscape and Key Companies:

GlaxoSmithKline, F.Hoffmann-La-Roche, Bayer AG, Amgen, Novartis, AbbVie, Bristol-Myers Squibb, Janssen Pharmaceutical, Merck KgaA, and AstraZeneca are among the prominent companies in the monoclonal antibody therapeutics (mABs) market. The monoclonal antibody therapeutics (mABs) market report includes company positioning and concentration to evaluate the performance of key players in the market.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Key factors that are driving the growth of this market are production of mabs-based drugs to treat several infectious diseases is expected to boost the market growth for the monoclonal antibody therapeutics over the years.

The CAGR value of the monoclonal antibody therapeutics market during the forecasted period of 2022-2030 is 13.9%.

The recombinant mABs segment held the largest share of the market in the global monoclonal antibody therapeutics market and held the largest market share in 2022.

Amgen and GlaxoSmithKline are the top two companies that hold huge market shares in the monoclonal antibody therapeutics market.

Monoclonal antibody (mAbs) therapeutics is a homogenous collection of antibodies used to treat illness and are selected to target antigens. Therapeutic mAbs require a mammalian expression system offering the cell machinery required to glycosylate, fold, orient, and covalently bind antibody peptide chains to produce complete and biologically functional molecules. Also, the therapeutic antibody is expanding the use of new modality antibodies such as bispecific and trispecific antibodies to recognize the multiple epitopes on the same antigen and single domain antibodies that can more easily penetrate tissues and antibody-drug conjugates for targeting chemotherapy agents to specific cell types.

The autoimmune disease segment dominated the global monoclonal antibody therapeutics market and held the largest market share in 2022.

The monoclonal antibody therapeutics market majorly consists of the players such GlaxoSmithKline, F.Hoffmann-La-Roche, Bayer AG, Amgen, Novartis, AbbVie, Bristol-Myers Squibb, Janssen Pharmaceutical, Merck KgaA, and AstraZeneca, and amongst others.

Global monoclonal antibody therapeutics market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. North America held the largest market share of the monoclonal antibody therapeutics market in 2022.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Monoclonal Antibody Therapeutics Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Monoclonal Antibody Therapeutics Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Monoclonal Antibody Therapeutics Market - Global Market Analysis

6.1 Monoclonal Antibody Therapeutics - Global Market Overview

6.2 Monoclonal Antibody Therapeutics - Global Market and Forecast to 2030

7. Monoclonal Antibody Therapeutics Market – Revenue Analysis (USD Million) – By Product, 2020-2030

7.1 Overview

7.2 Recombinant Monoclonal Antibodies (mABs)

7.3 Antibody-Drug Conjugates

7.4 Bi-Multi Specific Monoclonal Antibodies (mABs)

7.5 Biosimilars

7.6 Others

8. Monoclonal Antibody Therapeutics Market – Revenue Analysis (USD Million) – By Application, 2020-2030

8.1 Overview

8.2 Cancer

8.3 Autoimmune Diseases

8.3.1 Rheumatoid Arthritis (RA)

8.3.2 Psoriasis

8.3.3 Ulcerative Colitis

8.3.4 Others

8.4 Others

9. Monoclonal Antibody Therapeutics Market – Revenue Analysis (USD Million) – By Distribution Channel, 2020-2030

9.1 Overview

9.2 Hospital Pharmacies

9.3 Retail Pharmacies

9.4 Others

10. Monoclonal Antibody Therapeutics Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

10.1 North America

10.1.1 North America Monoclonal Antibody Therapeutics Market Overview

10.1.2 North America Monoclonal Antibody Therapeutics Market Revenue and Forecasts to 2030

10.1.3 North America Monoclonal Antibody Therapeutics Market Revenue and Forecasts and Analysis - By Product

10.1.4 North America Monoclonal Antibody Therapeutics Market Revenue and Forecasts and Analysis - By Application

10.1.5 North America Monoclonal Antibody Therapeutics Market Revenue and Forecasts and Analysis - By Distribution Channel

10.1.6 North America Monoclonal Antibody Therapeutics Market Revenue and Forecasts and Analysis - By Countries

10.1.6.1 United States Monoclonal Antibody Therapeutics Market

10.1.6.1.1 United States Monoclonal Antibody Therapeutics Market, by Product

10.1.6.1.2 United States Monoclonal Antibody Therapeutics Market, by Application

10.1.6.1.3 United States Monoclonal Antibody Therapeutics Market, by Distribution Channel

10.1.6.2 Canada Monoclonal Antibody Therapeutics Market

10.1.6.2.1 Canada Monoclonal Antibody Therapeutics Market, by Product

10.1.6.2.2 Canada Monoclonal Antibody Therapeutics Market, by Application

10.1.6.2.3 Canada Monoclonal Antibody Therapeutics Market, by Distribution Channel

10.1.6.3 Mexico Monoclonal Antibody Therapeutics Market

10.1.6.3.1 Mexico Monoclonal Antibody Therapeutics Market, by Product

10.1.6.3.2 Mexico Monoclonal Antibody Therapeutics Market, by Application

10.1.6.3.3 Mexico Monoclonal Antibody Therapeutics Market, by Distribution Channel

Note - Similar analysis would be provided for below mentioned regions/countries

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Rest of Europe

10.3 Asia-Pacific

10.3.1 Australia

10.3.2 China

10.3.3 India

10.3.4 Japan

10.3.5 South Korea

10.3.6 Rest of Asia-Pacific

10.4 Middle East and Africa

10.4.1 South Africa

10.4.2 Saudi Arabia

10.4.3 U.A.E

10.4.4 Rest of Middle East and Africa

10.5 South and Central America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South and Central America

11. Industry Landscape

11.1 Mergers and Acquisitions

11.2 Agreements, Collaborations, Joint Ventures

11.3 New Product Launches

11.4 Expansions and Other Strategic Developments

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning and Concentration

13. Monoclonal Antibody Therapeutics Market - Key Company Profiles

13.1 F. Hoffmann-La-Roche

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

Note - Similar information would be provided for below list of companies

13.2 AstraZeneca

13.3 Bayer AG

13.4 Merck KGaA

13.5 GlaxoSmithKline plc

13.6 Amgen

13.7 Novartis AG

13.8 AbbVie Inc.

13.9 Janssen Pharmaceuticals

13.10 Bristol-Myers Squibb Company

14. Appendix

14.1 Glossary

14.2 About The Insight Partners

14.3 Market Intelligence Cloud

The List of Companies - Monoclonal Antibody Therapeutics (mABs) Market

- GlaxoSmithKline

- F.Hoffmann-La-Roche

- Bayer AG

- Amgen

- Novartis

- AbbVie

- Bristol-Myers Squibb

- Janssen Pharmaceutical

- Merck KgaA

- AstraZeneca

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Monoclonal Antibody Therapeutics (mABs) Market

Feb 2024

Pediatric Cardiology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Transcatheter Heart Valves, Occlusion Devices, Catheters, Stents, Introducer Sheaths, and Others), Disease Indication (Congenital Heart Disease, Acquired Heart Disease, Arrhythmias, Cardiomyopathies, and Others), Surgical Procedure (Interventional Procedures, Heart Rhythm Management Procedures, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Feb 2024

Pharmaceutical Membrane Filters Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Microfiltration, Ultrafiltration, Reverse Osmosis and Nanofiltration), Design (Hollow Fiber, Spiral Wound, Tubular System and Plate and Frame), Material (Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based Membranes, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN) and Others), End User (Pharmaceutical and Biotech Industries and CROs and CDMOs), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

Feb 2024

ECG Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Feb 2024

Surgical Laser Fiber Units Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (CO2 Laser, Diode Laser, Erbium Laser, Nd:YAG Laser, Holmium Laser, Alexandrite Laser, and Others), Material (Silica-Based Fibers, Quartz Fibers, Polymer-Based Fibers, Multimode Fibers, and Others), Power (Low-Power Lasers, Medium-Power Lasers, and High-Power Lasers), Application (Urology, Dermatology, Gynecology, Cardiology, Neurology, Ophthalmology, Respiratory, Dentistry and Others), Wavelength (9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm), End User (Hospitals, Specialty Clinics, Physician Office, and Others), and Geography

Feb 2024

Therapeutic Vaccines Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Cancer Vaccines, Infectious Disease Vaccines, and Others), Technology (Allogenic Vaccines and Autologous Vaccines), End User (Hospitals, Clinics, and Others), and Geography

Feb 2024

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

Feb 2024

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

Feb 2024

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography

Get Free Sample For

Get Free Sample For