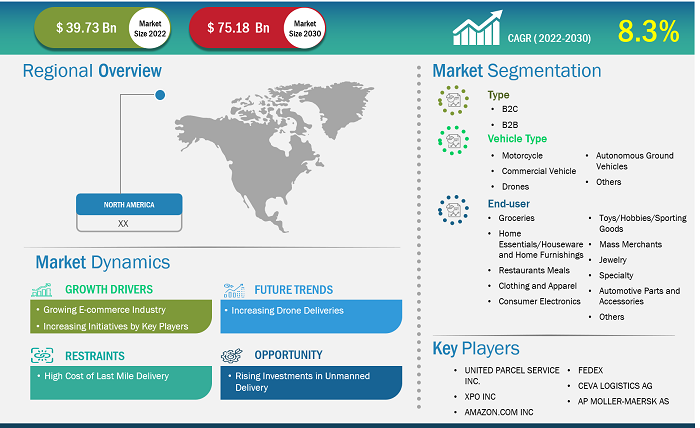

The North America last mile delivery market accounted for US$ 39.73 billion in 2022 and is expected to reach US$ 75.13 billion by 2030; it is expected to register a CAGR of 8.3% during 2022–2030.

Analyst Perspective:

The North America last mile delivery market has been segmented into Canada, the US, and Mexico. The North America market was among the first to adopt e-commerce early and widely. The US dominates the North America last mile delivery market with majority of the total last mile delivery market share. The next-day or same-day last-mile delivery business has evolved into an industry within the retail sector. According to the US Bureau of Labor Statistics, 1.7 million delivery drivers were employed last year. That figure is expected to rise to 1.9 million by 2031. Amazon is still spending tons of capital to make the last-mile delivery process more efficient. Moreover, in June 2021, FedEx Corp. and Nuro announced a multi-year, multi-phase partnership to test Nuro's next-generation autonomous delivery vehicle within FedEx operations over several years. FedEx and Nuro's relationship began in April with a test run in Houston. This experiment marks Nuro's entry into package logistics. It allows FedEx to investigate multiple use cases for on-road autonomous vehicle logistics, such as multi-stop and appointment-based deliveries. The Nuro pilot is the newest addition to FedEx's arsenal of self-driving same-day and customized delivery vehicles. The development of autonomous vehicles for deliveries is projected to generate lucrative opportunities in the last mile delivery market.

Market Overview:

Last mile delivery is the final step of the delivery process in which products are transferred from a transportation/warehouse center to their final destination, typically a personal residence or a business outlet. This is the most important phase in the delivery process, as the consumer's overall shopping experience and brand loyalty depend on it.

One of the main factors driving the North America last mile delivery market is the higher penetration of e-commerce in the region. Online shopping in the US has grown in popularity in recent years. This increment has directly affected the revenue generated. Total US e-commerce sales hit US$ 595.5 billion in 2019, an increase of 14.9% from US$ 518.5 billion in 2018. Many logistics giants in the North America last mile delivery market, such as UPS, FedEx, USPS, XPO Logistics, and Amazon, recognized the increasing demand for e-commerce delivery services. Thus, many key North America last mile delivery market players started focusing on organic and inorganic business growth strategies to acquire a larger North America last mile delivery market share. In June 2021, FedEx Corp. and Nuro announced a multi-phase partnership to test Nuro's next-generation autonomous delivery vehicle within FedEx operations. Currently, most of the industry's key players focus on drone deliveries. In August 2023, Wing, Alphabet's drone delivery service, partnered with Walmart to provide deliveries in the Dallas-Fort Worth metroplex.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America Last Mile Delivery Market: Strategic Insights

Market Size Value in US$ 1,077.57 million in 2022 Market Size Value by US$ 1,615.28 million by 2030 Growth rate CAGR of 5.2% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America Last Mile Delivery Market: Strategic Insights

| Market Size Value in | US$ 1,077.57 million in 2022 |

| Market Size Value by | US$ 1,615.28 million by 2030 |

| Growth rate | CAGR of 5.2% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Growing E-Commerce Industry is Driving the North America Last Mile Delivery Market Growth

One of the main factors driving the last North America last mile delivery market is the higher penetration of e-commerce in the region. Online shopping in the US has grown in popularity in recent years, as indicated by an increasing number of people purchasing goods and services over the Internet. The number of online shoppers is expected to grow in the coming years. This increment has directly affected the revenue generated. Total US e-commerce sales hit US$ 595.5 billion in 2019, an increase of 14.9% from US$ 518.5 billion in 2018. It is also one of the fastest rates of US e-commerce growth in seven years, trailing only 2017's 15.5% year-over-year gain. The numbers reveal that US e-commerce sales hit US$ 581.5 billion in the first three quarters of 2020 alone. This is only a percentage of the overall e-commerce sales for 2019. This represents a 32.4% increase year-on-year. The strongest quarter of the year was Q2 2020 when US e-commerce sales reached a record-high US$ 211.6 billion, representing a 31.9% quarterly growth. Sales at the top e-commerce companies in the US skyrocketed. Such revenue shows increased penetration of the e-commerce industry, ultimately driving the North America last mile delivery market.

Canadians have embraced electronic shopping positively. There were over 27 million e-commerce users in Canada in 2022, representing 75% of the Canadian population. This figure is predicted to rise to 77.6% by 2025. With more online shoppers, retail e-commerce sales in Canada continue to increase. Companies in the US do not need to have a separate website. Many American businesses have integrated Canadian transactions into their existing websites. Thus, owing to the abovementioned factors, the e-commerce industry is growing. The increase in orders directly fuels the demand for last mile delivery services, ultimately driving the North America last mile delivery market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

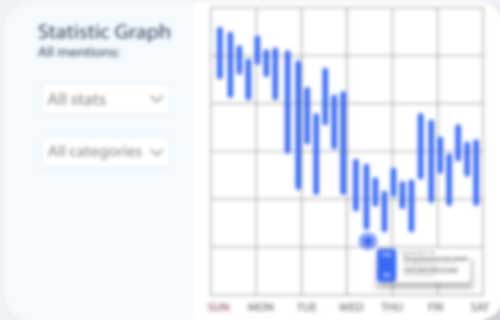

Based on type, the North America last mile delivery market share is categorized into B2C and B2B. Last mile delivery of the B2C focuses on delivering packages and items from close transportation hubs to end clients. The North America last mile delivery market for the B2C segment has grown gradually due to digitization and the advent of new technologies. Apart from digitalization, continuous growth in e-commerce is one of the primary factors for the development of the B2C segment. Business-to-business (B2B) last-mile delivery sends products from a warehouse or fulfillment center to the brick-and-mortar retailers or enterprises that order them.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Regional Analysis:

The continuously expanding e-commerce industry in the US is one of the primary factors for the North America last mile delivery market growth. As per Digital Commerce, in 2022, e-commerce sales in the US surpassed US$ 1 trillion. An increase in online purchasing is one of the main factors for the growth of e-commerce. As per the data published by the Tidio in 2022, ~70% of the US population prefers shopping online. In 2022, 268 billion buyers opted for online shopping in the US. As a result, the US has secured second rank in the e-commerce spending by country list. An average American spends ~US$ 3,428 on online shopping. E-commerce sales in the US account for 15% of the total retail sales. Thus, continuous growth in e-commerce sales is projected to drive the North America last mile delivery market in the coming years.

Key Player Analysis:

United Parcel Service Inc., XPO Inc., J B Hunt Transport Services Inc., Canada Post Corp., General Logistics Systems BV., Ceva Logistics AG, Intelcom Courrier Canada Inc., Ontrac Logistics Inc., TFORCE Logistics LLC, Amazon.com Inc., SEKO Logistic LLC, Deutsche Post AG, FedEx Corp, Pitney Bowes Inc., and AP MOLLER-MAERSK AS are the prominent North America last mile delivery market players.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies operating in the market. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The North America last mile delivery market players present in the market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by the key players are listed below:

Year | News |

Nov-2023 | Amazon, which has deployed over 6,000 EVs to deliver packages in over 400 cities across India, kicks off a global-first 100% EV-only program that enables its delivery service partners to lease a fleet of tailored three-wheeler EVs through a fleet management company. |

Oct-2023 | UPS Inc. announced a product launch to provide selected customers with a "fast" next-day delivery option inside a metropolitan service area. |

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Vehicle Type, End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

One of the main factors driving the last mile delivery market is the higher penetration of e-commerce in the region. Online shopping in the US has grown in popularity in recent years, as indicated by an increasing number of people purchasing goods and services over the Internet. The number of online shoppers is expected to grow in the coming years.

United Parcel Service Inc., XPO Inc., Ceva Logistics AG, Amazon.com Inc., FedEx Corp, and AP MOLLER-MAERSK AS are the top key market players operating in the North America last mile delivery market.

In 2022, more than ten drone operators accomplished more than 5,000 commercial deliveries in the US. Between 2021 and 2022, the number of packages delivered by drone climbed by more than 80%, reaching ~875,000 deliveries globally. Globally, US has the highest market share in drone deliveries globally. Major retail and e-commerce companies such as Amazon and Walmart are investing heavily in drone last mile delivery.

The North America market was among the first to adopt e-commerce early and widely. The US mainly dominates the North America market, with more than 70% of the total market share. The next-day or same-day last-mile delivery business has evolved into an industry within the retail sector. According to the US Bureau of Labor Statistics, 1.7 million delivery drivers were employed last year.

Self-driving cars are an essential topic in the logistics industry these days. Large corporations such as Google, Uber, and Ford are making significant advances in autonomous technology. Although self-driving technology is still in its early stages, it is likely to substantially impact several industries, including logistics, shortly.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness, By Country

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Last Mile Delivery Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of North America Last Mile Delivery Vendors

5. Last Mile Delivery Market - Key Industry Dynamics

5.1 Last Mile Delivery Market - Key Industry Dynamics

5.2 Market Drivers

5.2.1 Growing E-Commerce Industry

5.2.2 Increasing Initiatives by Key Players

5.3 Market Restraints

5.3.1 High Cost of Last Mile Delivery

5.4 Market Opportunities

5.4.1 Rising Investments in Unmanned Delivery

5.5 Future Trends

5.5.1 Increasing Drone Deliveries

5.6 Impact of Drivers and Restraints:

6. Last Mile Delivery Market - North America Market Analysis

6.1 Last Mile Delivery Market Revenue (US$ Billion), 2022 – 2030

6.2 Last Mile Delivery Market Forecast and Analysis

7. Last Mile Delivery Market Analysis - Type

7.1 B2C

7.1.1 Overview

7.1.2 B2C Market, Revenue and Forecast to 2030 (US$ Billion)

7.2 B2B

7.2.1 Overview

7.2.2 B2B Market, Revenue and Forecast to 2030 (US$ Billion)

8. Last Mile Delivery Market Analysis – Vehicle Type

8.1 Motorcycle

8.1.1 Overview

8.1.2 Motorcycle Market Revenue, and Forecast to 2030 (US$ Billion)

8.2 Commercial Vehicle

8.2.1 Overview

8.2.2 Commercial Vehicle Market Revenue, and Forecast to 2030 (US$ Billion)

8.3 Drones

8.3.1 Overview

8.3.2 Drones Market Revenue, and Forecast to 2030 (US$ Billion)

8.4 Autonomous Ground Vehicles

8.4.1 Overview

8.4.2 Autonomous Ground Vehicles Market Revenue, and Forecast to 2030 (US$ Billion)

8.5 Others

8.5.1 Overview

8.5.2 Others Market Revenue, and Forecast to 2030 (US$ Billion)

9. Last Mile Delivery Market Analysis – End user

9.1 Groceries

9.1.1 Overview

9.1.2 Groceries Market Revenue, and Forecast to 2030 (US$ Billion)

9.2 Home Essentials/Houseware and Home Furnishings

9.2.1 Overview

9.2.2 Home Essentials/Houseware and Home Furnishings Market Revenue, and Forecast to 2030 (US$ Billion)

9.3 Restaurants Meals

9.3.1 Overview

9.3.2 Restaurants Meals Market Revenue, and Forecast to 2030 (US$ Billion)

9.4 Clothing and Apparel

9.4.1 Overview

9.4.2 Clothing and Apparel Market Revenue, and Forecast to 2030 (US$ Billion)

9.5 Consumer Electronics

9.5.1 Overview

9.5.2 Consumer Electronics Market Revenue, and Forecast to 2030 (US$ Billion)

9.6 Toys/Hobbies/Sporting Goods

9.6.1 Overview

9.6.2 Toys/Hobbies/Sporting Goods Market Revenue, and Forecast to 2030 (US$ Billion)

9.7 Mass Merchants

9.7.1 Overview

9.7.2 Mass Merchants Market Revenue, and Forecast to 2030 (US$ Billion)

9.8 Jewelry

9.8.1 Overview

9.8.2 Jewelry Market Revenue, and Forecast to 2030 (US$ Billion)

9.9 Specialty

9.9.1 Overview

9.9.2 Specialty Market Revenue, and Forecast to 2030 (US$ Billion)

9.10 Automotive Parts and Accessories

9.10.1 Overview

9.10.2 Automotive Parts and Accessories Market Revenue, and Forecast to 2030 (US$ Billion)

9.11 Others

9.11.1 Overview

9.11.2 Others Market Revenue, and Forecast to 2030 (US$ Billion)

10. North America Last Mile Delivery Market - Country Analysis

10.1 Overview

10.1.1.1 North America Last Mile Delivery Market Revenue and Forecasts and Analysis - By Country

10.2 US

10.2.1 US Last Mile Delivery Market Overview

10.2.2 US Last Mile Delivery Market Revenue and Forecasts to 2030 (US$ Bn)

10.2.3 US Last Mile Delivery Market Breakdown by Type

10.2.3.1 US Last Mile Delivery Market Revenue and Forecasts and Analysis - By Type

10.2.4 US Last Mile Delivery Market Breakdown by Vehicle Type

10.2.4.1 US Last Mile Delivery Market Revenue and Forecasts and Analysis - By Vehicle Type

10.2.5 US Last Mile Delivery Market Breakdown by End user

10.2.5.1 US Last Mile Delivery Market Revenue and Forecasts and Analysis - By End user

10.3 Canada

10.3.1 Canada Last Mile Delivery Market Overview

10.3.1.1 Canada Last Mile Delivery Market Revenue and Forecasts to 2030 (US$ Bn)

10.3.2 Canada Last Mile Delivery Market Breakdown by Type

10.3.2.1 Canada Last Mile Delivery Market Breakdown by Type

10.3.3 Canada Last Mile Delivery Market Breakdown by Vehicle Type

10.3.3.1 Canada Last Mile Delivery Market Breakdown by Vehicle Type

10.3.4 Canada Last Mile Delivery Market Breakdown by End user

10.3.4.1 Canada Last Mile Delivery Market Breakdown by End user

10.4 Mexico

10.4.1 Mexico Last Mile Delivery Market Overview

10.4.1.1 Mexico Last Mile Delivery Market Revenue and Forecasts to 2030 (US$ Bn)

10.4.2 Mexico Last Mile Delivery Market Breakdown by Type

10.4.2.1 Mexico Last Mile Delivery Market Breakdown by Type

10.4.3 Mexico Last Mile Delivery Market Breakdown by Vehicle Type

10.4.3.1 Mexico Last Mile Delivery Market Breakdown by Vehicle Type

10.4.4 Mexico Last Mile Delivery Market Breakdown by End user

10.4.4.1 Mexico Last Mile Delivery Market Breakdown by End user

11. Last Mile Delivery Market – Impact of COVID-19 Pandemic

11.1 Pre & Post Covid-19 Impact

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning & Concentration

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

13.3 Product Development

13.4 Mergers & Acquisitions

14. Company Profiles

14.1 United Parcel Service Inc

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 XPO Inc

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 AIT Worldwide Logistics Inc

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Purolator Inc

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 J B Hunt Transport Services Inc

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Canada Post Corp

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Canpar Express Inc

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 General Logistics Systems BV

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 AxleHire Inc

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 CEVA Logistics AG

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

14.11 Intelcom Courrier Canada Inc

14.11.1 Key Facts

14.11.2 Business Description

14.11.3 Products and Services

14.11.4 Financial Overview

14.11.5 SWOT Analysis

14.11.6 Key Developments

14.12 United Delivery Service Ltd

14.12.1 Key Facts

14.12.2 Business Description

14.12.3 Products and Services

14.12.4 Financial Overview

14.12.5 SWOT Analysis

14.12.6 Key Developments

14.13 Better Trucks Inc

14.13.1 Key Facts

14.13.2 Business Description

14.13.3 Products and Services

14.13.4 Financial Overview

14.13.5 SWOT Analysis

14.13.6 Key Developments

14.14 OnTrac Logistics Inc

14.14.1 Key Facts

14.14.2 Business Description

14.14.3 Products and Services

14.14.4 Financial Overview

14.14.5 SWOT Analysis

14.14.6 Key Developments

14.15 TForce Logistics LLC

14.15.1 Key Facts

14.15.2 Business Description

14.15.3 Products and Services

14.15.4 Financial Overview

14.15.5 SWOT Analysis

14.15.6 Key Developments

14.16 Lone Star Overnight LLC

14.16.1 Key Facts

14.16.2 Business Description

14.16.3 Products and Services

14.16.4 Financial Overview

14.16.5 SWOT Analysis

14.16.6 Key Developments

14.17 Amazon.com Inc

14.17.1 Key Facts

14.17.2 Business Description

14.17.3 Products and Services

14.17.4 Financial Overview

14.17.5 SWOT Analysis

14.17.6 Key Developments

14.18 SEKO Logistic LLC

14.18.1 Key Facts

14.18.2 Business Description

14.18.3 Products and Services

14.18.4 Financial Overview

14.18.5 SWOT Analysis

14.18.6 Key Developments

14.19 Deutsche Post AG

14.19.1 Key Facts

14.19.2 Business Description

14.19.3 Products and Services

14.19.4 Financial Overview

14.19.5 SWOT Analysis

14.19.6 Key Developments

14.20 FedEx Corp

14.20.1 Key Facts

14.20.2 Business Description

14.20.3 Products and Services

14.20.4 Financial Overview

14.20.5 SWOT Analysis

14.20.6 Key Developments

14.21 Pitney Bowes Inc

14.21.1 Key Facts

14.21.2 Business Description

14.21.3 Products and Services

14.21.4 Financial Overview

14.21.5 SWOT Analysis

14.21.6 Key Developments

14.22 Ryder System Inc

14.22.1 Key Facts

14.22.2 Business Description

14.22.3 Products and Services

14.22.4 Financial Overview

14.22.5 SWOT Analysis

14.22.6 Key Developments

14.23 Hub Group Inc

14.23.1 Key Facts

14.23.2 Business Description

14.23.3 Products and Services

14.23.4 Financial Overview

14.23.5 SWOT Analysis

14.23.6 Key Developments

14.24 Estes Forwarding Worldwide LLC

14.24.1 Key Facts

14.24.2 Business Description

14.24.3 Products and Services

14.24.4 Financial Overview

14.24.5 SWOT Analysis

14.24.6 Key Developments

14.25 AP Moller-Maersk AS

14.25.1 Key Facts

14.25.2 Business Description

14.25.3 Products and Services

14.25.4 Financial Overview

14.25.5 SWOT Analysis

14.25.6 Key Developments

15. Appendix

15.1 Word Index

List of Tables

Table 1. Last Mile Delivery Market Segmentation

Table 2. List of North America Last Mile Delivery Vendors

Table 3. Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Billion)

Table 4. Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Billion) – Type

Table 5. Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Billion) – Vehicle Type

Table 6. Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Billion) – End user

Table 7. North America Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn) – By Country

Table 8. US Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn) – By Type

Table 9. US Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn) – By Vehicle Type

Table 10. US Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn) – By End user

Table 11. Canada Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn) – By Type

Table 12. Canada Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn) – By Vehicle Type

Table 13. Canada Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn) – By End user

Table 14. Mexico Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn) – By Type

Table 15. Mexico Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn) – By Vehicle Type

Table 16. Mexico Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn) – By End user

Table 17. Heat Map Analysis by Key Players

Table 18. List of Abbreviation

List of Figures

Figure 1. Last Mile Delivery Market Segmentation, By Geography

Figure 2. PEST Analysis

Figure 3. Ecosystem: Last Mile Delivery Market

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. Last Mile Delivery Market Revenue Breakdown by Country, 2022 and 2030 (USD Billion)

Figure 6. Last Mile Delivery Market Revenue (US$ Billion), 2022 – 2030

Figure 7. Last Mile Delivery Market Share (%) – Type, 2022 and 2030

Figure 8. B2C Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 9. B2B Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 10. Last Mile Delivery Market Share (%) – Vehicle Type, 2022 and 2030

Figure 11. Motorcycle: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 12. Commercial Vehicle: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 13. Drones: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 14. Autonomous Ground Vehicles: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 15. Consumer Electronics: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 16. Last Mile Delivery Market Share (%) – End user, 2022 and 2030

Figure 17. Groceries: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 18. Home Essentials/Houseware and Home Furnishings: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 19. Restaurants Meals: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 20. Clothing and Apparel: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 21. Consumer Electronics: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 22. Toys/Hobbies/Sporting Goods: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 23. Mass Merchants: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 24. Jewelry: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 25. Specialty: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 26. Automotive Parts and Accessories: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 27. Others: Last Mile Delivery Market Revenue and Forecast to 2030 (US$ Billion)

Figure 28. Last Mile Delivery Market Breakdown by Country, 2022 and 2030 (%)

Figure 29. US Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn)

Figure 30. US Last Mile Delivery Market Breakdown by Type (2022 and 2030)

Figure 31. US Last Mile Delivery Market Breakdown by Vehicle Type (2022 and 2030)

Figure 32. US Last Mile Delivery Market Breakdown by End user (2022 and 2030)

Figure 33. Canada Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn)

Figure 34. Canada Last Mile Delivery Market Breakdown by Type (2022 and 2030)

Figure 35. Canada Last Mile Delivery Market Breakdown by Vehicle Type (2022 and 2030)

Figure 36. Canada Last Mile Delivery Market Breakdown by End user (2022 and 2030)

Figure 37. Mexico Last Mile Delivery Market Revenue and Forecasts To 2030 (US$ Bn)

Figure 38. Mexico Last Mile Delivery Market Breakdown by Type (2022 and 2030)

Figure 39. Mexico Last Mile Delivery Market Breakdown by Vehicle Type (2022 and 2030)

Figure 40. Mexico Last Mile Delivery Market Breakdown by End user (2022 and 2030)

Figure 41. Company Positioning & Concentration

The List of Companies - North America Last Mile Delivery Market

- United Parcel Service Inc

- XPO Inc

- AIT Worldwide Logistics Inc

- Purolator Inc

- J B Hunt Transport Services Inc

- Canada Post Corp

- Canpar Express Inc

- General Logistics Systems BV

- AxleHire Inc

- CEVA Logistics AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to North America Last Mile Delivery Market

Jan 2024

Heavy Commercial Vehicle Air Brake Systems Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Compressor, Reservoir, Foot Valve, Brake Lining and Drum or Rotors, Brake Shoes, and Others), Type (Air Disc Brake and Air Drum Brake), Technology (Conventional Air Brake System, Electronically Controlled Air Braking System, and Antilock Braking System), Distribution Channel (OEMs and Aftermarket), Vehicle Type (Bus, Truck, Construction Equipment, and Tractor), and Geography

Jan 2024

Heavy Commercial Vehicle Clutch Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Distribution Channel (OEM and Aftermarket), Product (Single Plate Clutches, Multi-Plate Clutches, Diaphragm Spring Clutches, Centrifugal Clutches, and Hydraulic Clutches), Vehicle Type (Bus, Truck, Construction Equipment, and Tractors), and Geography

Jan 2024

Electric Vehicle Heat Pump Systems Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Propulsion Type (BEV, HEV, PHEV), Component (Evaporator, Condenser, Compressors, Others), Vehicle Type (Passenger Vehicle, Commercial Vehicle), and Geography

Jan 2024

Hydrogen Fuel Cell Train Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Proton Exchange Membrane Fuel Cell, Phosphoric Acid Fuel Cell, and Others), Component (Hydrogen Fuel Cell Pack, Batteries, Electric Traction Motors, and Others), Rail Type (Passenger Rail, Commuter Rail, Light Rail, Trams, Freight, and Others) and Geography

Jan 2024

Automotive Seat Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Heated, Heated-Ventilated, Ventilated, With Massage Functions, and Others), Adjustment Type (Electrically Adjusted and Manual), Vehicle Type (Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial Vehicle), and Seat Type (Front Row, Second Row, and Third Row) and Geography

Jan 2024

Connected Vehicle Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Technology (5G, 4G/LTE, 3G & 2G), Connectivity (Integrated, Tethered, Embedded), Application (Telematics, Infotainment, Driving assistance, Others) and Geography

Jan 2024

Automotive High Voltage Cable Market

Forecast to 2030 - Global Analysis by Vehicle Type [Battery Electric Vehicles (BEV), Plugin Hybrid Electric Vehicles (PHEV), and Plugin Hybrid Vehicles (PHV)], Conductor Type (Copper and Aluminum), and Core Type (Multi Core and Single Core)

Get Free Sample For

Get Free Sample For